Western economists and financiers have so commonly predicted a crash or zombification consequence to China’s spectacular run of development that it’s too simple to dismiss tales about deflation threat as but extra Rooster Littledom. However that may be a mistake. The warning signal this time is coming not from tea-leaf studying prognosticators however the home investor dominated, very massive and subsequently not manipulable Chinese language authorities bond market. Its plunge in yields to deflation-warning ranges is an indication of profound concern about development prospects. And if precise or borderline inflation turns into entrenched, it’s laborious to reverse.

Earlier than we flip to the proof, a wee little bit of background. As a lot as inflation-whacked Individuals may discover it laborious to imagine, deflation is much extra harmful than inflation. Falling costs throughout most of an economic system alerts weak demand. That may simply change into self-reinforcing. Companies and shoppers delay spending as a result of they aren’t sure if and when issues will decide up. Continued diminished outlays leads to much less hiring and ultimately reductions in hours and layoffs, producing but extra belt-tightening. A pattern of declining costs leads on to much more financial savings. In any case, if you happen to don’t purchase one thing now, it can in all probability be cheaper later. Since future {dollars} are price lower than current {dollars}, costs of threat property like shares and housing are inclined to fall, making these holders really feel poorer, as soon as once more whacking spending.

And an additional accelerant is debt dynamics. As the final value degree falls, the true worth of debt will increase. That together with a flagging economic system means extra enterprise failures, and so with that, much less industrial spending, extra job losses and an additional contraction in financial exercise. See Irving Fisher’s basic paper for particulars.

Since Chinese language financial statistics are sometimes criticized as unreliable. For example, Michael Pettis has defined long-form how their GDP figures are usually not similar to these within the West.1 After I began this website, analysts would commonly say they didn’t use reported GDP however as a substitute makes use of electrical energy consumption. A number of years later, for causes I don’t recall clearly, these figures got here to be thought to be fudged.

So one motive for a pessimistic bias amongst China commentators has not been Orientalism (though that performs a task) however that key Chinese language knowledge actually does have a bias, way more than Western stats, to magnify, in order that when any destructive figures or factoids seem, they’re deemed as “more true” resulting from wanting like admissions towards curiosity.

