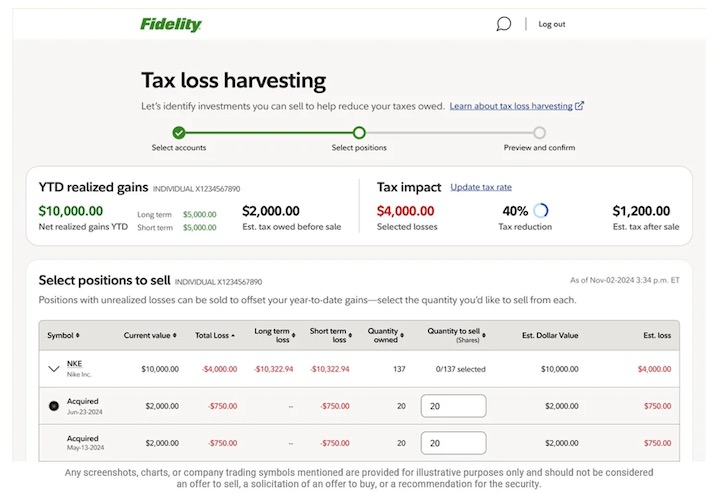

Constancy has quite a few helpful Instruments & Calculators, most of that are open to everybody to make use of. Nonetheless, their Tax-Loss Harvesting Instrument (login required) is supposed for Constancy taxable brokerage clients, as it’s primarily based in your private knowledge and exhibits the scale of your anticipated capital positive aspects this 12 months, whereas additionally serving to you establish capital losses you could “harvest” in case you needed.

You’ll want to supply your marginal tax charges (make an estimate with present brackets right here). The instrument may even provide help to place the (market) order to promote these shares with only a couple clicks.

This Constancy article The best way to cut back funding taxes incorporates plenty of particulars on the observe of tax-loss harvesting:

An funding loss can be utilized for two various things:

– The losses can be utilized to offset funding positive aspects.

– Remaining losses can offset $3,000 of revenue on a tax return in a single 12 months. (For married people submitting individually, the deduction is $1,500.)[…] There are 2 varieties of positive aspects and losses: short-term and long-term.

– Quick-term capital positive aspects and losses are these realized from the sale of investments that you’ve got owned for one 12 months or much less.

– Lengthy-term capital positive aspects and losses are realized after promoting investments held longer than one 12 months.

The important thing distinction between short- and long-term positive aspects is the speed at which they’re taxed.Quick-term capital positive aspects are taxed at your marginal tax fee as abnormal revenue. The highest marginal federal tax fee on abnormal revenue is 37%.

Wash sale warning: The instrument can’t cross-reference all of your different non-Constancy trades, and in addition doesn’t even account to your Constancy trades inside tax-deferred accounts. If a wash sale happens, your loss shall be disallowed. Right here’s the warning supplied:

Wash sale warning: Estimated financial savings primarily based on tax-loss harvesting assumes that you’ll not have a wash sale that will defer your tax loss.

Should you promote shares at a loss and you buy extra shares of the identical or a considerably an identical safety (in the identical or a unique account) throughout the 61-day interval that begins 30 days earlier than and ends 30 days after the commerce date of the sale, the acquisition might end in a wash sale. If a wash sale happens, the loss from the transaction shall be “disallowed” for tax functions, and the quantity of the loss shall be added to the price foundation of your shares in the identical safety. Constancy adjusts value foundation info associated to shares in the identical safety when a wash sale happens inside an account as the results of an an identical safety buy.

You could test your individual data throughout all your Constancy and non-Constancy accounts to make sure that you’re appropriately accounting for losses associated to any wash gross sales.

ETFs are sometimes the simplest strategy to harvest a tax loss. Even in case you buy-and-hold ETFs, take into account ETF tax-loss harvesting (my submit from 2008?!) as you possibly can harvest the loss from the sale of an ETF, after which instantly purchase an analogous however not “considerably an identical” ETF with out triggering a wash sale. This has turn into frequent trade observe. There’s a Constancy article on this too.

When evaluating your ETFs towards the wash-sale rule, examine the issuer, index, and underlying holdings between the 2 ETFs being swapped. The extra dissimilar these are, the extra probably it’s that you just received’t set off a wash sale.

Even Vanguard does ETF tax-loss harvesting of their advisory companies utilizing “surrogate ETFs”.

Surrogate funds are the ETFs (alternate?traded funds) Vanguard Private Advisor makes use of toreplace investments bought to reap losses. They’re Vanguard ETFs® with related asset and sub?asset allocations to the funds we’re changing.

There is probably not as many alternatives to reap a tax loss this 12 months since most issues are up (an excellent factor!), however one thing to bear in mind down the highway.

The standard disclaimer: I don’t present authorized or tax recommendation. The knowledge herein is common and academic in nature and shouldn’t be thought of authorized or tax recommendation.