I’m about to share Half 2 of the letter, the place I’ll take you deep into the “inside baseball” of our funding course of. Particularly, I’ll talk about how we construction and decide the place dimension of every inventory in our portfolios – one thing I haven’t lined earlier than (at the least not on this element) and haven’t seen different traders talk about a lot both.

Should you learn my articles primarily for the tales, be happy to skip this one. However if you happen to’re a severe weekend warrior investor, don’t skim – learn this rigorously. This portfolio development framework is essential, as a result of it skews the portfolio towards increased returns per unit of threat, the place threat means everlasting lack of capital. Whereas this is only one module of our funding course of, it’s an exceptionally necessary one.

Inside Baseball: How We Construct Portfolios

An funding course of is a residing organism as a result of it’s utilized by residing creatures. We proceed to enhance it and have made appreciable strides through the years. The largest leap got here in 2016, brought on by a really tough and fairly painful 2015 (I wrote about ache being an important instigator within the “Ache, Opera and Investing” chapter of Soul within the Sport). Then in early 2019, our funding course of took one other vital step ahead by assigning scores to our corporations throughout two dimensions:

- High quality: The best high quality corporations had been graded A, the bottom D

- Valuation: The most affordable corporations had been assigned a 1, the costliest a 4

This will likely not appear like a lot, but it surely helped us quantify our in any other case very qualitative analysis and considerably enhance our portfolio development.

Relatively than resting on our laurels after our latest success, I needed to capitalize on what we had discovered and enhance what we do. In reviewing our positions over time, I found a bias – I didn’t like giving C and D grades. I noticed that the scars from a decade of attending college in Russia and receiving poor grades had been stronger than my rational evaluation of those corporations. (Facet observe: I used to show investing on the College of Denver however stop as a result of I hated giving out unhealthy grades.)

On the one hand, this may not look like an enormous deal; in spite of everything, we solely needed to personal A and B corporations. However the authentic intent of this method was to take the best high quality layer of the worldwide inventory market and section it into 4 helpful classes. My aversion to C and D grades flattened the nuanced qualitative understanding we had developed about these corporations. We wanted a brand new score system that captured these distinctions.

And so we’ve got modified our scores to A, B, B-, and V. Right here’s what these grades imply:

- A: An organization with an unassailable moat, unbelievable administration, flawless stability sheet, excessive return on capital, excessive recurrence of revenues, and a non-cyclical enterprise.

- B: An organization with lots of the traits of an A, however which has a sure flaw. Perhaps its income recurrence could also be decrease, or we don’t have sufficient knowledge to totally consider administration. To be clear, the administration isn’t “unhealthy” – if it had been unhealthy, we merely wouldn’t purchase it. There may be just a few issue about it that makes the corporate decrease in high quality than these we give an A to.

- B-: May very well be an A or B firm in a cyclical, commodity enterprise, positioned in a riskier nation (for instance someplace in Latin America). Or may very well be an A or B non-cyclical firm within the early section of a turnaround. In both case, these corporations face transitional “headwinds” that high quality corporations can work by, making it decrease in high quality than B corporations.

- V: A, B, B- corporations are strong compounders which might be geared toward rising whereas preserving capital. However sure public corporations are early of their company journey and supply substantial asymmetry of returns. In the event that they succeed, they might go up as a lot as 5–20x, but when they fail, losses could also be as excessive as 100% (although within the corporations we’ve checked out, they appear nearer to 30–50%).

These “enterprise” corporations are disruptors, sometimes run by founders who’ve pores and skin within the sport. Most significantly, they’ve a long-term runway for earnings development, with a big market and a big probability of capturing a considerable share of it.

We’re not turning into enterprise capitalists and gained’t have a portfolio of Vs, however we’ve purchased just a few of those over the previous few months – I’ll point out them later within the letter. This shift introduces vital asymmetry to our portfolio on the edges. The core of it can proceed to be A/B/B- shares, whereas Vs carry excessive optionality and hopefully returns.

At present, throughout all purchasers and all methods, we personal 33 shares in our portfolio: 10 A’s, 12 B’s, 8 B-’s, and solely 3 V’s.

As corporations evolve, so do their scores. Ideally, we wish Vs to show into As. That’s the evolution we search for – corporations that mature from disruptive potential into established high quality.

For instance, Microsoft within the early Nineteen Eighties would have been a startup, run by formidable founders who aimed to place a private pc on each desk and in each residence. It was a daring, contrarian imaginative and prescient on the time, but it surely was additionally certainly one of many younger software program corporations chasing a quickly evolving market.

