I created my finest laid plans of mice and males for retirement, or as Dwight D. Eisenhower mentioned, “plans are nugatory, however planning is indispensable”. I observe a lot of what Christine Benz recommends in The best way to Retire: 20 Classes for a Blissful, Profitable, and Rich Retirement. I divide my intermediate funding bucket, consisting of Conventional IRAs, into conservative sub-portfolios of bonds that I handle and extra aggressive sub-portfolios of shares and bonds managed by Constancy and Vanguard for progress and revenue. On this article, I take a look at managing withdrawals in a secular bear market with an elevated sequence of return threat.

This Time Is Totally different, Extremely Totally different

Keynesian macroeconomic principle is to make use of authorities intervention to handle financial downturns and promote employment. The regulation of provide and demand means American customers will spend much less as tariffs are handed alongside within the type of worth will increase. Tariffs are a regressive tax on lower- and middle-income households. A broad measure of the greenback has declined by eight % year-to-date, making imports much more costly. Reducing Federal tax income greater than spending provides to deficits and is financed with greater nationwide debt. Companies don’t like uncertainty, and people who don’t move alongside the price of tariffs could have decrease income, which pressures excessive valuations. This time is extremely completely different!

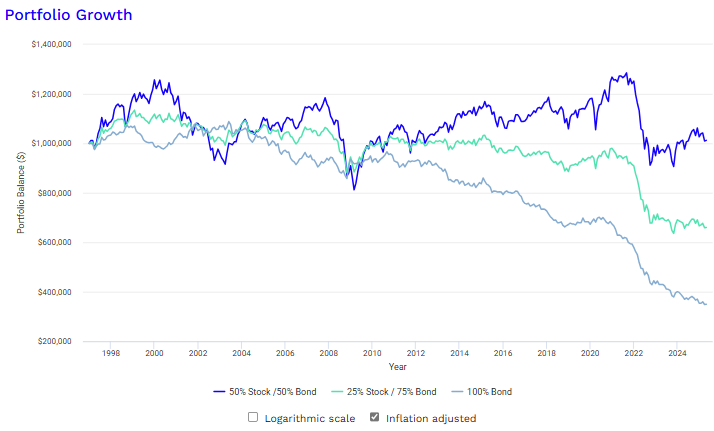

I wrote Investing in 2025 and the Coming Decade for the Mutual Fund Observer December 2024 e-newsletter. Constancy’s Asset Allocation Analysis Crew (AART) described “a brand new atmosphere of slower progress, rising geopolitical threat, and declining globalization”. This was earlier than tariffs had been elevated in April and earlier than abrupt cuts to the Federal workforce and spending! I displayed Determine #1 under, which I created from Vanguard Perspective (October 22, 2024), to signify projected 10-year nominal returns and volatility. Investing in worldwide equities and bonds helped traders with well-diversified portfolios sail by way of the 2025 correction with low volatility.

Determine #1: Vanguard VCMM 10-Yr Return vs Volatility Projections

Supply: Writer Utilizing Vanguard Perspective (October 22, 2024)

Uncertainty in retirement planning has tremendously elevated. Final month, whereas the inventory market had recovered, I diminished my general allocation of shares to bonds from about 57% to round 50%. For a candid evaluation of the dangers, I refer you to “JPMorgan CEO Jamie Dimon Says Markets Are Too Complacent On Tariffs, Expects S&P 500 Earnings Progress To Collapse,” by Hugh Son at CNBC. To be clear, I favor a balanced price range in a well-thought-out method over time. Uncertainty, whether or not strategic or not, could have lingering opposed results.

Paolo Confino wrote, “Because the Fed devises its new technique, Powell sees an economic system with ‘extra unstable’ inflation,” for Fortune. Mr. Confino quotes Federal Reserve Chairman Jerome Powell as saying, “We could also be getting into a interval of extra frequent and probably extra persistent provide shocks, a troublesome problem for the economic system and for central banks.” Mr. Powell continued, “Larger actual charges may replicate the chance that inflation might be extra unstable going ahead than throughout the inter-crisis interval of the 2010s.” Mr. Powell concludes, “Anchored expectations performed a key position in facilitating these expansions. Extra just lately, with out that anchor, it could not have been doable to realize a roughly 5 proportion level disinflation with no spike in unemployment.”

