Governments that adhere to the mainstream macroeconomic mantras about fiscal guidelines and appeasing the amorphous monetary markets have a behavior of undermining their very own political viability. As Australia approaches a federal election (by Could 2025), the incumbent Labor authorities, which slaughtered the Conservative opposition within the final election, is now dealing with outright loss to a Trump-style Opposition chief if the most recent polls are to be believed. That authorities has shed its political attraction because it pursued fiscal surpluses whereas the non-government sector, significantly the households, endured cost-of-living pressures, in no small half as a result of relentless revenue gouging from key firms (power, transport, retailing, and so forth). The federal government has not been riven with scandals or management instability. However its amazingly quick lack of voting assist is right down to its unwillingness to tackle the gouging firms and in addition to assert advantage within the fiscal surpluses, whereas the buying energy loss amongst households has been vital. The identical type of demise want is arising now within the UK, though the British Labour authorities is on the different finish of its electoral cycle which supplies it some house to study from its already mounting checklist of financial errors. The British authorities scenario is extra restrictive than the case of the Australian Labor authorities as a result of the previous has agreed to voluntarily constrain itself by way of an arbitrary fiscal rule.

The newest financial information from Britain

The newest Nationwide Accounts information from the British Workplace of Nationwide Statistics (ONS) – GDP first quarterly estimate, UK: October to December 2024 (launched February 13, 2025) – exhibits that the British financial system is overal GDP development was:

… 0.1% in Quarter 4 (Oct to Dec) 2024, following no development within the earlier quarter.

General, actual GDP development was 0.8 per cent within the March-quarter, then 0.4 per cent within the June-quarter, then 0 per cent within the September-quarter, to 0.1 per cent within the December-quarter.

The manufacturing sector recorded unfavourable 0.8 per cent development for the December-quarter and unfavourable 1.7 per cent for the 12 months.

This was principally because of contractions in manufacturing and mining and quarrying.

Enterprise funding fell by 3.2 per cent within the December-quarter 2024 however inventories rose considerably (significantly in manufacturing).

The rise in inventories is taken into account to be unintended funding and displays the declining outlook in gross sales – a unfavourable sign.

Family consumption expenditure didn’t develop in any respect within the December-quarter.

Exports (volumes) fell by 2.5 per cent (all right down to items)

Taxes much less subsidies fell by 0.8 per cent primarily because of a decline in VAT reflecting the stagnant exercise ranges.

Actual GDP per capita fell by 0.1 per cent and 0.1 per cent over the course of 2024.

This measure has fallen 7 out of the final 9 quarters.

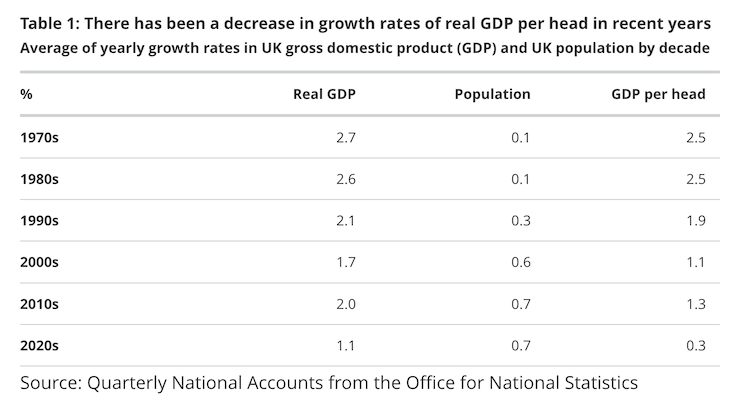

I believed this desk from the particular ONS article – Traits in UK actual GDP per head: 2022 to 2024 – summed up the folly of the neoliberal interval fairly succintly.

Curiously, the ONS signifies that “long-term illness” is among the causes for the decline in productiveness development, which has been a part of the rationale that GDP per capita has fallen and trailed behind general GDP development.

I’ve been following the COVID-related injury to the viability of the British labour power since 2020 and now we’re beginning to see a number of the longer-term unfavourable penalties of the dearth of consideration to this illness.

The subsequent graph exhibits the federal government contributions to GDP development in Britain for the reason that September-quarter 2023.

The Authorities contribution is the a few of authorities consumption expenditure and authorities capital formation.

The ‘GDP internet authorities’ line is simply the general GDP development fee minus the contribution of presidency, which is an approximation as a result of if we actually set the federal government contribution to zero, then it’s possible that non-government expenditure elements would change (most likely for the more severe) and the overal GDP development could be decrease than what’s proven on this graph.

