Change-traded funds (ETFs) which can be designed for use in bond ladders with goal maturities have been round for over a decade. They arrive in Company Debt BBB-Rated, Excessive Yield, Inflation-Protected, U.S. Treasury Common, and Municipal Bond Lipper Classes. They’ve the benefits of simplicity, diversification, liquidity, flexibility, and low expense ratios. The disadvantages are that an lively investor could possibly selectively decide higher-yielding bonds, a number of the bonds held within the ETF could also be callable, the dividends aren’t as predictable as particular person bonds, and within the closing yr the bonds which have matured are invested in Treasury payments.

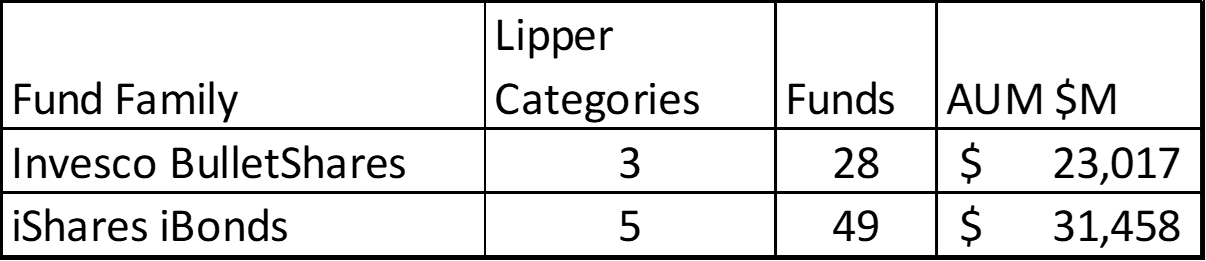

Invesco manages Bulletshares bond funds and BlackRock manages iShares iBonds. A abstract is proven in Desk #1. Included within the iShares iBond ETFs totals are ready-built bond ladders (LDRH, LDRI, LDRC, and LDRT) that are past the scope of this text in addition to the inflation-protected bonds that are lower than two years previous.

Desk #1: ETF Bond Ladder Funds

Overview

For an important article on Bond Ladder ETFs, I refer you to Bond Ladder ETFs Can Assist Traders Climb Increased at Morningstar by Saraja Samant. Outlined-maturity ETFs purchase bonds that mature within the yr the ETF terminates, returning its proceeds to buyers. Ms. Samant reveals an instance of how ladders constructed with iShares iBond and Invesco BulletShares would have carried out towards an combination bond fund.

The BlackRock iShares iBonds ETFs web site describes their bond ETFs as:

“iBonds exchange-traded funds (“ETFs”) are an progressive suite of bond funds that maintain a diversified portfolio of bonds with related maturity dates. Every ETF supplies common curiosity funds and distributes a closing payout in its acknowledged maturity yr, just like conventional bond laddering methods. Nonetheless, the funds’ distinctive construction is designed to assist buyers simply construct bond ladders with solely a handful of funds.”

The web acquisition yield supplies a yield estimate, internet of charges, and market worth affect if held to maturity. They don’t search to return any predetermined quantity at maturity or in periodic distributions. The prospectus states that they anticipate that an funding within the funds, if held by maturity, will produce combination returns similar to a direct funding in a bunch of bonds of comparable credit score high quality and maturity.

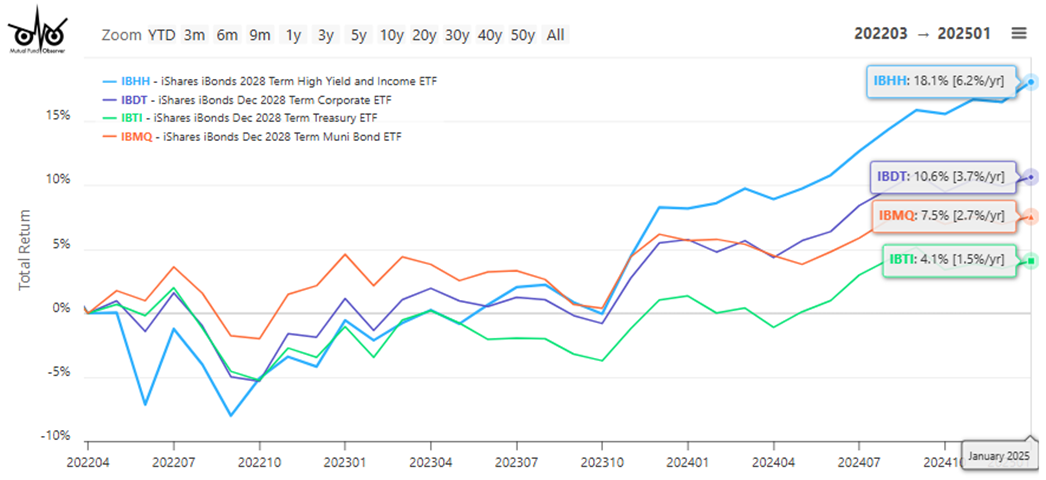

ETF Bond Ladder Efficiency by Lipper Class

This part compares the entire return efficiency of iShares iBonds maturing in 2028 for prime yield, company BBB-Rated, U.S. Treasuries, and municipals bond classes. It reveals the advantages of diversification. Municipal Bond Ladder ETFs have outperformed Treasuries over the previous three years.

