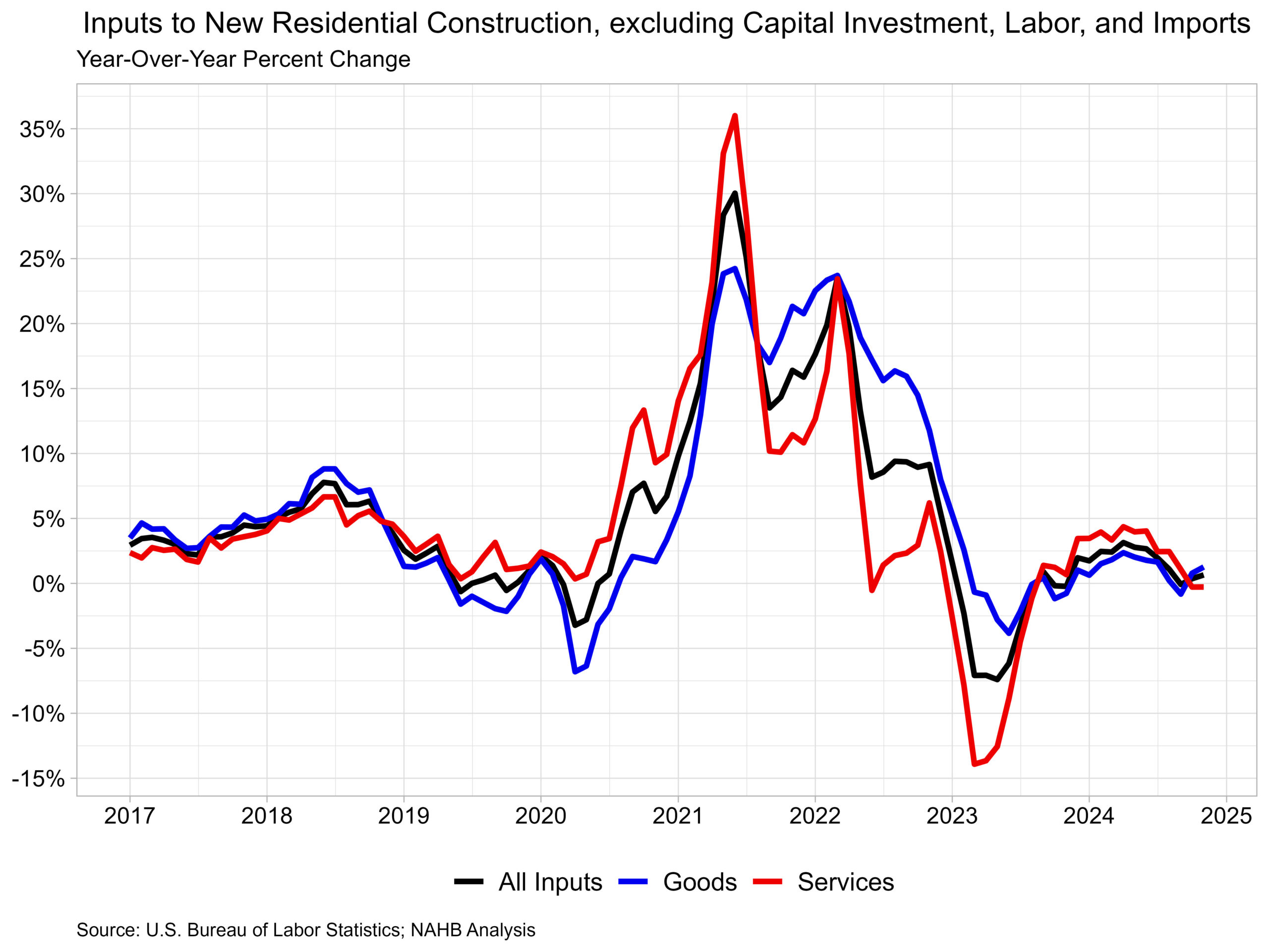

Costs for inputs to new residential building—excluding capital funding, labor, and imports—had been unchanged in November in response to the latest Producer Worth Index (PPI) report printed by the U.S. Bureau of Labor Statistics. In comparison with a yr in the past, this index was up 0.7% in November after rising 0.3% in October.