However it’s clear – for the reason that Labour Get together received workplace in Britain on July 4, 2024 – the general GDP development fee has been propped up by authorities expenditure.

Within the December-quarter 2024, the federal government development contribution was 0.29 per cent, and with out it, the financial system would have recorded unfavourable development.

Certainly, Britain would have been in recession within the second half of 2024 had the federal government contribution not been 0.13 share factors within the September-quarter and 0.29 share factors within the December-quarter.

The fiscal rule plank

The UK media are actually claiming that the British authorities is now caught in a bind.

The UK Guardian article (February 15, 2025) – Rachel Reeves has three choices to dodge an financial disaster and all are unthinkable – which adopted the discharge of the most recent Nationwide Accounts information in Britain suggests that each one the choices accessible to the Labour authorities carry large political injury.

The hope expressed by the Chancellor when she took workplace in July final 12 months was that her fiscal plans could be ratified by accelerating GDP development now seems to be misplaced.

GDP development just isn’t accelerating as famous above.

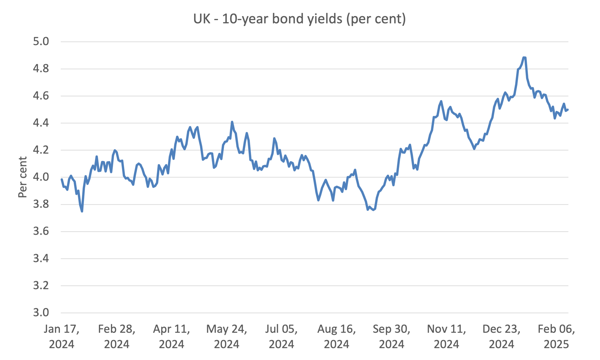

Additional, the following graph exhibits that authorities bond yields have been rising since September 2024 though that pattern has reversed for the reason that onset of the New 12 months.

But it surely stays that the 10-year bond yield has risen from a current low of three.762 on September 11, 2024 to its present degree of 4.499 per cent on February 14, 2025.

That type of shift in obvious throughout the suite of gilt yields.

What which means is that the British authorities is spending extra on servicing its excellent debt than beforehand.

Additionally with GDP development stalling, tax income has declined under what was anticipated.

The Chancellor was reported as saying she retained an “iron grip” on authorities spending (Supply).

Within the – Autumn Funds 2024 (launched on October 30, 2024) – the H.M. Treasury claimed that:

The federal government is asserting sturdy fiscal guidelines, which the impartial Workplace for Funds Duty (OBR) confirms the federal government is on observe to fulfill:

– Stability rule: to maneuver the present finances into steadiness in order that day-to-day spending is met by revenues.

– Funding rule: to scale back internet monetary debt as a share of the financial system.

It stated the present fiscal steadiness is in “surplus by £9.9 billion within the goal 12 months, 2029-30”.

The ahead estimates have been predicated on estimated GDP development of 1.1 per cent in 2024, 2 per cent in 2025, 1.8 per cent in 2026, 1.5 per cent in 2027 and 2028 and 1.6 per cent in 2029.

It additionally estimated that family consumption development could be 1.7 per cent in 2025 and export development would speed up.

The £9.9 billion estimated fiscal surplus by the top of the present time period of workplace (2029-30) is being touted by the media because the ‘fiscal headroom’ that the Authorities has – the leeway for slippage with out compromising their fiscal rule pledge underneath the debt part.

The present developments famous above recommend that the expansion forecasts will show to be overly optimistic, which then compromises the fiscal final result estimates.

In its most up-to-date – Financial Coverage Report – February 2025 (launched February 6, 2025) – the Financial institution of England has already downgraded their GDP development forecasts and are predicting simply 0.1 per cent within the first-quarter of 2025.

If that seems to be correct then will probably be very troublesome for Britain to attain an general 2 per cent fee of development for 2025 as is assumed within the Autumn 2024 assertion.

This UK Guardian article (February 15, 2025) – Rachel Reeves has three choices to dodge an financial disaster and all are unthinkable – claims that the readers ought to perceive the £9.9 billion projected fiscal surplus in 2029-30 as:

… spare cash …

Implying that there’s some restrict on the sterling that the UK authorities has at its disposable.

The ‘restrict’ is, actually, completely synthetic as a result of it will depend on a voluntary restriction on outcomes outlined by the fiscal guidelines – as an absolute.

