To date, 2025 is shaping as much as be a bit higher in relation to mortgage charges.

Whereas the 30-year mounted is barely barely beneath year-ago ranges in the intervening time, it appears to be trending in a greater route in comparison with final 12 months.

It’s at the moment round 6.75%, which is about an eighth beneath the 6.875% common seen in early March 2024.

However not like again then, mortgage charges may sink additional into spring, as a substitute of rising like they did in April and Could.

And that may very well be a boon for present owners seeking to refinance an present dwelling mortgage.

Price and Time period Refis Proceed to Acquire as Mortgage Charges Enhance

There are three primary sorts of mortgages – the house buy mortgage, which is self-explanatory.

And the mortgage refinance, which is damaged down right into a charge and time period refinance and a money out refinance.

When mortgage charges saved rising and ultimately hit 8% in late 2023, no person was making use of for a charge and time period refinance.

Why? Since you’d solely actually achieve this for those who may get hold of a decrease rate of interest within the course of.

That meant the one actual recreation on the town, other than some buy lending, was money out refinances, the place present owners have been both consolidating debt or tapping fairness to pay for different bills.

Nevertheless, now that mortgage charges are seemingly falling, and nicely beneath these scary 8% ranges seen about 18 months in the past, charge and time period refinances have made a little bit comeback.

They’ve really been the one shiny spot currently within the mortgage world, with money out refis additionally eeking out some smaller positive factors as nicely.

Lengthy story brief, these excessive mortgage charges seen over the previous few years have created a chance now that they’re fairly a bit decrease.

Debtors who took out mortgages with charges within the high-7s and even 8s can now commerce them in for one thing extra palatable, like a 6.5% charge.

For instance, on a $400,000 mortgage quantity a hypothetical borrower may decrease their principal and curiosity cost by roughly $300 per 30 days.

Price and Time period Refi Quantity Up Practically 120% 12 months-over-12 months

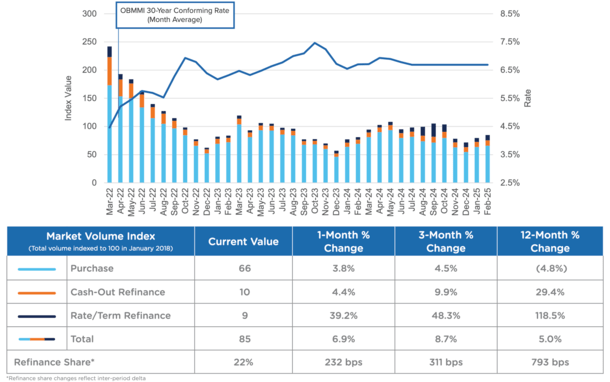

The most recent Market Benefit report from Optimum Blue revealed that charge/time period refinance lock quantity surged practically 40% (39.2%) in February from a month earlier.

And the 3-month change was a fair increased 48.3% improve, whereas the 12-month change was a whopping 118.5% improve.

In fact, if you have a look at the chart above, you’ll be able to see that charge and time period refis (darkish blue) nonetheless account for a sliver of total mortgage manufacturing.

So whereas they’re having fun with some good proportion positive factors, they aren’t pretty much as good as they appear. However you’ve obtained to start out someplace and the latest improve is a promising begin to 2025.

As alluded to earlier, if mortgage charges hold trending decrease because the months go by, quantity may actually explode.

For reference, the 30-year mounted was round present ranges final 12 months earlier than turning as much as round 7.50% in April and Could.

It will definitely eased throughout summer time earlier than falling to round 6% on the Fed pivot, which led to a giant uptick in refinance exercise.

However that was short-lived due to a scorching jobs report, adopted by a Trump presidential victory, each of which propelled charges increased.

Assuming cool financial knowledge continues to come back in, and Trump’s tariffs don’t trigger an excessive amount of hassle (no assure there), charges may revisit these 2024 lows and even go decrease.

If that occurs, there’s a variety of pent-up refinance demand ready on the sidelines, probably some who missed that window final September earlier than charges shot up once more in October.

Sub-6% Mortgage Charges May Add Hundreds of thousands of Refinance Candidates

When mortgage charges hit 6.125% in September, the in-the-money refinance inhabitants jumped by about 1.3 million, per a report from ICE on the time.

Had charges continued to fall, to say 5.75%, one other two million refi candidates would have materialized.

And if charges went down to five.5%, which many check with as a magic quantity for dwelling purchases, one other 1.2 million extra.

In different phrases, it is perhaps potential to unlock three million or extra refinances if/when the 30-year mounted falls again to the mid-5s, which is trying like an actual risk this 12 months.

That might lastly make refinances account for a good share of total lock quantity once more, as a substitute of merely seeing large proportion positive factors from rock-bottom ranges.

On the identical time, if low mortgage charges are pushed by a recession, you may need a scenario the place dwelling buy lending falls, regardless of improved affordability.

Merely put, decrease demand due to fewer eligible dwelling consumers means much less dwelling gross sales.

That too may push up the refinance share of the market, which stood at simply 22% in February.

It was as excessive as 32% final September, so if mortgage charges fall beneath these ranges, it wouldn’t be unreasonable to see refis seize a 40% share once more.

And that might make 2025 the 12 months of the speed and time period refinance after a tricky few years.