Lance Roberts at Actual Funding Recommendation explains in “Earnings Revision Exhibits Sharp Decline” that earnings “estimates are exceedingly optimistic”. He steered “rebalancing threat as essential and adjusting portfolio holdings to offer some hedge towards a sudden pickup in volatility”. Mr. Roberts factors out that “because the economic system slows, shopper demand falls”. One implication is that because the economic system slows, tax revenues will sluggish, worsening the deficit and including to the nationwide debt.

Present Funding Setting

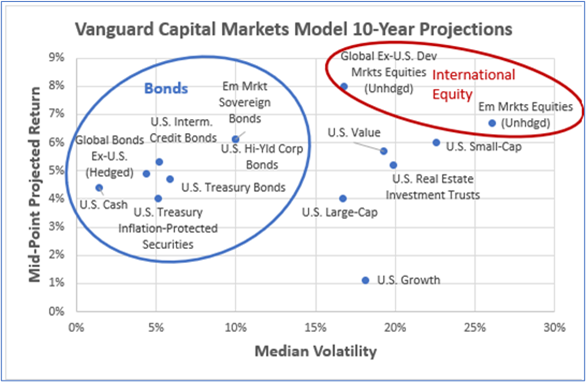

I watched “2025 Economic system Watch,” by The Convention Board, and “Navigating Markets by way of a Shifting Sea of Coverage” at Constancy. They articulated my considerations for the economic system very clearly. In Desk #1, I evaluate the well timed forecast from The Convention Board to the First Quarter 2025 Survey of Skilled Forecasters by the Federal Reserve Financial institution of Philadelphia, which was made earlier than the April 2nd announcement of tariffs. Economists at The Convention Board estimate that financial progress will most likely sluggish to under 2% this yr and subsequent, and inflation will stay elevated close to 3%.

Desk #1: Forecasts of Actual GDP and Inflation

Writer Utilizing Knowledge from The Convention Board and Federal Reserve Financial institution of Philadelphia Survey of Skilled Forecasters

The federal government bond sale this week was not met with enthusiastic traders, and the yield on 30-year Treasuries has risen from 4.4% following the April 2nd announcement of tariffs to over 5%. The ten-year Treasury has risen from 4.0% to almost 4.6% throughout the identical time as traders search greater yields to compensate for inflation and uncertainty. The S&P 500 fell 1.6% that day.

Walmart just lately introduced that it must increase costs to offset tariffs. Walmart’s web working revenue margin is round 3%, and it depends upon stock turnover. They’ve little selection however to lift costs for customers due to the price of tariffs.

The latest GOP price range proposal is estimated to price over $3T over ten years. “New Report: Rising Nationwide Debt Will Trigger Vital Injury to the U.S. Economic system” by the Peter G. Peterson Basis, describes a examine that estimates that the present path of rising nationwide debt will, within the coming a long time, cut back the scale of the economic system, the variety of jobs, non-public funding, and wages. Moody’s grew to become the final of the three main score companies to decrease the score of US authorities debt, citing excessive deficits and rising curiosity prices.

