As central banks shrink their steadiness sheets to revive worth stability and section out expansionary packages, gauging the ampleness of reserves has grow to be a central subject to policymakers and lecturers alike. The reason being that the ampleness of reserves informs when to sluggish after which cease quantitative tightening (QT). The Federal Reserve, for instance, implements financial coverage in a regime of ample reserves, whereby the amount of reserves within the banking system must be giant sufficient such that on a regular basis modifications in reserves don’t trigger giant variations in short-term charges. The objective is due to this fact to implement QT whereas making certain that reserves stay sufficiently ample. On this submit, we evaluation the way to gauge the ampleness of reserves utilizing the brand new Reserve Demand Elasticity (RDE) measure, which might be revealed month-to-month on the general public web site of the Federal Reserve Financial institution of New York as a standalone product.

In a Liberty Road Economics submit in 2022, we proposed specializing in the slope of the reserve demand curve to evaluate the ampleness of reserves within the banking system. The reserve demand curve describes the value at which banks are prepared to commerce their reserve balances with each other as a perform of mixture reserves. Within the U.S., this worth known as the federal funds fee, which is the speed focused by the Federal Open Market Committee (FOMC) in its communication of the financial coverage stance. The slope of the reserve demand curve measures the elasticity of the federal funds fee to modifications within the degree of reserves; that’s, by how a lot this fee modifications in response to variation in mixture reserves. We name this amount the Reserve Demand Elasticity.

