Here’s a recap of how the technique was designed and the thought course of behind it.

What’s the problem in constructing an fairness portfolio utilizing mutual funds?

Constructing an fairness mutual fund portfolio can really feel complicated and overwhelming.

- Too Many Decisions!

With over 45 fund homes providing an enormous array of fairness fund schemes throughout a number of classes, the alternatives can really feel infinite. And the nagging query stays: What if I select the mistaken one? - Fund Scores don’t work!

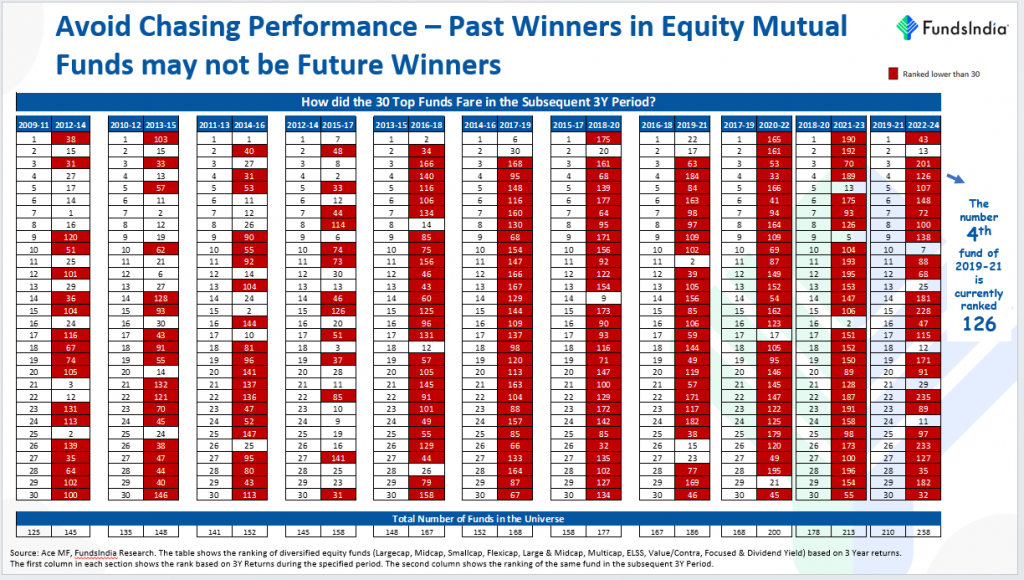

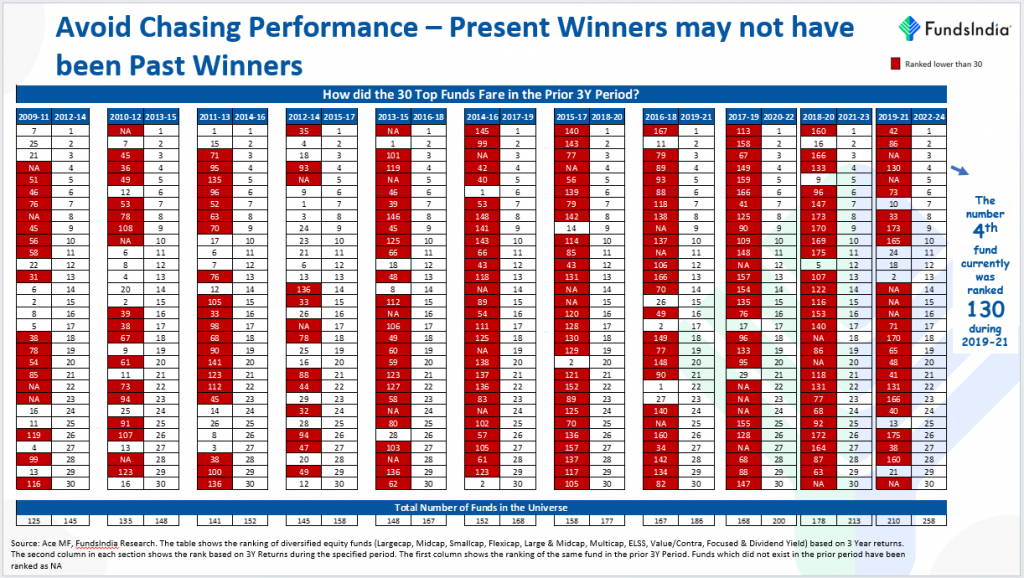

Have you ever ever questioned why ranking companies by no means present the efficiency observe document of their 5-star-rated funds? - Previous Efficiency doesn’t assist in choosing future winners!

Proof means that portfolios made up solely of latest winners are inclined to underperform sooner or later.

How can we resolve this?

Determine confirmed funding kinds that may outperform the passive index (Nifty 50 or Nifty 500) over the long term!

Funding analysis worldwide has repeatedly proven that shares with particular, well-defined traits usually outperform widespread market-cap-based benchmarks just like the Nifty 50 or Nifty 500 over the long run. These traits, often called components, have demonstrated enduring success, persistently delivering efficiency over time and proving efficient throughout various fairness markets.

Up to now, seven key components have been recognized and validated globally.

Primarily based on the historic efficiency and portfolios of those totally different kinds, we discovered that

- ‘Dividend Yield’ hasn’t labored properly in India.

- ‘Low volatility’ portfolios have a really excessive overlap with ‘High quality’ portfolios

So we’ll keep away from these two kinds.

