Immediately (November 27, 2024), the Australian Bureau of Statistics (ABS) launched the newest – Month-to-month Client Value Index Indicator – for November 2024, which confirmed that the annual underlying inflation price, which excludes risky objects continues to fall – from 3.5 per cent to three.2 per cent. The general CPI price (together with the risky objects) rose barely from 2.1 per cent to 2.3 per cent, however that was principally because of the timing of presidency electrical energy rebates between October and November. In different phrases, the slight rise can’t be interpreted as signalling a renewed inflationary spiral is underway. All the symptoms are suggesting inflation is declinig and the main drivers are abating. The general price has been on the decrease finish of the RBA’s inflation targetting vary (2 to three per cent) for 4 successive months now, but the RBA continues to assert they worry a wages breakout and that unemployment wants to extend. The RBA has gone rogue and its public statements bear little relationship with actuality. It’s clear that the residual inflationary drivers usually are not the results of extra demand however fairly replicate transitory components like climate occasions, institutionally-driven value changes (reminiscent of indexation preparations), and abuse of anti-competitive, company energy. The final conclusion is that the worldwide components that drove the inflationary pressures have largely resolved and that the outlook for inflation is for continued decline. There’s additionally proof that the RBA has brought about a number of the persistence within the inflation price by way of the affect of the rate of interest hikes on enterprise prices and rental lodging.

The most recent month-to-month ABS CPI knowledge reveals for November 2024 that the annual value actions are:

- The All teams CPI measure rose 2.3 per cent over the 12 months (+0.2 on October).

- Meals and non-alcoholic drinks rose 2.9 per cent (down from 3.3).

- Alcohol and tobacco rose 6.7 per cent (from 6)

- Clothes and footwear 2 per cent (from 0.6 per cent).

- Housing 1.2 per cent (0.2). Rents (6.6 per cent (6.7).

- Furnishings and family gear 1.6 per cent (regular).

- Well being 3.9 per cent (regular).

- Transport -2.4 per cent (-2.8).

- Communications 0.1 per cent (-0.7).

- Recreation and tradition 3.2 per cent (4.3).

- Training 6.3 per cent (regular)

- Insurance coverage and monetary companies 5.5 per cent (6.3).

The ABS Media Launch (January 8, 2024) – Month-to-month CPI indicator rises 2.3% within the 12 months to November 2024 – famous that:

The month-to-month Client Value Index (CPI) indicator rose 2.3 per cent within the 12 months to November 2024, up from a 2.1 per cent rise within the 12 months to October …

The biggest contributors to the annual motion have been Meals and non-alcoholic drinks (+2.9 per cent), Alcohol and tobacco (+6.7 per cent), and Recreation and tradition (+3.2 per cent). Partly offsetting the rise within the CPI have been annual falls for Electrical energy (-21.5 per cent) and Automotive gas (-10.2 per cent) …

Annual CPI inflation has risen since final month, partially because of the timing of electrical energy rebates. In some states and territories, households obtained two rebate funds in October in lieu of not receiving a fee in July. From November most households obtained one fee. Because of this, electrical energy costs fell 21.5 per cent within the 12 months to November, in comparison with a fall of 35.6 per cent to October …

Annual trimmed imply inflation was 3.2 per cent in November, down from 3.5 per cent in October …

Rents rose 6.6 per cent within the 12 months to November, following an identical annual rise of 6.7 per cent to October

So just a few observations:

1. The underlying inflation price that excludes risky objects continues to fall.

2. The general CPI determine stays in the direction of the underside of the RBA’s targetting vary, though they may declare it’s the underlying determine that issues, which remains to be barely greater than the higher restrict they artificially impose on their coverage choices.

3. The on-going hire inflation is partly because of the RBA’s personal price hikes as landlords in a decent housing market simply go on the upper borrowing prices – so the so-called inflation-fighting price hikes are literally driving inflation. There’s now worldwide analysis supporting this view, which I’ll touch upon in a distinct weblog publish.

4. The month-to-month rise within the CPI was principally because of the institutional timing of electrical energy rebates fairly than being as a consequence of an acceleration in underlying driving forces. The electrical energy part remains to be considerably decrease after the introduction of the federal and state authorities rebates offsetting the profit-gouging within the vitality sector. This demonstrates how expansionary fiscal coverage will be an efficient instrument in combatting inflation.

