At this time (November 27, 2024), the Australian Bureau of Statistics (ABS) launched the most recent – Month-to-month Client Worth Index Indicator – for October 2024, which confirmed that the annual inflation fee was regular at 2.1 per cent and is now on the decrease finish of the RBA’s inflation targetting vary (2 to three per cent). It’s clear that the residual inflationary drivers will not be the results of extra demand however relatively replicate transitory components like climate occasions and abuse of anti-competitive, company energy (journey fares and many others). The overall conclusion is that the worldwide components that drove the inflationary pressures have largely resolved and that the outlook for inflation is for continued decline. There’s additionally proof that the RBA has triggered a number of the persistence within the inflation fee by the affect of the rate of interest hikes on enterprise prices and rental lodging.

The newest month-to-month ABS CPI information exhibits for October 2024 that the annual outcomes are:

- The All teams CPI measure rose 2.1 per cent over the 12 months (regular).

- Meals and non-alcoholic drinks 3.3 per cent (regular).

- Clothes and footwear 0.6 per cent (final month 1.8).

- Housing 0.2 per cent (1.6). Rents (6.7 per cent (6.6).

- Furnishings and family tools 1.6 per cent (0.6).

- Well being 3.9 per cent (4.8).

- Transport -2.8 per cent (-3.8).

- Communications -0.7 per cent (-0.8).

- Recreation and tradition 4.3 per cent (2,4).

- Training 6.3 per cent (6.4).

- Insurance coverage and monetary providers 6.3 per cent (6.1).

The ABS Media Launch (November 27, 2024) – Month-to-month CPI indicator rose 2.1% within the yr to October 2024 – famous that:

The month-to-month Client Worth Index (CPI) indicator rose 2.1 per cent within the 12 months to October 2024 …

… stays the bottom annual inflation since July 2021.

The highest contributors to the annual motion on the group stage have been Meals and non-alcoholic drinks (+3.3 per cent), Recreation and tradition (+4.3 per cent), and Alcohol and tobacco (+6.0 per cent) …

Annual CPI inflation has fallen from 3.8 per cent in June to 2.1 per cent in October due, partially, attributable to vital value falls in Electrical energy and Automotive gasoline …

Housing rose 0.2 per cent within the 12 months to October, down from a 1.6 per cent annual rise to September. The massive fall in electrical energy costs largely offset increased rents and new dwelling costs …

The annual rise in Rents of 6.7 per cent was partly offset by a rise in Commonwealth Lease Help (CRA).

So just a few observations:

1. There is no such thing as a case to be made that inflation stays in peril of accelerating.

2. It’s now on the backside of the RBA’s targetting vary but they refuse to cut back rates of interest, which tells us that their motivation is to push up unemployment relatively than include accelerating inflation.

3. The foremost drivers – vitality and gasoline – are in retreat – as a result of provide components are abating or the federal government is offsetting the value gouging (electrical energy) with subsidies. These actions don’t have anything to do with the financial coverage settings, which implies the RBA actually can not declare its coverage shifts over the previous few years have been the explanation inflation has fallen so rapidly.

4. The on-going lease inflation is partly because of the RBA’s personal fee hikes as landlords in a good housing market simply go on the upper borrowing prices – so the so-called inflation-fighting fee hikes are literally driving inflation.

5. The electrical energy element is considerably decrease after the introduction of the federal and state authorities rebates offsetting the profit-gouging within the vitality sector. Expansionary fiscal coverage will be an efficient software in combatting inflation.

6. The principle drivers of the present inflation scenario will not be delicate to the RBA’s rate of interest modifications.

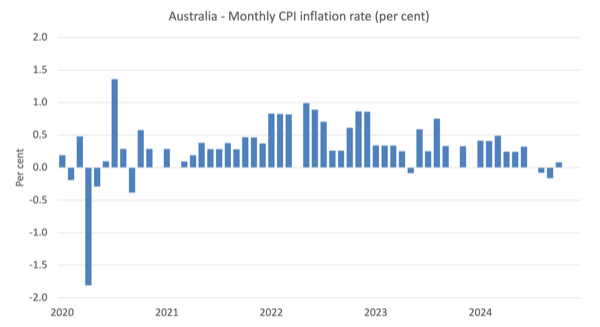

The following graph exhibits the month-to-month fee of inflation which fluctuates consistent with particular occasions or changes (similar to, seasonal pure disasters, annual indexing preparations and many others).

There is no such thing as a trace from this information that the inflation fee is accelerating or wants any particular coverage consideration..

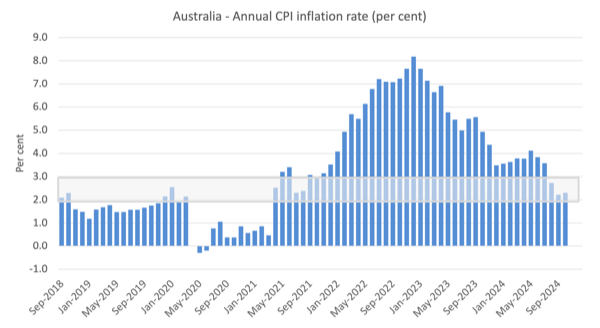

The following graph exhibits the annual motion with the shaded space exhibiting the RBA targetting vary.