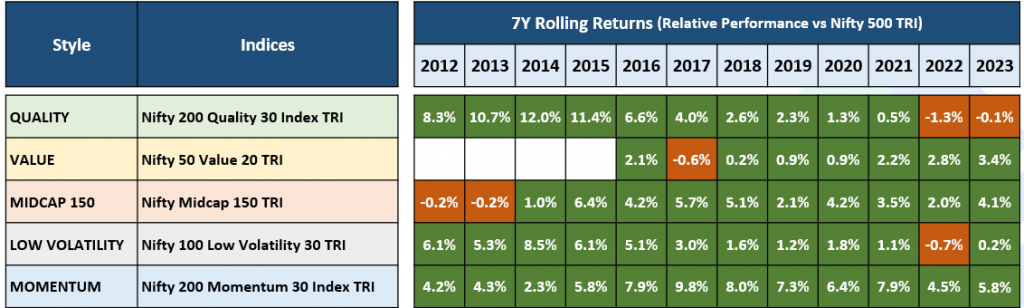

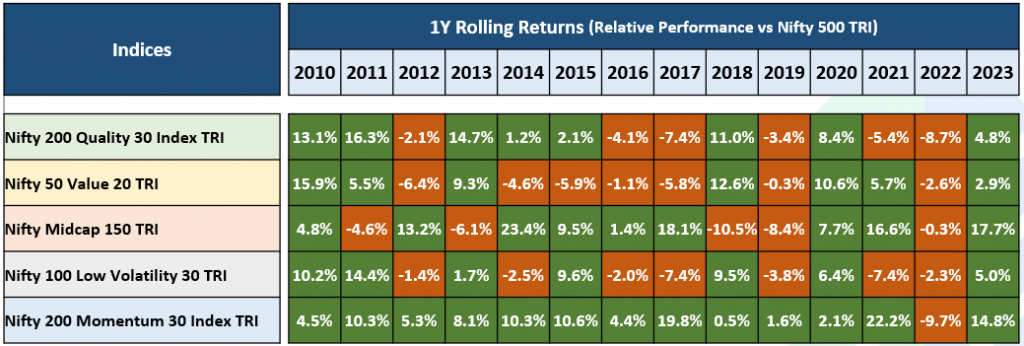

Do these funding kinds outperform over the long term in India?

As seen beneath, most kinds have been in a position to outperform the passive index (Nifty 500 TRI) persistently over totally different 7 yr intervals.

What’s the catch?

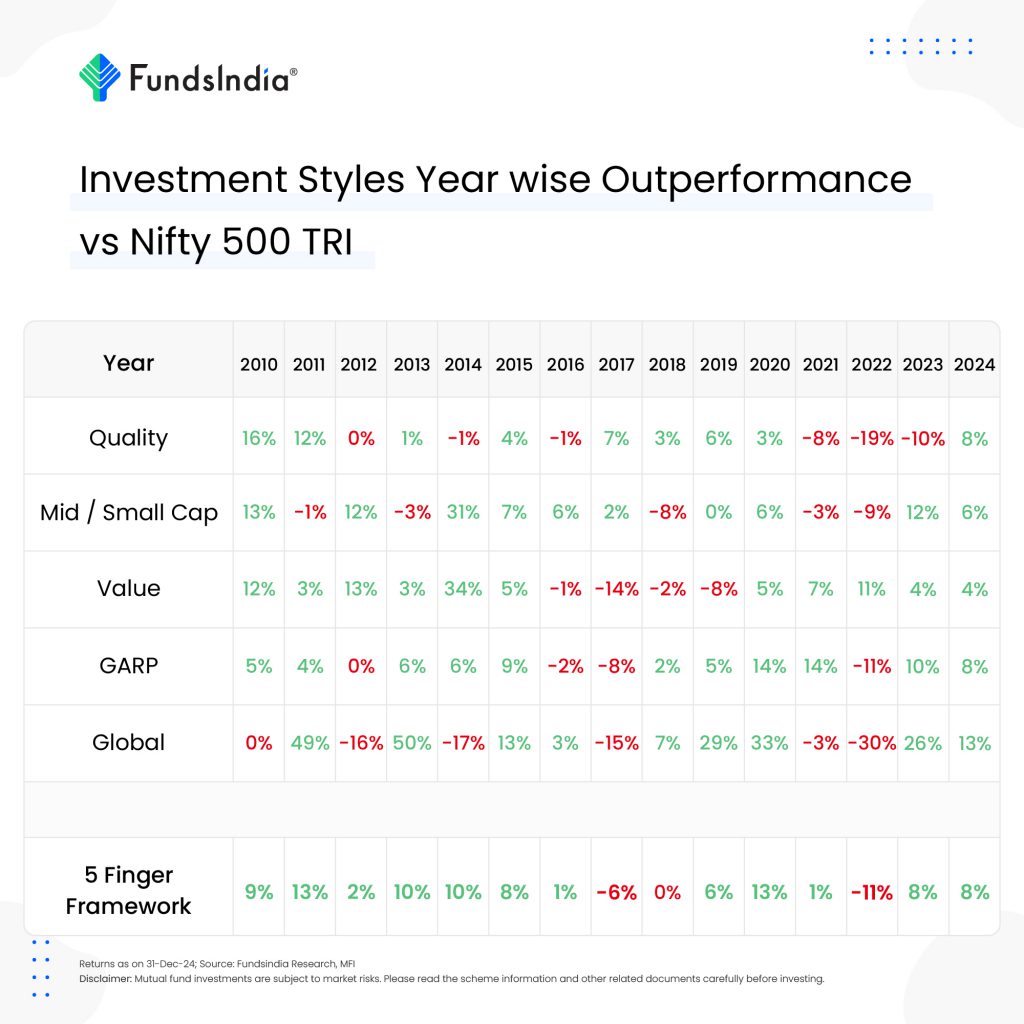

Totally different time examined Fairness Kinds whereas they outperform over the long term, undergo intermittent intervals of underperformance…

Whereas these funding kinds have persistently delivered robust outcomes over lengthy intervals (7+ years), they don’t carry out equally properly within the brief time period. Every fashion experiences its personal cycles, with phases of underperformance adopted by intervals of great outperformance. Nevertheless, over the long term, the positive factors from outperformance greater than make up for the lean phases of underperformance.

This underscores an vital actuality: all kinds will inevitably face intervals of non permanent underperformance as a part of their pure cycle.

Focusing solely on funds which have carried out properly within the latest previous can result in a portfolio closely concentrated in a single or two funding kinds. When these kinds fall out of favor, your whole portfolio might expertise extended underperformance for years.

This is the reason relying solely on previous efficiency is an unreliable technique for predicting future winners!