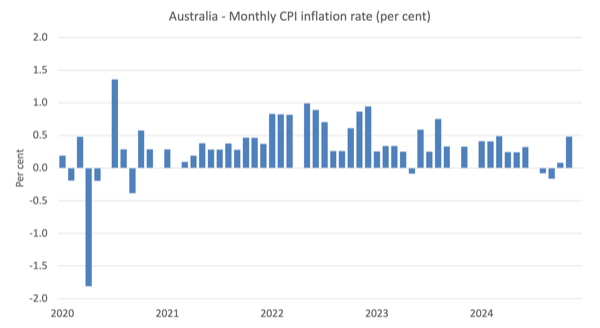

The subsequent graph reveals the month-to-month price of inflation which fluctuates in keeping with particular occasions or changes (reminiscent of, seasonal pure disasters, annual indexing preparations and so on).

There isn’t any trace from this knowledge that the inflation price is accelerating or wants any particular coverage consideration.

As famous above, there have been timing points regarding electrical energy rebates that influenced the month-to-month outcomes.

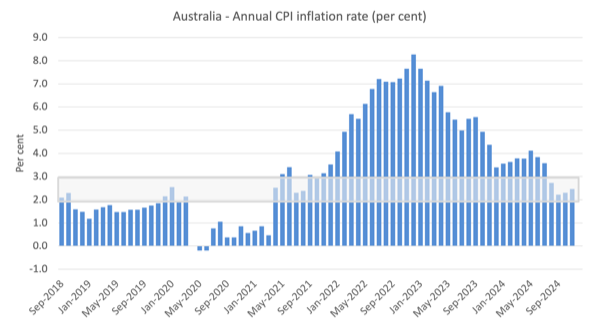

The subsequent graph reveals the annual motion with the shaded space exhibiting the RBA targetting vary.

The general inflation price was constantly inside the targetting vary for 4 months resulting in November 2024

Inflation peaked in December 2022 as the availability components pertaining to the pandemic, Ukraine and OPEC began to abate.

The RBA stored climbing by way of 2023 claiming that there was a hazard that wages development would ‘breakout’ even if the information was exhibiting no such factor with development at report or close to report lows.

It is usually helpful to notice that previous to the inflationary episode, the RBA largely didn’t preserve the annual inflation price inside their goal zone, which tells us concerning the effectiveness of the financial coverage instrument in relation to its acknowledged goal.

