Firm overview

HDB Monetary Companies Ltd is seventh largest main diversified retail-focused non-banking monetary firm (NBFC) in India. Categorized by the RBI as an higher layer NBFC (NBFC-UL), the corporate gives a big portfolio of lending merchandise by three enterprise verticals – Enterprise Lending, Asset Finance and Client Finance. The corporate commenced its operations as a subsidiary of HDFC Financial institution Ltd, the biggest non-public sector financial institution in India. With a consumer base comprised of salaried and self-employed people, in addition to enterprise house owners and entrepreneurs, the corporate primarily caters to underserved and underbanked prospects in low-to middle-income households with minimal or no credit score historical past.

Objects of the supply

- Augmenting firm’s Tier – I capital base to satisfy future capital necessities together with onward lending, arising out enterprise progress.

- Perform a suggestion on the market of fairness shares aggregating Rs.10,000 crore by the promoting shareholders.

- To obtain the good thing about itemizing of fairness shares on inventory exchanges.

Funding Rationale

- Enterprise segments – The corporate operates by three major enterprise verticals: enterprise lending, asset finance, and shopper finance. Enterprise lending, which accounts for 39.3% of complete gross loans, gives secured and unsecured credit score to micro, small, and medium enterprises (MSMEs) to assist their numerous and evolving enterprise wants. Asset finance contributes 38.03% of gross loans and offers secured loans for income-generating property similar to new and used business autos, development tools, and tractors. Client finance, making up 22.66% of gross loans, consists of each secured and unsecured loans for the acquisition of shopper durables, digital and life-style merchandise, two-wheelers, vehicles, and different private loans.

- Quickly rising buyer base – The corporate boasts a quickly increasing buyer base, rating because the second largest and third fastest-growing buyer franchise amongst its NBFC friends, in keeping with a CRISIL report. As of FY25, it has served 19.2 million prospects, reflecting a sturdy CAGR of 25.45% over FY23–25. Buyer focus threat stays low, with the highest 20 prospects accounting for simply 0.34% of the whole gross mortgage e book. The corporate’s goal prospects are the underbanked but bankable inhabitants of India.

- Extensive distribution community – The corporate has constructed a sturdy nationwide footprint, working 1,771 bodily branches throughout greater than 1,170 cities and cities in 31 States and Union Territories. The department community is geographically balanced, with no single area comprising greater than 35% of the whole branches. Notably, over 80% of branches are situated outdoors India’s 20 most populous cities (as per the 2011 census), and greater than 70% are located in Tier 4 and smaller cities. This underscores the corporate’s robust give attention to reaching underserved and underbanked buyer segments throughout India.

- Monetary Efficiency – The corporate reported a complete revenue of Rs.87 billion in FY25 as towards Rs.63 billion in FY23, a progress of 18%. The web curiosity revenue of the corporate in FY25 was Rs.74 billion. The PAT of the corporate in FY25 is Rs.20 billion. The CAGR between FY23-25 of internet curiosity revenue is 17% and PAT is 5%. Between FY23-25, GNPA improved from 2.73% to 2.26%. Nonetheless, NNPA declined from 0.95% for FY23 to 0.99% for FY25. Whole gross loans is at Rs.1,069 billion, a CAGR of 23.54% between FY23-25. Throughout the identical interval, AUM grew at a CAGR of 23.71% to Rs.1.073 billion. The ROA and ROE of the corporate stand at 2.16% and 14.72% respectively in FY25.

Key dangers

- OFS threat – Along with a contemporary challenge, the IPO will see the sale of shares value as much as Rs.10,000 crore by Promoter Promoting Shareholder HDFC Financial institution Ltd.

- Default threat – The danger of non-payment or default by prospects (heightened by the truth that banks cater majorly to economically weaker and low to middle-income segments) could adversely have an effect on the corporate’s enterprise, outcomes of operations and monetary situations.