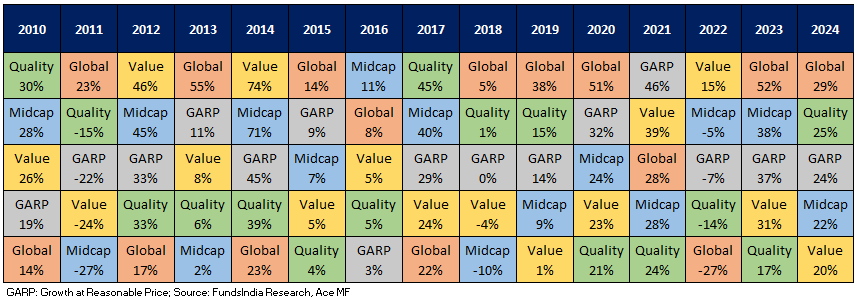

Can we determine the kinds that can carry out properly within the subsequent few years?

As seen from the above desk, funding kinds rotate yearly and this can be very tough to foretell when these kinds might be in favor or out of favor.

construct an excellent fairness fund portfolio?

Regardless of this, we are able to construct a easy and efficient portfolio utilizing the time examined magical device – Diversification.

As a substitute of attempting to foretell which fashion will work over the following 5-7 years, we choose to diversify throughout these 5 kinds. We can even be including ‘international’ publicity to offer international diversification.

Our perception – Time within the fashion is extra vital than Timing the fashion!

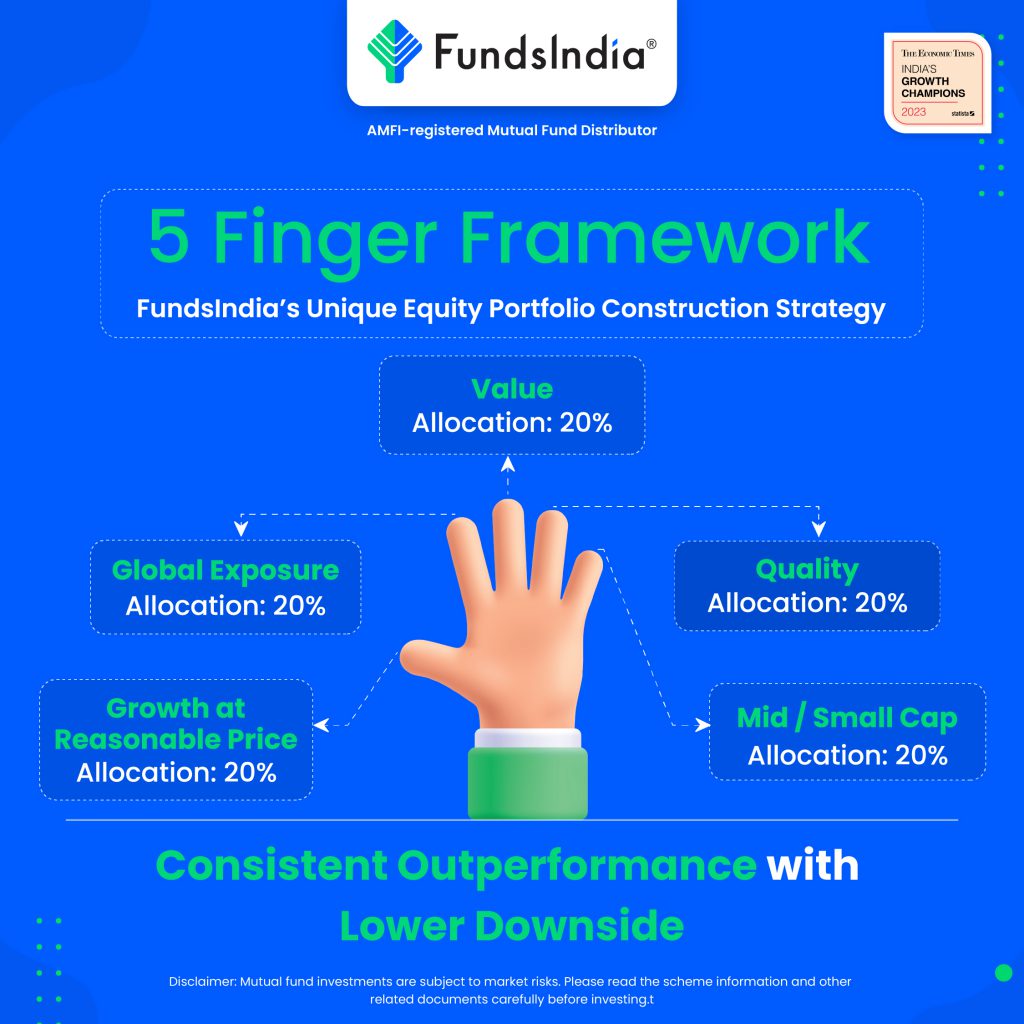

Presenting ‘5 Finger Framework’ – Your All Seasons Fairness Portfolio Technique

Simply as we want all 5 fingers to carry out day by day actions successfully, a well-constructed fairness fund portfolio requires a balanced illustration of 5 key kinds:

- High quality

- Worth

- Progress at a Cheap Worth (GARP)

- Mid/Small Cap

- World Publicity/Momentum

Our Choose Funds are rigorously chosen to make sure these kinds are adequately represented, leveraging the experience of the very best fund managers. Below our 5-Finger Framework, the fairness portfolio is evenly distributed, with 20% allotted to every fashion.

To keep up this stability, the portfolio is rebalanced yearly if any particular person fund’s allocation deviates past ±5% (i.e., falls beneath 15% or exceeds 25%). This disciplined method ensures the portfolio stays diversified and properly positioned to navigate totally different market environments.

The efficiency of any technique is nearly as good as its underlying funds. You may put money into one or two funds below every fashion. However you will need to choose the suitable funds below every fashion. You may discuss with our FundsIndia SELECT Funds checklist the place we determine good funds and skilled fund managers to play the actual kinds.

What’s the logic?

- Excessive chance of particular person kinds outperforming over the long run.

- Totally different cycles of outperformance and underperformance be sure that when some kinds lag, others excel, making total portfolio efficiency constant.

- Helps you keep invested in underperforming funds, as robust total portfolio returns present confidence and conviction.