Inflation peaked in December 2022 as the availability components pertaining to the pandemic, Ukraine and OPEC began to abate.

The RBA stored mountaineering by 2023 claiming that there was a hazard that wages progress would ‘breakout’ even though the info was exhibiting such progress at file or close to file low charges.

It’s also helpful to notice that previous to the inflationary episode, the RBA largely didn’t maintain the annual inflation fee inside their goal zone, which tells us in regards to the effectiveness of the financial coverage software in relation to its acknowledged goal.

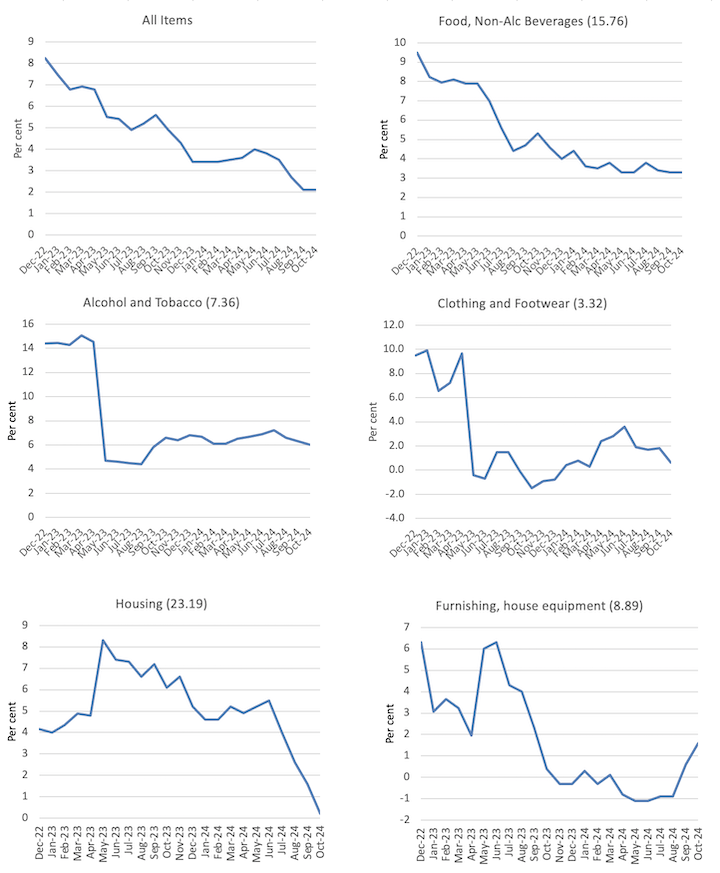

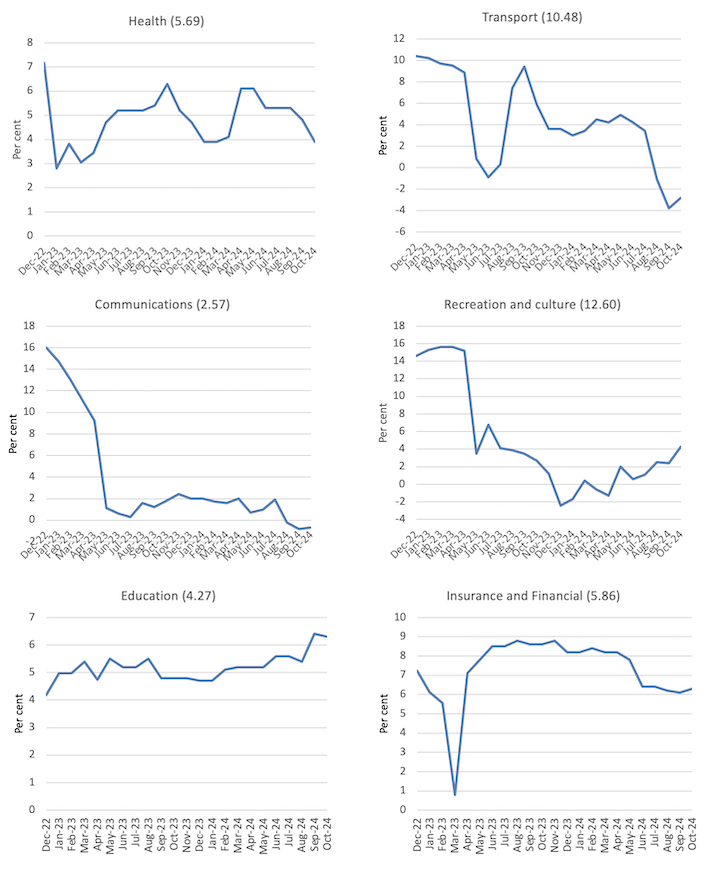

The following graphs present the actions between December 2022 and October 2024 for the principle elements of the All Gadgets CPI (the decimal numberfifi subsequent to the element title is the load of that element within the total CPI the place the sum is 100).

Normally, most elements are seeing dramatic reductions in value rises as famous above and the exceptions don’t present the RBA with any justification for additional rate of interest rises.

