THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

Budgeting may be sophisticated, and it’s simple to fall into unhealthy budgeting habits with out noticing the issue.

Budgeting errors could make it far more tough to achieve your monetary objectives, so it’s essential to determine any points that may very well be holding you again.

Everybody’s budgeting expertise is completely different, however there are a variety of typical errors that you could be not pay attention to.

This text will cowl a couple of of essentially the most generally neglected budgeting errors and how one can alter your method to repair them.

| Finances Mistake | Finances Repair |

|---|---|

| Too Strict | Enable enjoyable cash in your finances |

| Not Getting Out of Debt | Finances for more cash to pay down debt |

| Not Having Targets | Create quick and long run monetary objectives |

| Forgetting About Surprising Prices | Construct an emergency fund |

| Forgetting About Small Bills | Evaluate earlier statements to search out all of your spending |

| Budgeting Alone | Discover an accountability associate |

| Manually Budgeting | Use an app |

| Not Sufficient Cash to Cowl Finances Bills | Enhance revenue with aspect hustles |

| Impulse Spending | Establish and repair spending points |

| Utilizing The Incorrect Finances | Discover the fitting finances technique in your state of affairs |

| Forgetting About Payments | Arrange reminders |

| Setting Your Finances in Stone | Evaluate your finances and alter when wanted |

12 Finances Errors Too Many Individuals Make

#1. Cease Being So Strict

It’s good to take budgeting significantly, however being overly tight with spending can even have a adverse impact.

Attempting to chop out issues like leisure and hobbies will solely make you resent your finances, and you’ll be extra more likely to ignore your monetary objectives by making an impulse buy.

I’m responsible of this one.

Again once I created my first finances, I utterly lower out leisure.

It was nice for a short while, however ultimately I acquired offended and ended up overspending on my bank cards.

How you can repair it: Embrace leisure prices in your finances.

Whereas there’s nothing incorrect with making an attempt to cut back how a lot you spend on stuff you don’t want, that doesn’t imply you need to go too far in the other way.

Be reasonable about how a lot you need to spend on enjoyable, and take a look at to not let your self really feel unhealthy about having an excellent time.

Start by wanting by way of earlier financial institution statements to trace how a lot you normally spend on these prices.

From there, you may decide whether or not you’re content material along with your current habits or must make an adjustment.

In case you do determine to start out spending much less, goal for small, gradual adjustments relatively than altering your life-style instantly.

