Can financial institution failures be predicted earlier than they occur? In a earlier put up, we established three information about failing banks that indicated that failing banks expertise deteriorating fundamentals a few years forward of their failure and throughout a broad vary of institutional settings. On this put up, we doc that financial institution failures are remarkably predictable based mostly on easy accounting metrics from publicly accessible monetary statements that measure a financial institution’s insolvency danger and funding vulnerabilities.

Why Is It Necessary to Predict Financial institution Failures?

This query is essential for 2 causes. First, understanding if failures are predictable is of sensible significance for financial institution supervisors, traders, and clients. The flexibility to foretell failures could present scope for averting or not less than mitigating the price of failures.

Second, the predictability of financial institution failures can present clues concerning the underlying causes of issues in failing banks. For instance, if financial institution failures are predictable based mostly on previous lending habits and rising losses, then deteriorating fundamentals doubtless play a central function in financial institution failures. Alternatively, if financial institution failures are largely unpredictable, then they’re extra prone to be attributable to surprising shocks or financial institution runs unrelated to financial institution fundamentals.

Predicting Financial institution Failures with Measures of Financial institution Solvency and Funding Vulnerabilities

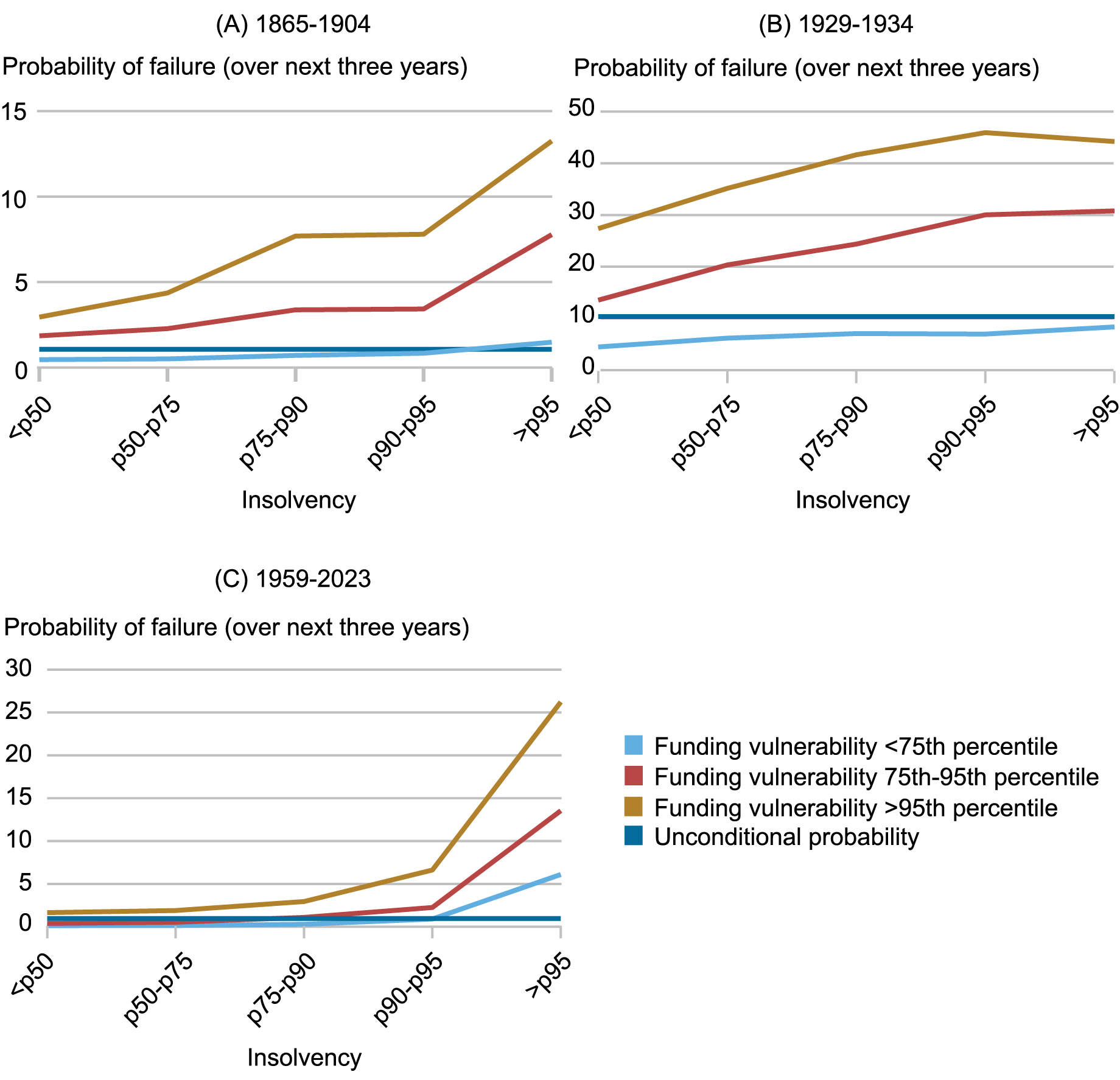

As in our first put up, our evaluation relies on a novel dataset of financial institution fundamentals and failures spanning 1865 to 2023, detailed in our new working paper. We first illustrate that the chance of a future financial institution failure is strongly rising in proxies for weak financial institution fundamentals. The chart under plots the likelihood of financial institution failure