Profitability for single-family residence builders reached the very best ranges in additional than a decade in 2023. Industrywide revenue benchmarks are essential as a result of they permit corporations to match their monetary efficiency towards your entire trade. Doing so can information useful resource allocation, budgeting, and goal setting for prices and expense traces. Extra broadly, understanding trade benchmarks can result in an improved enterprise technique and to larger monetary outcomes.

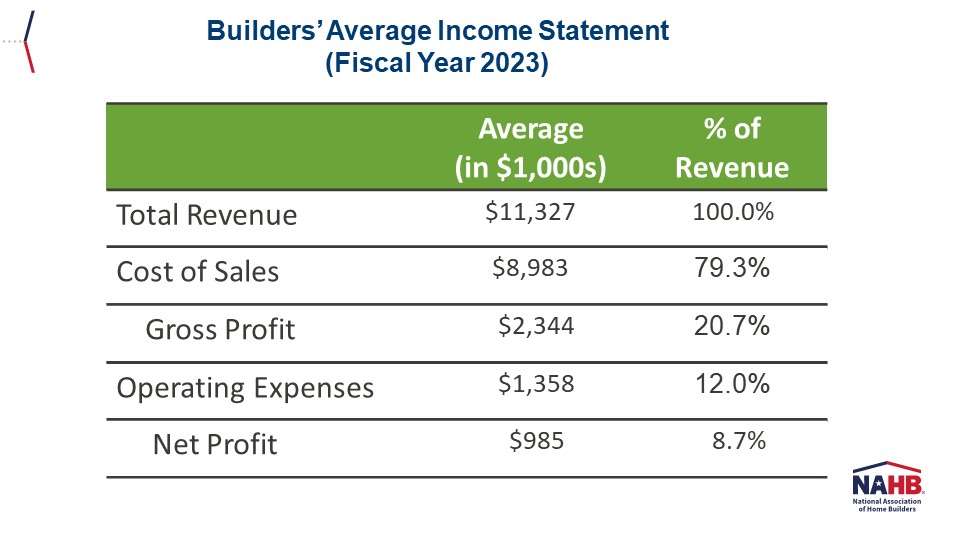

On common, builders reported $11.3 million in whole income for fiscal 12 months 2023. Of that, about $9.0 million (79.3%) was spent on price of gross sales (i.e., land, direct and oblique building prices), which interprets into a mean gross revenue margin of 20.7%. Working bills (i.e., finance, S&M, G&A, and proprietor’s compensation) price builders a mean of $1.4 million (12.0% of income), leaving them with a mean web revenue margin of 8.7%. This put up summarizes the outcomes from NAHB’s most up-to-date version of the Builders’ Value of Doing Enterprise Research.