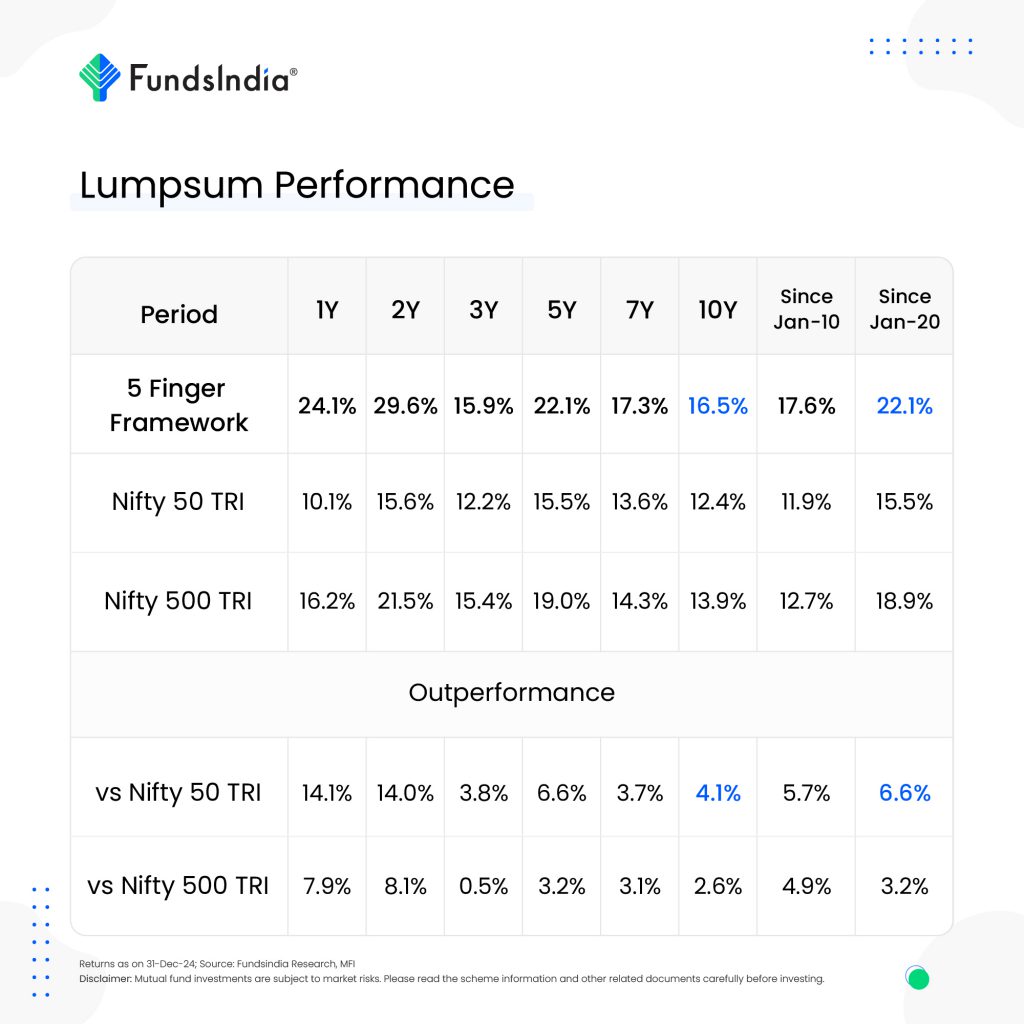

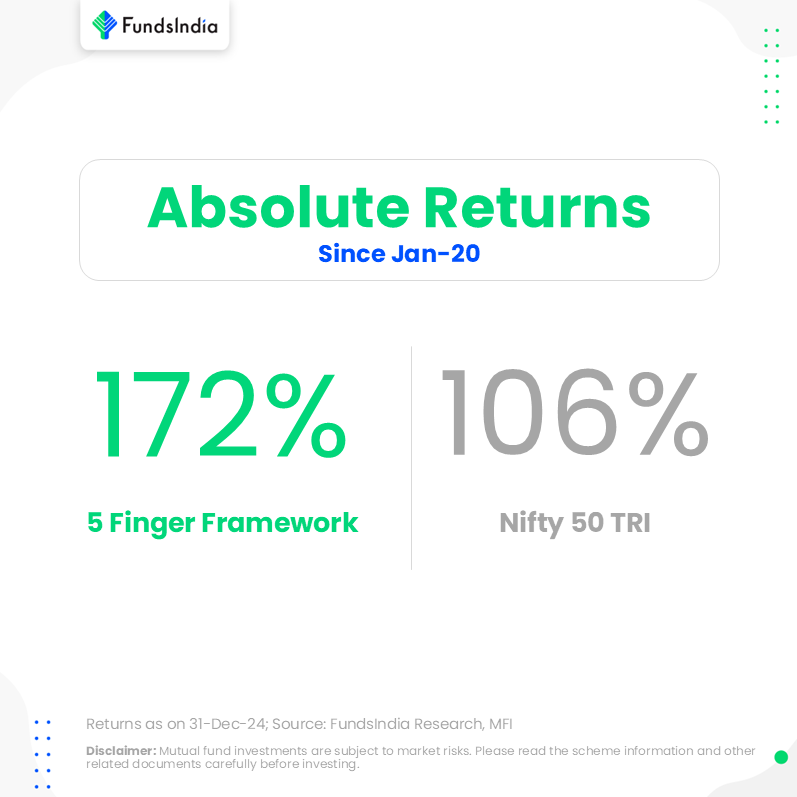

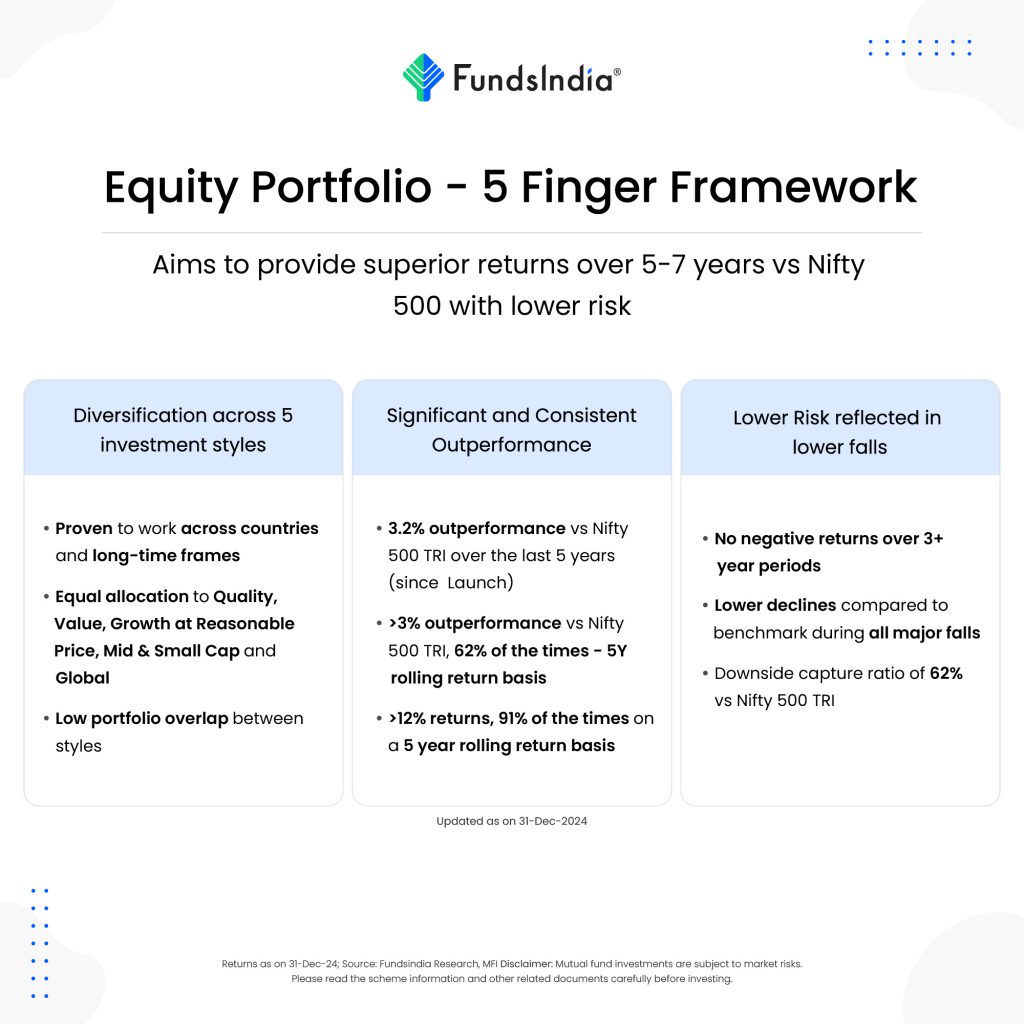

We launched the technique in January 2020 after conducting in depth back-testing from January 2010, which delivered spectacular outcomes. Since then, we’ve got tracked the technique’s precise efficiency over the previous 5 years.

How did the technique carry out since its launch during the last 5 years?