Microsoft graduated to a V score within the late Nineteen Eighties after it gained the DOS wars with IBM and secured its place because the de facto working system supplier. Arguably it grew to become a B- just a few years later: the upside remained substantial, however questions emerged round potential competitors and the sturdiness of its moat.

By the mid-to-late Nineteen Nineties, Microsoft had clearly develop into B after which an A – it had established an unassailable moat in working methods and productiveness software program, generated monumental recurring income, and constructed one of many strongest stability sheets out there.

Our score system is a continuum that captures corporations throughout their total lifecycle as they transfer up the standard spectrum and even down (this occurred to certainly one of our corporations in 2025). As they transfer up, so does our tolerance for rising their place dimension in our portfolio (which I talk about subsequent).

To be clear, C and D corporations haven’t utterly disappeared from our course of; we encounter them continuously throughout analysis, however we simply are usually not all for them.

What constitutes C or D corporations? Easy: they aren’t high quality. I like Warren Buffett’s definition of high quality: if the inventory market was closed for ten years, would I be comfy holding this inventory?

Inventory market liquidity – the flexibility to purchase and promote at any time – typically turns traders into merchants. Buffett’s high quality framework, nonetheless, places us firmly within the seat of an investor. C and D corporations are people who fall into the “not comfy” bucket.

The fantastic thing about our method is that with 10,000 publicly traded corporations globally and maybe solely a thousand or two assembly our high quality standards, we are able to afford to be extraordinarily selective. We don’t must compromise on high quality when there’s such an abundance of alternatives to select from – we solely want to seek out 25 shares.

The Energy of Combining High quality with Valuation

Up up to now we’ve mentioned firm high quality and ignored valuation – what the enterprise is price and the way a lot we should always pay for it.

Our valuation evaluation entails two extremes: smothering the enterprise in our fashions with a pillow (stress testing for when “life occurs” – i.e., declining margins, slowing income development, worsening unit economics) and, simply as importantly, envisioning its full potential. By way of this train, we arrive at a spread of values.

The worst-case state of affairs units our ground. If we expect the corporate is price $50 in a catastrophe and $100 in probably the most possible state of affairs, we don’t wish to pay rather more than $50. That is our margin of security.

Our high quality score system turns into extremely highly effective as soon as it’s married with valuation evaluation. We spend a whole lot of hours researching shares to reach at these two inputs (high quality and honest worth). Right here’s how combining these scores works in apply utilizing a grossly simplified instance (I take advantage of considerably oversimplified numbers right here, however they’re directionally much like what we do in your portfolios).

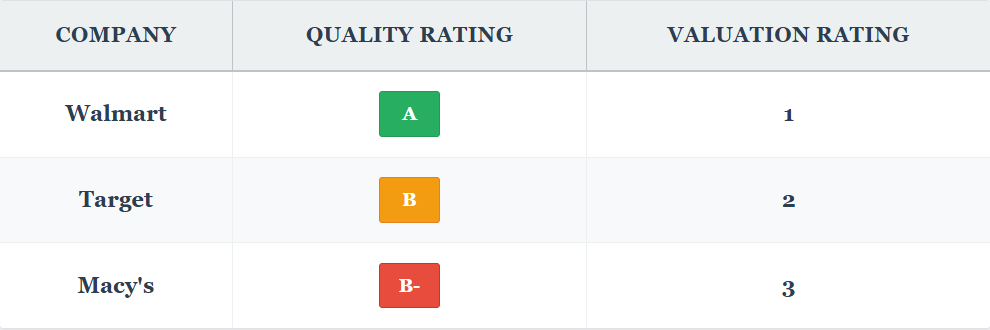

Let’s say we’ve got three corporations, all price $100 in 5 years:

(Between you and me, I’m unsure if Macy’s even deserves a B-, however let’s use it for illustrative functions.)

The sample is evident: the decrease the standard, the larger the low cost we demand. If all three shares traded at $50 right this moment:

Now, V-rated corporations are a unique animal completely. These are our venture-like investments, and we’re betting on explosive return potential. For these, we dimension positions small (1-3%) and search for multiples of return whereas accepting increased threat of loss.