over the subsequent three years as a operate of measures of financial institution insolvency danger and financial institution funding vulnerability (proxied by the reliance on costly and risk-sensitive sorts of noncore funding). This permits us to ask: Are banks extra prone to fail after they have weak solvency and are counting on weak sources of funding?

Poor Fundamentals Predict a Larger Threat of Financial institution Failure

Notes: The chart plots the likelihood of financial institution failure from t+1 to t+3 towards the joint distribution of proxies for insolvency and funding vulnerability in 12 months t. For the Nationwide Banking Period (1865-1904) and Nice Melancholy (1929-1935), insolvency is measured by undivided earnings over fairness, and funding vulnerability is measured by wholesale funding over property. For the Fashionable Period (1959-2023), insolvency is measured by equity-to-assets, and funding vulnerability is measured by time deposits to complete deposits.

The chart reveals that the danger of failure rises as a financial institution’s solvency deteriorates and its reliance on costly types of funding rises. Furthermore, banks which have each excessive insolvency and excessive funding vulnerability have the best chance of failure. For instance, a financial institution within the high fifth percentile of each insolvency danger and funding vulnerability has a likelihood of failure over the subsequent three years of round 14 p.c within the Nationwide Banking Period (1865-1904), 42 p.c through the Nice Melancholy (1929-1934), and 26 p.c within the fashionable interval (1959-2023). This quantities to a ten- to twenty-fold improve within the likelihood of failure relative to the typical financial institution, a substantial differential, and means that failures are usually not random. Relatively, failing banks present indicators of weak fundamentals of their publicly accessible monetary statements earlier than they fail.

Are Financial institution Failures That Happen Throughout Financial institution Runs Predictable?