The inputs to the brand new residential building value index will be damaged into two elements—one for items and one other for providers. The products element elevated 1.2% over the yr, whereas providers decreased 0.3%. For comparability, the entire ultimate demand index elevated 3.0% over the yr in November, with ultimate demand with respect to items up 1.1% and ultimate demand for providers up 3.9% over the yr.

Items

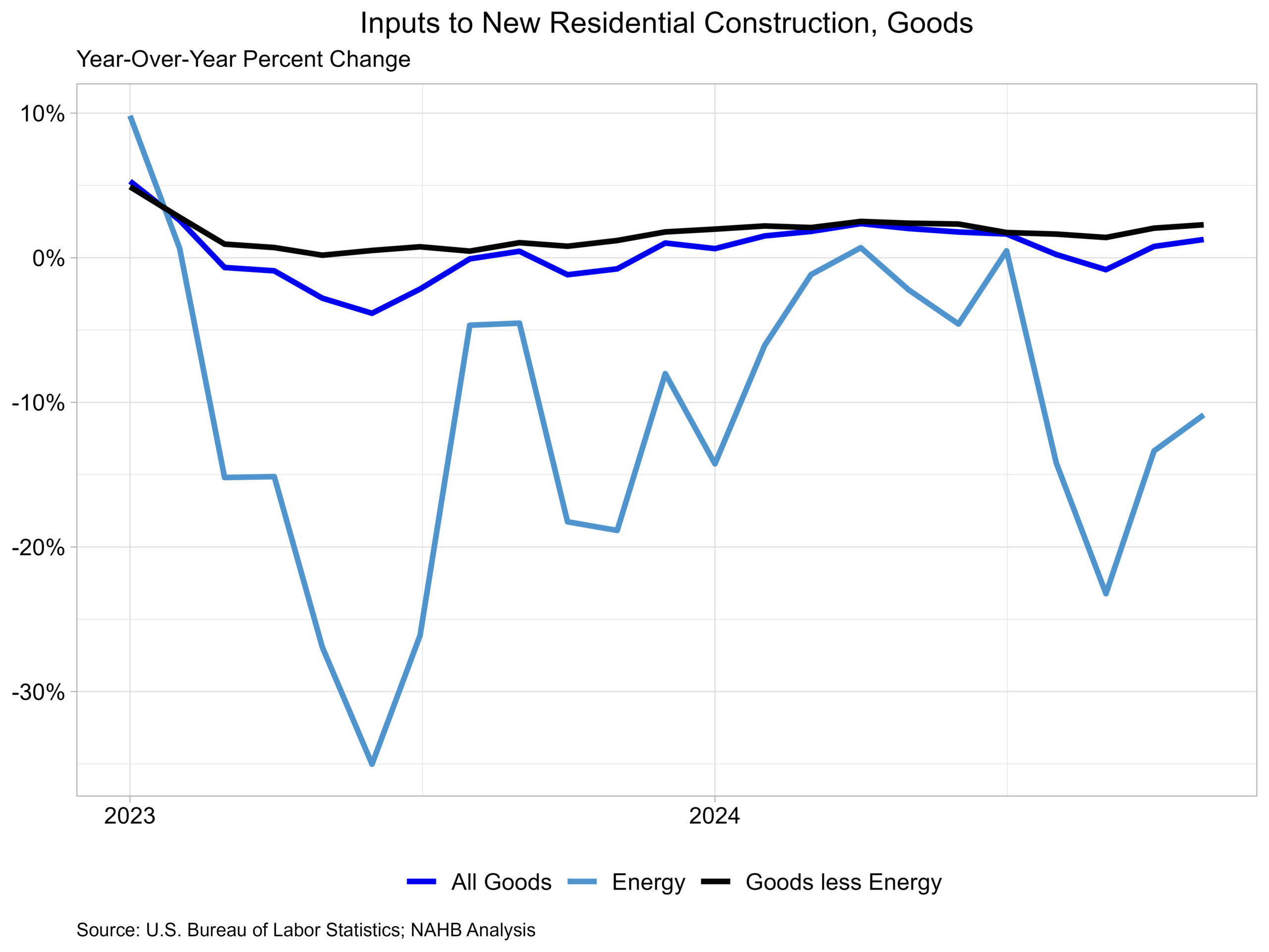

The products element has a bigger significance to the entire residential building inputs value index, representing round 60%. The value of enter items to new residential building was unchanged in November from October. The enter items to residential building index will be additional damaged down into two separate elements, one measuring vitality inputs with the opposite measuring items much less vitality inputs. The latter of those two elements merely represents constructing supplies utilized in residential building, which makes up round 93% of the products index.

Costs for inputs to residential building, items much less vitality, had been up 2.3% in November in comparison with a yr in the past. This year-over-year improve was bigger than in October (2.0%) and was the biggest year-over-year improve since June earlier this yr. The expansion fee in November 2023 was 1.2%. The index for inputs to residential building for vitality fell 10.9% year-over-year in November, the fourth straight yearly decline in enter vitality costs.

The graph under focuses on the info because the begin of 2023 for residential items inputs. Power costs have continued to fall over the previous yr, with solely two intervals of progress in 2024.

