Final night time (March 25, 2025), the Australian authorities delivered the most recent fiscal assertion for 2025-26 (aka – The Finances – and, in doing so tried to win renewed electoral enchantment given its waning recognition and a nationwide election that must be held within the subsequent 6 or so weeks. So it supplied the tax cuts and different inducements to the voters. However the underlying tenor of the fiscal place is unsustainable not as a result of it’s predicting on-going fiscal deficits out to 2028-19 however as a result of these deficits will likely be too small relative to different tendencies which might be prone to happen (exterior sector and family consumption spending). Whereas the commentariat has been in conniptions about ‘eye watering crimson ink’ for a far as we are able to see (their eyes are poor), the actual fact is that the projected fiscal deficit is concerning the common stage since 1970-71. However within the present atmosphere, the forecasted authorities contraction will injury the financial system and push unemployment up additional than they’re forecasting. Positive sufficient, the Authorities handed out some dollops of cost-of-living reduction to low-income households – a couple of pennies within the scheme of issues and that can in all probability assist them retain votes. Bu with all of the challenges forward now will not be the time to be in contractionary mode. Profitable the election is one factor, however neglecting a number of existential issues within the medium time period will not be the best way to go.

Authorities erases the unemployed from the general public debate

In ‘Finances Paper No.1’, Assertion 2: Financial Outlook, we observe the next forecasts.

| Combination | 2023-24 (Precise) | 2024-25 | 2025-26 | 2026-27 |

| GDP development | 1.4 | 1.5 | 2.25 | 2.5 |

| Present Account (% of GDP) | -1.3 | -1.75 | -3.75 | -4.25 |

| Public Last Demand | >4.23 | 5.0 | 3.0 | 2.0 |

| Employment | 2.2 | 2.75 | 1.0 | 1.25 |

| Unemployment | 4.0 | 4.25 | 4.25 | 4.25 |

| Participation charge | 66.8 | 67.25 | 67.0 | 66.75 |

| Inflation | 3.8 | 2.5 | 3.0 | 2.5 |

The most recent ABS estimates point out that inhabitants development “grew by 1.8 per cent within the 12 months main as much as 30 September 2024” (Supply).

The Treasury forecasts that participation will likely be largely steady (slight decline).

Observe additionally that the implied productiveness development within the above forecasts (GDP development minus Employment development) is round 1.25 per cent by the top of the forecast interval.

The one purpose that employment development is initially sturdy then falling away is as a result of productiveness development is assumed to be damaging in 2024-25 earlier than bettering to 1.25 per cent within the final two years of the forecast interval.

How does that affect the unemployment charge forecasts?

The well-known US economist Arthur Okun developed a rule of thumb about the best way unemployment reacts to GDP development.

The rule of thumb has it that if the unemployment charge is to stay fixed, the speed of actual output (GDP) development should equal the speed of development within the labour pressure plus the expansion charge in labour productiveness.

Keep in mind that labour productiveness development reduces the necessity for labour for a given actual GDP development charge whereas labour pressure development provides staff that must be accommodated for by the true GDP development (for a given productiveness development charge).

If we assume the labour pressure grows in keeping with the assumed underlying inhabitants forecasts – so round 1.8 per cent (given participation is estimated to be steady) and productiveness development is round 1.25 per cent, then GDP development must be 3.05 per cent in every of the forecast years if the unemployment charge is to remain unchanged.

A cursory take a look at the Desk above, exhibits the next if the forecasts become reality:

1. 2024-25 – GDP will likely be above the required charge by round 0.95 factors as a result of productiveness development is assumed to be damaging.

2. 2025-26 – GDP will likely be beneath the required charge by round 0.8 factors.

3. 2026-27 – GDP development will likely be beneath the required charge by round 0.55 factors..

The implication is that it’s onerous to see how the unemployment charge improve may be confined to a forecast 0.25 factors over the forecast interval.