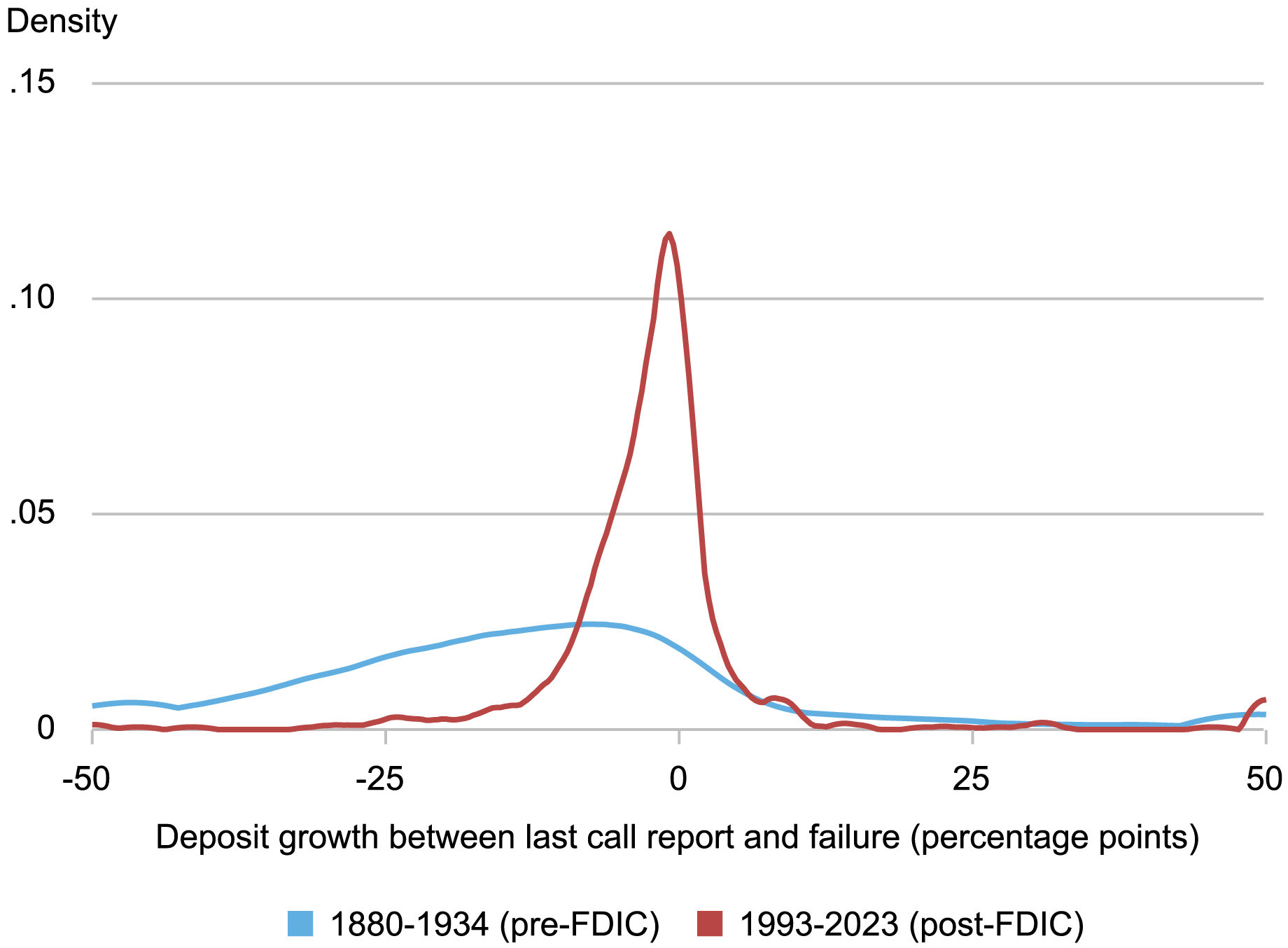

The run on, and failure of, Silicon Valley Financial institution in spring 2023 took many individuals abruptly and drew comparisons to runs on banks within the period earlier than deposit insurance coverage. Our lengthy historic pattern of banks, which extends again to the interval earlier than deposit insurance coverage and creation of the Federal Reserve, incorporates many failures that includes runs. The following chart plots the distribution of deposit outflows in failing banks within the fast run-up to failure. Earlier than the introduction of federal deposit insurance coverage in 1934, failures involving massive deposit withdrawals have been fairly frequent. For instance, virtually two-thirds of nationwide financial institution failures that occurred earlier than the founding of the Federal Deposit Insurance coverage Company (FDIC) featured deposit outflows of not less than 7.5 p.c, and greater than one-third of failures featured deposit withdrawals of over 20 p.c. In distinction, common outflows are far more modest after the introduction of deposit insurance coverage.

Deposit Outflows in Failing Banks

Notes: The chart exhibits the distribution of the expansion in deposits between the final name report from earlier than failure and the deposits reported in failure. Deposit development is clipped at +/- 50 share factors.

This raises the query: Are failures that happen throughout financial institution runs predictable? Or are they laborious to foretell as a result of financial institution runs are pushed by panics and are unrelated to fundamentals?

