Welcome to 2025. My weblog recorded its twentieth 12 months of existence on December 24, 2024 which I suppose is one thing to have fun. However after I look out the window and attempt to discover optimism I fail. Who is aware of what the 12 months holds and world uncertainty is dominating the narratives surrounding financial developments. Now we have a loopy man about to take over the US alongside along with his band of loopy guys. Authorities coalitions are failing in all places and worldwide cooperation is giving option to nationalism. Now we have Israel nonetheless slaughtering tens of 1000’s of harmless civilians utilizing the gear made out there by the US and different superior nations. Apparently opposing that slaughter makes one anti-semitic. I may go on. These observations will clearly situation my pondering within the subsequent 12 months. However right now, I’m catching up on previous work. On November 29, 2024, the Financial institution of Japan printed a analysis paper – (論文)「量的・質的金融緩和」導入以降の政策効果の計測 ― マクロ経済モデルQ-JEMを用いた経済・物価への政策効果の検証 (which interprets to “Measuring the results of the “Quantitative and Qualitative Financial Easing” coverage since its introduction: Analyzing the results of the coverage on the financial system and costs utilizing the macroeconomic mannequin Q-JEM” – the paper is just out there in Japanese). The analysis makes use of modern statistical methods to evaluate the influence of the low rate of interest, massive bond-buying technique deployed by the Financial institution of Japan between 2013 and 2023. The Financial institution of Japan analysis refutes the principle predictions made by economists concerning the impacts of huge bond-buying packages.

The Financial institution of Japan launched its Quantitative and Qualitative Easing coverage in April 2013.

You’ll be able to refresh your recollections concerning the QQE coverage by studying this paper from the previous governor of the Financial institution of Japan, Haruhiko Kuroda (October 8, 2016) – “Quantitative and Qualitative Financial Easing (QQE) with Yield Curve Management”: New Financial Coverage Framework for Overcoming Low Inflation (in English).

You may additionally wish to learn my very own evaluation right here:

1. Q&A Japan fashion – Half 5b (December 5, 2019).

2. Q&A Japan fashion – Half 5a (December 3, 2019).

Those that observe Japanese financial coverage shifts will know that the Financial institution of Japan has been attempting to push the inflation fee up for a few years.

The newest try began on April 4, 2013 when the Financial institution of Japan introduced they have been resuming their program of Quantitative and Qualitative Financial Easing (QQE), which includes the Financial institution coming into the secondary JGB market and extra just lately company debt markets and utilizing its infinite capability to purchase issues which might be on the market in yen, together with authorities bonds and different monetary property.

They introduced they’d spend round “60-70 trillion yen” a 12 months (see Assertion Introduction of the “Quantitative and Qualitative Financial Easing”).

On October 31, 2014, the Financial institution of Japan introduced it was increasing the QQE program.

It will now “conduct cash market operations in order that the financial base will enhance at an annual tempo of about 80 trillion yen (an addition of about 10-20 trillion yen in contrast with the previous).”

Then on January 29, 2016, the Financial institution issued the assertion – Introduction of “Quantitative and Qualitative Financial Easing with a Unfavourable Curiosity Charge” – which augmented the QQE program – continuation of the annual purchases of JGB of 80 trillion yen and the appliance of “a damaging rate of interest of minus 0.1 p.c to present accounts that monetary establishments maintain on the Financial institution”.

I thought-about that final choice on this weblog submit – The folly of damaging rates of interest on financial institution reserves (February 1, 2016).

Later (in the course of the early COVID interval), the Financial institution of Japan added help for companies, which stopped share costs from falling.

QQE additionally noticed the yen depreciate as central banks all over the world hiked rates of interest whereas the Financial institution of Japan held their coverage fee fixed.

Fiscal coverage additionally remained expansionary, with the Authorities truly rising its discretionary web spending to melt the cost-of-living pressures that arose from the supply-side induced inflationary pressures.

In March 2024, as soon as the Financial institution was happy that the most recent wage bargaining rounds have been delivering an elevated wage end result and that this might see the underlying inflation fee rise in the direction of their desired degree, QQE was terminated.

All of the mainstream pundits (together with senior economists) predicted that inflation would speed up and the bond yields would skyrocket as a result of the federal government was successfully shopping for large portions of its personal debt – which the mainstream claimed was ‘printing cash’.

How improper they have been.

The inflation fee barely moved though there was a bit spike in 2014, which adopted the fiscal coverage choice to hike the consumption tax fee.

That alone demonstrated the relative power of every of the 2 mixture coverage devices (financial and financial).

and the explosion in yields clearly didn’t pan out because the moronic monetary press predicted.

The yields adopted precisely the course that Trendy Financial Principle (MMT) predicted – down.

The truth that the Financial institution of Japan was shopping for up authorities debt at its leisure clearly demonstrated that it’s a monopoly provider of financial institution reserves denominated in yen.

Quick observe to November 2024, when the Financial institution of Japan researchers have now formally investigated all this utilizing superior statistical methods.

The researchers used Q-JEM, which is the Quarterly Japanese Financial Mannequin maintained by the Financial institution, to simulate counterfactual outcomes for key variables within the absence of the QQE coverage intervention.

The write (translated):

The distinction between the simulation outcomes and the precise values of the financial and value variables was then measured because the coverage impact.