Determine #1: iShares iBonds Efficiency for ETFs Maturing in 2028

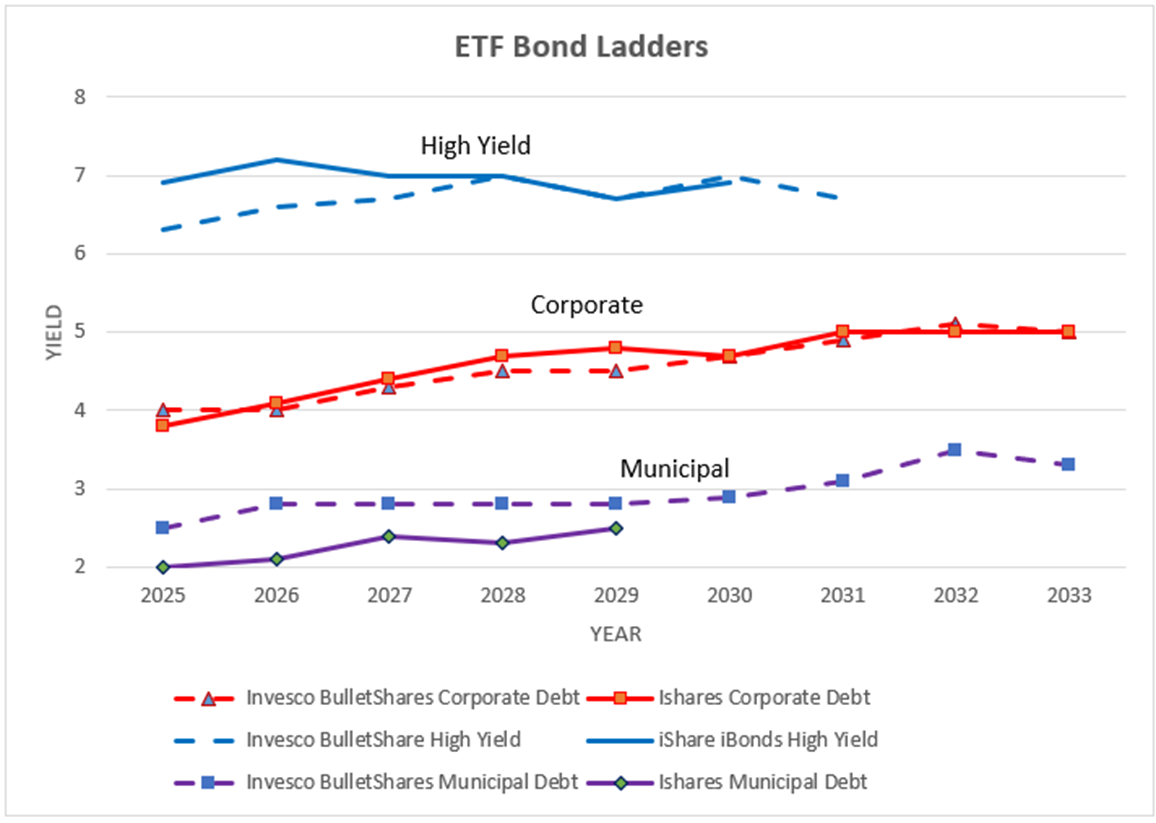

Determine #2 compares the yields of Invesco BulletShares and iShares iBond ETFs for the Company, Municipal and Excessive Yield Lipper Classes.