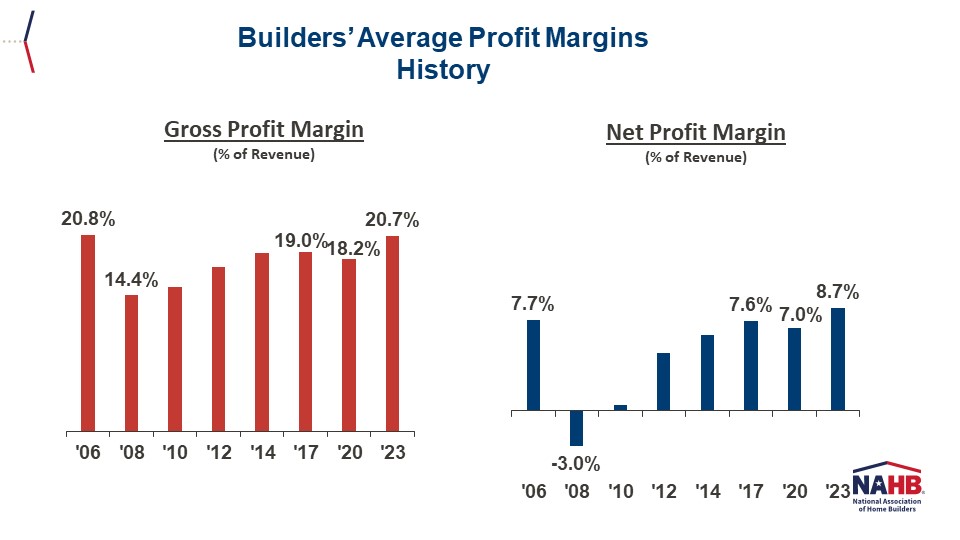

Based mostly on historic survey knowledge (carried out each three years), the 20.7% common gross revenue margin in 2023 was the very best registered since 2006 (20.8%). As a degree of reference, builders’ gross margin sank to a report low of 14.4% in 2008 (i.e., in the course of the housing recession), however bounced again steadily by 2017 (19.0%). The onset of COVID-19 in 2020 elevated prices, inflicting builders’ common gross margin to drop (18.2%) for the primary time since 2008.

The 8.7% common web revenue margin for fiscal 12 months 2023 is the very best on this survey’s current historical past, exceeding the 7.7% reported in 2006. Nonetheless, elevated use of monetary incentives, equivalent to mortgage fee buydowns, and cuts in residence costs are more likely to have brought on this margin to shrink in 2024.

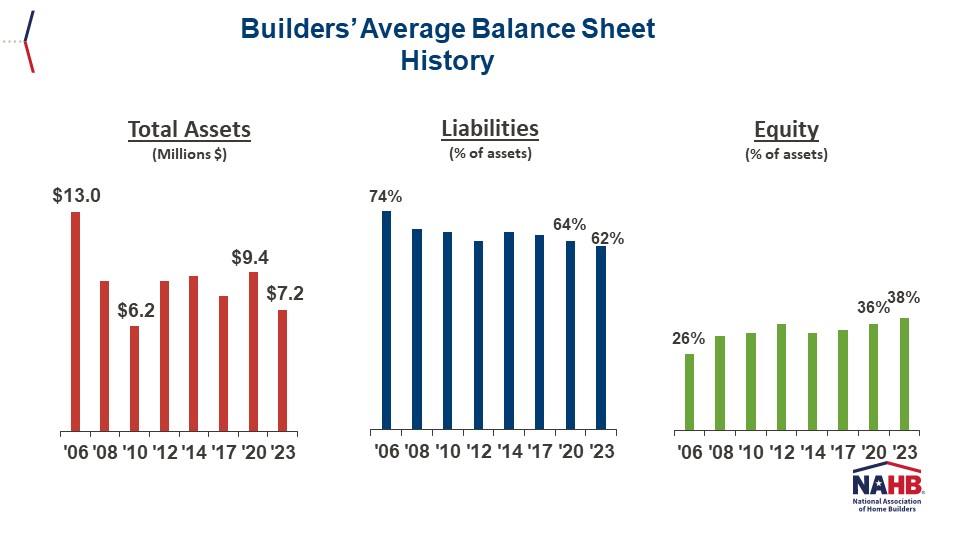

The Value of Doing Enterprise Research additionally tracks builders’ steadiness sheets. On common, builders reported $7.2 million in whole property on their 2023 steadiness sheets. Of that, $4.5 million (62%) was financed by liabilities (both short- or long-term) and the opposite $2.7 million (38%) by fairness builders held of their corporations.

Historic knowledge present the typical $7.2 million in whole property in 2023 was 23% decrease than in 2020 ($9.4 million), and builders’ lowest asset degree since 2010 ($6.2 million). However maybe extra essential than fluctuations within the dimension of their steadiness sheets, the info reveal a long-term decline in builders’ reliance on debt to finance their operations: in 2006, 74% of their property had been backed up by debt; by 2020, the share was down 10 factors to 64%; and by 2023, it dropped to a report low of 62%. Logically, the latter means builders are utilizing extra of their very own capital to run their corporations, as illustrated by their fairness share rising from 26% of property in 2006 to 38% in 2023.

The NAHB Economics staff will conduct a Value of Doing Enterprise Research for residential remodelers within the spring of 2025. If that’s your agency’s main exercise, please take into account collaborating on this confidential survey. We merely can’t produce benchmarks with out your enter. To take part, please full this manner. A abstract of the newest profitability benchmarks for residential remodelers is out there on this weblog put up.

Uncover extra from Eye On Housing

Subscribe to get the newest posts despatched to your e-mail.