Superior Efficiency: 22% each year vs 19% each year benchmark returns -> 3% outperformance

5 Finger Technique multiplied your cash 2.7 occasions over 5 years (vs 2.3 occasions for the benchmark)

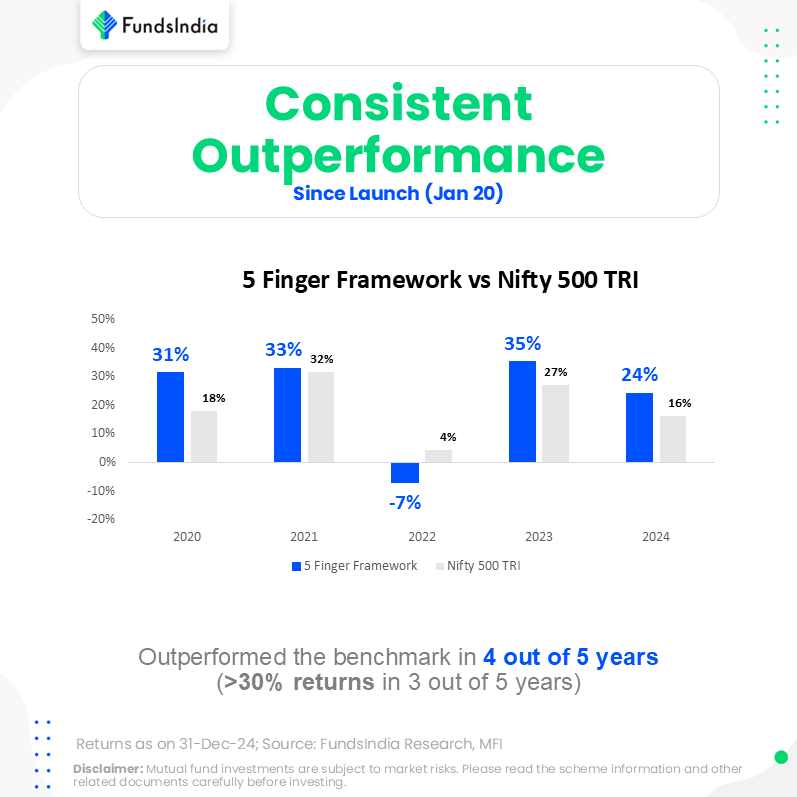

Was the efficiency constant?

The outperformance shouldn’t be attributable to a single distinctive yr however has been persistently robust throughout a number of years

