I’ve lengthy mentioned that the banks weren’t enthusiastic about mortgages anymore.

Their distaste for house loans in all probability started post-2008 when a number of have been pressured to shut their doorways. Keep in mind Bear Stearns, Wachovia, or Washington Mutual?

Others needed to take huge losses as a consequence of defective loans that ought to have by no means been made, resulting in new laws put in place to keep away from the same catastrophe.

Whereas these new guidelines have served their function, over time increasingly more nonbanks have entered the fray.

And with the product menu dominated by agency-backed loans, mortgages have kind of grew to become a commodity.

This pushed former mortgages heavyweights out of the sport, permitting nonbanks like Rocket and UWM to thrive.

A brand new proposal to regulate capital necessities for banks may change that. And that might be one more tailwind for mortgage charges.

Banks Have Misplaced Curiosity in Mortgages

It’s no secret that banks simply don’t love mortgages anymore. Other than the fallout of the early 2000s housing disaster, mortgages grew to become fairly homogenous.

Nearly each mortgage today is a boring previous 30-year fixed-rate mortgage backed by both Fannie Mae, Freddie Mac, or Ginnie Mae (VA/FHA/USDA).

In different phrases, you may get the identical mortgage wherever, and plenty of non-banks are sooner and fewer bureaucratic than the banks.

Additionally they simply wish to originate your mortgage and transfer on. Banks, then again, wish to cross-sell and get you to open a checking and/or financial savings account and make a deposit.

The issue is at this time’s customers aren’t . Sprinkle in elevated danger and stringent capital guidelines and banks have largely thrown within the towel.

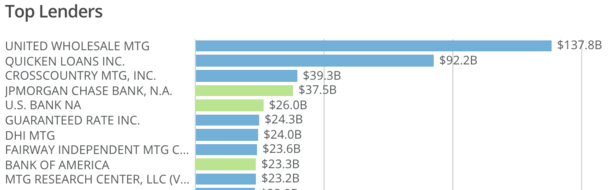

This explains why the highest mortgage lender within the nation is a nonbank, a wholesale nonbank no much less.

I’m referring to United Wholesale Mortgage, which knocked Rocket Mortgage off its perch in 2024, as seen within the chart above from Richey Might.

Earlier than that, San Francisco-based Wells Fargo was the king of mortgages. However they handled a sequence of lawsuits that led to them deliberately lowering their mortgage footprint.

At current, solely three of the prime 10 mortgage lenders within the nation are banks.

Numerous Banks Have Stopped Mortgage Lending Totally

We’ve seen a number of banks exit mortgage lending lately, together with Seattle-based WaFd as a result of it wasn’t well worth the danger (they cited holding their loans versus nonbanks promoting them off instantly).

Extra lately, Widespread Financial institution stopped making mortgages, as did Ally Monetary.

And simply this month, Amalgamated Financial institution mentioned it’s directing clients in search of a mortgage to make use of its new nonbank companion Embrace House Loans.

It’s comprehensible between the shortage of revenue, the capital constraints, and the nonbanks beating them on value, expertise, and execution.

Possibly that can change although.

Easing Capital Necessities for Banks Might Result in a Mortgage Increase

Throughout a speech on the American Bankers Affiliation 2026 Convention for Neighborhood Bankers, Federal Reserve Vice Chair for Supervision Michelle W. Bowman mentioned they’re taking a look at methods to get banks again within the recreation.

She famous that in 2008, banks originated about 60% of all mortgages and held servicing rights on 95% of balances.

By 2023, banks originated simply 35% of mortgages and serviced solely 45% of excellent balances.

Other than nonbanks dominating the house, they’re additionally seen as greater danger as a result of they aren’t depository establishments.

To entice banks, Bowman famous that they may regulate present capital framework that “would improve financial institution incentives to have interaction in mortgage origination and servicing.”

The tip end result may be huge banks vying in your mortgage once more, which may imply larger entry to mortgage choices and probably decrease mortgage charges.

Merely put, if there’s extra competitors in your mortgage, chances are high charges can be decrease.

And since banks maintain loans on their books, they will provide choices past the identical previous boring Fannie, Freddie, and FHA stuff.

Maybe aggressive adjustable-rate mortgages, jumbo loans, or outside-the-box loans with extra versatile underwriting (inside motive).

Both manner, extra gamers within the house would enhance your probabilities of touchdown a greater deal in your mortgage.

Learn on: Who’re the highest financial institution mortgage lenders within the nation?