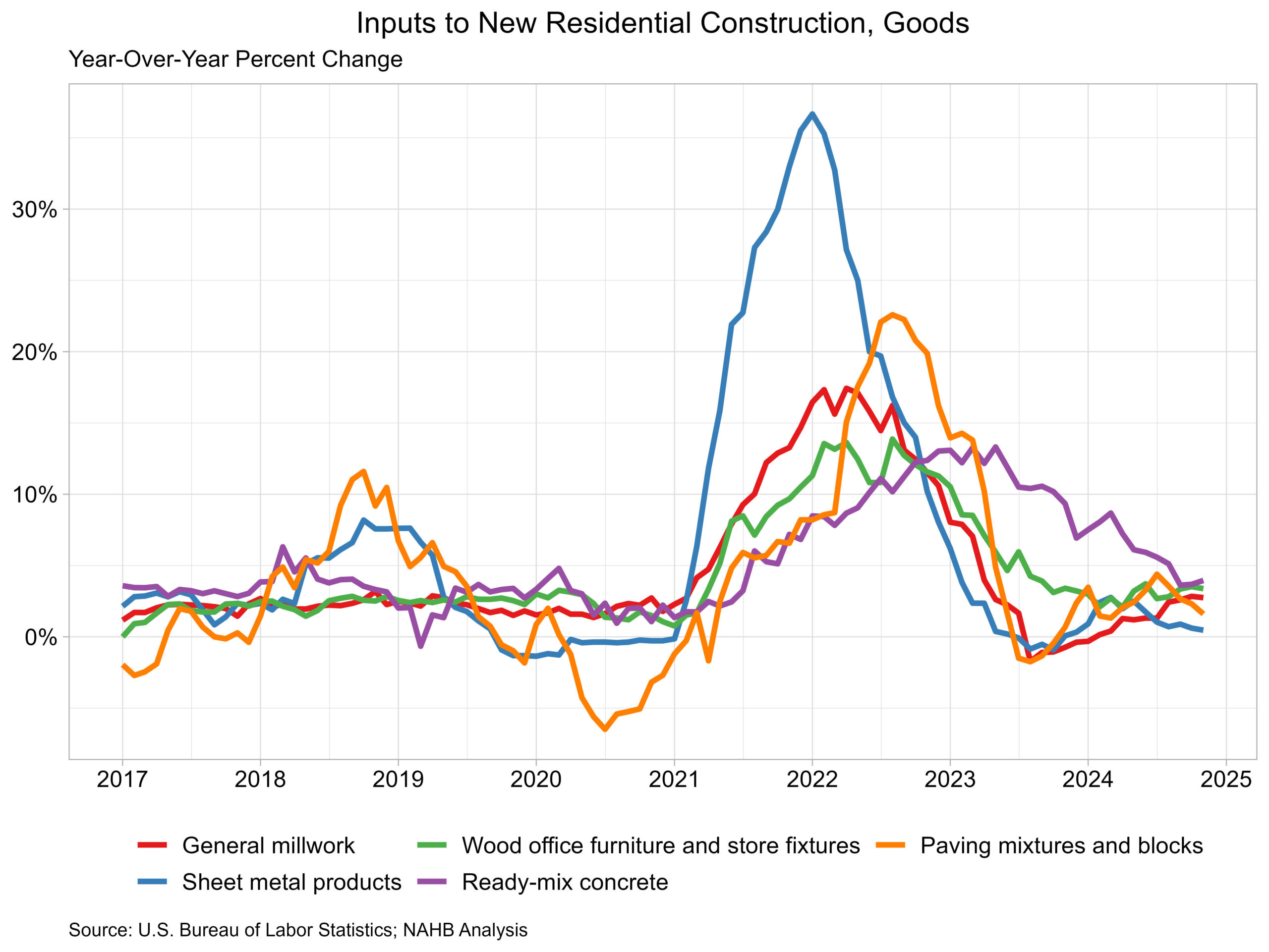

On the particular person commodity degree, excluding vitality, the 5 commodities with the best significance for constructing supplies to the brand new residential building index had been as follows: ready-mix concrete, basic millwork, paving mixtures/ blocks, sheet metallic merchandise, and wooden workplace furnishings/retailer fixtures. Throughout these commodities, there was value progress throughout the board in comparison with final yr. Prepared-mix concrete was up 3.9%, wooden workplace furnishings/retailer fixtures up 3.4%, basic millwork up 2.8%, paving mixtures/blocks up 1.6% and sheet metallic merchandise up 0.5%. Unsurprisingly, given how vitality costs have trended this yr, the enter commodity that had the biggest fall in value over the yr was No. 2 diesel, which was down 20.6%.