The rule of thumb tells us that it’ll rise by round 0.4 factors over the forecast interval..

That’s clearly an approximation.

However it suggests there’s not consistency throughout the modelled forecasts utilized by Treasury.

The one manner that the unemployment charge improve might be confined to 0.25 factors over the subsequent three years is that if productiveness development stayed low or damaging.

The opposite manner of contemplating that is to simulate the underlying labour pressure aggregates primarily based on the Treasury assumptions with respect to employment development.

That simulation (utilizing the ABS inhabitants development knowledge) and the Treasury employment development forecasts, delivers an unemployment charge of 5.03 per cent by the top of June 2027 with unemployment rising from 612.6 thousand in February 2025 to 794.3 thousand by the top of June 2027.

Keep in mind that the Treasury forecasts are for fiscal years so a rising unemployment charge will report a decrease annual common than its endpoint within the month of June 2027.

My finest guess is that the unemployment charge will rise nearer to five per cent than 4.25 per cent as estimated by the Treasury.

It tells me that the fiscal place the federal government is selecting as its coverage technique is simply too contractionary.

Additional, I’ve commonly indicated that the unemployed are compelled to stay on so-called Jobseeker advantages (unemployment advantages) that are more and more beneath the recorded poverty line.

Successive federal governments have refused to handle that growing hole.

In final night time’s fiscal assertion, the Authorities didn’t embody any measures to extend the earnings help funds for the unemployed (or any social help funds for that matter).

It’s as if the Authorities has simply erased the plight of the jobless that it’s intentionally growing from the general public debate.

I discover that an appalling prospect.

‘Pink ink’ hysteria

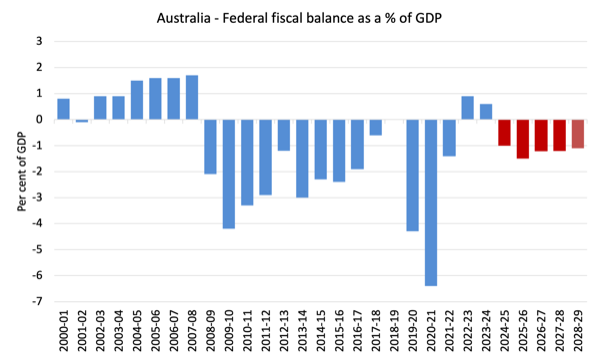

Right here is the fiscal place since 2000-01 with the crimson bars indicating the forecast values.

Over the forecast interval there’s a slight contraction deliberate, which is why the unemployment charge is forecast to rise.

Final night time’s assertion indicated that the federal authorities can be in fiscal deficit eventually out to 2028-29, which has prompted the ‘crimson ink’ hysteria brigade to prophesise all kinds of impending disasters.

What number of commentators are you able to rely that use phrases comparable to ‘eye watering deficits’ or comparable.

Pathetic.

Since 1970-71, the fiscal deficit has averaged 0.9 per cent of GDP.

By 2028-29, it’s forecast to be 1 per cent of GDP.

If commentators would simply acquire some historic data, they may be much less susceptible to those excessive hysterics.

As I famous above, the fiscal deficit is too low – not extreme and there are various methods to reveal that (see beneath).

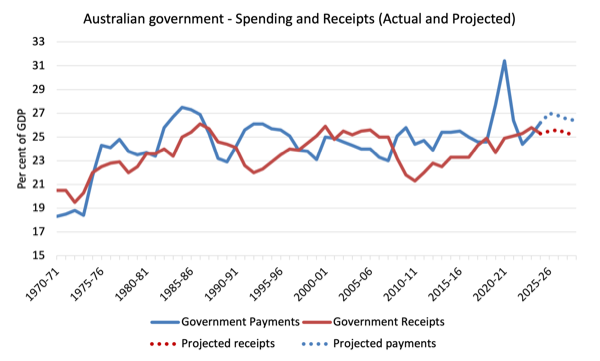

The next graph exhibits the motion in these aggregates as a p.c of GDP since 1970-71.