#2. Finances For Extra Than Minimal Funds

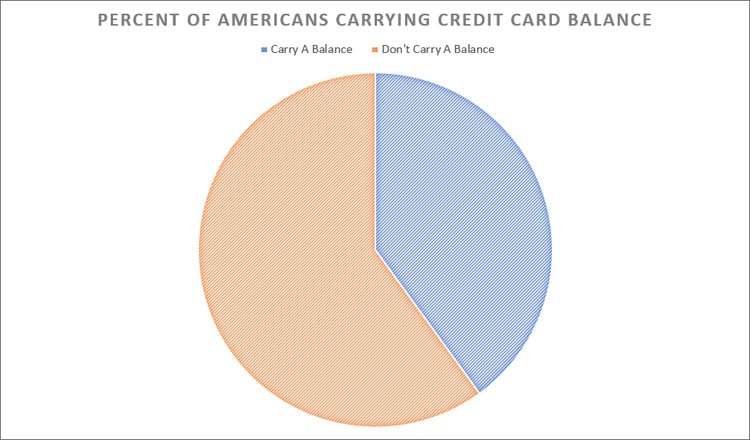

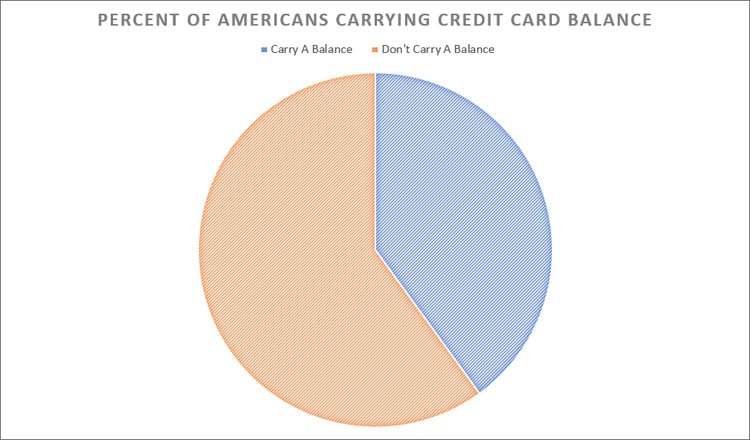

Practically 40% of American households carry a bank card stability from one month to the subsequent, and they may not contemplate this debt an essential monetary concern.

“I’ve made the minimal fee, so I’m good, proper?” is the overall thought course of.

The reality is that bank cards normally include extraordinarily excessive rates of interest in comparison with different types of credit score, and over time, the curiosity accrual will kill your finances.

Paying off debt isn’t an thrilling method to make use of the additional cash in your paycheck, however the stability will solely proceed to develop should you don’t begin making funds.

The common bank card rate of interest is over 14% for current accounts and greater than 19 % for brand new accounts.

How you can repair it: Enhance the quantity you finances for bank card funds.

You would possibly really feel overwhelmed by your bank card stability and different money owed, however you can begin transferring towards turning into debt-free by placing as a lot as you may towards them.

Since money owed develop the longer the stability stays unpaid, they need to all the time be one in all your high monetary priorities.

In case you’re at the moment managing a number of money owed, begin by paying down the stability with the best rate of interest earlier than transferring to the bottom, often known as the debt avalanche technique.

That is essentially the most environment friendly strategy to get out of debt whereas avoiding as a lot curiosity as doable.

#3. Use Targets to Energy Your Budgeting

In case you can’t join your budgeting habits to real-life objectives, it is going to be robust to stay to your finances when you haven’t any motivation.

Whenever you’re merely selecting between a free finances template (maybe one you discovered on-line) and one thing you actually need, there’s an excellent probability you’ll give your self quick satisfaction.

It is advisable to join your finances to actual, precise objectives.

Why are you going by way of this month-to-month train of budgeting and sticking to it? It is advisable to write down precisely why you’re doing this.

And naturally, obscure or generic objectives in all probability received’t provide help to keep motivated.

Some folks attempt to “lower your expenses” with out committing to something particular, however this isn’t normally an efficient long-term method.

I’ve discovered that I should be extraordinarily detailed with my objectives as a way to be motivated by them.

How you can repair it: Outline your quick and long-term objectives.

Budgeting is nearly all the time helpful, however it’s simpler to remain dedicated should you’re focusing on each quick and long-term monetary objectives.

Reasonably than spending much less simply to be extra frugal, you’ll be transferring towards a tangible objective like beginning to make investments, saving for retirement, or constructing a university fund for a liked one.

For a similar causes, it’s greatest to give you a concrete, measurable objective every month.

Begin with one thing small, even simply $25 or $50 monthly will go a great distance.

Whenever you’re tempted by one thing you don’t want, hold each your quick and long-term wants in thoughts.

It’s simpler to carry off if you imagine the cash you save goes to one thing extra essential.

And here’s a bonus tip I exploit. I create a imaginative and prescient board in my journal.

It has pictures of my objectives and I assessment them each morning.

This lights a hearth inside me that carries by way of the whole day to be sensible with my cash so I can attain my objectives.

#4. Embrace Surprising Prices In Your Finances

It’s simple to finances for recurring and common bills like groceries, subscriptions, and gasoline, however issues get extra sophisticated for brand new or one-time prices.

If you must go to the dentist and take your cat to the vet in the identical month, you’ll end up going over finances shortly.

When unavoidable bills utterly change your budgeting plans, it may be robust to get again on monitor.

With the intention to finances successfully, you’ll want to keep up a long-term outlook that takes prices under consideration earlier than they arrive up.

This can provide help to keep away from monetary surprises and keep on with your finances with out breaking the financial institution for main bills.