Bonds For Conservative and Aggressive Buckets

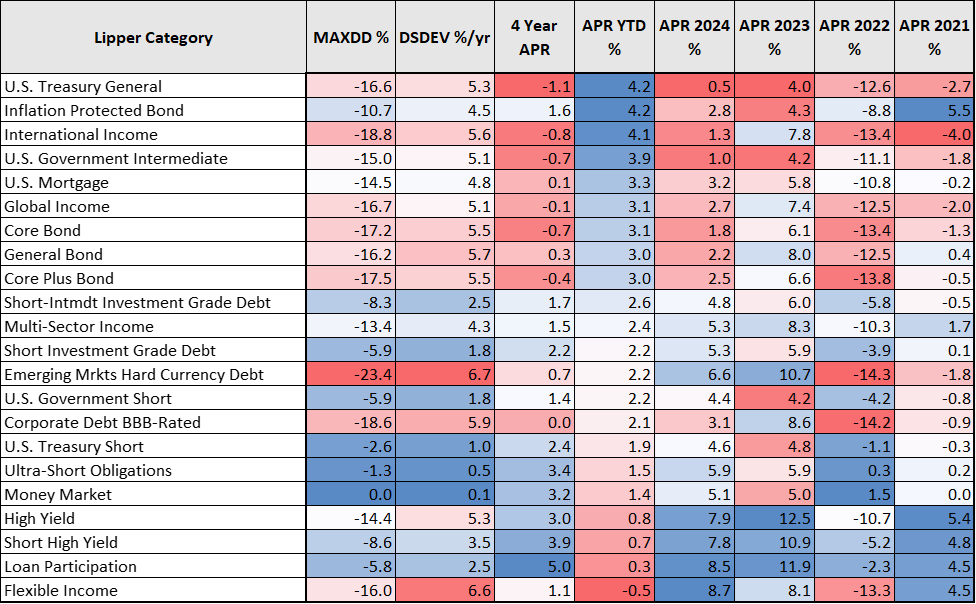

I extracted efficiency information for the previous 5 years of 723 bond and cash market funds utilizing MFO Premium fund screener and Lipper international dataset for all Fund Households loosely excluding these with efficiency scores within the backside quintile, these with lower than $5B in property underneath administration, and people with fewer than 5 bond funds. The outcomes are in Desk #2. The info is color-coded with finest as blue and worst as crimson. The worst-performing bond classes of the previous 4 years grew to become the best-performing of 2025 as of the time of this writing. I count on short-term rates of interest to fall on the finish of the yr and long-term rates of interest to rise, and tilt away from core bonds to these with shorter durations and inflation-protected bonds.