Determine #2: Evaluating Yields of ETF Bond Ladders for Varied Lipper Classes

Company BBB Rated Yield Modifications Over Time

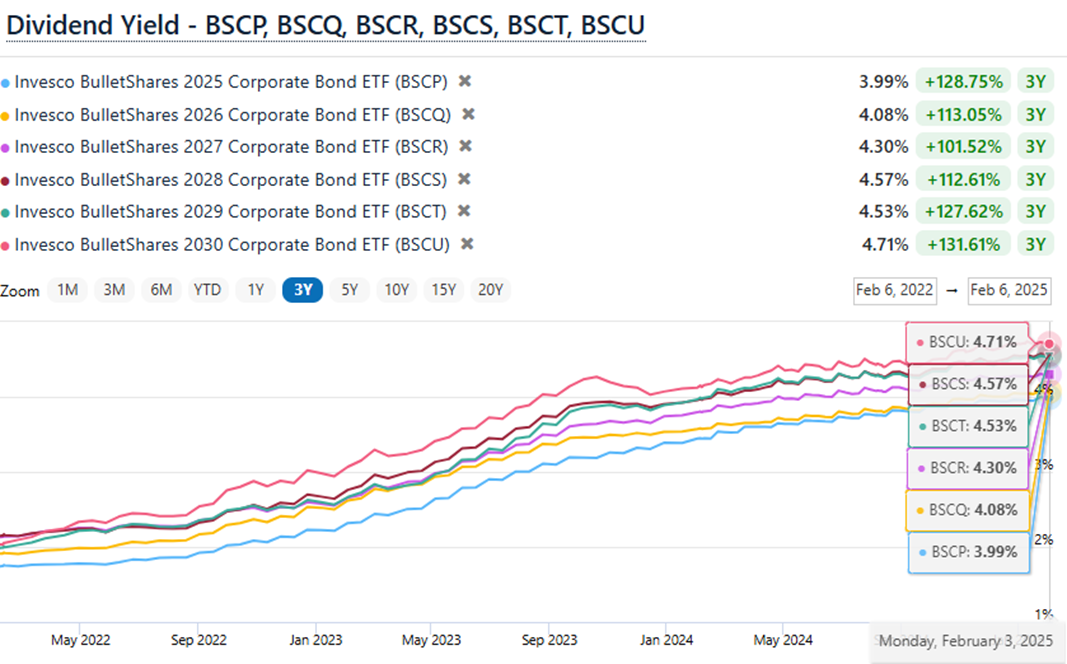

Determine #3 reveals the dividend yield for the previous three years from FinanceCharts for the Invesco Company Bond BulletShares with maturities from 2025 by 2030. Now might be a great time to start locking in increased yields.

Determine #3: Dividend Yield Over Time for Invesco BulletShares Company BBB-Rated Debt

Monetary Targets

We’ve established relationships with Monetary Advisors at Constancy and Vanguard. If I had been to cross away earlier than my spouse, I would like her to show over the remainder of the accounts to them to handle for earnings. I wish to hold issues so simple as potential however no less complicated.

Whether or not bond ladders or ETF Bond Ladders are proper for an investor relies upon upon their monetary objectives. I view my Bucket #2 conservative Conventional IRAs as a spot to withdraw funds if and provided that the inventory market shouldn’t be doing properly sufficient to withdraw from different sources. I wish to keep sufficient on this funding bucket to final a lifetime by replenishing it when shares are excessive or withdrawing at a sustainable charge taking into account inflation.

Over full cycles, core bond, funding grade debt, excessive yield, and multi-sector debt have had the very best returns, yields, and drawdowns. These are the classes that I wish to use to construct bond ladders the place the funds aren’t wanted for a number of years, they usually get extra conservative over time. I wish to personal Company Debt BBB-rated bonds with out doing the analysis to select particular person bonds.

I acquire the dividends in cash markets and make withdrawals as wanted. That the dividends of bond ladder ETFs aren’t as predictable as particular person bonds doesn’t concern me. Lastly, that bond ETFs make investments the funds from bonds that matured in Treasury payments within the closing yr is a plus for me as a result of I would like them to get extra conservative as they mature, particularly within the yr that I select to withdraw them. I additionally just like the liquidity.