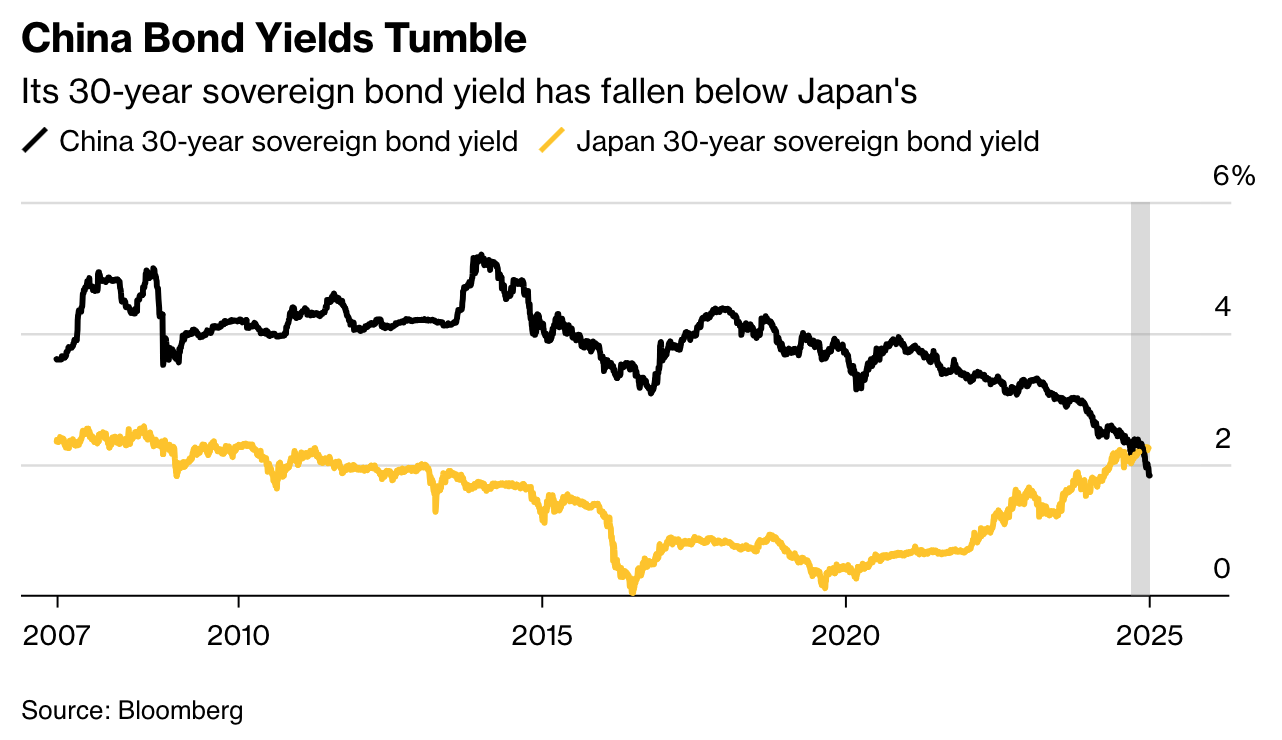

To the bond market warning signal, after which different causes to assume that deflation and zombification threat in China is actual. From Bloomberg:

Traders in China’s $11 trillion authorities bond market have by no means been so pessimistic in regards to the world’s second-largest economic system, with some now piling into bets on a deflationary spiral mirroring Japan’s within the Nineteen Nineties..

The plunge, which has dragged Chinese language yields far under ranges reached in the course of the 2008 international monetary disaster and the Covid pandemic, underscores rising concern that policymakers will fail to cease China from sliding into an financial malaise that might final many years….

In an indication of how significantly traders are taking the chance of Japanification, China’s 10 largest brokerages have all produced analysis on the neighboring nation’s misplaced many years….

Whereas an echo of post-bubble Japan is much from sure, the similarities are laborious to disregard. Each international locations suffered from an actual property crash, weak personal funding, tepid consumption, an enormous debt overhang and a quickly growing older inhabitants. Even traders who level to China’s tighter management over the economic system as a motive for optimism fear that officers have been sluggish to behave extra forcefully. One clear lesson from Japan: Reviving development turns into more and more troublesome the longer authorities wait to stamp out pessimism amongst traders, shoppers and companies.

“The bond market is already telling the Chinese language folks: ‘you might be in stability sheet recession’,” stated [Richard] Koo, chief economist at Nomura Analysis Institute. The time period, popularized by Koo as a strategy to clarify Japan’s lengthy battle with deflation, happens when a lot of corporations and households scale back debt and enhance their financial savings on the identical time, resulting in a speedy decline in financial exercise…

The issue is that the coverage prescriptions thus far haven’t been almost bold sufficient to reverse falling costs, with weak shopper confidence, a property disaster, an unsure enterprise atmosphere combining to suppress inflation. Knowledge due Thursday will seemingly present shopper value development remained close to zero in December whereas producer costs continued to slip. The GDP deflator — the broadest measure of costs throughout the economic system — is in its longest deflationary streak this century.

One challenge with the most recent Chinese language stimulus method is that China has been attempting to shift from development through debt-fueled funding in actual property to tech {industry} development. The issue is that this nonetheless quantities to specializing in rising manufacturing versus consumption. Despite the fact that many Twitterati and reader pooh-pooh the notion that there’s such a factor as overinvestment, take a look on the railroad {industry} within the mid-late 1800s which was rife with overbuilding and bankruptcies, or now, the workplace area market in most US cities, which is in appreciable overcapacity resulting from work from home. An excessive amount of output in relationship to demand for product and companies leads to aggressive competitors for the prevailing patrons and so both value chopping or covert discounting through freebies. Sufficient of that and also you get capability cutbacks through operation closures and/or bankruptcies. The output degree (ex persevering with authorities subsidies) ultimately contract to a degree that may be supported by gross sales volumes.

However China’s policy-makers appear to have a case of getting modified their minds however not their hearts. Despite the fact that many agree that the Center Kingdom must shift to a extra consumer-driven financial mannequin, China recoils from taking the large step to getting shoppers to avoid wasting much less, which is stronger and extra intensive social security nets. Take into account:

To advertise frequent prosperity, we can’t interact in ‘welfarism.’ Up to now, excessive welfare in some populist Latin American international locations fostered a bunch of ‘lazy folks’ who obtained one thing for nothing. Because of this, their nationwide funds have been overwhelmed, and these international locations fell into the ‘center revenue entice’ for a very long time. As soon as welfare advantages go up, they can’t come down. It’s unsustainable to have interaction in ‘welfarism’ that exceeds our capabilities. It can inevitably result in severe financial and political issues.