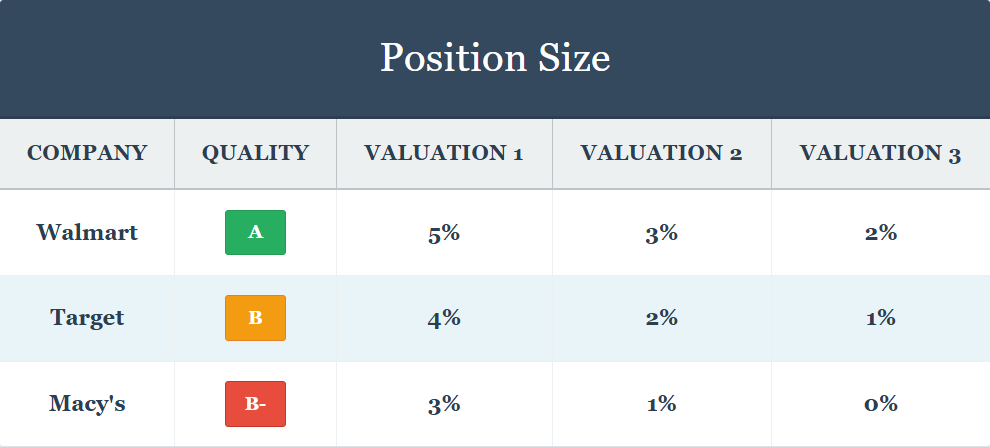

Place Sizing

The standard score and valuation system is a cornerstone of our portfolio development. The upper the standard of the corporate and the extra undervalued it’s, the bigger its place goes to be. This makes excellent sense since increased high quality reduces threat and vital undervaluation results in increased returns.

Why is that this necessary? This method forces high-quality corporations which might be considerably undervalued to rise to the highest whereas limiting our publicity to comparatively low-quality corporations. If “life occurs” to a lower-quality firm, the influence on the portfolio is decrease; nonetheless, if issues work out, we’ll get compensated for taking a better threat.

Equality of outcomes was by no means my factor. I really like meritocracy, and our portfolio is constructed on advantage.

Generally purchasers ask why we hassle with small place sizes. There are numerous eventualities the place this is smart. For instance, we could have began shopping for a B high quality firm when it had a valuation of 1, then the inventory worth went up and it grew to become A3. We should purchase 1% for brand spanking new purchasers.

Moreover, we could have performed analysis on the corporate and at current imagine it deserves a 1% place, however the worth could decline or high quality could enhance – in each circumstances meriting a bigger place dimension. Shopping for even a small place ensures we keep on high of the title.

Let me finish this primary a part of the letter by sharing three remaining ideas about our valuation course of and place sizing.

First, there’s worth within the course of itself – deciding firm high quality creates artistic friction as we debate whether or not an organization is A or B and problem valuation assumptions. Simply doing this makes us higher traders and enriches our understanding of what we personal.

Second, quantifying place sizing removes feelings. It’s accomplished virtually robotically and calculated each day by our methods – the variable that adjustments most just isn’t high quality or honest worth however market worth.

Lastly, as I used to be penning this, I observed just a few areas the place we are able to already enhance – and that is our objective: to not stand nonetheless, however to repeatedly evolve.

I hope this explains portfolio development, particularly for brand spanking new purchasers.

And yet another factor – choices

In accounts with ample money and choices buying and selling permissions, we established a number of small choices positions as hedges.

We bought calls on gold (GLD), making a modest wager that gold costs will rise as forex debasement continues. We additionally purchased places on 20-year treasuries (TLT) to hedge in opposition to potential spikes in long-term rates of interest ensuing from elevated cash provide. Moreover, we acquired places on the S&P 500 to partially hedge our portfolio in opposition to a broader market decline.

None of those investments function a panacea for present world financial circumstances. The core of our returns and our final success or failure will proceed to rely on considerate inventory choice.

Key takeaways

- The funding course of developed from painful classes in 2015 and now makes use of a refined score system of A, B, B-, and V as an alternative of the unique A-D grades, overcoming psychological biases in opposition to giving poor marks that flattened nuanced firm assessments.

- High quality scores seize your entire company lifecycle: A corporations have unassailable moats and unbelievable administration, B corporations have minor flaws, B- face transitional headwinds, and V corporations are early-stage disruptors with 5-20x upside potential however increased threat.

- Place sizing follows a meritocratic system the place increased high quality corporations with better undervaluation obtain bigger allocations, with A1 corporations getting as much as 7% positions whereas lower-quality names are capped at smaller percentages to restrict draw back publicity.

- The valuation course of entails stress testing companies in catastrophe eventualities and envisioning full potential to ascertain a spread, demanding larger reductions for lower-quality corporations and utilizing the worst-case state of affairs because the margin of security ground.

- Portfolio development advantages from quantified artistic friction throughout high quality debates, automated each day place sizing calculations that take away feelings, and selective deal with discovering simply 25 shares from 1000’s of high quality candidates globally, supplemented by small choices hedges on gold, treasuries, and the S&P 500.