Company Debt BBB-Rated Bond Ladder ETFs

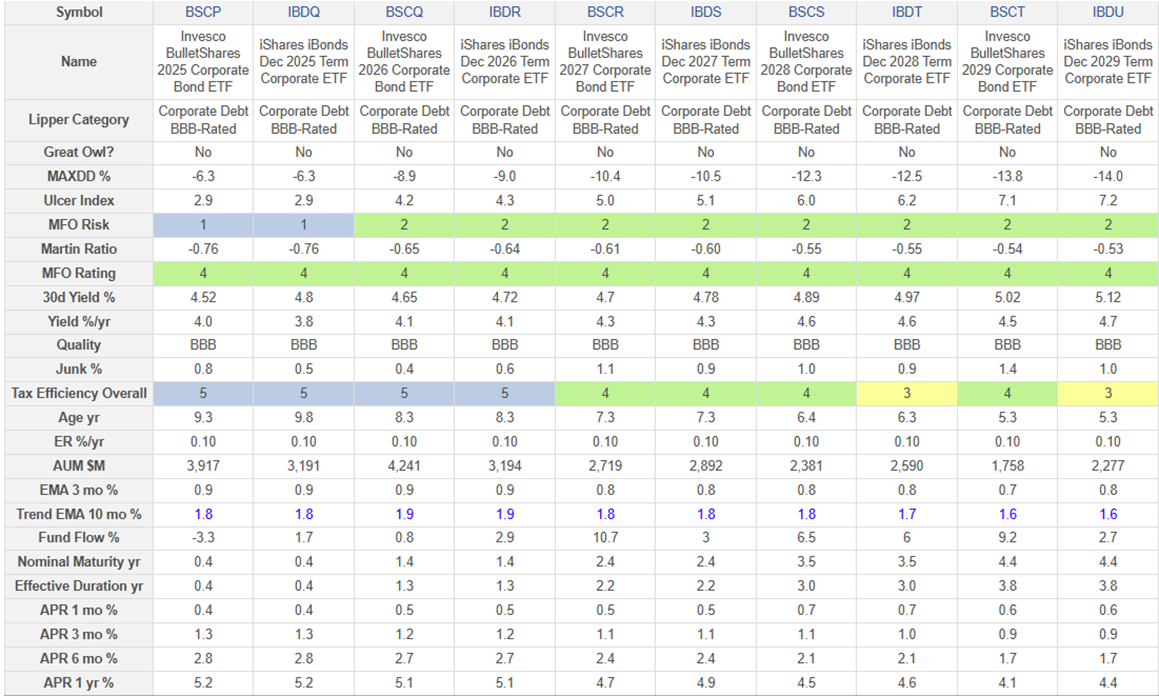

Desk #2 supplies a abstract desk evaluating Invesco Bulletshares and iShares iBonds within the Company Debt BBB-Rated Lipper Bond Class. It’s exceptional how equally the Bulletshares and iBonds carry out. I’d be comfy with both. In the course of the previous yr, these funds have returned 4.1% to five.2% and at the moment yield between 4.5% and 5.3%.

Desk #2: Company Debt BBB-Rated Bond Ladder ETFs – (3-Yr Metrics)

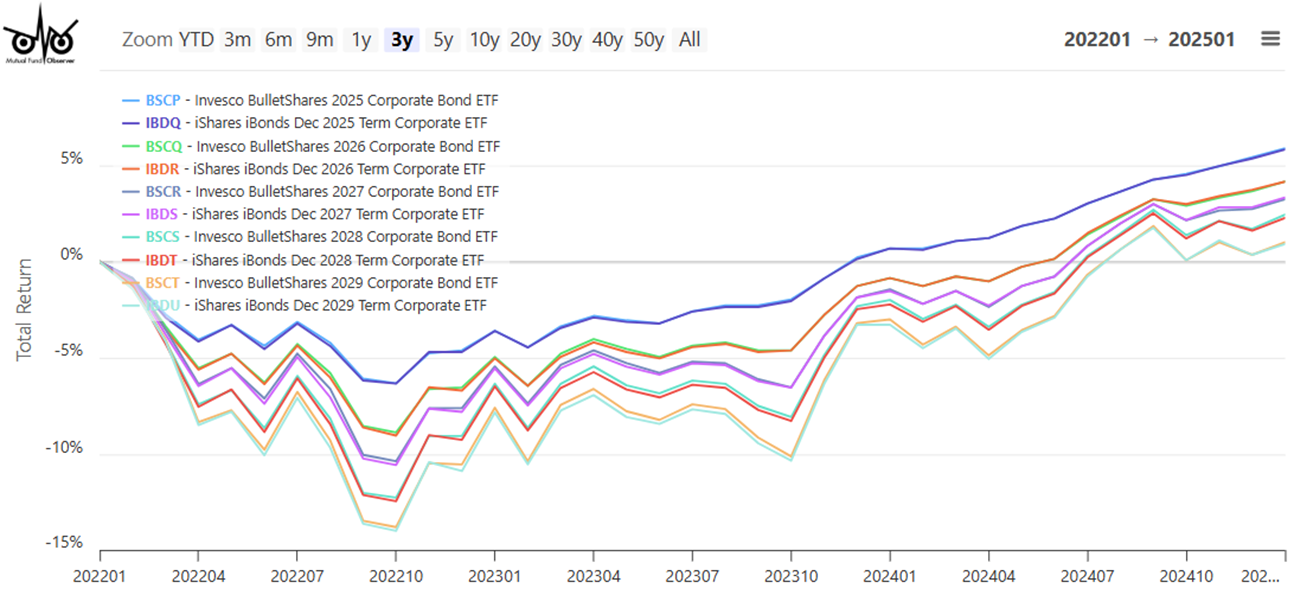

Determine #4 reveals the entire return efficiency of the company debt BBB-rated Bond Ladder ETFs over the previous three years. Shares and bonds did poorly in 2022. Bond ETFs maturing in two years had a drawdown of about 6% whereas bond ETFs maturing in six years had a drawdown of about 14%.

