Disclaimer: This isn’t Funding recommendation. PLEASE DO YOU OWN RESEARCH:

Administration abstract (Spoiler):

After promoting Biontechs just a few years in the past, I reviewed Biontech as soon as once more through the use of LLMs to judge the event pipeline. Though this was a particularly fascinating train, it isn’t an funding for me in the interim.

Background:

Biontech is an organization I’ve owned prior to now and written about. It grew to become well-known as a result of they have been the primary to develop a MRNA based mostly vaccine in opposition to Covid which they offered worldwide along with Pfizer.

My preliminary write-up could be discovered right here, a observe up right here.

Particularly the observe up evaluation was clearly too optimistic with regard to the final vaccine market. I finally offered the remainder of the place for ~77 EUR/share in 2024 however total it was very worthwhile. My aim was to proceed to observe the corporate as it’s clearly one of the crucial progressive German corporations.

Only in the near past, Profitlich & Schmidlin devoted a current submit to Biontech which triggered this evaluation. They’d written prior to now about Biontech, as an illustration in January 2025.

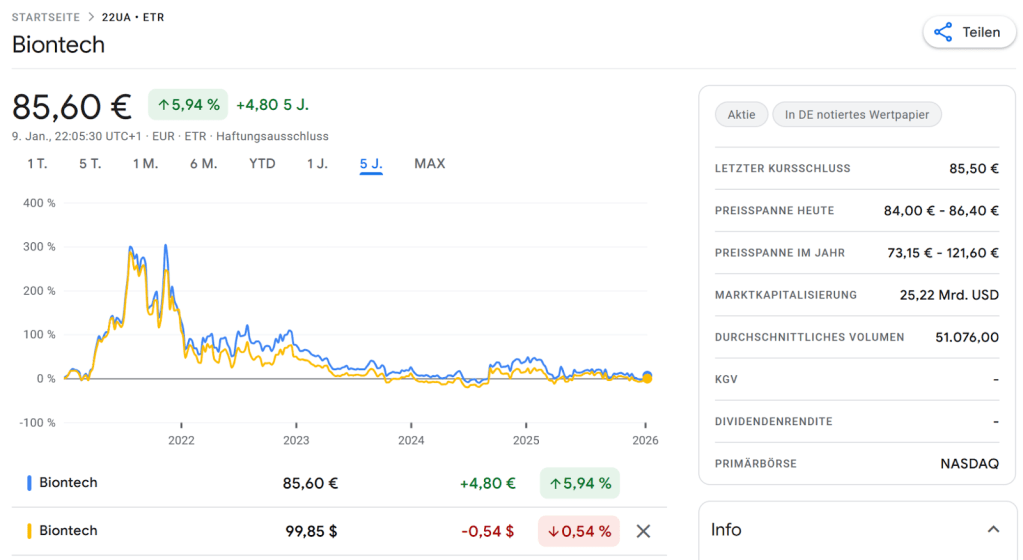

Earlier than diving into the basics, let’s look shortly on the inventory chart: The share worth in of Biontech has flatlined in USD and EUR.

Curiously, Biontech is now again to the place it was earlier than the Covid hype and valued at 25 bn USD or ~22 bn EUR..