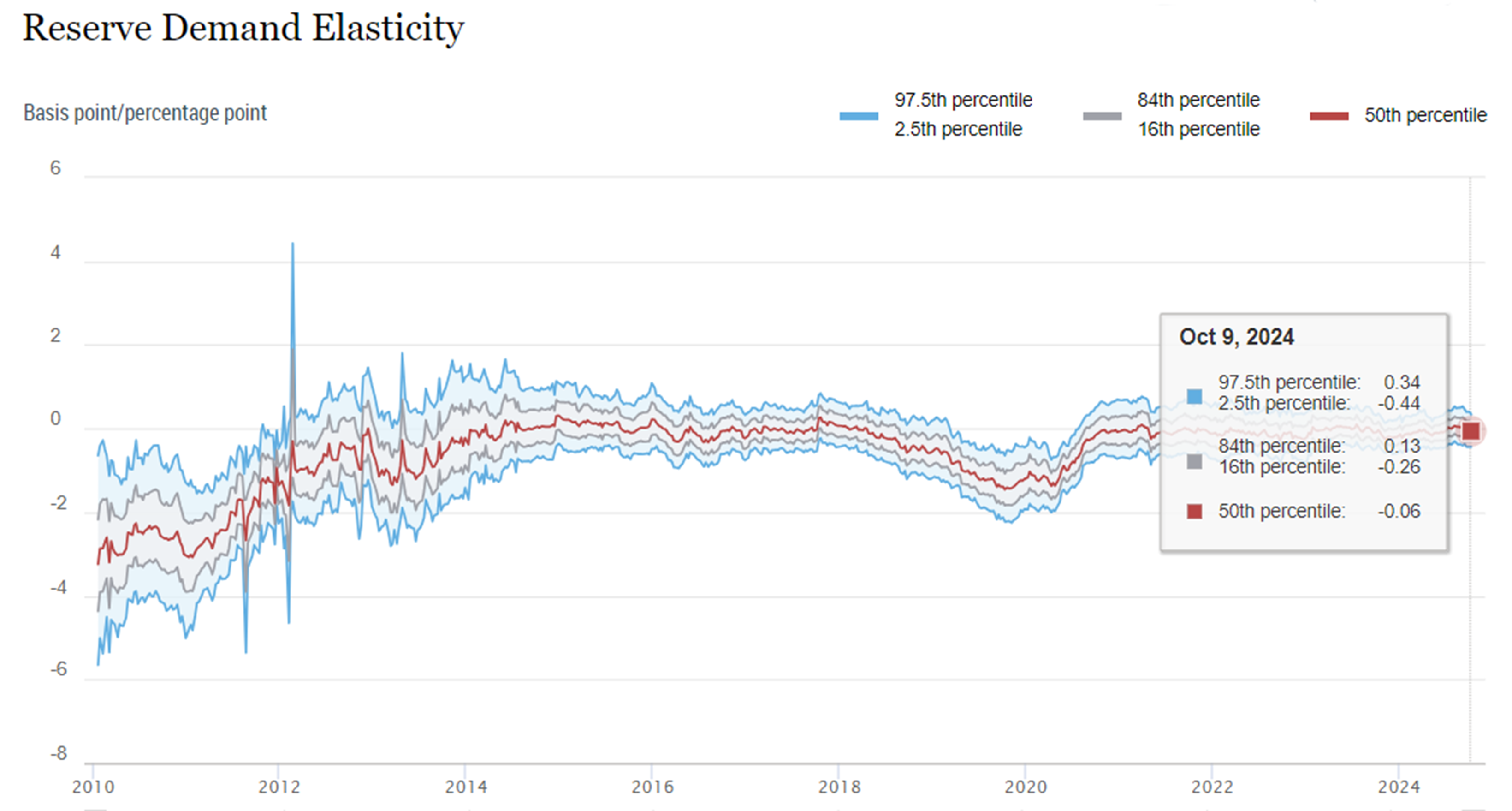

Financial idea tells us that the RDE (that’s, the slope of the reserve demand curve) is completely different at completely different reserve ranges. We will then operationalize the notion of ample reserves within the Federal Reserve financial coverage framework because the area of the reserve demand curve the place the slope is simply modestly damaging: for this vary of reserve ranges, the RDE is small. At increased reserve ranges, the place reserves within the banking system are plentiful, the RDE is zero (the demand curve is flat); at decrease ranges, the place reserves are scarce, the RDE is damaging and enormous (the curve is steeply sloped). To function in an ample reserves framework and keep away from reserve shortage, it’s due to this fact vital to determine the transition level between plentiful and ample reserves.

Figuring out the transition between these areas is difficult as a result of banks’ demand for reserves fluctuates over time and, in flip, the availability of reserves might reply to sudden modifications in banks’ demand. As defined in our paper, we developed an econometric methodology that addresses these challenges. The concept is easy: exploiting giant fluctuations in mixture reserves during the last decade, we transfer alongside the reserve demand curve and, for every day, estimate its slope (the RDE).

Within the first submit of a two-part Liberty Road Economics sequence revealed this summer time, we suggest constructing on our methodology to watch reserve ampleness in actual time. We estimate the RDE every day utilizing solely data obtainable as of every day, making our estimates equal to real-time calculations. We will then assemble a sign of ampleness of reserves by taking a look at when the real-time estimates of the RDE grow to be damaging at a given confidence degree.

The chart under, taken as a screenshot from the brand new interactive RDE webpage, exhibits our real-time estimate of the RDE from January 2010 via October 9, 2024. The RDE was considerably damaging in 2010-11 however then turned indistinguishable from zero all through 2012-17 on account of the big quantities of reserves injected into the banking system by the Federal Reserve in response to the World Monetary Disaster. In the course of the Federal Reserve QT of 2018-19, the RDE returned to be considerably damaging on the 68 % confidence degree in August 2018 and on the 95 % confidence degree in March 2019—twelve to 6 months prematurely of the cash market turmoil of September 2019. After that episode, the RDE began to maneuver again in the direction of zero, because the Federal Reserve injected liquidity within the banking system to take care of management of short-term charges; since mid-2020, because the Federal Reserve used quantitative easing (QE) in response to the COVID-19 disaster, the RDE has been indistinguishable from zero. Our most up-to-date estimates recommend that, though reserves have declined by over $1 trillion since their peak of $4.2 trillion in November 2021, they continue to be plentiful.

Importantly, at the moment we’re launching Reserve Demand Elasticity as a standalone product, with new readings to be revealed every month on the New York Fed’s public web site. The Reserve Demand Elasticity webpage presents the historic and newest estimates of the RDE, in addition to data on the underlying information, methodology, and interpretation. The objective of this product is to equip the general public with a novel instrument that may assist in monitoring the ampleness of reserves within the U.S. banking system and stimulate additional evaluation on this vital space.

Gara Afonso is the pinnacle of Banking Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Domenico Giannone is an assistant director on the Worldwide Financial Fund and an affiliate professor on the College of Washington.

Gabriele La Spada is a monetary analysis advisor in Cash and Funds Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

John C. Williams is the president and chief govt officer of the Federal Reserve Financial institution of New York.

Methods to cite this submit:

Gara Afonso, Domenico Giannone, Gabriele La Spada, and John C. Williams, “Monitoring Reserve Ampleness in Actual Time Utilizing Reserve Demand Elasticity,” Federal Reserve Financial institution of New York Liberty Road Economics, October 17, 2024, https://libertystreeteconomics.newyorkfed.org/2024/10/tracking-reserve-ampleness-in-real-time-using-reserve-demand-elasticity/.