Innoscripta SE: 60% EBIT margins & speedy development however why did the 2025 IPO flop ?

Administration abstract:

Innoscripta, a younger German “SaaS firm” which IPOed in 2025 got here to my consideration as a result of this can be very worthwhile (EBIT margin 60%) and rising like loopy (10x in gross sales since 2020). Nevertheless, due to the distinctive income mannequin (success charge as an alternative of software program charges) and a speedy lower in quarterly development in 2025, I’m at the moment not investing, though the inventory will not be tremendous costly at 21x trailing P/E. However I’ll hold a detailed watch.

The 2025 IPO

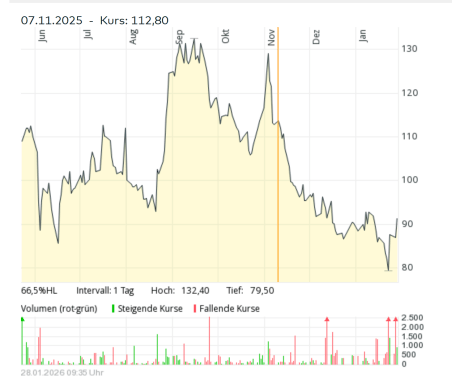

Innoscripta was one of many few “official” IPOs in Germany in 2025. If we take a look at the share worth, it was not a really profitable one:

The IPO worth was 120 EUR in Could 2025 they usually bought solely present shares. We are going to quickly see that they simply didn’t want any new capital.