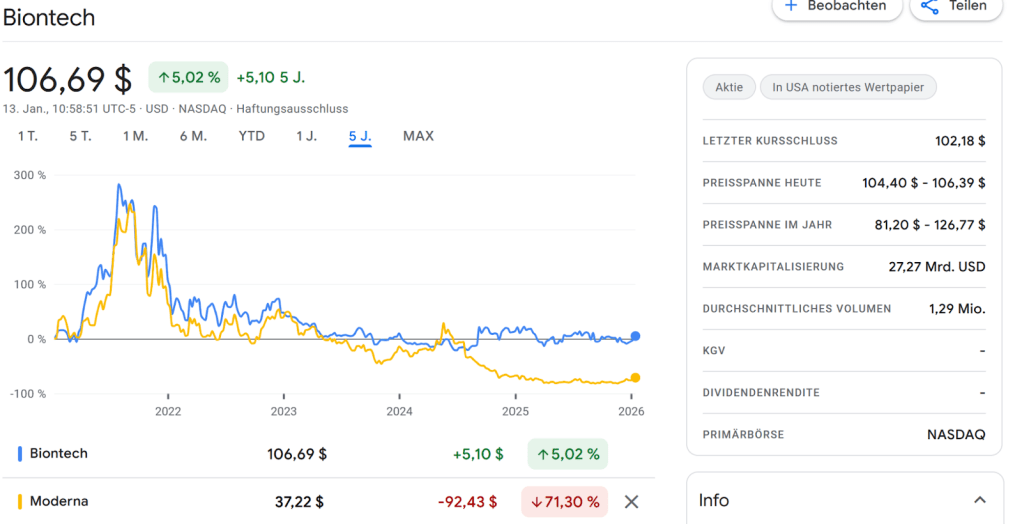

this positively, the inventory has executed loads higher than Moderna over the previous 5 years:

To my understanding, Moderna had targeted roughly absolutely on vaccines and spent aggressively which underneath the present “ anti vaxxer” regime of RFK jr was not a ery good technique.

Biontech in distinction appears to have “diversified” a lot better. The blockbuster Deal of “BNT327” with Bristol Myers as an illustration just isn’t a MRNA based mostly expertise. This BNT327 had been licensed by Biontech solely 6 months earlier from a Chinese language firm at a fraction of the worth they are going to get from Bristol Myers.

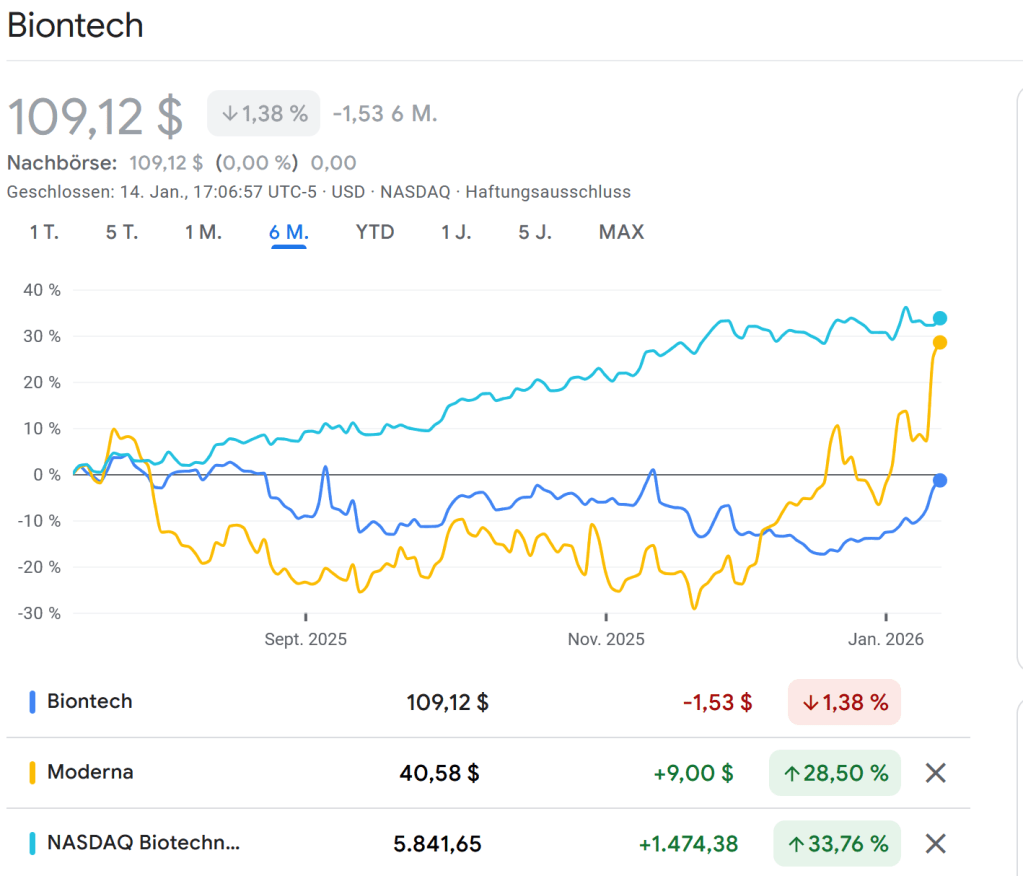

One other fascinating commentary is that Biotech up to now didn’t take part a lot within the current restoration within the Biotech indices as we are able to see on this 6M chart:

Even Moderna did take part in the previous few days however not Biontech.

