It was an incredible and horrifying story about two younger boys and the arrival of the Cooger and Darkish Carnival in Inexperienced City, Illinois. For those who entered the carnival grounds late at evening, you may be drawn to its iconic trip, Cooger & Darkish’s Pandemonium Shadow Present. It’s a narrative concerning the methods through which evil could be a highly effective temptation to even the perfect of folks. A number of the traces are maddeningly good.

A stranger is shot on the street, you hardly transfer to assist. But when, half an hour earlier than, you spent simply ten minutes with the guy and knew a little bit about him and his household, you would possibly simply bounce in entrance of his killer and attempt to cease it. Actually realizing is sweet. Not realizing, or refusing to know is unhealthy, or amoral, no less than. You may’t act should you don’t know.

Others half-haunt me.

Oh, what unusual fantastic clocks ladies are. They nest in Time. They make the flesh that holds quick and binds eternity. They dwell contained in the reward, know energy, settle for, and needn’t point out it. Why communicate of time if you end up Time, and form the common moments, as they go, into heat and motion? How males envy and infrequently hate these heat clocks, these wives, who know they may dwell ceaselessly.

Bradbury declared it his most “scrumptious” story.

The title can also be an homage to the witches of Macbeth (Act 4, Scene 1, following “boil and hassle”):

2nd Witch:

By the pricking of my thumbs,

One thing depraved this manner comes. [Knocking]

Open locks,

Whoever knocks!

[Enter Macbeth]

I admit to having been pondering of darkish circuses and evil clowns relatively rather a lot currently. They make it arduous to select up the newspaper most mornings. Chief Justice Warren bought it, too: “I all the time flip to the sports activities part first. The sports activities part information man’s accomplishments; the entrance web page has nothing however man’s failures” (Sports activities Illustrated, July 22, 1968).

For readers of the Mutual Fund Observer, two coming circuses will likely be notably urgent.

The explosion of single-stock and leveraged single-stock ETFs.

Single-stock exchange-traded funds (ETFs) and leveraged single-stock ETFs are comparatively new and sophisticated funding merchandise which have garnered vital consideration from each buyers and researchers. I used to be struck by the utter flood of latest fund registrations within the first weeks of Could, which could sign a July or August. Launch.

In the course of 2024, there have been about 100 such funds globally. The primary within the US appears to have been AXS Tesla and AXS NVIDIA, each launched in 2022. Buying and selling quantity and AUM knowledge are scant. Morningstar did report a doubling within the pool’s AUM within the first quarter of 2024.

What do they do? Basically, they don’t personal the one inventory in query. They personal derivatives tied to the efficiency of the inventory, however they’re typically tied to at some point’s efficiency: if Tesla drops 25% tomorrow, an inverse-leveraged TSLA ETF will drop by 25%, or 50%, or 75% in a day. The extent of the drop relies on the extent of the leverage supplied. The identical is true within the different route.

- Returns are sequence-dependent. TSLA would possibly fall 25% then rise 25% in consecutive days. A TSLA ETF would possibly present a two-day lack of 6.25% as a result of the autumn eroded the share’s worth on day one, decreasing the impression of day two’s rise. A 2x Bull TSLA would present a lack of 25% in the identical two days. A 3X Bull TSLA can be down 56%. The phenomenon is known as “compounding decay resulting from path dependency.”

- The price of the derivatives and administration charges create an enormous drag. Per Morningstar, the typical leveraged single-stock ETF costs 1.07%, about 3 times as a lot as the typical ETF general. These bills imply you by no means get the pure efficiency of the inventory.

Basically, these are toys for speculators. They don’t seem to be funding merchandise. Sadly, buyers fall for advertising and overestimate their very own talents. They suppose they’ll monitor that 3X DraftKings ETF and transfer like a ballerina. Or, frankly, extra possible, like Dumbo.

Basically, tutorial {and professional} analysis attain the identical conclusion. For those who’re knowledgeable with huge monitoring sources and a holding interval of at some point or much less, these are high quality instruments. For those who aren’t knowledgeable and don’t intend to watch hour-by-hour for the remainder of your grownup life, run away.

Morningstar’s take:

Single-stock ETFs can meet the wants of some. Excessive-conviction merchants with a single-day or shorter holding interval could discover them helpful automobiles to precise their views. In any case, it’s arduous for on a regular basis buyers to make use of leverage or assemble their very own coated calls.