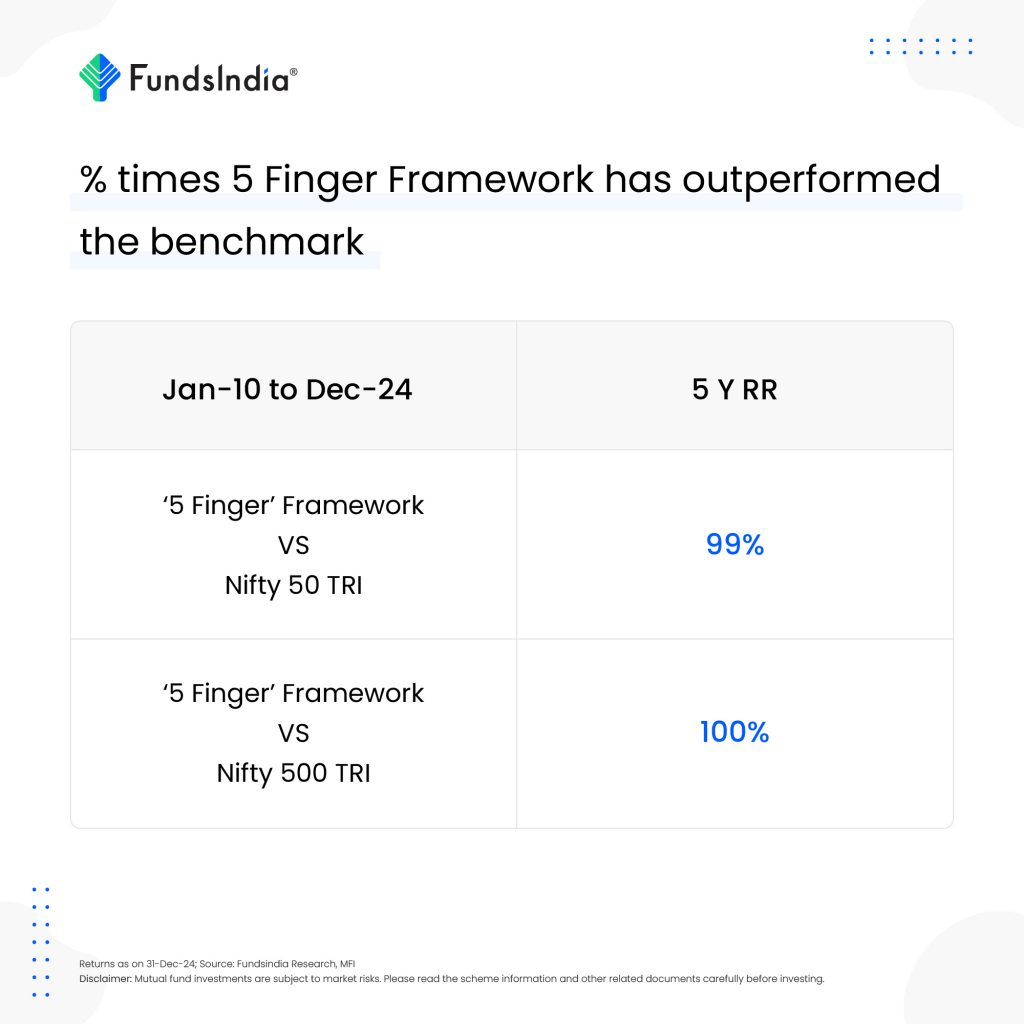

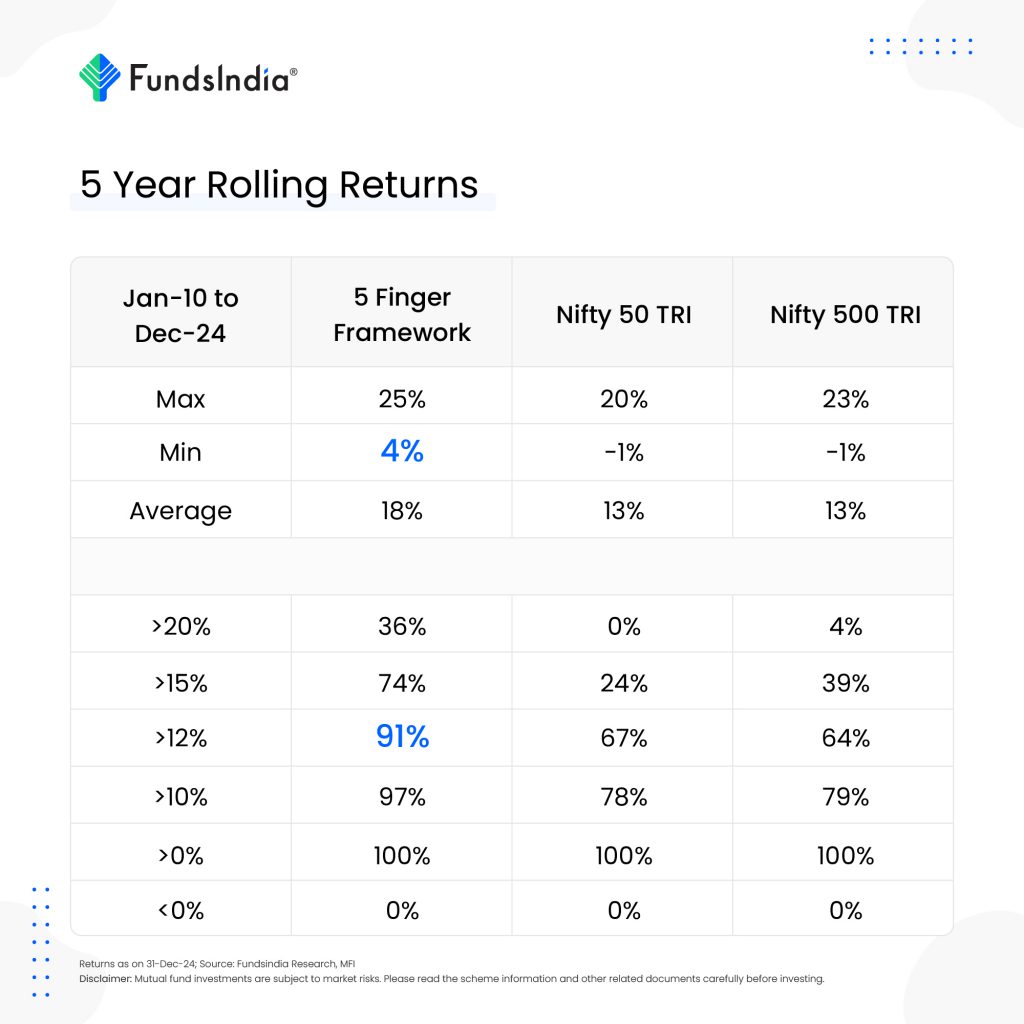

And even for longer time frames i.e. throughout all of the 5-year intervals since 2010 this framework has labored properly persistently

- Common 5Y Rolling Returns at 18% vs Nifty 500 TRI at 13%

- 5 Finger Framework has outperformed Nifty 500 TRI, 100% of the occasions on a 5 12 months rolling return foundation!