- Regulatory threat – Any incapability to adjust to the necessities stipulated by RBI might have a fabric antagonistic impact on the corporate’s enterprise.

Outlook

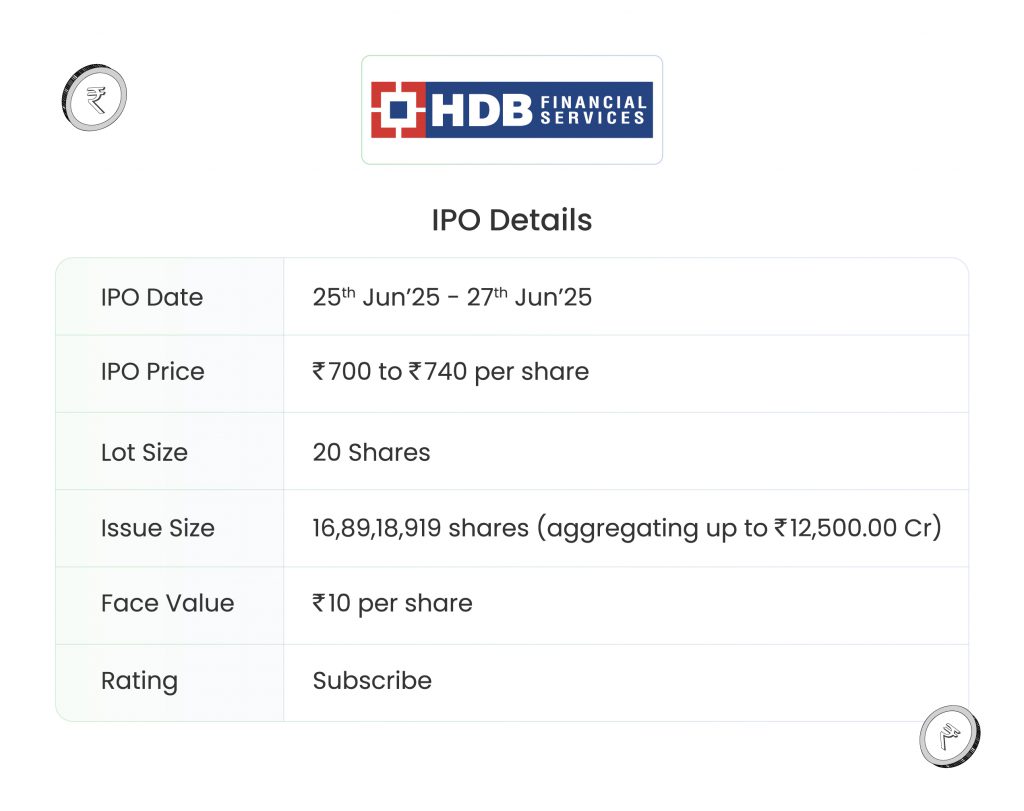

The corporate maintains a secure presence within the low-income financing phase, with constant progress in its buyer base over the reported durations. Its established model and robust guardian backing are anticipated to assist continued progress momentum. Based on RHP, Bajaj Finance Restricted, Sundaram Finance Restricted, Shriram Finance Restricted are few of the listed rivals for HDB Monetary Companies Ltd. The friends are buying and selling at a median P/E of 23.20x with the best P/E of 34.30x and the bottom being 13.00x. On the greater worth band, the itemizing market cap of HDB Monetary Companies shall be round ~Rs.61,388 crore and the corporate is demanding a P/E a number of of 28.21x primarily based on publish challenge diluted FY25 EPS of Rs.26.23. In comparison with its friends, the problem appears to be moderately priced in (pretty valued). Primarily based on the above views, we offer a ‘Subscribe’ score for this IPO for a medium to long-term Holding.

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork rigorously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork rigorously earlier than investing. Registration granted by SEBI, and certification from NISM by no means assure the efficiency of the middleman or present any assurance of returns to buyers.

For extra particulars, please learn the disclaimer.

Different articles you might like

Submit Views:

21