Determine #4: Company Debt BBB-Rated Bond Ladder ETFs (3 Years)

Excessive Yield Bond Ladder ETFs

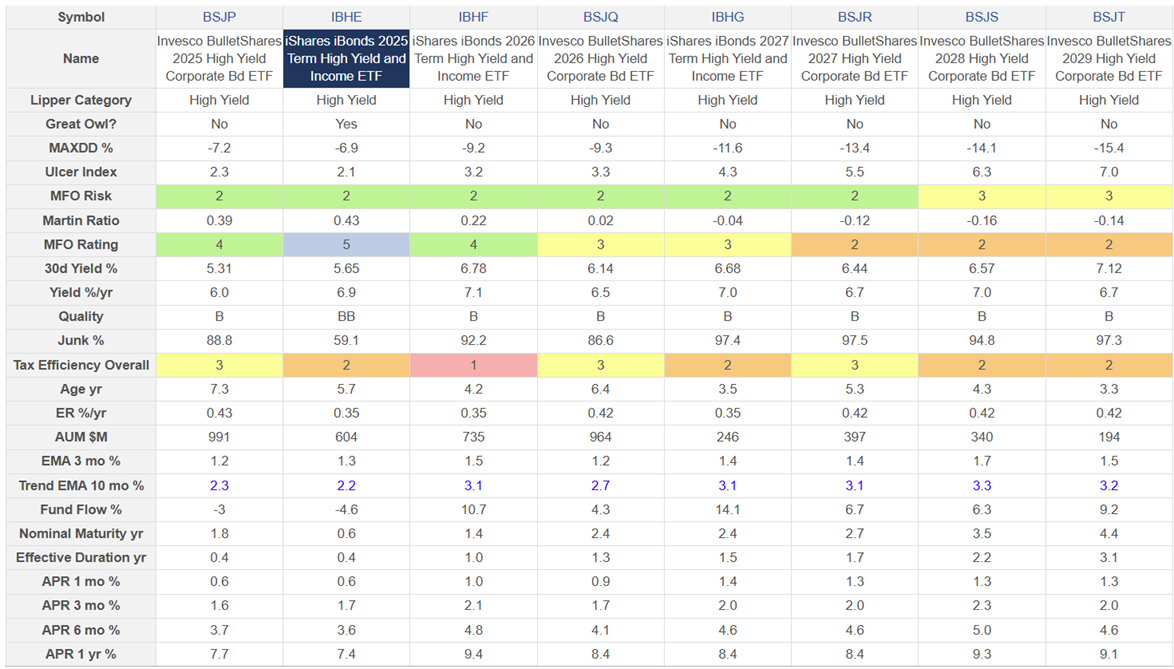

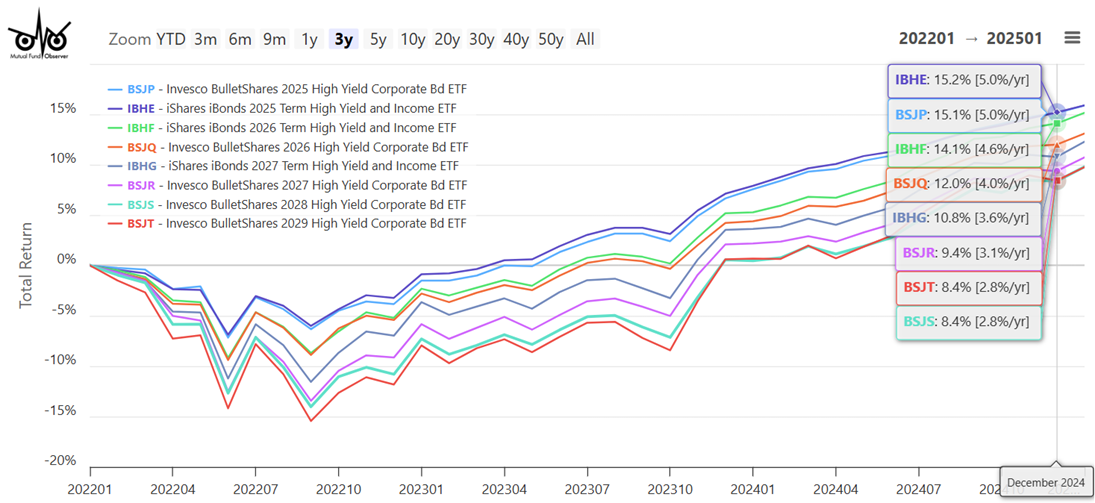

Excessive-yield bonds can have massive drawdowns throughout recessions. I favor shorter period excessive yield bonds. Over the previous three years, these bond ETFs had drawdowns between 7% and 15%. In the course of the previous yr, they’ve returned 7.4% to 9.3% and at the moment yield 5.3% to 7.1%.