Desk #2: Lipper Bond Class Efficiency by Yr

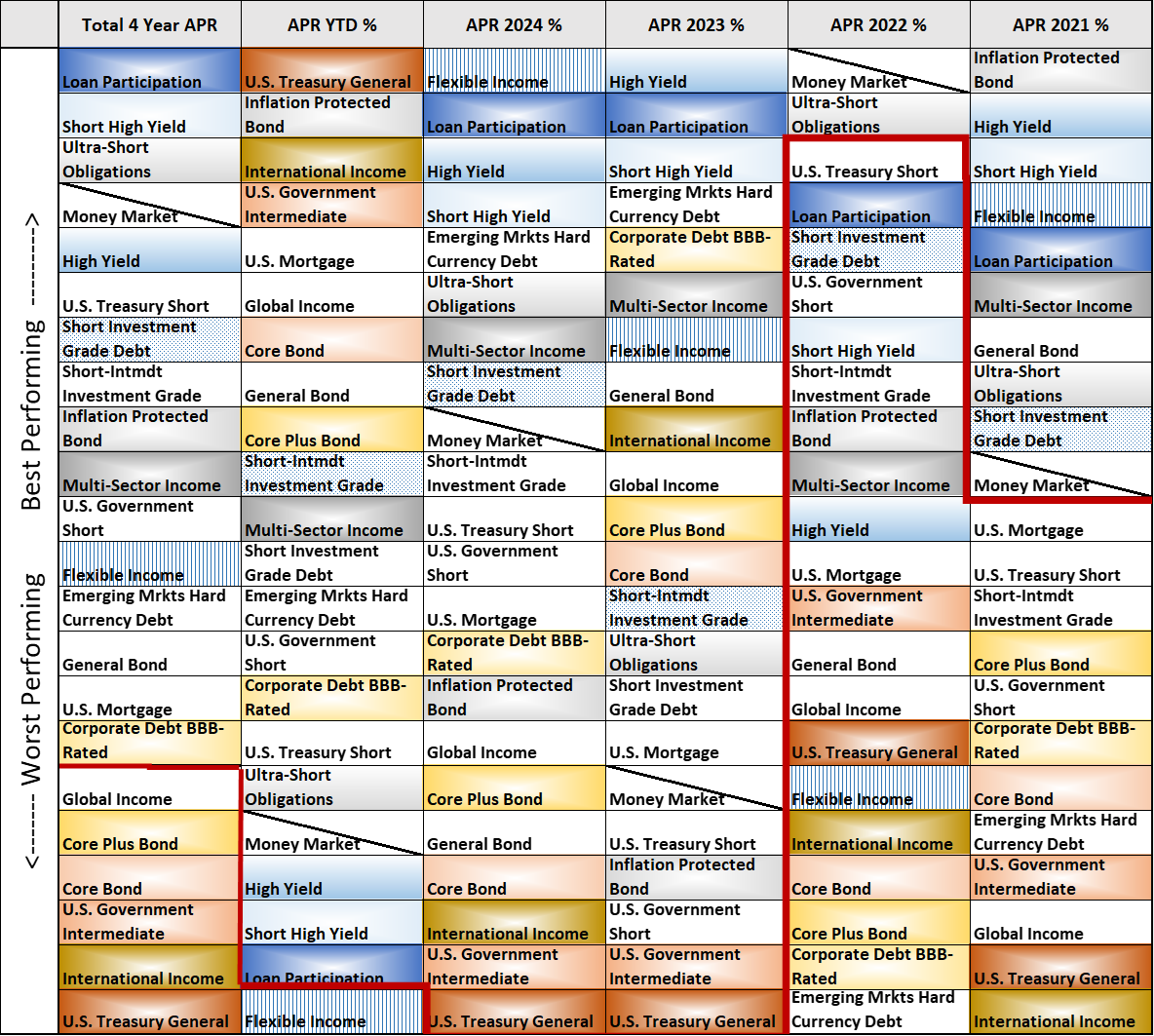

Desk #3 lists the Lipper Classes sorted by the very best returns to the bottom for 2021 to 2025, plus for the previous 4 years. Funds within the Lipper Class under the darkish crimson line had unfavourable returns for the time interval. The blue and grey shaded Classes had been probably the most constant excessive performers and appropriate for a conservative fastened revenue portfolio. These within the reddish and yellowish cells had been much less constant and/or worse performers over the previous 4 years. When inflation is excessive and long-term charges are rising, bonds with longer durations don’t carry out effectively.

Desk #3: Lipper Bond Class Efficiency by Yr

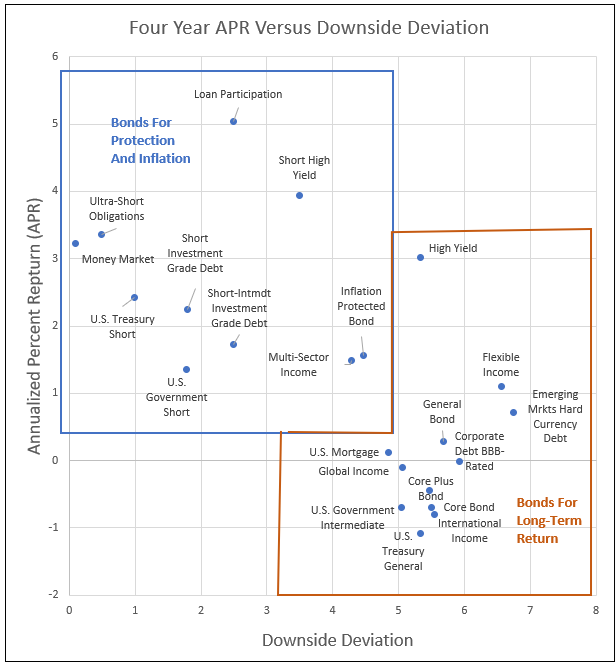

Determine #2 exhibits the Annualized P.c Return (APR) for the previous 4 years versus Draw back Deviation. These within the blue rectangle are the Lipper Classes that I’d put in a conservative intermediate bucket sub-portfolio. These within the orange form are the extra unstable Lipper Classes that could be appropriate for a extra aggressive intermediate bucket sub-portfolio.