The present developments recommend that even when the ‘funding rule’ just isn’t but compromised, the ‘stability rule’ – that recurrent spending have to be matched by taxation income – will wrestle to be met.

The Guardian claims that this implies within the context of the Spring Assertion (on the finish of March 2025):

One thing has to present and shortly.

And all of that is within the context of main upheavals within the world financial system with the tariff uncertainty, the shifts in US assist for Ukraine, and the proposed ‘actual property improvement’ on the sovereign Palestinian territory.

The three choices that commentators are itemizing are:

1. Reduce authorities spending “by greater than deliberate already in actual phrases in direction of the top of this parliament”.

2. Improve tax charges “once more”.

3. Abandon the substitute fiscal guidelines.

In accordance with the Guardian, the Labour parliamentarians know:

… that each one of them could be massively damaging politically.

After all, Choices 1 and a couple of are solely listed due to the fiscal guidelines.

The British Treasury launched an announcement on January 8, 2025 claiming that regardless of these developments:

Nobody ought to be underneath any doubt that assembly the fiscal guidelines is non-negotiable and the federal government may have an iron grip on the general public funds.

Already the monetary markets are issuing threats of an “adversarial market response” if Choice 3 was chosen and that if a mix of Choices 1 and a couple of weren’t chosen then the Authorities “would threat a lack of confidence in monetary markets”.

The identical previous.

Britain now has a traditional case of a authorities that has tried to fulfill the mainstream economists and in doing so has constrained itself politically to the purpose that it solely faces a really harmful stroll out on a really brief plank.

The Chancellor has made too many ensures – no additional tax will increase, no additional austerity, and an ‘iron grip on the fiscal guidelines’.

And people ensures have been within the context of unrealistic development forecasts.

Taking Choice 1 and/or 2 would possible drive the financial system right into a deep recession, which might make it nigh on unimaginable to fulfill the fiscal guidelines.

A bind.

As I famous when Labour was in Opposition adherence to their fiscal guidelines wouldn’t be doable underneath a variety of doable financial outcomes.

These outcomes are current now which suggests the one method ahead, if the Authorities actually desires to keep away from an austerity-driven recession is to desert the fiscal guidelines and admit they have been a folly within the first place.

The issue is that the Authorities has itself in charge for the scenario it now faces.

By making these synthetic and largely meaningless fiscal guidelines central to the general public’ notion of ‘credibility’ and ‘fiscal duty’, the Authorities has conditioned the controversy such that it could solely fail.

There isn’t a foundation in financial concept for these guidelines.

They’re arbitrary and place pointless constraints on authorities fiscal coverage.

Why ought to recurrent spending be matched with tax income?

What’s recurrent spending anyway?

For instance, numerous spending on training is classed as recurrent when it delivers long-term (past 12 months) advantages.

Salaries for nurses are recurrent however their work ship long-term well being advantages.

And so forth.

Why ought to authorities debt ratios be decrease after 5 years?

Why not 2 or 3 or 10 years?

Why is the present debt ratio too excessive, such that it have to be decrease in 5 years?

And so forth.

Additional, the monetary markets are hawks.

The individuals are motivated solely by greed and are frequently appraising the power of presidency dedication to a plan of action.

They know that the British authorities has cornered itself with the general public and can fold if the monetary markets put strain on the forex with short-selling.

The markets thus know that they’ll bluff Reeves as a result of she has bestowed such significance on the fiscal guidelines.

Conversely, the Japanese authorities (together with the Financial institution of Japan) at all times resist these pressures and so the monetary markets make losses on makes an attempt to destabilise coverage settings.

The Japanese authorities doesn’t profess these exhausting and quick fiscal guidelines and thus doesn’t ‘field’ itself in to unsustainable positions.

The truth is that the monetary markets don’t have any actual leverage over authorities if the federal government performs them out of the sport, as occurs in Japan.

The British authorities might simply instruct the DMO (Debt Administration Workplace) to cease issuing gilts if the yields on the public sale course of rose because the monetary markets tried to flex their muscle.

They may power the Financial institution of England to buy ample debt in secondary markets to drive yields to zero.

Conclusion

All of this mess that the Labour authorities is now discovering itself rises as a result of it has tried to be intelligent by holding out these articifical fiscal guidelines as a sacrosanct barrier past which civilisation ends.

They then must reap the political failure that follows.

One other Labour authorities committing 切腹 (harakiri).

That’s sufficient for at present!

(c) Copyright 2025 William Mitchell. All Rights Reserved.