However the reality is that these merchandise are not often wise for on a regular basis buyers. They’re flawed, pricey, and liable to take extra from buyers than they offer. (Ryan Jackson, “For Most Traders, Single-Inventory ETFs Are Greatest Left Alone,” Morningstar.com, 4/9/2024)

Which, after all, signifies that we’re being flooded with them. Right here’s a sampling of the 485A prospectus filings that MFO got here throughout throughout simply two weeks in Could 2025:

| GraniteShares 2x Lengthy ABNB Day by day ETF | Airbnb, Inc. |

| GraniteShares 2x Lengthy APP Day by day ETF | AppLovin Company |

| GraniteShares 2x Lengthy BULL Day by day ETF | Webull Company |

| GraniteShares 2x Lengthy CEG Day by day ETF | Constellation Vitality Company |

| GraniteShares 2x Lengthy COST Day by day ETF | Costco Wholesale Company |

| GraniteShares 2x Lengthy CRWV Day by day ETF | CoreWeave, Inc. |

| GraniteShares 2x Lengthy CVNA Day by day ETF | Carvana Co. |

| GraniteShares 2x Lengthy ETOR Day by day ETF | eToro Group Ltd. |

| GraniteShares 2x Lengthy FSLR Day by day ETF | First Photo voltaic, Inc. |

| GraniteShares 2x Lengthy GLXY Day by day ETF | Galaxy Digital Inc. |

| GraniteShares 2x Lengthy HIMS Day by day ETF | Hims & Hers Well being, Inc. |

| GraniteShares 2x Lengthy ISRG Day by day ETF | Intuitive Surgical, Inc. |

| GraniteShares 2x Lengthy KO Day by day ETF | The Coca-Cola Firm |

| GraniteShares 2x Lengthy MCD Day by day ETF | McDonald’s Company |

| GraniteShares 2x Lengthy MELI Day by day ETF | MercadoLibre, Inc. |

| GraniteShares 2x Lengthy NBIS Day by day ETF | Nebius Group N.V. |

| GraniteShares 2x Lengthy NKE Day by day ETF | NIKE, Inc. |

| GraniteShares 2x Lengthy OKLO Day by day ETF | Oklo Inc. |

| GraniteShares 2x Lengthy PM Day by day ETF | Philip Morris Worldwide Inc. |

| GraniteShares 2x Lengthy RGTI Day by day ETF | Rigetti Computing, Inc. |

| GraniteShares 2x Lengthy SBUX Day by day ETF | Starbucks Company |

| GraniteShares 2x Lengthy SNAP Day by day ETF | Snap Inc. |

| GraniteShares 2x Lengthy SPOT Day by day ETF | Spotify Expertise S.A. |

| GraniteShares 2x Lengthy UNH Day by day ETF | UnitedHealth Group Integrated |

| GraniteShares 2x Lengthy WMT Day by day ETF | Walmart Inc. |

| Leverage Shares 2X Lengthy ABNB Day by day ETF | Airbnb, Inc. |

| Leverage Shares 2X Lengthy AFRM Day by day ETF | Affirm Holdings, Inc. |

| Leverage Shares 2X Lengthy BBAI Day by day ETF | BigBear.ai Holdings, Inc. |

| Leverage Shares 2X Lengthy BYDDY Day by day ETF | BYD Firm ADR |

| Leverage Shares 2X Lengthy COST Day by day ETF | Costco Wholesale Company |

| Leverage Shares 2X Lengthy FUTU Day by day ETF | Futu Holdings Restricted |

| Leverage Shares 2X Lengthy GOLD Day by day ETF | Gold |

| Leverage Shares 2X Lengthy HIMS Day by day ETF | Hims & Hers Well being, Inc. |

| Leverage Shares 2X Lengthy JD Day by day ETF | JD.com, Inc. |

| Leverage Shares 2X Lengthy NEM Day by day ETF | Newmont Company |

| Leverage Shares 2X Lengthy OKLO Day by day ETF | Oklo Inc. |

| Leverage Shares 2X Lengthy PDD Day by day ETF | PDD Holdings Inc. |

| Leverage Shares 2X Lengthy RGTI Day by day ETF | Rigetti Computing, Inc. |

| Leverage Shares 2X Lengthy RKLB Day by day ETF | Rocket Lab Company |

| Leverage Shares 2X Lengthy SOUN Day by day ETF | SoundHound AI, Inc. |

| Leverage Shares 2X Lengthy UNH Day by day ETF | UnitedHealth Group Integrated |