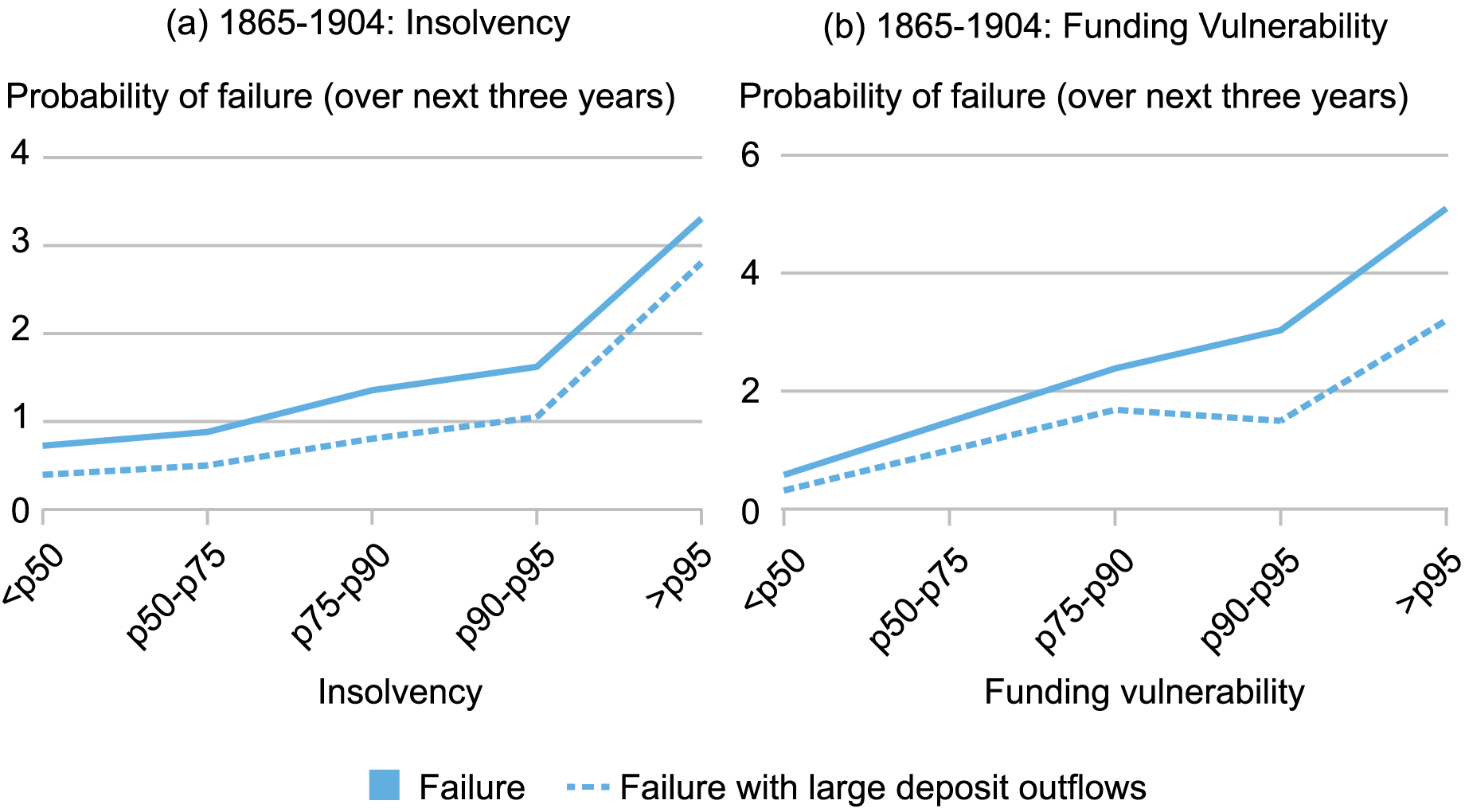

The following chart plots the conditional likelihood of failure for all failures and for failures with massive deposit outflows, the latter being a sign that failure was accompanied by a run. The chart focuses on the Nationwide Banking Period (1865-1904), earlier than authorities interventions comparable to deposit insurance coverage or a lender of final resort. We outline a big deposit outflow occurring if deposits decline by greater than 7.5 p.c between the final name report and the financial institution’s failure. The chart reveals that fundamentals strongly predict failures with massive deposit outflows. Within the Nationwide Banking Period, transferring from wholesome fundamentals (under the fiftieth percentile) to excessive insolvency or funding vulnerability is related to a rise within the likelihood of failure that’s much like the rise for all failures. (The likelihood of failure with deposit outflows have to be decrease than the likelihood of failure, thus the strong line have to be above the dashed line.) Thus, the failures related to massive deposit outflows—failures that sometimes concerned runs—weren’t wholly surprising occasions that have been disconnected from fundamentals. As a substitute, at any time when depositors run, they appear to be reacting to weak financial institution fundamentals and anticipating failure.

Financial institution Failures with Financial institution Runs Are Predictable

Notes: The chart plots the likelihood of financial institution failure over a three-year horizon towards the distribution of proxies for insolvency and funding vulnerability. Insolvency is measured by undivided earnings over fairness. Funding vulnerability is measured by wholesale funding over property. Failures with massive deposit outflows are outlined as these the place deposits fall by greater than 7.5 p.c between the final name report and failure. Failures with massive deposit outflows are based mostly on the 1880-1904 pattern, because the OCC solely stories deposits on the time of failure beginning in 1880.

Predicting Waves of Mixture Financial institution Failures

To date, we’ve got seen that particular person financial institution failures could be predicted utilizing easy indicators from publicly accessible monetary statements. Can the identical traits additionally predict waves of financial institution failures throughout banking crises? Mentioned in another way, does the predictability of financial institution failures differ relying on whether or not there’s a banking disaster?