Perhaps that’s the rationale why even “trendsurfer” Ritchie Dobensberger has them in his Wikifolio as a smaller place.

Again to Biontech

Strategically Biontech appears to be fairly versatile and nimble to go for alternatives exterior its core MRNA expertise which was the premise of the Covid Vaccine.

The acquisition of the Chinese language Startup Biotheseus as an illustration appeared to have been an actual coup. Purchased for 800 mn USD in November 2024, solely 6 months later, they landed a giant take care of Bristol Myers for precisely that one drug which is now known as BNT327, giving them 2 bn USD upfront funds plus a 50% royalty share

This deal apart, for the remainder of the corporate it’s for somebody like me very difficult to grasp what is admittedly happening and particularly methods to worth the corporate.

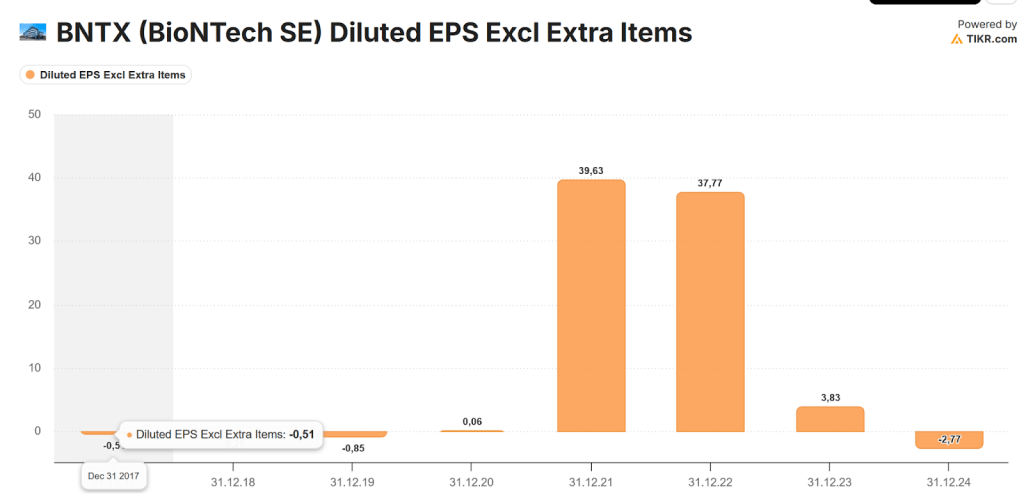

Wanting on the EPS since IPO tells us that the Covid Vaccine led to 2 nice years however that is clearly no indication what will occur sooner or later:

So in Biotech’s case, the valuation must be a mix of utilizing the present Web money plus an assumption on how a lot the pipeline of tasks is value.

the latest presentation from just a few days in the past, I’ve little or no concept which of these tasks has what sort of likelihood of success.

Financials

So let’s shortly have a look at the financialsl. At yr finish 2025, Biontech had round 17 bn EUR in Money or securities in opposition to a Market cap of twenty-two bn EUR. To my understanding, this contains already the 1,25 bn EUR money out for the Curevac acquisition which in itself was an fascinating transaction.