The dotted segments are the fiscal assertion projections.

You may see that whereas funds are projected to fall from 27 per cent of GDP in 2025-26 to 26.4 per cent in 2028-29, receipts are projected to stay comparatively steady and report 25.3 per cent of GDP in 2028-29.

Therefore the projected shrinking fiscal deficit by 2028-29.

Each spending and receipts are barely above their historic common at current.

However there’s nothing wild occurring right here.

The fiscal help through the pandemic was substantial however now the aggregates are returning to ‘base’.

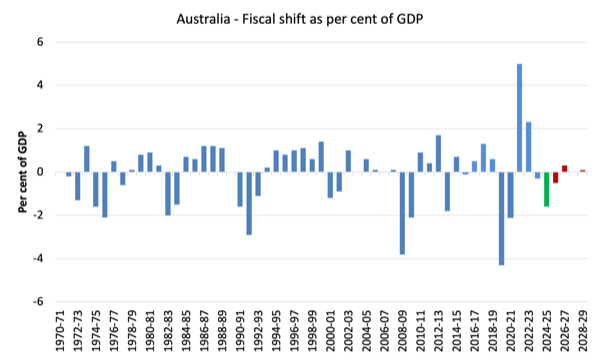

The fiscal shift from one 12 months to a different is the change within the fiscal stability as a share of GDP adjustments.

It offers an concept of how expansionary or contractionary the present fiscal place relative to the earlier monetary 12 months.

It’s the results of two components – the fiscal stability itself (in $As) and the worth of nominal GDP (in $As).

The next graph exhibits the current historical past (from 1970-71) of fiscal shifts as much as the top of the projection interval (2026-27).

A constructive worth signifies a contractionary shift (even when the fiscal place continues to be in deficit) and vice versa.

I’ve colored the present fiscal 12 months (2024-25) inexperienced and the remaining crimson columns are the ahead estimates for subsequent 12 months (2025-26) and people past.

The contractionary in 2021-22 was massive (a 5 per cent of GDP shift) because the Authorities deserted the pandemic help.

Within the first two years of the present Authorities (elected Could 2022), the contraction continued, with the Authorities relentlessly pursuing surpluses taking an additional 2.3 per cent of GDP out of the financial system in 2022-23 permitting two fiscal surpluses to be recorded.

However the contraction has killed financial development and with a nationwide election simply weeks away, the Authorities has been compelled to take an expansionary place this 12 months earlier than resuming its shift to contraction.

The RBA rate of interest hikes that began in Could 2022 mixed with the fiscal shift this diploma of fiscal contraction is the explanation that GDP development is now projected to be at ranges the place the unemployment charge rises considerably.

The place is the expansion coming from?

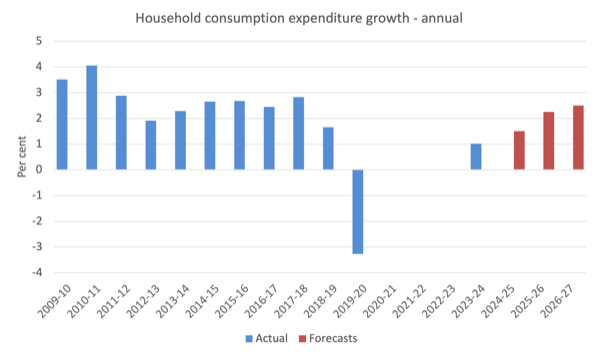

Because the Desk above exhibits, the Authorities is presenting an optimistic outlook for financial development which seems to be pushed by a big ‘comeback’ in Family consumption expenditure.

The 2025-26 fiscal assertion forecasts that actual family consumption expenditure will develop by 0.75 per cent in 2024-25, then leap to 2.25 per cent within the subsequent two years.