Desk #3: Excessive Yield Bond Ladder ETFs – (3-Yr Metrics)

Determine #5 reveals that these short-duration high-yield bonds have had increased returns than company BBB-rated bond ETFs and with roughly comparable drawdowns.

Determine #5: Excessive Yield Debt Bond Ladder ETFs (3 Years)

U.S. Treasury Bond Ladder ETFs

For comparable maturities, U.S. Treasuries haven’t had a a lot decrease drawdown than investment-grade bonds, and even high-yield bonds. They’ve been slower to get well from 2022.

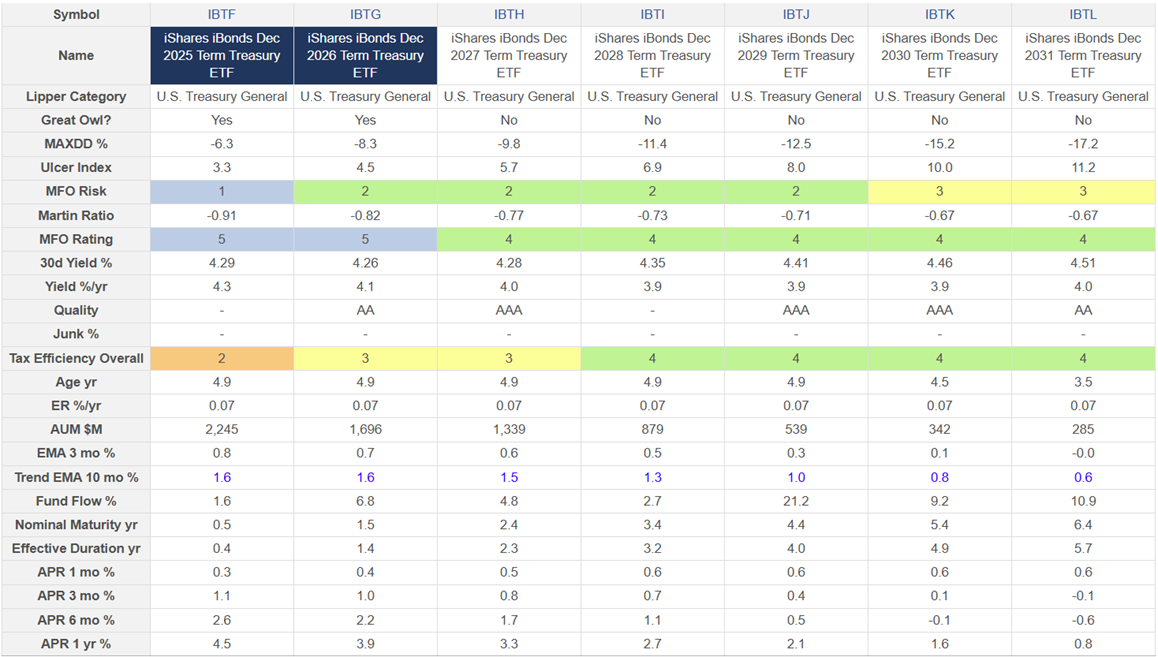