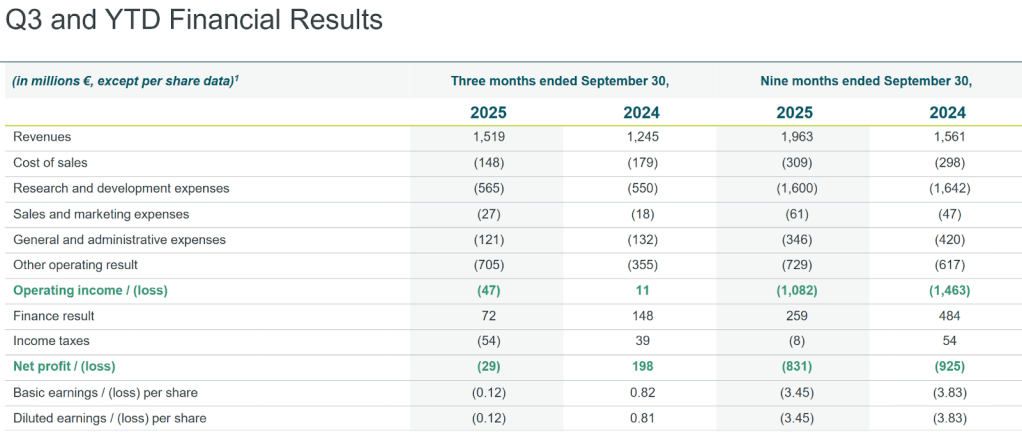

A fast have a look at Q3 numbers and the presentation exhibits that the corporate is GAAP loss making, though 2025 YTD loss is smaller than 2024:

On the plus aspect, operationally they appear to have been money move optimistic in 2025, largely because of the funds for BNT 327 and the remaining Covid vaccine gross sales.

That is fairly an achievement for a Biotech firm and Biontech indicated that 2026 will look roughly the identical with barely decrease vaccine gross sales.

Perhaps a guess on the Jockey ?

In my earlier posts I discussed that I think about Biontechs Administration, Ugur Shain and his spouse as absolute prime notch scientists and entrepreneurs, which up to now they clearly have confirmed.

So one may simplify the evaluation and say: At a 5 bn valuation ex money, this could possibly be a comparatively straightforward guess within the Jockey(s).

Alternatively, the Moderna CEO and founder appeared like a genius for a while till he didn’t.

My preliminary (human) Abstract: Too arduous pile

One way or the other I’m actually tempted to do a “commerce” right here: Biontech seems to be low-cost, is lagging the Biotech indices considerably and has some good successes plus superb administration.

Alternatively, I don’t know methods to worth this firm which is in fact not an excellent factor for a “worth investor”.

So usually I might put them proper on the “too arduous” pile.

AI enters the room: Gemini & ChatGPT Deep analysis

I requested Gemini Deep Analysis to have a look at the newest Biontech presentation and analyse the pipeline with regard to gross sales potential, likelihood of success and time to market.

Gemini gave me an in depth report and with out being explicitly requested for got here to the next conclusion:

Valuation Outlook: Our detailed modeling of scientific belongings means that the risk-adjusted Web Current Worth (rNPV) of the oncology pipeline underestimates present market sentiment, which remains to be closely influenced by declining COVID revenues. We forecast the start of a brand new income period beginning in 2026/2027 pushed by preliminary oncology launches, resulting in a diversified income stream by 2030 that considerably reduces reliance on infectious illnesses.

I ask myself now what do I do with it ?

One apparent factor to do is to let ChatGPT Deep analysis analyse Gemini’s outcomes critically. That’s what I did. i additionally requested ChatGPT to place a price on Biotech’s Pipeline.

ChatGPT principally agreed with Gemini (I assume each are skilled on the identical information) and gave me this conclusion:

Conclusion (Early 2026)

BioNTech has transitioned from a pure COVID vaccine firm to a diversified oncology participant. Based mostly on rNPV evaluation, the inventory seems undervalued. Even conservative assumptions indicate honest worth above present market capitalization. Vital dangers stay (competitors, regulatory hurdles, manufacturing complexity), however BioNTech’s €17.2bn money place supplies a considerable security buffer. The market at the moment costs the pipeline near a bear situation, creating significant upside if upcoming Part 3 readouts are optimistic.

With regard to the worth of the pipeline ChatGPT will get the next outcomes:

Danger-Adjusted Pipeline Valuation (rNPV) and Eventualities

- Base case: Oncology pipeline rNPV ~€7–8bn → whole fairness worth incl. money ~€24–25bn

- Bull case: rNPV ~€14–15bn → whole ~€32bn

- Bear case: rNPV ~€2–3bn → worth largely equals money (~€19–20bn)

Operating these two analyses solely took me like half-hour, together with wait time. I assume if I might have tried to do this myself with Google Search, it may need taken me a 100x in actual time.