The next graph exhibits the annual Family consumption expenditure development from 2009-10 to 2026-27, with the crimson bars capturing the Authorities’s projections (I deleted the pandemic outliers on either side of the zero axis).

I believe the ahead estimates of family consumption expenditure will likely be excessively optimistic.

Why?

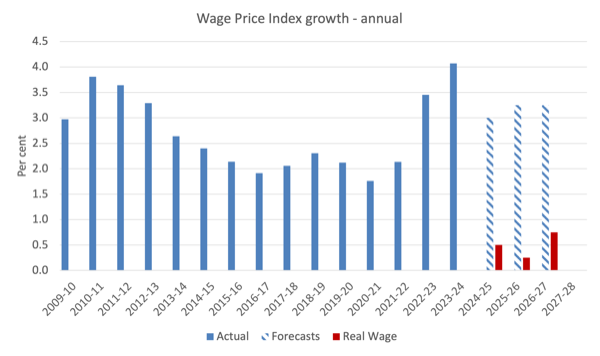

As a result of the projected wages development is overly optimistic given present tendencies and the delayed affect of the RBA rate of interest hikes and the fiscal contraction underway.

With the unemployment charge forecast to rise it’s onerous to see wages development sustaining the expansion predicted.

There will likely be some wages development however nothing like that projected within the fiscal assertion (see the subsequent graph).

Even with these optimistic nominal wage development projections, actual wages development is modest.

But when the wages development is lower than predicted then there’s the chance that the true wage good points is not going to materialise.

That leaves additional credit score development to drive development in consumption expenditure and with family debt at report ranges and rates of interest at elevated ranges, I can’t see that taking place.

Why the federal government technique is unsustainable

Trying again on the first Desk, we see that the expenditure drain from the exterior sector is predicted to extend reasonably considerably over the forecast interval as the anticipated phrases of commerce decline considerably (Fiscal assertion – “sharper fall within the phrases of commerce).

The fiscal assertion additionally notes that:

Development in exports is predicted to average to 1 per cent in 2024–25, with companies exports development slowing following the sharp rebound in training and tourism exports lately. Non-rural commodity exports are anticipated to stay subdued, reflecting ongoing weak circumstances within the Chinese language property sector.

Ally that with the data that the fiscal stability is forecast to say no.

Taken collectively it signifies that personal home demand should do the lifting and that implies rising indebtedness.

We all know that the monetary stability between spending and earnings for the personal home sector (S – I) equals the sum of the federal government monetary stability (G – T) plus the present account stability (CAB).

The sectoral balances equation is:

(1) (S – I) = (G – T) + CAB

which is interpreted as that means that authorities sector deficits (G – T > 0) and present account surpluses (CAD > 0) generate nationwide earnings and internet monetary property for the personal home sector to internet save total (S – I > 0).

Conversely, authorities surpluses (G – T < 0) and present account deficits (CAD < 0) scale back nationwide earnings and undermine the capability of the personal home sector to build up monetary property.

Expression (1) will also be written as:

(2) [(S – I) – CAB] = (G – T)

the place the time period on the left-hand facet [(S – I) – CAB] is the non-government sector monetary stability and is of equal and reverse signal to the federal government monetary stability.

That is the acquainted Fashionable Financial Principle (MMT) assertion {that a} authorities sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that whole personal financial savings (S) minus personal funding (I) has to equal the general public deficit (spending, G minus taxes, T) plus internet exports (exports (X) minus imports (M)) plus internet earnings transfers.

All these relationships (equations) maintain as a matter of accounting.

The federal government is estimating that the damaging international components will proceed to undermine Australia’s phrases of commerce.

They forecast a decline of two.5 per cent in 2024-25, then for a large contraction (-0.6 per cent) in 2025-6 and an additional fall of three per cent in 2025-26.

In different phrases, the commodity worth growth which has pushed the exterior stability into surplus just lately is forecast to finish and Australia will return to its common place of a exterior deficit of round 3.5 to 4 per cent of GDP – a state that has been dominant for the reason that Seventies.