Determine #2: Lipper Bond Class APR Versus Draw back Deviation

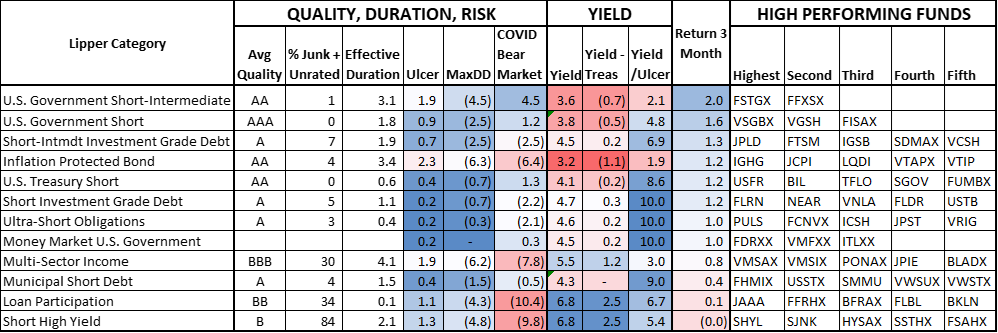

Desk #4 comprises funds within the Lipper Classes for conservative bond portfolios as of mid-Could. Yields for municipal bond funds are adjusted to the tax equal yield for an investor taxed at 22%. Bonds with shorter length and inflation-protected bonds are trending greater.

Desk #4: Writer’s Rating System of Conservative Bond Classes

Goal Allocation (Shares to Bonds)

Now that I’ve been in retirement for 3 years, I’ve a agency deal with on bills and assured revenue, and up to date my lifetime monetary plan. My life expectancy is fifteen years plus or minus, effectively, fifteen years. On the quick finish of that vary, I have to be involved about “Sequence of Return” threat, and on the lengthy finish of the vary, I have to be involved about longevity threat.

To estimate the sensitivity of adjusting my goal inventory to bond allocation, I downloaded the entire blended asset funds with a thirty-year historical past and created a regression trendline evaluating allocation of fairness to the annualized % return (APR) and rolling minimal (worst) three-, five-, and ten-year returns. Desk #5 represents efficiency versus allocation. Altering my inventory to bond allocation goal from 60% to 50% doesn’t have a significant affect on outcomes. The info additionally exhibits that over the worst ten-year interval, returns might not beat inflation.

Desk #5: Estimated Threat Sensitivity to Inventory Allocation – Previous Thirty Years

| % Fairness | APR | Rolling APR Minimal | ||

| 3 Yr | 5 Yr | 10-Yr | ||

| Core Bond | 4.4 | -5.6 | -0.9 | 0.8 |

| 10 | 5.1 | -2.8 | 0.0 | 2.6 |

| 20 | 5.6 | -4.1 | -0.6 | 2.3 |

| 30 | 6.1 | -5.4 | -1.1 | 1.9 |

| 40 | 6.6 | -6.8 | -1.7 | 1.6 |

| 50 | 7.1 | -8.1 | -2.2 | 1.3 |

| 60 | 7.6 | -9.4 | -2.8 | 1.0 |

| 70 | 8.1 | -10.7 | -3.4 | 0.7 |

| 80 | 8.6 | -12.0 | -3.9 | 0.3 |

| Multi-Cap | 9.1 | -18.4 | -7.9 | -2.5 |

Supply: Writer Utilizing MFO Premium fund screener and Lipper international dataset.

“A Lifetime Funding Method in a Single Technique,” by Constancy, describes two necessary ideas about retirement planning, that are age at retirement and present age, which affect the time in retirement that one has to have revenue. For somebody who’s 70 and in retirement for a number of years, the chart estimates {that a} typical investor might need a stock-to-bond ratio between 40% and 50%. A monetary plan and threat tolerance ought to be used to find out the goal allocation to shares and bonds.