- 62% of the occasions the 5 Finger Framework has outperformed Nifty 500 TRI by greater than 3% each year over 5 12 months time frames

- 91% of the occasions the 5 finger technique has delivered >12% returns over 5Y time frames

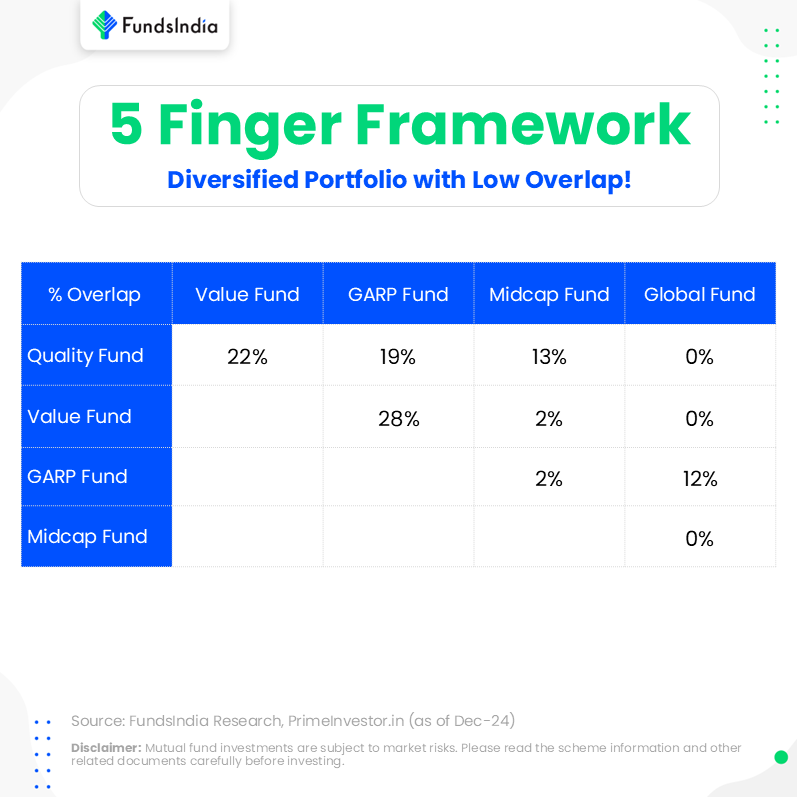

Did the diversification throughout kinds work?

Low overlap throughout funds…

Led to totally different kinds out/underperforming at totally different time intervals – serving to in a extra constant efficiency at an total portfolio stage.

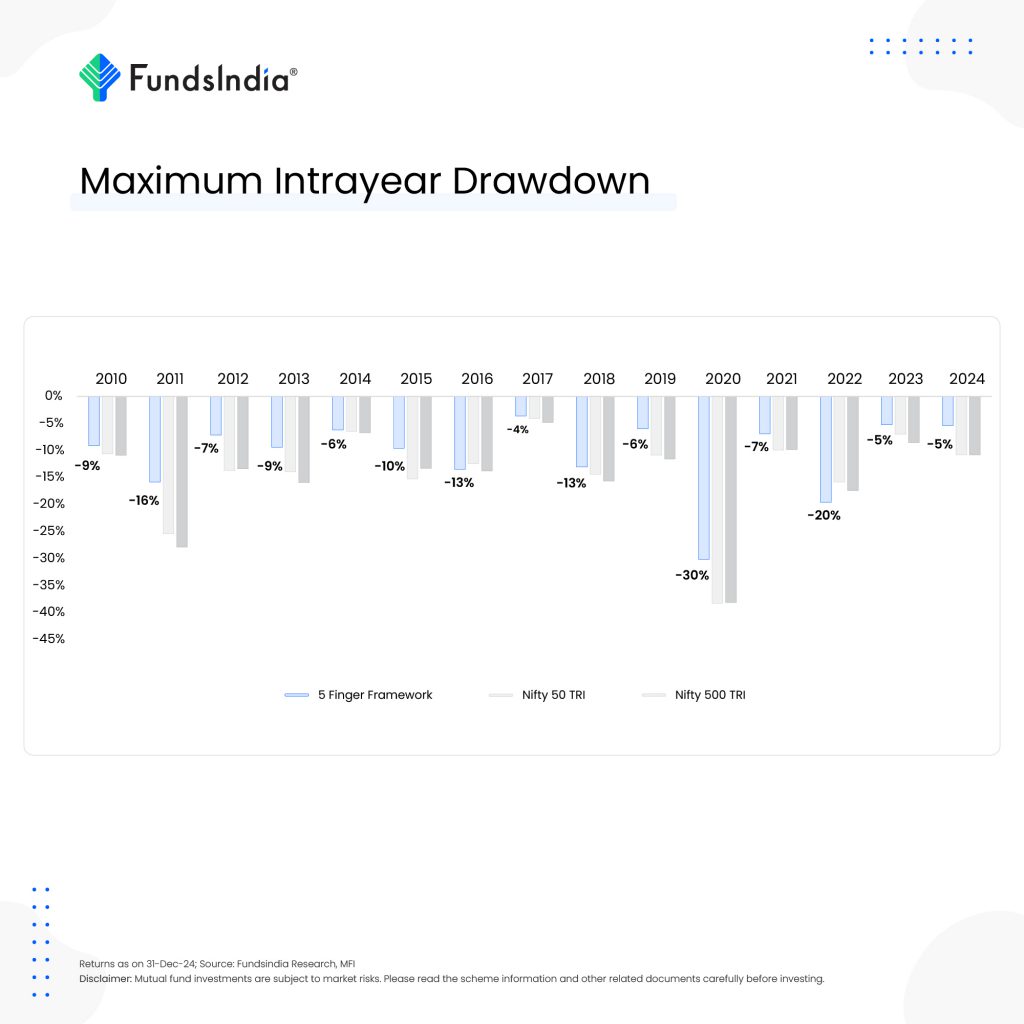

What about threat?

