Michael Burry, of “Large Quick” fame, just lately shut down his hedge fund and began a Substack with an academic objective. I take pleasure in following his musings as a result of he’s not afraid to say what he thinks, even when I typically don’t agree (or have any thought what he’s obliquely referring to). He just lately posted a “foundational” article that’s supposed to point out his pondering course of, with a well-known starting:

For these that don’t belief something analog, since 1990, there have been over 750 replacements within the S&P 500 Index. Google’s Gemini 3 Professional swears by it. Claude Max agrees.

Gemini 3 Professional and Claude Max additional suggest that 45% of the highest 20 names within the 1999 NASDAQ 100 ended up bankrupt or acquired after a >75% loss. This checks out, my convention room says.

Capital is all the time combating to be recycled.

Thusly, you now carry the information that almost all buyers are finest off in an index – and don’t have any must spend money on particular person shares.

If one is quite younger and has 50-70 years left, then one completely ought to be nearly solely invested in frequent inventory indices, ideally the S&P 500 or the Nasdaq 100 or each. Reside life, contact grass, obtain actual issues, mechanically reinvest dividends, and let the compounding of the Index Gods do the work. Possibly not this very day, however over time, that is the best way for many.

After all, a few of us simply do…not…need…straightforward.

For them, effectively, their God gave them GameStop.

He then goes very deep into how he analyzed GameStop and thru ability and smarts, in fact made some good returns on the commerce.

That is the central humblebrag {of professional} buyers. *You* ought to index, however right here’s what *I* do as an alternative. In case you are a motivated one that research investing with an trustworthy and open thoughts, you understand that you simply most likely shouldn’t actually be actively buying and selling. However in case you are a motivated one that research investing, you most likely assume you’re within the tiny minority that may earn a living reliably with actively buying and selling. Sensible sufficient to show off “straightforward” mode.

That is the central wrestle for all particular person buyers. The issue with “straightforward” is that additionally it is boring and sometimes sluggish. In the meantime, your Robinhood app or equal will fortunately promote you:

- Crypto, together with memecoins which have zero utility.

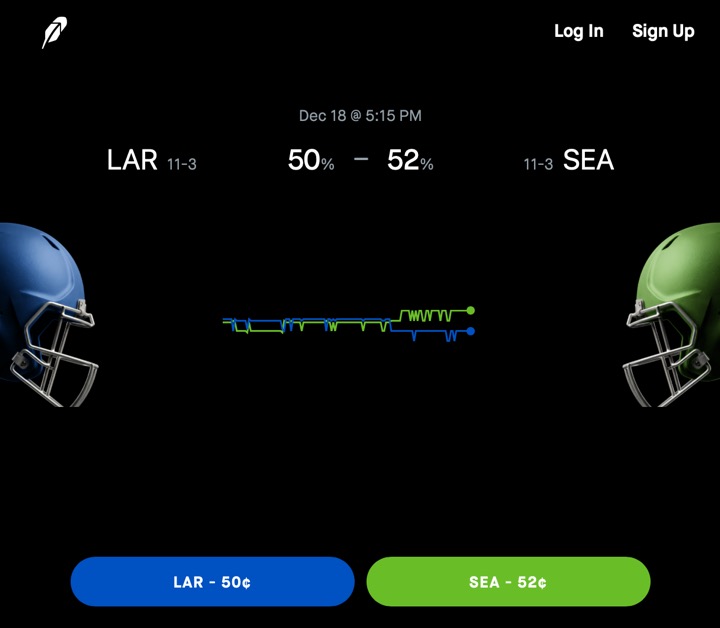

- Playing, err “Prediction markets” on this weekend’s NFL recreation.

- “Dividend” ETFs with a loopy 12% yield that some assume will final perpetually.

- Aggressive choices that may lose all of your cash inside days.

- “Boomer sweet” ETFs that promise stock-like upside with zero draw back.

- Index “Plus”. Index with additional ketchup. Index minus the ketchup. Simply 25 foundation factors additional!

I spend a whole lot of my very own time doing simply this – studying throughout varied corners within the investing world however repeatedly convincing myself to choose “straightforward”. I’ll learn this text and luxuriate in it (replace: it seems to have gone from free to behind a paywall since this writing), however I don’t want to investigate GameStop.