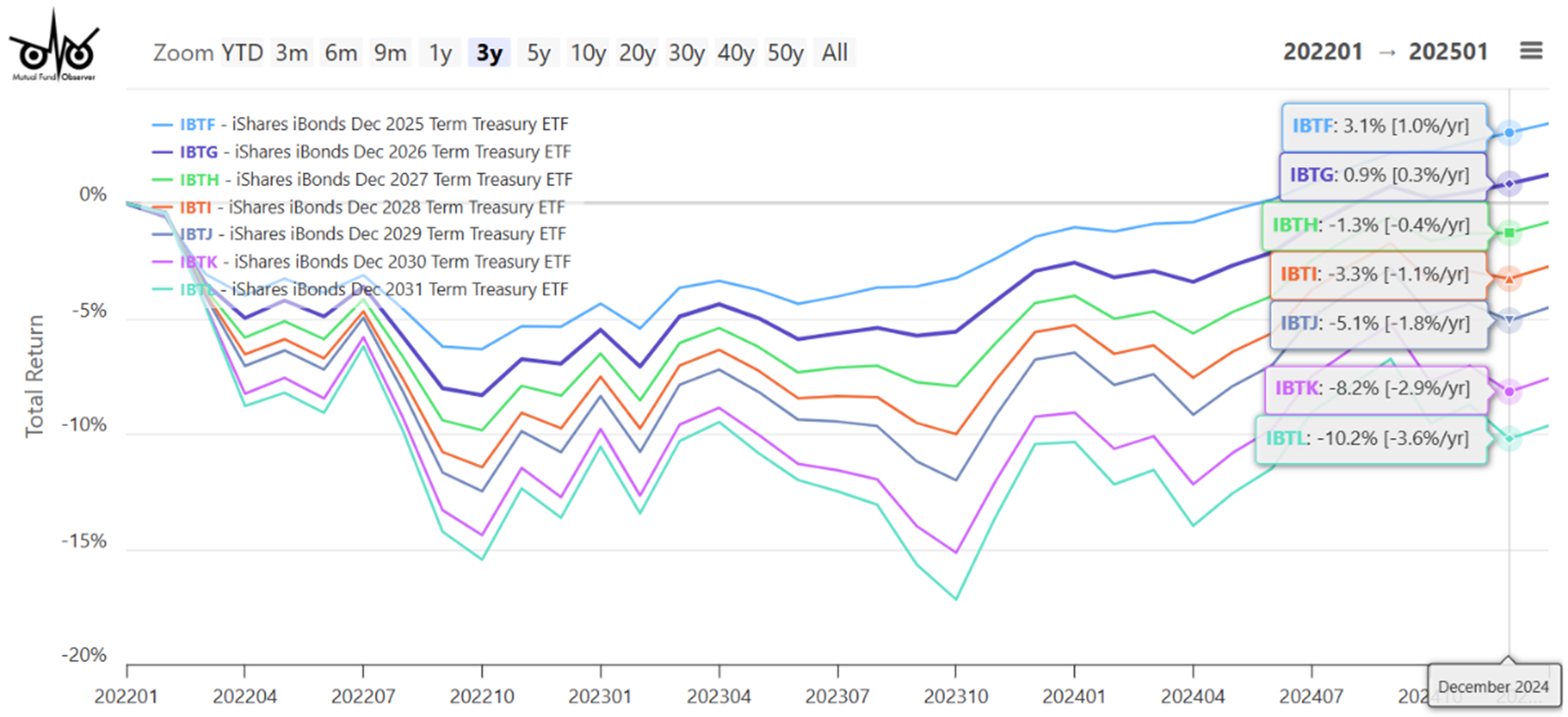

Desk #4: Treasury Bond Ladder ETFs – (3-Yr Metrics)

Determine #6: Treasury Bond Ladder ETFs (3 Years)

Municipal Bond Ladder ETFs

Municipal bond funds have performed properly contemplating their low yield. Constancy has a Calculator for Fastened Revenue Taxable-Equal Yields for Particular person Bonds, CDs, & SPDAs. The hyperlink is supplied right here. I take advantage of municipal bonds as long-term accounts the place I wish to hold taxes low. I’m contemplating if there’s a house for municipal Bond Ladder ETFs in my portfolio.