Majority of the time, 5 finger technique fell decrease than Nifty 500 & Nifty 50…

The 5 Finger portfolio had a Draw back Seize Ratio of 62% in opposition to the Nifty 500 for the final 5 years i.e. it roughly captured solely 62% of the falls suffered by the broader market. A ratio lower than 100% signifies robust threat administration potential of the portfolio.

As seen from the intra-year declines (most falls confronted by the broader market inside a yr), the portfolio utilizing the 5 Finger framework has typically fallen lower than the benchmarks. Besides for two out of the final 15 calendar years (2016 & 2022), the intra-year declines for five Finger technique was decrease than Nifty 50 TRI.

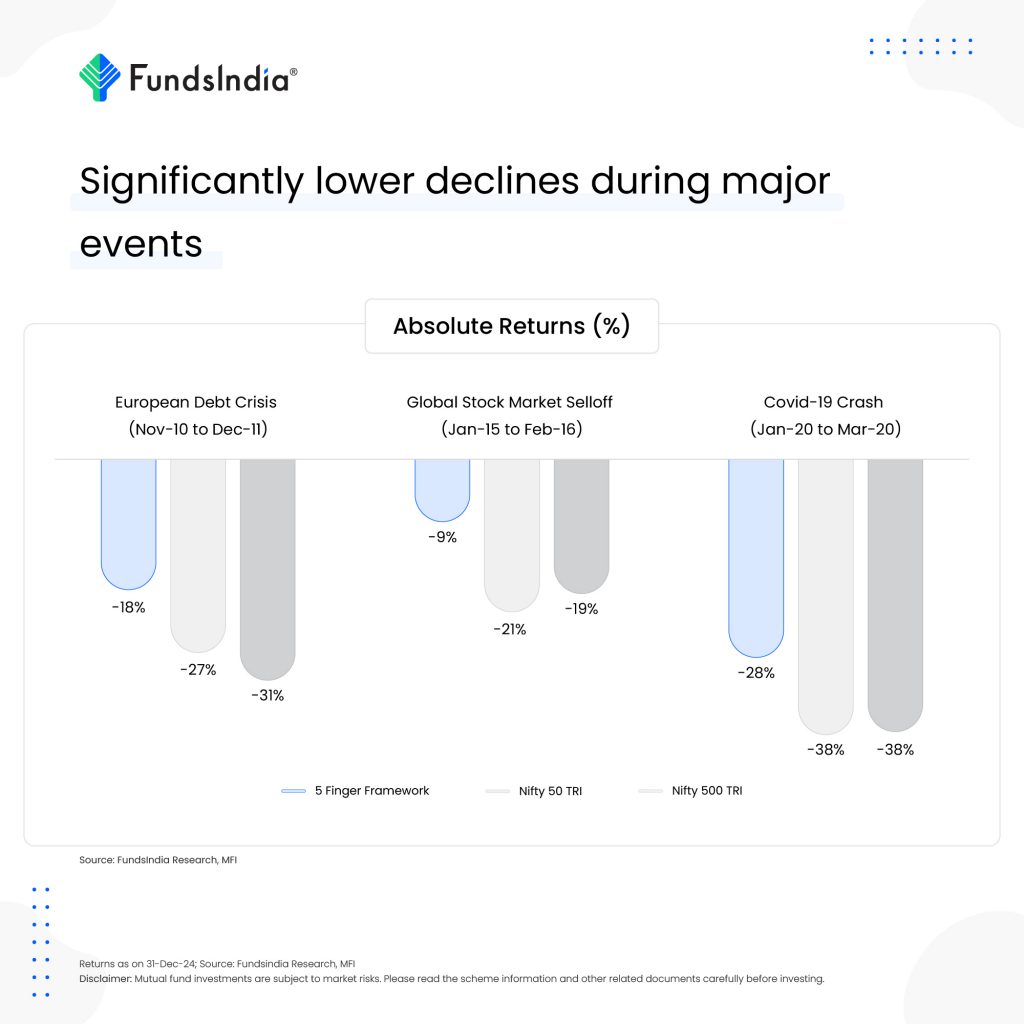

We are able to additionally see that this method has been resilient throughout the main market declines previously 10+ years leading to low falls.

Have been there adjustments within the funds?

There was only one change within the final 5 years and this was made final yr in 2024.

For the standard fashion, we transitioned from the Axis Targeted 25 Fund resulting from a dilution in its funding fashion. Curiously, as an alternative of following the standard method of switching from an underperformer to a prime performer, we selected one other high quality fund which was additionally underperforming on the time.

This choice was in keeping with our portfolio design philosophy, which acknowledges that each one funding kinds expertise intervals of underperformance. Among the many high quality funds accessible, we chosen one whose underperformance intently aligned with the traits of the standard fashion and related indices.

This new fund has additionally carried out properly over the previous six months, as the standard cycle exhibits early indicators of restoration.

Summing it up

We additionally launched one other model of the 5 Finger Technique with solely India publicity the place we’ve got changed World fashion with Momentum fashion. This technique has additionally accomplished properly consistent with our expectation (CY24 Returns: 23% for five Finger Home vs 16% for Nifty 500 TRI)

Our Learnings

- Each funding fashion experiences phases of underperformance and outperformance. By combining these kinds, the 5 Finger Framework has confirmed to be an efficient behavioral answer, serving to buyers stick to the total technique and stay invested, even during times of underperformance inside particular kinds.

- This technique can also be tax-efficient resulting from minimal portfolio churn—we’ve got made just one fund change, prompted by a change within the fund administration group that diluted its funding fashion.

- Totally different funding kinds excel in various market circumstances. By mixing these kinds throughout the 5 Finger Framework, intervals of underperformance in one fashion have been offset by outperformance in others. This method has delivered constant efficiency with lesser declines in comparison with benchmark indices.

Is 5 Finger technique best for you?

The 5 Finger method is finest suited to affected person buyers with a long-term horizon of a minimum of 5 to 7 years. Some funding kinds might expertise relative underperformance for prolonged intervals, however staying invested regardless of that is essential to totally profit from diversification, because it’s inconceivable to foretell when kinds go out and in of favor.

Please do not forget that at any cut-off date, one or two kinds might lag, however these underperforming kinds rotate over time, making a balanced and resilient portfolio.

As at all times, glad investing!

Different articles you could like

Submit Views:

24