The present ‘commerce warfare’ that the US authorities is waging with the remainder of the world will definitely add ripples into this image – on the draw back.

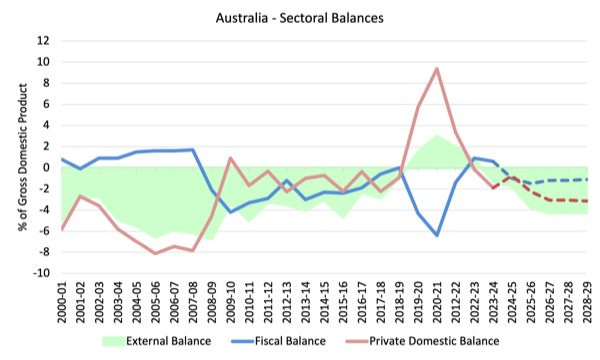

The next graph tells the story.

It exhibits the sectoral stability aggregates in Australia for the fiscal years 2000-01 to 2027-28, with the ahead years utilizing the Treasury projections revealed in ‘Finances Paper No.1’ in dotted kind.

The projections start in 2024-25 (though the present 12 months’s outcomes are in all probability going to be as forecast).

I’ve assumed that the exterior place in 2026-27 and past would be the similar because the Authorities’s estimate for that 12 months.

All of the aggregates are expressed when it comes to the stability as a p.c of GDP.

I’ve modelled the fiscal deficit as a damaging quantity though it quantities to a constructive injection to the financial system.

You additionally get to see the mirror picture relationship between it and the personal stability extra clearly this manner.

So it turns into clear, that with the present account deficit (inexperienced space) projected to return growing deficits, which drain internet spending from the home financial system and with the fiscal stability shifting in direction of zero over the identical interval, the personal home stability (crimson line) will head rapidly into larger deficits.

Increased personal home deficits imply larger ranges of indebtedness.

The Family sector is already carrying report ranges of indebtedness which is why family consumption expenditure has been slowing down appreciably.

So mirror on that in relation to the earlier part on sources of development.

You may see that the pandemic help from Authorities clearly allowed the personal home sector to rebuild its saving buffers and scale back the precarity of its stability sheet (given the huge family debt).

Within the ancient times, previous to the GFC, the credit score binge within the personal home sector was the one purpose the federal government was in a position to report fiscal surpluses and nonetheless get pleasure from actual GDP development.

However the family sector, particularly, gathered report ranges of (unsustainable) debt (that family saving ratio went damaging on this interval though traditionally it has been someplace between 10 and 15 per cent of disposable earnings).

The fiscal stimulus in 2008-09 noticed the fiscal stability return to the place it needs to be – in deficit – given the nation’s exterior deficit place.

This not solely supported development but additionally allowed the personal home sector to begin the method of rebalancing its precarious debt place.

You may see the crimson line strikes into surplus or near it.

That course of was interrupted by the renewal of the fiscal surplus obsession in 2012-13.

The sturdy fiscal help through the pandemic overwhelmed all of the nonsensical deficit scaremongering and allowed the personal home sector to extend its total saving (and pay down debt) which was an excellent factor.

However because the earlier authorities withdrew its stimulus and the present authorities continued to pursue a contractionary fiscal place (see above), the personal home sector has just one choice given the tendencies within the exterior sector if it needs to keep up consumption expenditure – resume the method of accumulating extra debt.

With a worldwide recession threatening and with larger rates of interest the norm, the technique outlined in yesterday’s fiscal assertion is as soon as once more putting the financial system on an unsustainable path counting on family debt accumulation, which is a finite course of.

Conclusion

There are lots of different features to the present fiscal stance which I may focus on if I had extra time.

Normally, I’m unimpressed.

That’s sufficient for at present!

(c) Copyright 2025 William Mitchell. All Rights Reserved.