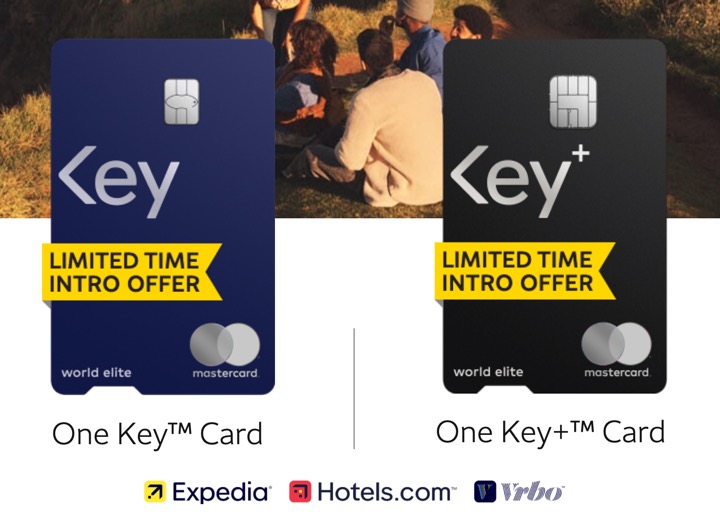

The One Key and One Key+ bank cards are journey rewards playing cards supplied by Expedia Group (Expedia, Resorts.com, and VRBO) and issued by Wells Fargo. Rewards are earned as “OneKeyCash” which may solely be used to offset journey bookings on a type of three websites. Personally, the primary draw for me is VRBO as we frequently ebook one bigger area as an alternative of two lodge rooms for our household of 5. Proper now, there’s a limited-time supply. Highlights:

One Key Card

- New cardholder bonus: $400 in OneKeyCash after you spend $1,000 on purchases within the first 3 months.

- 3% again in OneKeyCash on Expedia, Resorts.com and Vrbo.

- 3% again in OneKeyCash at gasoline stations, grocery shops and on eating.

- 1.5% again in OneKeyCash on all different purchases.

- Automated Silver One Key standing. Supposedly, this contains “financial savings of 15% or extra on over 10,000 resorts worldwide.” Unlock Gold whenever you spend $15,000 per calendar yr.

- Different advantages embody no overseas transaction charges, cellphone safety, and journey protections like journey accident insurance coverage and journey cancellation insurance coverage.

- No annual charge.

One Key+ Card (observe the plus signal!)

- New cardholder bonus: $600 in OneKeyCash after you spend $3,000 on purchases within the first 3 months.

- 3% again in OneKeyCash on Expedia, Resorts.com and Vrbo.

- 3% again in OneKeyCash at gasoline stations, grocery shops and on eating.

- 2% again in OneKeyCash on all different purchases.

- Automated Gold One Key standing. Supposedly, this contains “financial savings of 12% or extra on over 10,000 resorts worldwide.” Unlock Platinum whenever you spend $30,000 per calendar yr.

- $100 in OneKeyCash annually in your Cardholder anniversary.

- $120 World Entry/TSA credit score. Obtain one assertion credit score as much as $120 for a Trusted Traveler Program, equivalent to World Entry® or TSA PreCheck®.

- Different advantages embody no overseas transaction charges, cellphone safety, and journey protections like journey accident insurance coverage and journey cancellation insurance coverage.

- $99 annual charge.

The bank card rewards stack on high of the usual OneKeyCash earned for reserving on Expedia, Resorts.com, and VRBO. Nevertheless, it’s usually cheaper to ebook a lodge straight at their very own web site, so I normally don’t use Expedia or Resorts.com. With VRBO, usually the identical home can also be listed on Airbnb and on a small impartial administration website. Typically VRBO is the most cost effective (in spite of everything their charges and taxes) or provides the very best refund coverage, so I nonetheless use VRBO in these circumstances.

Limitations on Expedia flight bookings. You need to use OneKeyCash for a flight, however observe the next limitations:

To make use of OneKeyCash on a flight, you will want sufficient OneKeyCash to cowl the complete value of your eligible flight, together with taxes and costs, and will not add any optionally available extras like checked baggage or seat assignments. You should purchase these extras after reserving your ticket. OneKeyCash might solely be used on chosen flights.

In distinction, you should utilize OneKeyCash to partially offset a VRBO rental, right down to the penny. Observe that not all VRBO properties are eligible for OneKeyCash redemption (VRBO have to be their fee processor) and you need to use the “Pay Now” choice.

I personally don’t normally use Expedia or Resorts.com regularly, however I do ebook on VRBO commonly sufficient to anticipate to make use of up the OneKeyCash bonus. For those who have executed many of the different large bank card bonuses, this card nonetheless provides some good potential worth, even whether it is in a extra restricted rewards system.