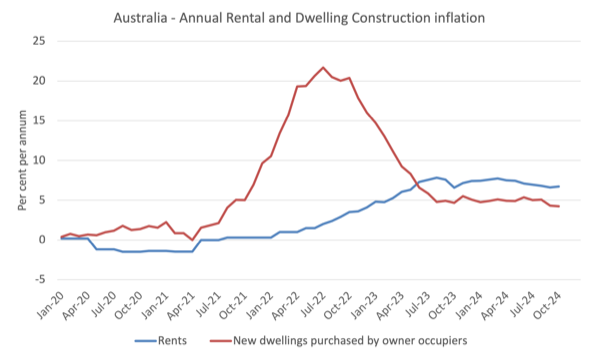

The following graph exhibits the actions within the housing element (with rents separated out from the brand new dwelling buy by owner-occupiers.

The lease element has risen nearly in sync with the RBA rate of interest hikes and now the speed hikes have ended (for now), the lease inflation has levelled off.

The development prices for brand new dwellings have been in retreat since early 2022 as the availability constraints arising from pure disasters (fireplace burning down forests), the pandemic (constructing provide disruptions), and the Ukraine scenario have eased.

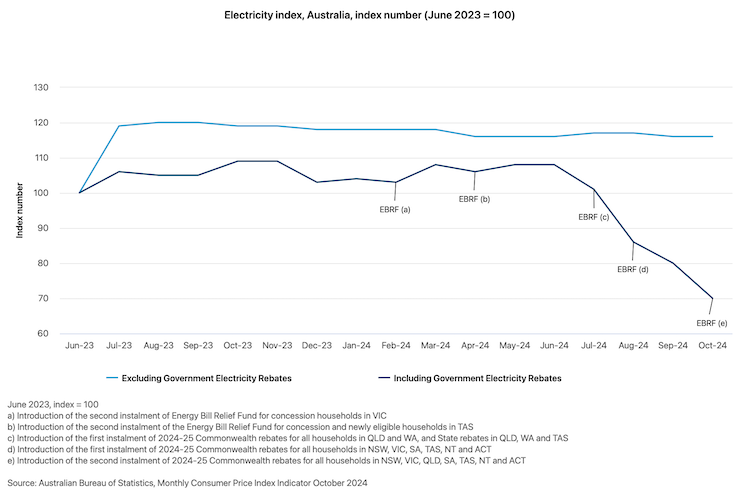

The ABS additionally revealed an attention-grabbing graph, which compares the electrical energy costs underneath the Federal authorities’s – Power Invoice Reduction Fund – rebates which have been launched in July 2023 and what they’d have been within the absence of that fiscal intervention.

The Reduction Fund offered subsidies to households and small companies relying on the locality.

The ABS report that:

The EBRF rebates have been first launched in July 2023 and have been prolonged and expanded to all households in July 2024. These rebates have had the impact of lowering electrical energy prices for households. Together with authorities electrical energy rebates, electrical energy prices for households have fallen by 30.2% since June 2023. Excluding these rebates, electrical energy prices for households would have elevated 16.1% since June 2023.

Right here is the affect of that straightforward and really modest scheme.

It demonstrates that targetted expansionary fiscal coverage can certainly be anti-inflationary, which signifies that the spending-inflation nexus isn’t easy because the mainstream narratives might need you imagine.

This was the strategy the Japanese authorities took to rapidly include the cost-of-living will increase for households.

It really works.

Austerity just isn’t required when the inflation is sourced from the supply-side because it was in 2021 and 2022.

Migration from Twitter to Bluesky

As I famous final week, I’m quitting Twitter and am now utilizing Bluesky to submit details about my work.

My Bluesky handle is: @williammitchell.bsky.social

That needs to be straightforward to search out.

I now have 20.5 thousand individuals following my Twitter posts and I respect the curiosity all of you could have in my work.

I hope you’ll observe me on Bluesky as my Twitter account evaporates (at this time).

There are some sources accessible that assist individuals migrate and discover their pals (Due to Liz for the following pointers):

1. https://www.theverge.com/24295933/bluesky-social-network-custom-how-to

2. https://chromewebstore.google.com/element/sky-follower-bridge/behhbpbpmailcnfbjagknjngnfdojpko

3. https://www.youtube.com/watch?v=m_V2PiMgs4c

So please come throughout and proceed to observe my work on Bluesky.

Music – Jimi Hendrix

That is what I’ve been listening to whereas working this morning.

I think about two guitarists to be a stage above the remainder – Peter Inexperienced – and – Jimi Hendrix.

This monitor was recorded on October 11, 1968 on the well-known – Winterland Ballroom – in San Francisco, when Jimi Hendrix was on the top of his powers.

It was launched in 1992 as one among three bonus tracks on the – Dwell at Winterland – album.

The unique 13-song album got here out in 1987.

Here’s a model of the tune – Like a Rolling Stone – written by – Bob Dylan – that redefines creativity and sonic brilliance.

That’s sufficient for at this time!

(c) Copyright 2024 William Mitchell. All Rights Reserved.