My end-of-week morning prepare WFH reads:

• Views on Market Downturns. The market doesn’t care about your opinions. Cease it. Simply cease it. Empirical research on environments like this remind us that we don’t know. Goldman Sachs doesn’t know. Morgan Stanley doesn’t know. UBS doesn’t know. I don’t know. You don’t know. (Fortunes & Frictions)

• Trump’s Insurance policies Have Shaken a As soon as-Stable Financial Outlook: Financial forecasts have deteriorated in latest weeks, reflecting the upheaval from federal layoffs, tariff strikes and immigration roundups. (New York Instances) see additionally Wall Avenue Fears Trump Will Wreck the Comfortable Touchdown: The economic system’s pilot has a brand new message: Fasten your seat belts. (WSJ)

• By no means Root for a Recession. If we assume that the market will ultimately recuperate, then a decline in fairness costs right now permits younger and “asset-light” buyers to purchase cheaper right now and earn increased returns sooner or later. However the issue with this logic is that every one else isn’t equal. Market crashes don’t occur in a vacuum. When asset costs decline, financial penalties usually comply with. Employees lose their jobs or don’t get promoted. Hiring freezes up. Folks cease spending as a lot cash. And this detrimental cycle feeds on itself. (Of {Dollars} and Knowledge)

• Are Shares a Positive Factor Over the Lengthy Time period? Not Essentially: Whereas it doesn’t happen steadily, U.S. shares, in addition to worldwide markets, have produced losses over 10- and 20-year durations, analysis exhibits. (Wall Avenue Journal)

• Beijing embraces DeepSeek to steer AI adoption because it seems to be for brand new progress drivers: Goldman Sachs expects China’s economic system to start out reflecting the constructive affect of AI adoption led by DeepSeek from subsequent 12 months. Over the long run — by 2030 — it pegs a 20-basis-point to 30-basis-point increase to China’s GDP. DeepSeek has shaken China’s AI ecosystem as nicely, with state-owned entities in addition to giant tech gamers, together with opponents, leveraging its open-sourced structure. (CNBC)

• How Pure Fuel Grew to become America’s Most Necessary Export: The White Home’s LNG-powered diplomacy will solely develop in Trump’s second time period. (Bloomberg)

• Why A few of America’s Richest Folks Are Lacking From a Listing of Large Donors: The Chronicle of Philanthropy’s annual record of the 50 most beneficiant American donors affords one thing noteworthy: A few of the wealthiest individuals aren’t on it. (Barron’s)

• How Big White Homes Took Over America: They’re enormous. They’re ugly. They’re in all places. When one went up subsequent door, I went on a quest for solutions. (Slate)

• Why You Ought to Signal Up for the I.R.S.’s Identification Theft Prevention Instrument: With staff from the so-called Division of Authorities Effectivity poking round in company techniques, religion in knowledge safety isn’t what it as soon as was. The software, an id safety PIN, will help. (New York Instances)

• The 100 Finest Sports activities Moments of the Quarter Century: However the wild factor about sports activities is that it by no means actually does. With such an unparalleled capability to bottle up the human situation—the highs, the lows, the adversity, the depth, the buildup, the discharge, the heartbreak, the triumph—sports activities are able to delivering moments of true marvel that grow to be reminiscences, that grow to be a part of our lives. When the inconceivable turns into doable, when the definition of absurd is redefined, when women and men flip into superheroes—you don’t simply overlook one thing like that. (The Ringer)

Remember to take a look at our Masters in Enterprise interview this weekend with Stephanie Kelton, professor of economics and public coverage at Stony Brook College and a Senior Fellow on the Schwartz Middle for Financial Coverage Evaluation. Beforehand, she was Chief Economist on the U.S. Senate Price range Committee, and was named by Politico as one of many 50 individuals most influencing the coverage debate in America, and one in every of Barron’s prime 100 Ladies in Finance. Her e-book “The Deficit Delusion” grew to become an on the spot New York Instances bestseller.