Constancy Market Sense supplies a superb abstract of the very best and lowest returns for one- and five-year time intervals over roughly 100 years. My general goal allocation was arrange for “Progress and Earnings,” which is a conventional 60% inventory/40% bond portfolio. The typical return is 8.56% with a minimal (worst) one-year return of -47% and a rolling minimal five-year return of -8.26%. I in contrast this to the “Balanced” goal portfolio, which had a mean long-term annualized return of seven.98% with a rolling minimal one-year return on -40.64%. My life expectancy is way lower than 100 years, so I construct in a margin of security.

I used the Constancy Retirement planner to simulate end-of-plan property and revenue for 25 years for various asset allocations. The Constancy Retirement Planner really useful that I preserve my present allocation of near 60% shares. The chance price of decreasing my goal allocation from 60% to 50% in below-average market circumstances is that the top of plan property might be about 6% decrease. Throughout common market circumstances, the distinction between the 2 portfolios is bigger.

Withdrawal Technique

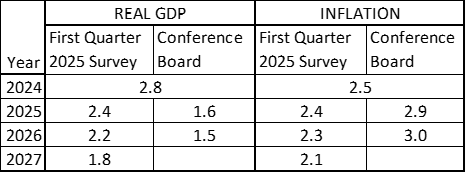

Determine #3 is a comparability of an intermediate time period funding bucket #2 consisting of Conventional IRAs with $1,00,000 in it and a $40,000 annual (4%) withdrawal from 1997 to 2025. The hyperlink to Portfolio Visualizer is supplied right here. The portfolio steadiness and withdrawals are adjusted for inflation. For this train, one-third of the inventory allocation is in worldwide shares.

Discover that the 100% bond portfolio had low drawdowns however didn’t sustain with inflation. Efficiency worsened beginning in 2012, largely as a result of Quantitative Easing and simple financial coverage suppressed yields. Yields are more likely to be greater within the coming decade so as to finance the rising nationwide debt. The 50% inventory/50% bond portfolio stored up with inflation; nevertheless, one has to have the tolerance for the excessive volatility. The 25% inventory/75% bond is a compromise to reduce drawdown however with some progress. Throughout 2022, each shares and bonds did poorly. Versatile withdrawal methods based mostly on market circumstances can enhance outcomes, and within the case of Conventional IRAs with RMDs, withdrawals in extra of spending wants could be reinvested in after-tax accounts.

Determine #3: Portfolio Efficiency Together with Withdrawals Adjusted For Inflation

My Technique

We’re obese in Conventional IRAs. I switched as quickly as ROTH 401ks grew to become out there and made ROTH conversions after retirement. We’re accelerating withdrawals and reinvesting the surplus over spending wants in tax-efficient after-tax accounts so as to cut back long-term taxes and depart an inheritance in a tax-efficient method.

I wish to make the conservative sub-portfolios that I handle final the remainder of our lives. Over the previous yr, I transformed the conservative sub-portfolios that I handle to 100% short-term bonds and bonds ladders and arrange computerized withdrawals from an aggressive managed IRA sub-portfolio to an after-tax account for longer-term objectives. I additionally lowered my general goal allocation for much less draw back threat. As rates of interest rise, I’ll search for alternatives to increase the length in bond ladders.

At Vanguard, withdrawals could also be automated to withdraw from a fund. In managed accounts, Vanguard rebalances when the portfolio is out of its allocation tolerance ranges. At Constancy, withdrawals could be automated for self-managed IRA accounts, and Constancy sells eligible funds to cowl the withdrawal.

I’m contemplating organising a Individually Managed Account sooner or later for short-duration bonds that Constancy manages for a payment of 0.35%–0.40% with a minimal funding of $350,000. I’m taking one small step at a time.

Closing

We’ve got been serving to household and buddies with hospice, shifting to nursing properties, discovering assisted/impartial dwelling amenities, updating wills and sturdy powers of legal professional, and monetary planning. I volunteer over twenty hours every week to repay society for the great alternatives that I’ve skilled in my life and to assist folks in a wide range of circumstances. As a most cancers survivor, I’m conscious that best-laid plans of mice and males might not come to fruition and that plans are nugatory, however planning is indispensable. I seek for sustainable simplicity on this unsure atmosphere.