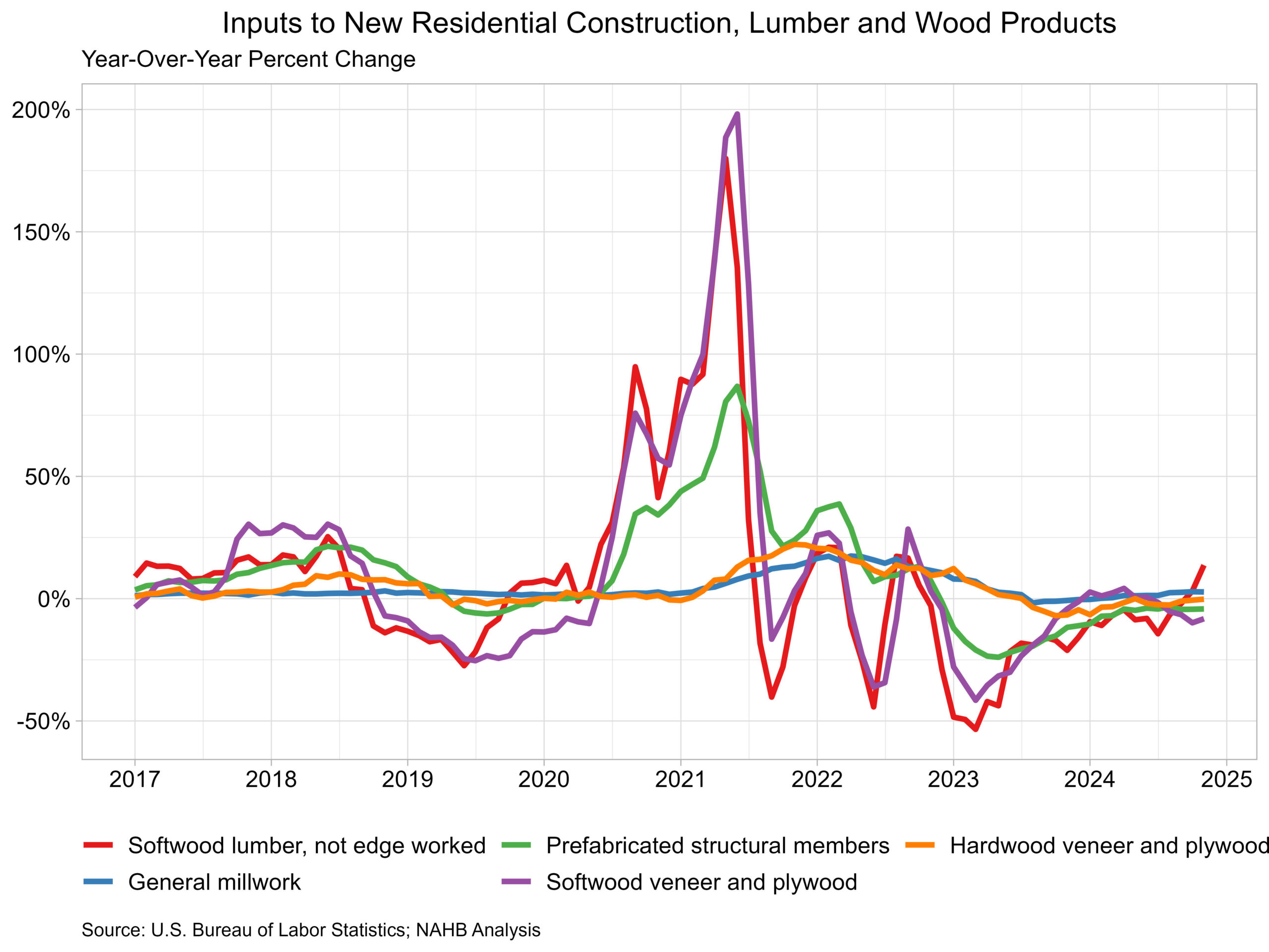

Amongst lumber and wooden merchandise, the commodities with the best significance to new residential building had been basic millwork, prefabricated structural members, softwood veneer/plywood, softwood lumber (not edge labored) and hardwood veneer/plywood. The enter commodity in residential building that had the best year-over-year % change (throughout all enter items) in November was softwood lumber (not edge labored), which was 13.7% larger than November 2023. That is of specific word as a result of not one of the different high wooden commodities had a year-over-year change above 3% in November. Lumber provides have been driving costs larger over the previous month because the sawmill business continues to regulate to the mill closures that occurred earlier this yr. Larger lumber demand as residential building rebounds as a consequence of decrease rates of interest is prone to proceed to extend lumber costs.