The ChatGPT Cross verify is sort of straightforward to learn and features out what assumptions are made which I discover tremendous fascinating. I nonetheless can’t absolutely decide if that is any good but it surely all sounds fairly believable.

Only for Enjoyable, I requested ChatGPT to do a Deep Dive into BNT 327. It gave me a really detailed evaluation of the anticipated timeline, points and competitors. Together with the Bristol Myers Deal, it gave me an approx. NPV of round 8 bn which is roughly 50% of the worth of the general pipeline within the Bull case.

So what to do now ?

The query now could be: Do I belief the outcomes ? And even when I do, is it a sexy investments given the inherent dangers in Biotech ?

Leaving the pipeline apart, the next factors converse for Biontech:

- run by very succesful administration

- efficiently broadened their providing / Expertise from the preliminary MRNA

- achieved a possible “blockbuster deal” with BNT 327

- Working cashflow optimistic

- didn’t take part within the current Biotech rally

On the minus aspect we now have:

- extra complexity because of the Curevac take-over

- legislation fits (from Moderna)

- Covid vaccine enterprise shrinking

- chaos/uncertainty within the US, each on the regulatory aspect but in addition with regard to future pricing (Because of “MAHA”)

- total growing competitors from China. It’s questionable if a deal like BNT 327 could possibly be repeated.

Eventualities:

Let’s park the LLM query for a second and have a look at an Upside and draw back situation for the following 12 months..

Let’s assume that the ~17 bn EUR money or 72 EUR per share will stay fixed. Then I might argue that the decrease certain for the share worth must be possibly the lows from 2024 at round 80 EUR per share as they now have a minimum of the potential BNT 327 Blockbuster together with the two bn cost from Bristol Myers. This could be the Money plus the residual worth of vaccine gross sales.

From the present share worth of round 92 EUR, this might be a draw back of ~13%.

For an upside situation one may both assume that Biontech closes the hole with Moderna and the Biotech index over the previous months which might be +30%.

Or I may additionally assume that the market attributes 100% of the Pipeline worth on prime of the money which might be 17 bn plus 15 bn= 144 EU per share or an upside of 45%

If I common the 2 upside instances and assume a easy 50/50 likelihood for each, the draw back and (common) upside situation, I get an anticipated return of ~16%. Not nice however not that unhealthy both, relying on the estimated time-frame.

The problem for me right here is clearly that we don’t have a clearly outlined time scale.

For a typical particular scenario funding, I would wish eventualities that I can assign chances to in addition to an excellent understanding till when this eventualities could be realized.

In Biotech’s Case, I’m not 100% certain how the timeline seems to be like which makes it very tough for me to “qualify” this as a particular scenario.

One may argue that possibly the timeline for BNT 327 could possibly be the set off.

Why Biontech won’t be so enticing for conventional Biotech buyers

Historically, Biotech investments are characterised by numerous “duds” and a small variety of spectacular outperformers. In Biontech’s case, the difficulty is that even when BNT 327 will develop into a blockbuster, you received’t get a 10x return, as the corporate sits on 17 bn in Money which is a part of the valuation.

Abstract:

For me, the abstract could be structured into 2 foremost take-aways:

- Biontech in the meanwhile just isn’t an funding for me. It’s not a transparent Particular scenario, neither is it the “regular Eddy” firm that I choose exterior particular conditions. Sure, it has nice administration, a good observe document and the draw back appears to be protected, however it isn’t a match for what I’m in search of.

- With regard to the capabilities of the LLMs, I used to be fairly impressed by what the fashions can ship. It could be fascinating to listen to from specialists on how they understand the standard of the evaluation, however my intestine feeling is that these outcomes are possibly 70-80% of what an actual specialist may do.

I discover it actually fascinating you can get to this stage through the use of LLMs. And clearly an extra argument that LLms may help to widen the circle of competence in a a lot shorter time period than within the previous days.

P.S.: Prior to now, I may need not written about such an evaluation if it doesn’t result in an funding. As I now have extra time, I may even publish efforts that don’t result in an funding.

I hope that that is nonetheless fascinating for readers. For me it is usually a instrument to higher observe “second order” errors that I make once I don’t put money into a doubtlessly fascinating inventory.