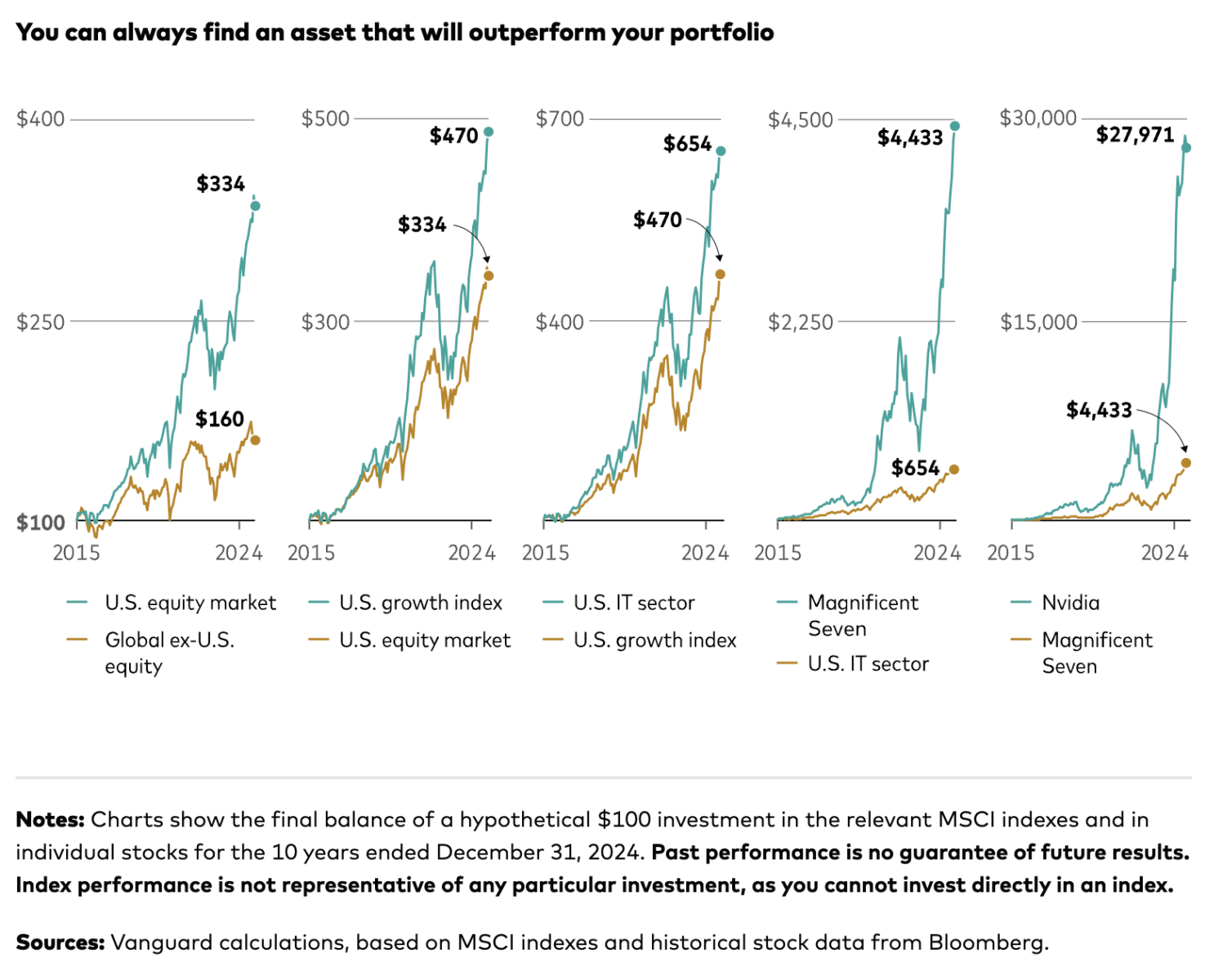

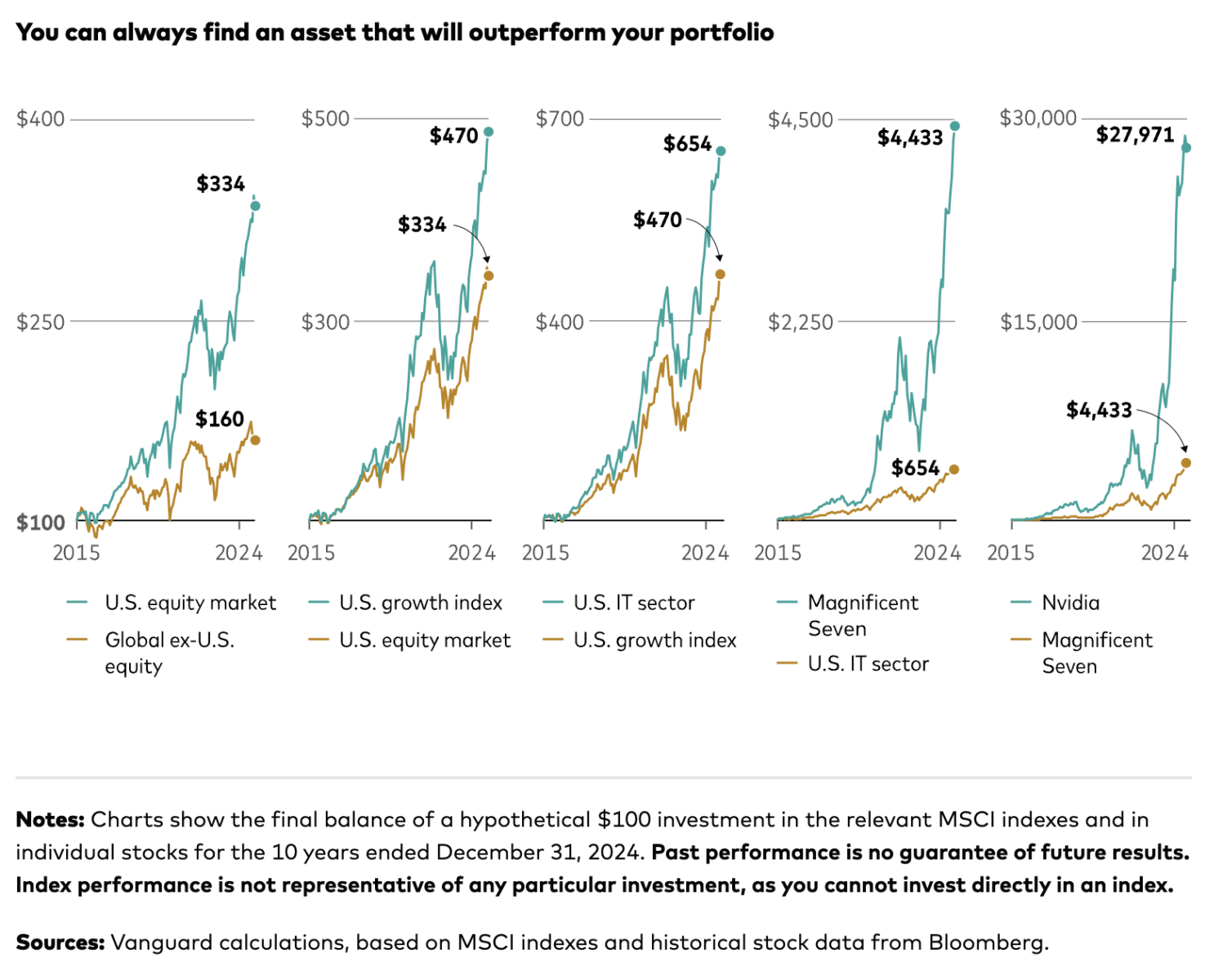

Suppose otherwise about world diversification

Supply: Vanguard

Join our reads-only mailing record right here.