— Xi Jinping

If something, China’s meager social security internet has change into extra threadbare of late. From the Hudson Institute:

Native governments are accountable for greater than 90 p.c of China’s social companies prices however solely obtain about 50 p.c of tax revenues. For many years, they’ve relied on land gross sales and associated actual property revenues to fulfill their budgets, however each sources have declined precipitously because the housing growth has reversed course. In line with the Rhodium Group, greater than half of Chinese language cities face difficulties paying down their debt, and even assembly curiosity funds, severely limiting their sources for social companies. China’s whole debt ranges are estimated to be round 140 p.c of GDP, limiting finances flexibility for supporting social companies.

Whereas the bond market knowledge is arresting, different statistics level in the identical path. Youth unemployment is excessive, reported lately at between 16% and 19% till China cease publishing that date collection. Costs have fallen for six consecutive quarters. Yet another would put it at China’s fashionable file, in the course of the Nineteen Nineties

Asian disaster.

Bloomberg, in a special story proper earlier than yr finish, famous:

Costs rocketed within the US and different large economies after they reopened after the Covid-19 pandemic, as pent-up demand coincided with shortages within the provide of many items. Predictions the identical would occur in China proved to be incorrect. Shopper spending energy is weak and an actual property droop has dented confidence, holding folks again from shopping for big-ticket gadgets.

A tightening of laws on high-paying industries from tech to finance has led to lay-offs and wage cuts, additional dampening the urge for food for spending. A coverage push to develop manufacturing and high-tech items led to elevated manufacturing, however demand for the products has been weak, forcing companies to mark down costs….

Transport has been the largest drag on shopper costs these days, pushed largely by falling automotive and gasoline costs. Carmakers together with BYD Co. have requested suppliers to chop costs, signalling an intensified value conflict in China’s auto-market. For the broader economic system, actual property and manufacturing are the sectors that recorded the deepest contraction in costs within the first three quarters of 2024, based mostly on an industry-level gross home product deflator calculated by Bloomberg. A persistent property bubble has led to a housing stock glut, whereas the federal government’s assist for manufacturing — from low-cost loans to beneficial tax insurance policies — has elevated the provision of products that customers are hesitant to buy.

These and different articles have identified that China’s current stimulus measures are weaker than previous ones. They’re additionally directed to shoppers solely to a restricted diploma, with some help to college students and the poor, subsidies for auto and equipment purchases, stress on banks to lend for the aim of finishing stalled developments, and exhortations to native governments to buy unsold residential items and convert them to public housing (the most recent stimulus bundle does embrace native authorities debt aid, so they may have sufficient finances room to do this to at the very least a level). The Financial institution of China has additionally been chopping charges over the past two years. However as we have now repeatedly identified, placing cash on sale doesn’t lead companies to speculate extra except their enterprise is leveraged hypothesis (like monetary merchants, banks, personal fairness and infrequently actual property builders). Enterprises will borrow to fund development in the event that they see alternative; the price of cash could be a constraint however low-cost cash isn’t enough trigger in and of itsself for many managers to decide to an enlargement plan. As we noticed with ZIRP, the uncomfortable side effects of a protracted interval of too-low rates of interest is revenue inequality and a painful exit, since at very low charges, the monetary asset value whackage of charge will increase is far better than at “regular” ranges (say 2% or greater coverage charges).

Up to now, China has performed a wonderful job of escaping the standard destiny of economies that transfer from being export and investment-lead to consumption-lead, that of struggling a severe monetary disaster. Has its luck lastly run out?

_____

1 The attention-catching begin to his January 2019 article:

The Chinese language economic system is just not rising at 6.5 p.c. It’s in all probability rising by lower than half of that. Not everybody agrees that the speed is that low, in fact, however there’s nonetheless a working debate about what is absolutely taking place within the Chinese language economic system and whether or not or not the nation’s reported GDP development is correct….

….once you converse to Chinese language companies, economists, or analysts, it’s laborious to search out any financial sector having fun with respectable development. Nearly everyone seems to be complaining bitterly about terribly troublesome situations, rising bankruptcies, a collapsing inventory market, and dashed expectations. In my eighteen years in China, I’ve by no means seen this degree of monetary fear and unhappiness.