Companies

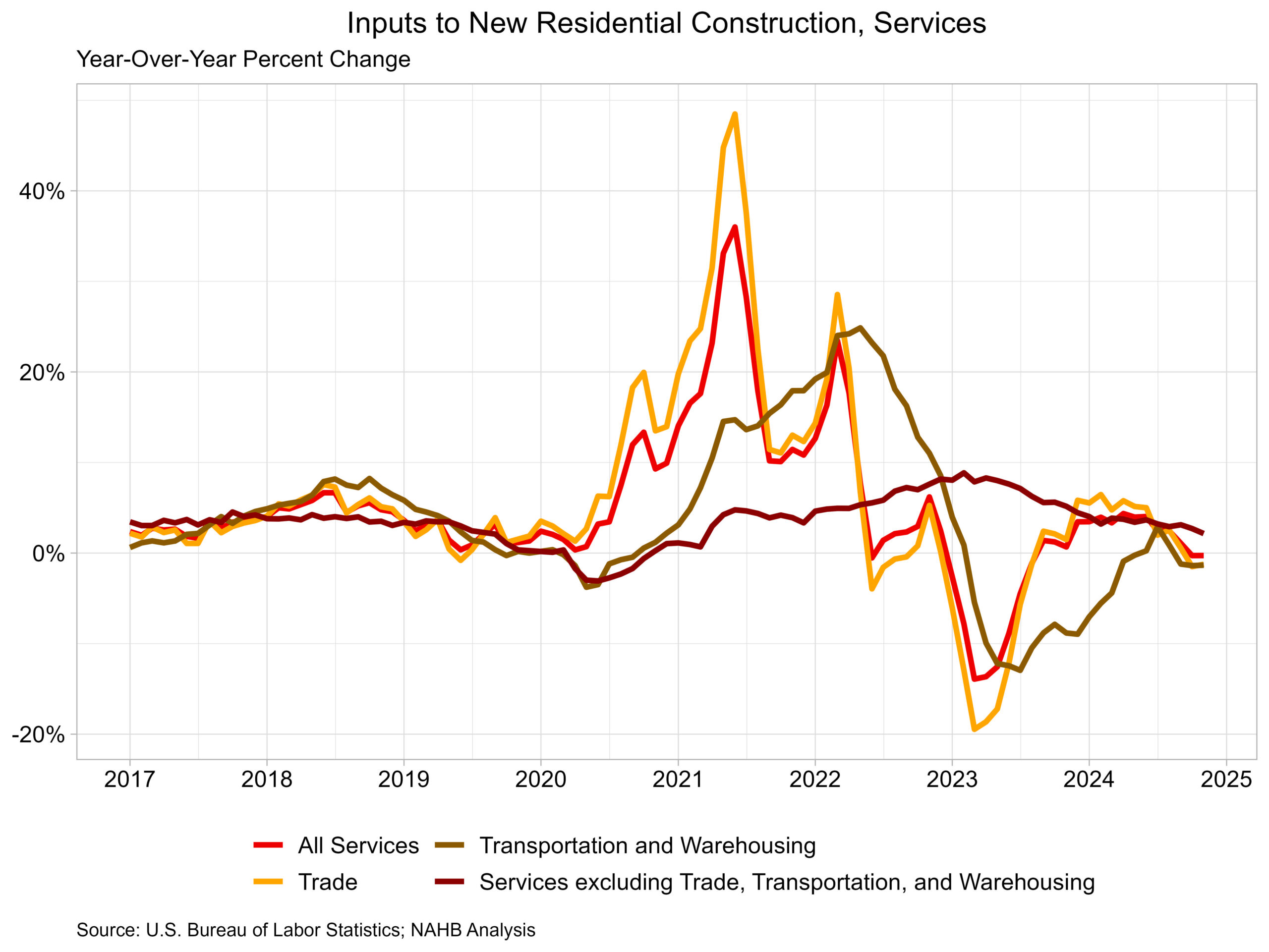

Costs of inputs to residential building for providers, had been unchanged in November from October. The value index for service inputs to residential building will be damaged out into three separate elements: a commerce providers element, a transportation and warehousing providers element, and a providers excluding commerce, transportation and warehousing element. Probably the most significant factor is commerce providers (round 60%), adopted by providers much less commerce, transportation and warehousing (round 29%), and eventually transportation and warehousing providers (round 11%). The most important element, commerce providers, in comparison with final yr was down 1.2% in November after declining 1.5% in October.

Uncover extra from Eye On Housing

Subscribe to get the newest posts despatched to your e-mail.