| Leverage Shares 2X Lengthy VST Day by day ETF | Vistra Corp. |

| Roundhill 2X Lengthy VIX Futures Factors ETF | Volatility Index |

| Roundhill 2X Quick VIX Futures Factors ETF | Volatility Index |

| Roundhill Lengthy VIX Futures Factors ETF | Volatility Index |

| Roundhill Quick VIX Futures Factors ETF | Volatility Index |

| Tradr 2X Lengthy ASTS Day by day ETF | AST SpaceMobile, Inc. |

| Tradr 2X Lengthy CEG Day by day ETF | Constellation Vitality Company |

| Tradr 2X Lengthy CEP Day by day ETF | Cantor Fairness Companions, Inc. |

| Tradr 2X Lengthy CRWV Day by day ETF | CoreWeave, Inc. |

| Tradr 2X Lengthy DDOG Day by day ETF | Datadog, Inc. |

| Tradr 2X Lengthy GEV Day by day ETF | GE Vernova Inc. |

| Tradr 2X Lengthy ISRG Day by day ETF | Intuitive Surgical, Inc. |

| Tradr 2X Lengthy LRCX Day by day ETF | Lam Analysis Company |

| Tradr 2X Lengthy NET Day by day ETF | Cloudflare, Inc. |

| Tradr 2X Lengthy SMR Day by day ETF | NuScale Energy Company |

| T-REX 2X Lengthy ACHR Day by day Goal ETF | Archer Aviation Inc. |

| T-REX 2X Lengthy AFRM Day by day Goal ETF | Affirm Holdings, Inc. |

| T-REX 2X Lengthy AUR Day by day Goal ETF | Aurora Innovation, Inc. |

| T-REX 2X Lengthy AVAV Day by day Goal ETF | AeroVironment, Inc. |

| T-REX 2X Lengthy AXON Day by day Goal ETF | Axon Enterprise, Inc. |

| T-REX 2X Lengthy BBAI Day by day Goal ETF | BigBear.ai Holdings, Inc. |

| T-REX 2X Lengthy BKNG Day by day Goal ETF | Reserving Holdings Inc. |

| T-REX 2X Lengthy BULL Day by day Goal ETF | Webull Company |

| T-REX 2X Lengthy CEG Day by day Goal ETF | Constellation Vitality Company |

| T-REX 2X Lengthy CRWV Day by day Goal ETF | CoreWeave, Inc. |

| T-REX 2X Lengthy CVNA Day by day Goal ETF | Carvana Co. |

| T-REX 2X Lengthy DDOG Day by day Goal ETF | Datadog, Inc. |

| T-REX 2X Lengthy DKNG Day by day Goal ETF | DraftKings Inc. |

| T-REX 2X Lengthy DNA Day by day Goal ETF | Ginkgo Bioworks Holdings, Inc. |

| T-REX 2X Lengthy DUOL Day by day Goal ETF | Duolingo, Inc. |

| T-REX 2X Lengthy GEV Day by day Goal ETF | GE Vernova Inc. |

| T-REX 2X Lengthy GLXY Day by day Goal ETF | Galaxy Digital Inc. |

| T-REX 2X Lengthy GOLD Day by day Goal ETF | Gold |

| T-REX 2X Lengthy HHH Day by day Goal ETF | Howard Hughes Holdings Inc. |

| T-REX 2X Lengthy KTOS Day by day Goal ETF | Kratos Protection & Safety Options, Inc. |

| T-REX 2X Lengthy OKLO Day by day Goal ETF | Oklo Inc. |

| T-REX 2X Lengthy QUBT Day by day Goal ETF | Quantum Computing Inc. |

| T-REX 2X Lengthy RXRX Day by day Goal ETF | Recursion Prescription drugs, Inc. |

| T-REX 2X Lengthy SMLR Day by day Goal ETF | Semler Scientific, Inc. |

| T-REX 2X Lengthy SMR Day by day Goal ETF | NuScale Energy Company |

| T-REX 2X Lengthy SOUN Day by day Goal ETF | SoundHound AI, Inc. |

| T-REX 2X Lengthy TEM Day by day Goal ETF | Tempus AI, Inc. |

| T-REX 2X Lengthy TTD Day by day Goal ETF | The Commerce Desk, Inc. |

| T-REX 2X Lengthy UPST Day by day Goal ETF | Upstart Holdings, Inc. |

| T-REX 2X Lengthy UPXI Day by day Goal ETF | Upexi, Inc. |

| T-REX 2X Lengthy WGS Day by day Goal ETF | GeneDx Holdings Corp. |

| T-REX 2X Lengthy XXI Day by day Goal ETF | Twenty One |

| Tradr 2X Lengthy SMR Day by day ETF | NuScale Energy Company |

Extra specialised new video games embrace:

- Bitwise Bitcoin Choice Earnings Technique ETF

- Bitwise BITQ Choice Earnings Technique ETF

- Bitwise Ethereum Choice Earnings Technique ETF

- Defiance Enhanced Lengthy Vol ETF

- Defiance Enhanced Quick Vol ETF

- Defiance Vol Carry Hedged ETF

- Tuttle Capital 1x Inverse Volatility ETF

- Tuttle Capital 2x Inverse Volatility ETF

The arrival of cryptocurrency in retirement plan portfolios

On Could 28, 2025, Mr. Trump’s Division of Labor rescinded a 2022 coverage urging “excessive warning” about together with cryptocurrency in retirement plans. The official announcement learn:

The U.S. Division of Labor’s Worker Advantages Safety Administration has rescinded a 2022 compliance launch that beforehand discouraged fiduciaries from together with cryptocurrency choices in 401(ok) retirement plans.

The 2022 steerage directed plan fiduciaries to train “excessive care” earlier than including cryptocurrency to funding menus. This language deviated from the necessities of the Worker Retirement Earnings Safety Act and marked a departure from the division’s traditionally impartial, principled-based method to fiduciary funding choices.

“The Biden administration’s division of labor made a option to put their thumb on the size,” mentioned U.S. Secretary of Labor Lori Chavez-DeRemer. “We’re rolling again this overreach and making it clear that funding choices ought to be made by fiduciaries, not D.C. bureaucrats.”

One would possibly pause on the breathtaking hypocrisy disguised as coverage steerage. If we’re speaking about crypto, beloved by Elon & co., the rule is “funding choices ought to be made by fiduciaries, not D.C. bureaucrats.” If we’re speaking concerning the possibility of socially-responsible investments in the identical accounts, the rule reverses, and the federal government should absolutely make monetary choices relatively than trusting fiduciaries.

It’s a coverage that marries the mendacious with the disastrous, a uncommon accomplishment.

The proposed inclusion of cryptocurrencies in employer retirement plan choices raises vital issues about investor safety, notably given the intense volatility and danger traits these digital belongings exhibit.

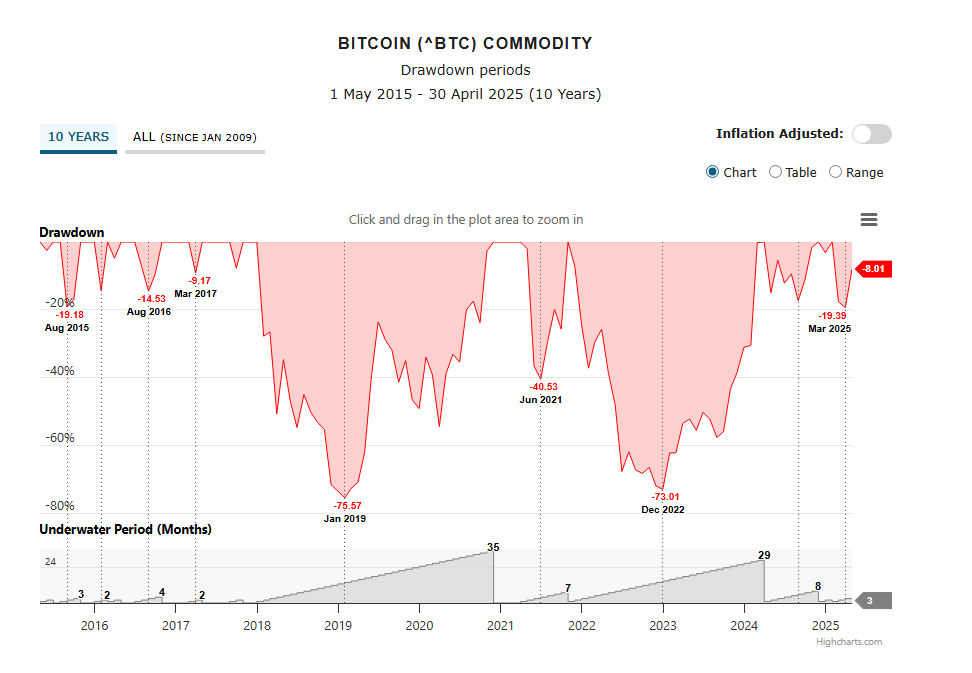

The cryptocurrency market has skilled substantial progress in buying and selling exercise, with the highest exchanges processing trillions in quantity yearly. In line with present market knowledge, there are actually tens of millions of cryptocurrencies in circulation (actually, you could possibly make your individual this afternoon since there are not any laws and no limitations to entry). The full cryptocurrency market capitalization fell 18.6% in Q1 2025 to shut at $2.8 trillion, after briefly touching $3.8 trillion in January. This dramatic swing inside a single quarter exemplifies the kind of volatility that might devastate retirement portfolios, notably for buyers nearing or in retirement who’ve restricted time to recuperate from vital losses. Contemplate, for instance, the drawdown durations for the oldest and most liquid coin, Bitcoin.