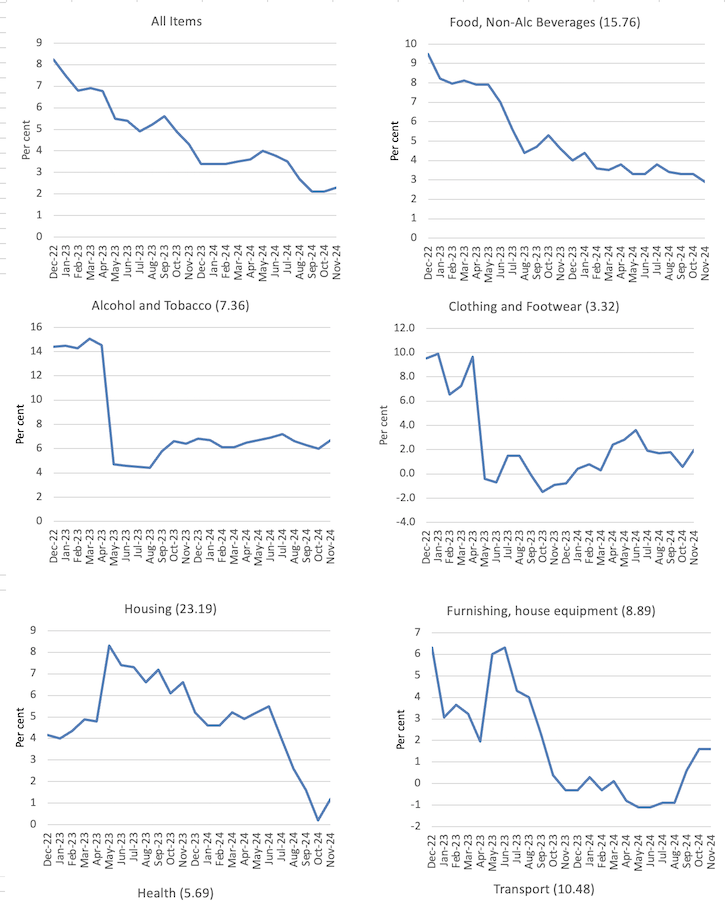

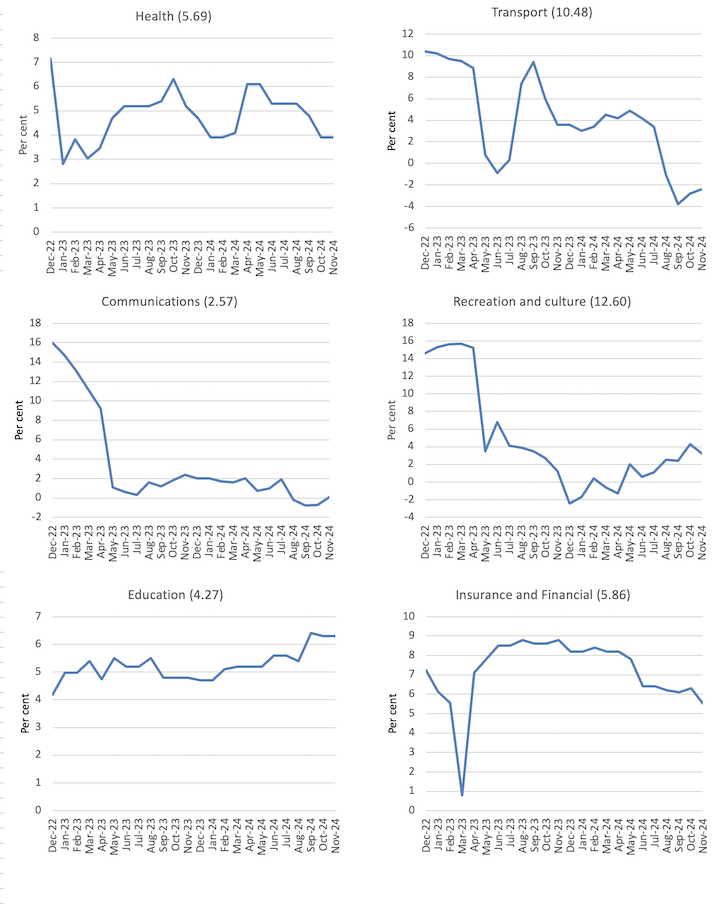

The subsequent graphs present the actions between December 2022 and November 2024 for the primary elements of the All Gadgets CPI (the decimal quantity subsequent to the part title symbolize the burden of that part within the general CPI the place the sum is 100).

On the whole, most elements are seeing dramatic reductions in value rises as famous above and the exceptions don’t present the RBA with any justification for additional rate of interest rises.

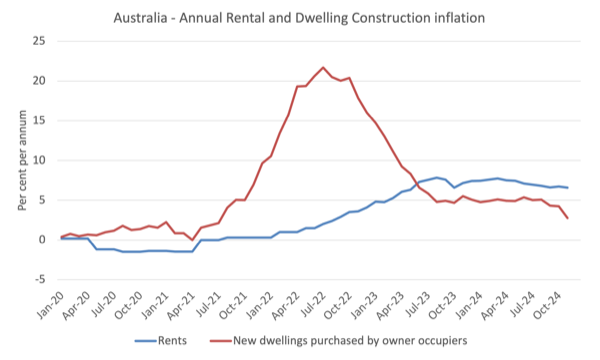

The subsequent graph reveals the actions within the housing part (with rents separated out from the brand new dwelling buy by owner-occupiers.

The RBA began climbing rates of interest in Could 2022 and led to November 2023.

The hire part has risen nearly in sync with the RBA rate of interest hikes and now the speed hikes have ended (for now), the hire inflation has levelled off.

The development prices for brand new dwellings have been in retreat since early 2022 as the availability constraints arising from pure disasters (fireplace burning down forests), the pandemic (constructing provide disruptions), and the Ukraine state of affairs have eased.

