My back-to-work morning practice WFH reads:

• A Tidal Wave of Change Is Headed for the U.S. Economic system: American shoppers aren’t but seeing a lot proof of the drastic adjustments President Trump has made on commerce. However they’re on their approach. (New York Instances)

• Inventory Market Bulls Have Gone Into Hiding. Why Our Cash Execs Are the Most Bearish in Almost 30 Years. Large Cash execs are extra anxious now than throughout the bursting of the dot-com bubble, the 2008-09 monetary disaster, and the Covid-19 pandemic. (Barron’s) see additionally Warren Buffett’s Favourite Valuation Indicator Flashes Purchase Sign. The “Buffett Indicator” measures the ratio of the US inventory market’s whole worth to the greenback worth of US gross home product and is at the moment at its lowest degree since early September. The indicator is now at 180%, round the place it stood after a short selloff final 12 months, and is signaling that equities are comparatively low-cost.The measure continues to be above ranges it plumbed throughout previous market bottoms, together with the Covid-19 selloff of early 2020, when it fell to almost 100%. (Bloomberg)

• We’ve unlocked a holy grail in clear power. It’s solely the start. The unimaginable know-how is harnessing the potential of photo voltaic and wind — and quietly revolutionizing the power system. (Vox)

• Rebecca Patterson: Farewell, Ye Mighty Greenback. Was Good Realizing You: A seek for new secure harbors started. Within the week ending April 16, gold funds had their largest inflows since 2007, whereas promoting of U.S. bond funds was the best recorded since late March 2020. Inventory markets churned in methods not seen since both the pandemic or the 2008 monetary disaster. (New York Instances)

• How Warren Buffett Modified the Method Buyers Consider Investing: The concept of “worth investing” had lengthy existed. However nobody did it as efficiently or for so long as he did. (Dealbook) see additionally Who Is Gregory Abel, Warren Buffett’s Successor? Mr. Buffett gained renown and made billions as one of the vital profitable inventory pickers of all time. Mr. Abel’s strengths lie extra in operating companies. (New York Instances)

• The MAHA-Pleasant App That’s Driving Meals Firms Loopy: Yuka and different apps are influencing customers’ buying habits; ‘There are quite a lot of opinions on the market’. (Wall Avenue Journal)

• The world–politely–tells Trump to take a hike: In Canada and in Europe, some very fascinating information. (The Essential Years)

• When ChatGPT Broke an Complete Subject: An Oral Historical past: Researchers in “pure language processing” tried to tame human language. Then got here the transformer. (Quanta) see additionally Within the age of AI, we should defend human creativity as a pure useful resource: As AI outputs flood the Web, numerous human views are our most dear useful resource. (Ars Technica)

• Tina Fey’s reboot of ‘The 4 Seasons’ looks like a throwback: Steve Carell, Colman Domingo and Will Forte be a part of Fey on this feel-good comedy about marriage, divorce, friendship and GenX. (Washington Put up)

• We simply had probably the most preposterous 12 months of Aaron Decide: Yankees captain’s previous 162 video games deserves legendary standing at school of Babe Ruth, Barry Bonds and Ted Williams (Yahoo Sports activities)

You should definitely take a look at our Masters in Enterprise this week with Sander Gerber, the CEO/CIO of Hudson Bay Capital. The agency is a world multi-strategy funding agency based mostly in Greenwich, with workplaces in NY, Miami, London, Hong Kong, and Dubai. Based in June 2005 (with Yoav Roth) they handle $20B in shopper property.

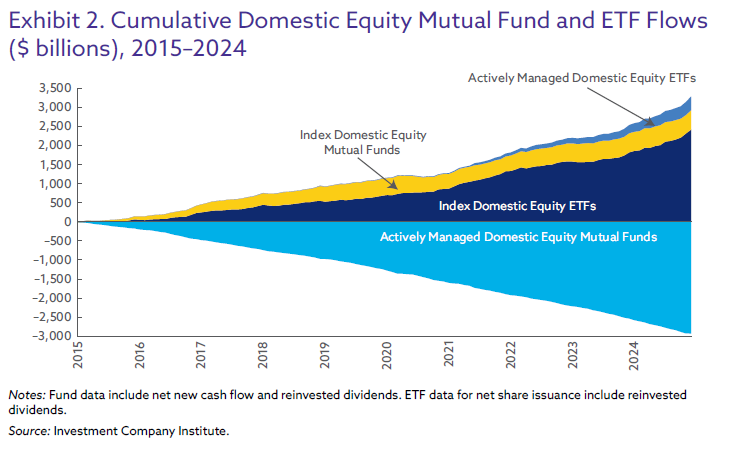

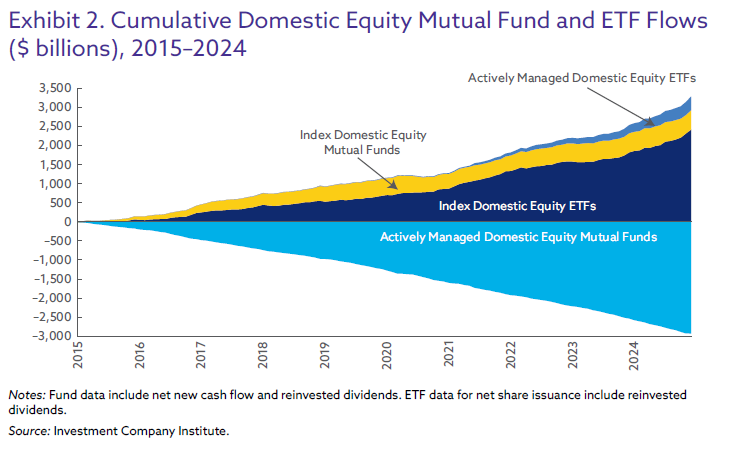

ETFs Gained. Now What?

Supply: Nadig.com

Join our reads-only mailing record right here.