Supply: LazyPortfolioETF, utilizing Highcharts graphing.

Bear in mind, that is simply the draw back. There are lunatic value spikes the remainder of the time. The purpose right here is that will help you get a giant image of how deep the knife plunges (the crimson drawdowns) and the way lengthy the wound lasts (the grey “ramps” exhibits months to restoration).

Under are the five-year risk-return metrics for the 2 largest cryptocurrencies, which we assume are the 2 probably to infiltrate a retirement plan.

| Annual Return | Most Drawdown | Commonplace Deviation | Greatest 12 months Return | Worst 12 months Return | Ulcer Index | |

| Bitcoin (BTC) | 51% | -73% | 65.6% | +303% (2020) | -64% (2022) | 36.2 |

| Ethereum (ETH) | 61% | -79% | 91.2% | +420 (2020) | -68% (2022) | ~40 |

Sources: Lazy Portfolio ETF (for Bitcoin), Portfolio Labs ETH-USD, and S&P Ethereum Index

The information reveals a number of alarming traits that underscore the inappropriateness of those investments for retirement accounts. Bitcoin, regardless of being essentially the most established cryptocurrency, has skilled most drawdowns exceeding 70%, which means buyers may lose greater than 70% of their funding. The restoration interval for Bitcoin’s most drawdown required 19 months, throughout which retirement buyers would face sustained and extreme portfolio losses.

Ethereum presents much more excessive danger traits, with a most five-year drawdown of practically 79% (and a near-complete meltdown in 2018) The present Ethereum drawdown stands at 45.29%, that’s, on the finish of Could 2025, an Ether is price 45% lower than it was at its November 2021 peak. For retirement buyers, such sustained durations of considerable losses may show financially catastrophic, notably for these requiring portfolio withdrawals throughout retirement.

The smaller cryptocurrencies are worse.

Retirement buyers require steady, predictable progress that preserves capital whereas producing cheap returns over very long time horizons. The documented most drawdowns approaching 95-96% for main cryptocurrencies signify existential threats to the retirement safety of aged buyers. The intense volatility documented on this evaluation represents not an funding alternative however relatively a basic risk to retirement system stability and particular person monetary safety.

Backside Line

These choices, authorities and company, proceed to maneuver the markets within the route of a on line casino. Traders’ conviction that “endurance is for losers” simply makes them losers. Purchase high quality shares from skilled managers. Diversify away from belongings that depend upon Washington performing like adults. Discover managers who handle volatility thoughtfully. We record them!

What’s an investor to do? Be taught from the expertise of others. While you suspect one thing depraved is round, don’t go alone into the basement with a flickering mild. While you suspect one thing depraved this manner comes, don’t wander away by yourself – away from the safety of associates – “to see what made that noise.”

“Appearing with out realizing takes you proper off the cliff.” ― Ray Bradbury, One thing Depraved This Approach Comes (1962)

An MFO Bonus Function: What Traders Can Be taught from Teen Slasher Flicks!

| How one can Die in a Teen Slasher Flick | How one can Lose All Your Cash |

| Cut up Up – “Let’s cowl extra floor!” (Spoiler: you simply coated your grave.) | Go All-In – “Let’s 3X leverage this!” (Spoiler: you simply leveraged your chapter.) |

| Ignore the Bizarre Native – “He’s simply being dramatic.” (He’s additionally all the time proper.) | Ignore the Boring Professional – “They don’t perceive innovation!” (They do. You simply don’t like what they are saying.) |

| Examine That Noise – “Is somebody there?” (Sure. With a machete.) | Chase the Hype – “Everybody’s speaking about this token!” (Simply earlier than it vanishes.) |

| Drop the Weapon – “Oh, thank god, it’s simply you!” (It’s not.) | Promote the Winner, Maintain the Loser – “It’ll come again finally.” (It received’t. Ever.) |

| Say You’ll Be Proper Again – (You received’t. Ever.) | Say You’ve Acquired a Intestine Feeling – (Your intestine additionally instructed you Taco Bell was a good suggestion.) |

| Belief the Cop – He’s both useless, possessed, or ineffective. Probably all three. | Belief the Finfluencer – She’s not your good friend. She’s your exit liquidity. |

| Go Into the Basement – No exit, no lights, no hope. | YOLO Into Retirement Crypto – No ground, no plan, no future. |