How you can repair it: Construct an emergency fund and finances for surprises.

With an emergency fund, you’ll be capable of cowl sudden prices that might in any other case derail your finances.

When you’ve saved sufficient cash, your emergency fund may also be your first fallback should you lose your major supply of revenue.

Many specialists due to this fact advocate constructing a fund equal to not less than three months of bills.

It would take time to achieve that objective, however just some hundred {dollars} will provide help to get by way of a spread of inauspicious monetary conditions.

Even should you’re at the moment in debt, it’s nonetheless a good suggestion to place not less than a few of your paycheck towards an emergency fund should you don’t have already got one.

Simply as an emergency fund offers you some insurance coverage for shock bills, you may finances for the prices you expect by beginning to consider them a couple of months upfront.

In case your ten-year anniversary is developing, for instance, don’t wait till that month to finances for the price of a present.

As a substitute, determine it as a future expense round six months upfront, then divide the price and save a fraction of the full every month.

Reasonably than budgeting for $300 all of sudden, for instance, you can begin taking $50 out of your paycheck six months beforehand and distribute the financial savings extra evenly.

If the vendor gives financing with little or no curiosity, make the most of this feature to offer your self much more time to repay the debt.

If you recognize you’ll have six months to make funds, for instance, you possibly can divide that preliminary $300 into twelve funds of simply $25.

The extra you may unfold out these prices, the simpler it turns into to account for them in your month-to-month finances.

#5. Give attention to the Small Stuff Too

Whenever you first began budgeting, you in all probability targeted on the most important and most blatant bills.

It’s satisfying to avoid wasting some huge cash with a single change, and that is undoubtedly the best strategy to finances.

Then again, if you prioritize your most costly purchases every month, it’s simple to neglect how shortly the smaller issues add up.

You could possibly be spending quite a bit much less (and taking some strain off of different adjustments) by commonly reviewing the much less conspicuous areas of your finances.

How you can repair it: Evaluate your statements each month.

Most of us lose monitor of how a lot we spend on issues like subscriptions, espresso, and nights out, however these are sometimes the bills that put us in monetary bother.

Reasonably than being glad with a couple of adjustments, be sure to totally study your financial institution statements on the finish of every month to see precisely the place your cash goes.

In case you’re having bother staying on high of your finances, contemplate downloading one of many many free and low-cost cell apps designed for customers new to budgeting.

They’ll provide help to categorize your bills, arrange computerized funds, and make the perfect changes to start out transferring in the fitting course.

When you develop the behavior of wanting over your statements, you’ll begin to get an thought of your most problematic spending habits.

From there, you may start to develop reasonable monetary objectives that match your present finances and long-term wants.

By evaluating your finances each month, you may alter your objectives primarily based on life-style adjustments or outcomes from the earlier month.

Your finances shouldn’t be static. It’s essential to persistently adapt your method to your present monetary circumstances.

#6. Discover Methods to Domesticate Accountability

Many examine budgeting to weight-reduction plan.

In case you don’t like coping with cash and haven’t any incentive to vary, change possible received’t occur.

How you can repair it: Discover an accountability associate.

Another choice for you, in case you have bother sticking to your finances, is to ask somebody near you to test in in your progress and maintain you accountable in your choices.

Make certain that is somebody you belief utterly.

It’s essential that they’ll inform you the reality if issues aren’t going nicely.

With an accountability associate, you received’t be capable of shrug issues off should you miss your targets.

In the identical method that an train associate might help you retain making progress even if you aren’t motivated, accountability companions offer you another excuse to stay to your finances.

#7. Use Expertise to Establish Higher Methods and Errors

Budgeting utilizing a pad and paper could make it extraordinarily tough to remain on high of your spending.

It’s a must to continuously replace your finances bodily, which is simple to keep away from doing.

Greater than that, the potential for human error means that you may make errors that can value you cash.

How you can repair it: Use a budgeting app.

Budgeting apps make it simpler to remain on high of your web value, transactions, and even your current debt.