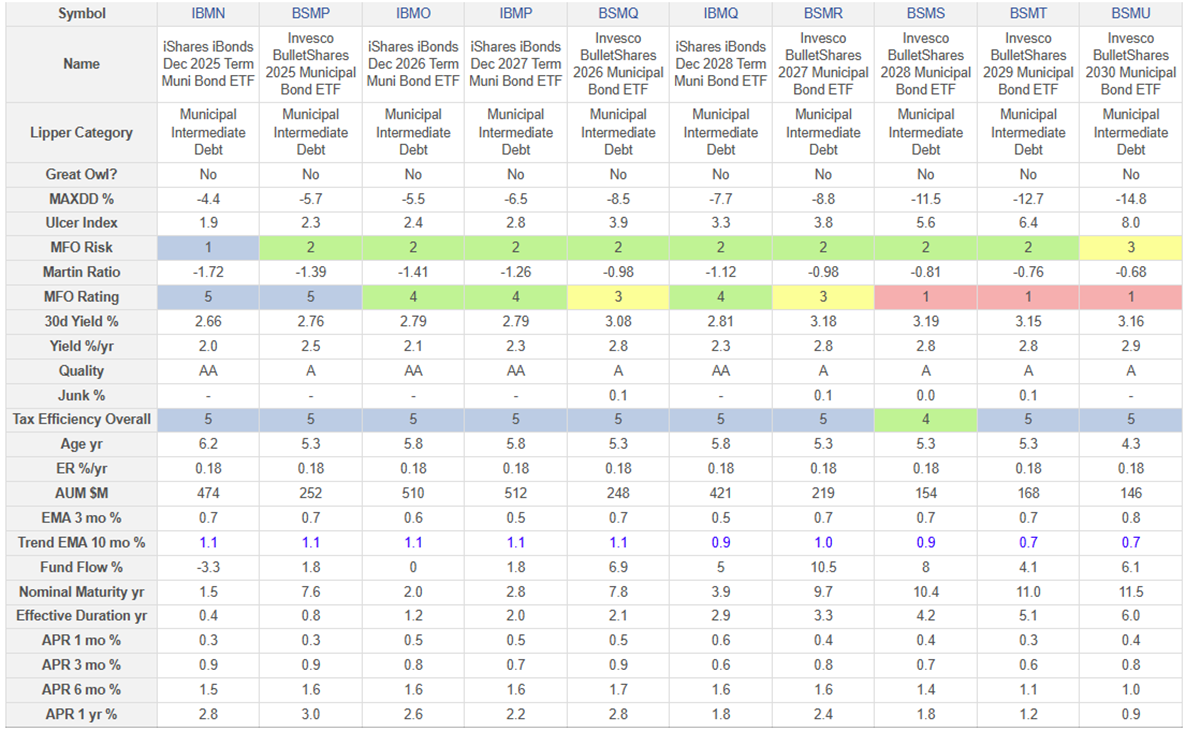

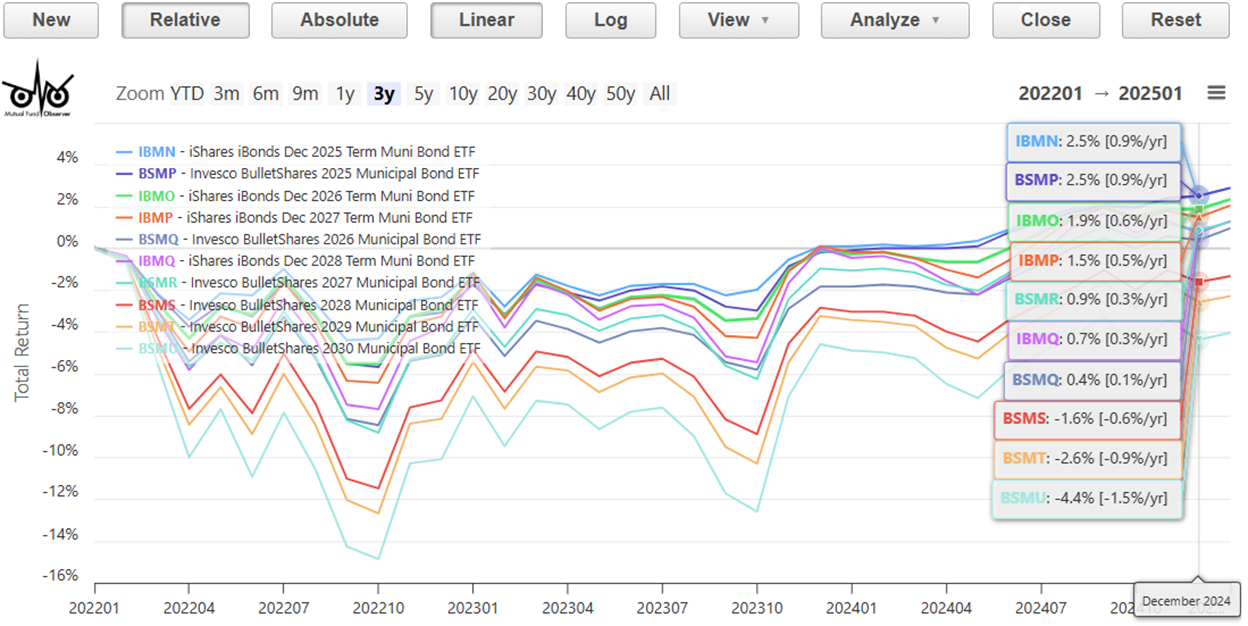

Desk #5: Municipal Bond Ladder ETFs – (3 Yr Metrics)

Determine #7: Municipal Bond Ladder ETFs (3 Years)

Closing

This analysis has helped me to determine when the following rungs on my bond ladder mature that I will likely be investing in bond ladder ETFs. Which of them? Company BBB-rated Bond Ladders would be the mainstay. I’m contemplating a rung of excessive yield within the couple of years because the economic system is robust and default threat is comparatively low. I can see the place a bond ladder of municipal bond ETFs can match right into a long-term tax environment friendly account as properly.