How does Q-JEM enable for coverage interventions to influence on actual variables similar to GDP development and personal capital funding and consumption expenditure?

The mannequin is standard and thus decrease rates of interest scale back prices of financing funding tasks and housing purchases.

Additionally, the decrease rates of interest place downward strain on the yen (by way of “the widening of the home and overseas rate of interest differential”), which helps to stimulate demand for exports and boosts company earnings.

I gained’t talk about all of the technicalities of the analysis strategies right here – I truly don’t need this weblog to change into a remedy for insomnia.

The analysis concluded that:

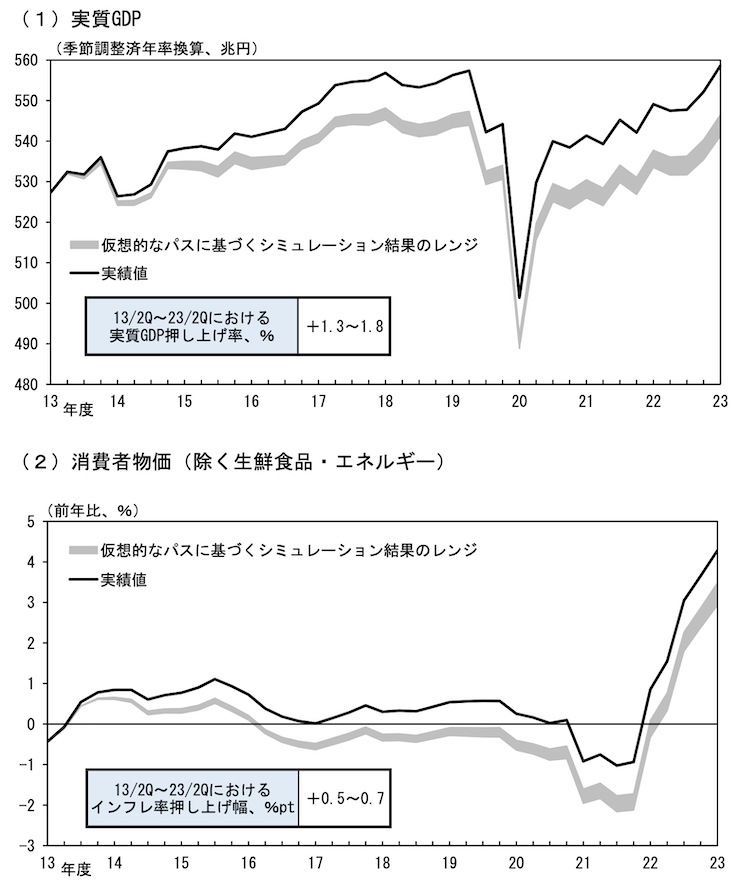

Wanting on the common for the interval since April-June 2013, the coverage impact on the extent of actual GDP was +1.3 to +1.8% … and the impact on the year-on-year change in shopper costs was +0.5 to +0.7 share factors. Wanting extra carefully, the coverage impact has cumulatively boosted the extent of actual GDP for the reason that introduction of QQE, and has supported the financial system even after the unfold of COVID-19 an infection in 2020. The speed of enhance in shopper costs has been repeatedly boosted, and within the interval since 2016, when the precise worth declined as a result of slowdown in rising nations and the sturdy yen, the unconventional financial coverage has been efficient.

This graph (Determine 7, Web page 32) exhibits these outcomes primarily based on the precise and simulated values for GDP development (high) and the inflation fee (backside).

The thicker line is the simulated counterfactual path (that’s, no QQE intervention).

The researchers additionally concluded that:

Provided that the year-on-year change in shopper costs remained optimistic at lower than 0.5% for a lot of the late 2010s, the latter end result means that if the collection of unconventional financial easing insurance policies had not been carried out, costs would have continued to fall for a very long time throughout that interval.

In accordance with the modelling, the key cause that the QQE was supportive was by the influence of decrease rates of interest on capital funding and family consumption, significantly the previous.

Taken at face worth, the analysis demonstrates that the key predictions that mainstream economists made concerning the impacts of QQE have been misplaced.

Nonetheless, the analysis must be certified as a result of it ignores the impacts of fiscal coverage.

The researchers acknowledge that they take fiscal coverage as given and don’t search to isolate its personal impacts on whole demand.

They acknowledge that this ignores the interplay between QQE and financial coverage, regardless that the QQE coverage basically meant that the Authorities may spend with out having to divert any of that expenditure into curiosity funds.

Within the case of 10-year bonds, the yield curve management facets of QQE even delivered damaging yields, which meant that the federal government was being paid by bond buyers to promote them the monetary property.

And that lack of diversion meant that authorities spending might be extra targetted.

Don’t take from this that the curiosity funds are a problem.

Nonetheless, there are distributional impacts and through this era the companies have been sitting on large retained earnings and the non-public banks, that traditionally have been the most important purchaser of Japanese authorities bonds (earlier than the central financial institution took over) weren’t hoarding earnings.

Conclusion

Anyway, all the most effective for 2025 as my weblog enters its twenty first 12 months of operation.

That’s sufficient for right now!

(c) Copyright 2025 William Mitchell. All Rights Reserved.