With the fitting app, it makes it simpler to finances and determine errors in your spending that you just didn’t discover earlier than (reminiscent of forgotten subscriptions that you just didn’t account for in your finances).

#8. Enhance Your Revenue

Decreasing your spending will provide help to finances with better ease.

Nevertheless, it’s solely one-half of the equation.

With the intention to make budgeting and monetary planning simpler on you, you have to to have extra revenue flowing in.

In case you really feel like you may’t spend any much less to make your finances doable, there are answers.

How you can repair it: Enhance your revenue.

The important thing to coping with budgeting that appears far too restrictive and not possible to keep up is to search for methods to generate extra revenue.

There are many concepts on the market that may provide help to make more cash.

Relying in your time or your skills, you possibly can choose up a part-time job, freelance, tackle a aspect hustle, or search for small methods to generate revenue, like taking surveys.

Each penny counts!

#9. Establish Your Spending Weaknesses

Some folks by no means battle with a need to fend off impulse purchases.

Others have a really tough time saying “no” to themselves in terms of spending cash.

These within the latter class battle with budgeting as a result of all of their cash is being spent on non-essentials.

It’s okay to deal with your self each every now and then, however impulse spending or retail remedy can shortly develop uncontrolled, plunge you into debt, and put your well being and security in danger.

How you can repair it: Establish your weak spot and take motion to cease shopping for issues.

Step one is to see the place you’re overspending. For instance, you might be somebody who loves to purchase collectibles or join subscription packing containers.

When you’ve discovered the place you’re overspending, take the suitable motion.

In case you have a tendency to make use of your credit score to purchase stuff you need, lock up your bank cards quickly.

In case you use saved on-line funds for impulse purchases, delete them out of your telephone.

The more durable you make it to buy impulsively, the much less pressure you’ll placed on your self and your finances.

#10. Acknowledge That Some Budgets Might Not Match You

Returning again to the weight-reduction plan comparability, some folks could begin a finances, solely to get discouraged after they aren’t seeing outcomes.

This can be as a result of folks selecting up no matter finances they hear of first after which making an attempt it out.

The 50/30/20 finances is likely to be common, however that doesn’t imply that it’s going to work for everybody.

How you can repair it: Attempt a number of budgeting strategies.

When one finances works for you, you don’t need to essentially attempt to make it work.

There are different budgeting strategies on the market that could be extra appropriate in your monetary state of affairs.

Whether or not it’s zero-based budgeting, the money envelope system, or one thing else altogether, experiment with a number of budgets till you discover that’s the fitting match for you.

#11. Set up Reminders for Payments and Different Bills

Budgeting solely works if you find yourself on high of your monetary tasks.

Lacking month-to-month payments or forgetting about rare bills can shortly make budgeting a nightmare.

It’s simple to finish up falling behind, which creates pointless obstacles for you.

How you can repair it: Arrange reminders for all your payments.

If in case you have reminders that you must pay your payments activated in your telephone, you recognize what you must pay and when you must pay it.

This helps you keep on high of your bills so your cash is leaving your account as deliberate.

Professional tip: Schedule reminders forward of time for rare bills like preventative automotive upkeep or birthday items.

#12. Establish Adjustment Durations and Change With Your Monetary Wants

Budgets usually are not one thing you may set and neglect.

In case you’ve seen that your finances is all of a sudden not working, there’s one thing occurring behind the scenes.

What does this imply for you? It usually means it’s time for a change.

How you can repair it: Regulate your finances as wanted.

Has your revenue gone down as a result of a demotion? Have utilities and meals costs began to spike? Are you spending extra as a result of well being points you’re experiencing?

All of those eventualities will affect your finances.

Take discover of when life circumstances and alter your finances as your monetary wants and circumstances shift.

Remaining Ideas

Budgeting is one of the best ways to construct higher spending habits, however many individuals surrender on their budgets within the first few months.

The following tips will provide help to develop reasonable expectations and create the finances that’s proper in your revenue, bills, and monetary objectives.

Bear in mind to test your statements each month to search for much more methods to save cash.