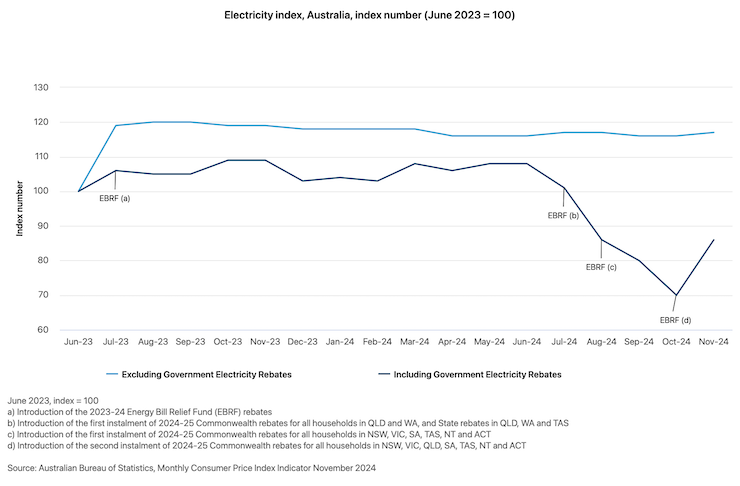

The ABS additionally publishes an fascinating graph, which compares the electrical energy costs below the Federal authorities’s – Power Invoice Reduction Fund – rebates which have been launched in July 2023 and what they might have been within the absence of that fiscal intervention.

The Reduction Fund supplied subsidies to households and small companies relying on the locality.

The ABS report that:

The EBRF rebates have been first launched in July 2023 and have been expanded to all households in July 2024. These rebates have had the impact of decreasing electrical energy costs for households. Together with authorities electrical energy rebates, electrical energy costs for households have fallen by 14.6% since June 2023. Excluding these rebates, electrical energy costs for households would have elevated 16.9% since June 2023.

Right here is the affect of that straightforward and really modest fiscal intervention.

It demonstrates that targetted expansionary fiscal coverage can certainly be anti-inflationary, which implies that the spending-inflation nexus isn’t easy because the mainstream narratives may need you consider.

This was the method the Japanese authorities took to shortly include the cost-of-living will increase for households.

It really works.

Austerity shouldn’t be required when the inflation is sourced from the supply-side because it was in 2021 and 2022.

Migration from Twitter to Bluesky

As I’ve beforehand famous I’ve stop Twitter and am now utilizing Bluesky to publish details about my work.

My Bluesky handle is: @williammitchell.bsky.social

That needs to be simple to search out.

I hope you’ll comply with me over to Bluesky as my Twitter account is now gone perpetually.

Evidently Bluesky now has crucial mass and is a a lot saner place to be than Twitter had grow to be.

Announcement

I’ve a really heavy workload at current with a spread of initiatives needing progress and numerous journey commitments scheduled.

To make all that doable, I’ve determined to chop out the Wednesday weblog publish this 12 months except there’s a particular occasion – for instance, Nationwide Accounts knowledge all the time comes out on a Wednesday in Australia or the inflation knowledge (as at this time).

So for 2025, my weblog will publish posts on Monday’s and Thursdays with exceptions.

The exceptions embody the (present) month-to-month replace of our Manga collection – The Smith Household and their Adventures with Cash – the following instalment (Episode 10), which is due out this Friday, January 10, 2025.

And, after I return to Japan later in 2025 for just a few months, the common weekly Kyoto Replace will resume on Tuesdays.

That is music …

That is what I’ve been listening to whereas working this morning.

This tune – Flamingo – is taken from the 1959 Blue Observe album – The Sermon.

This was a monster recording and featured:

1. Jimmy Smith – Hammond B3 organ.

2. Lee Morgan – Trumpet.

3. Artwork Blakey – Drums.

4. Kenny Burrell – guitar.

It was recorded on February twenty fifth, 1958 on the Manhattan Towers in New York Metropolis.

On the time – Lee Morgan – was simply 19 years outdated and solely lasted to 33 years of age.

He was shot by his de facto spouse in a jazz membership the place he was performing.

That’s sufficient for at this time!

(c) Copyright 2025 William Mitchell. All Rights Reserved.