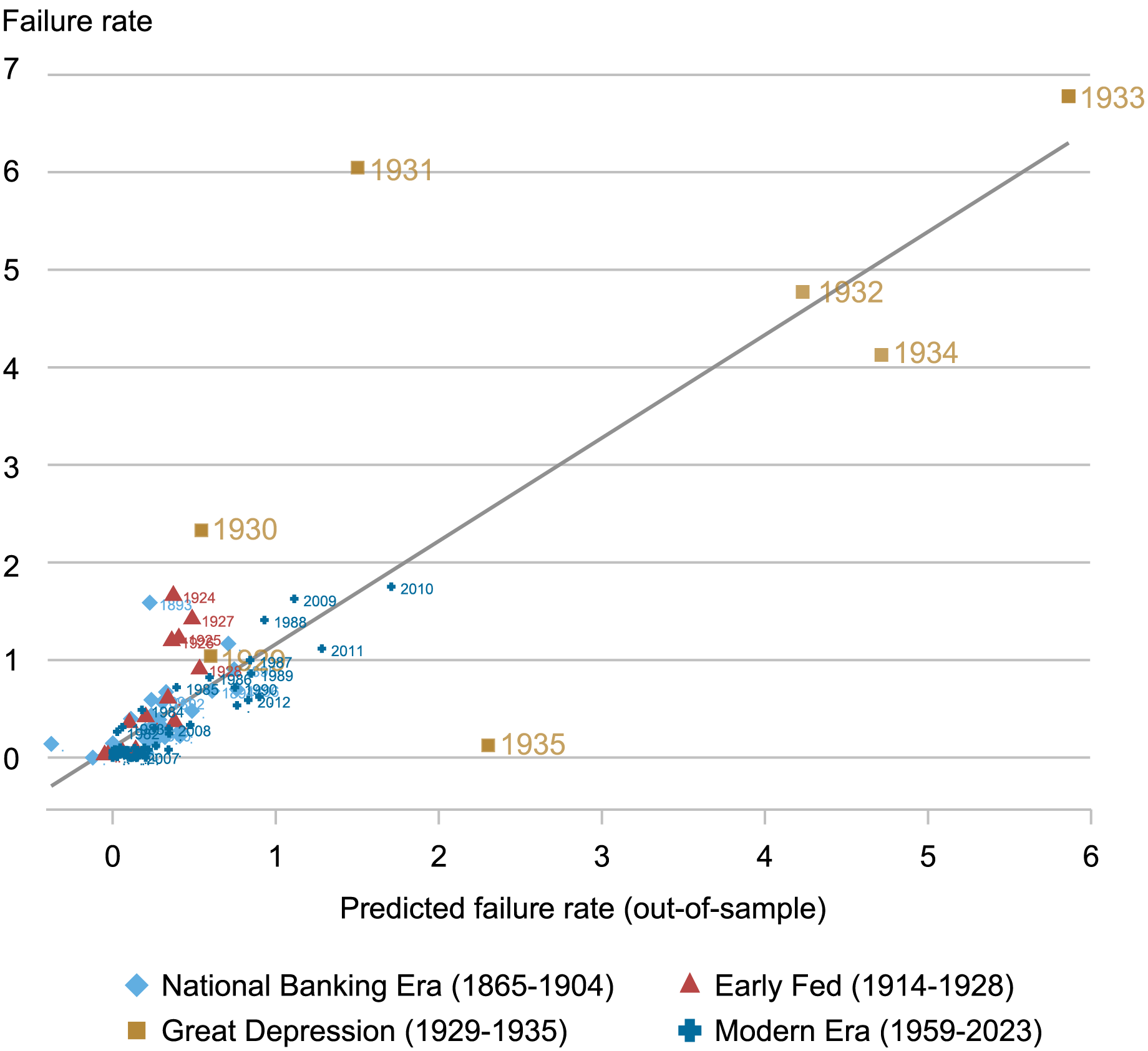

The following chart compares the realized mixture failure charge on the y‑axis towards an out-of-sample predicted failure charge on the x-axis. The anticipated failure charge is constructed by aggregating the predictions from a easy bank-level mannequin that predicts failure utilizing measures of insolvency danger, funding vulnerabilities, and financial institution development, in addition to mixture GDP development. The prediction is completed out-of-sample, so, for instance, the prediction for the 12 months 1933 relies solely on info as much as 1932.

Fundamentals Predict Mixture Waves of Financial institution Failures

Notes: The chart plots the realized mixture failure charge towards the anticipated mixture failure charge. The anticipated mixture failure charge for a given 12 months is constructed utilizing solely info as much as that 12 months, so the prediction is pseudo out-of-sample. Each measures begin ten years after the beginning of our knowledge in order that we’ve got a sufficiently lengthy coaching pattern. The predictions for every pattern interval are based mostly on regression fashions which can be described intimately within the paper.

There’s a very robust constructive relation between the anticipated and the realized failure charge. The excessive charge of financial institution failures within the Nice Recession (2009-2010) and Nice Melancholy (1929-1933) was largely predictable based mostly on the deteriorating financial institution and financial fundamentals. Thus, spikes in financial institution failures throughout systemic banking crises can not merely be defined by panic-based financial institution runs. As a substitute, waves of failures are strongly accounted for by deteriorating fundamentals.

Wrapping Up

This put up has documented that U.S. financial institution failures occurring since 1865 are extremely predictable based mostly on financial institution fundamentals. The chance of future failure is considerably larger for banks with decrease solvency and a larger reliance on costly and risk-sensitive sources of funding. Furthermore, financial institution fundamentals forecast the key waves of financial institution failures in U.S. historical past, together with the failures within the Nice Melancholy and Nice Recession. Within the subsequent put up, we talk about the implications of our findings for our understanding of the causes of financial institution failures.

Sergio Correia is a principal economist within the Monetary Stability Division on the Board of Governors of the Federal Reserve System.

Stephan Luck is a monetary analysis advisor in Banking Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Emil Verner is an affiliate professor of finance on the MIT Sloan Faculty of Administration.

cite this put up:

Sergio Correia, Stephan Luck, and Emil Verner, “Why Do Banks Fail? The Predictability of Financial institution Failures,” Federal Reserve Financial institution of New York Liberty Avenue Economics, November 22, 2024, https://libertystreeteconomics.newyorkfed.org/2024/11/why-do-banks-fail-the-predictability-of-bank-failures/.

Disclaimer

The views expressed on this put up are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the writer(s).