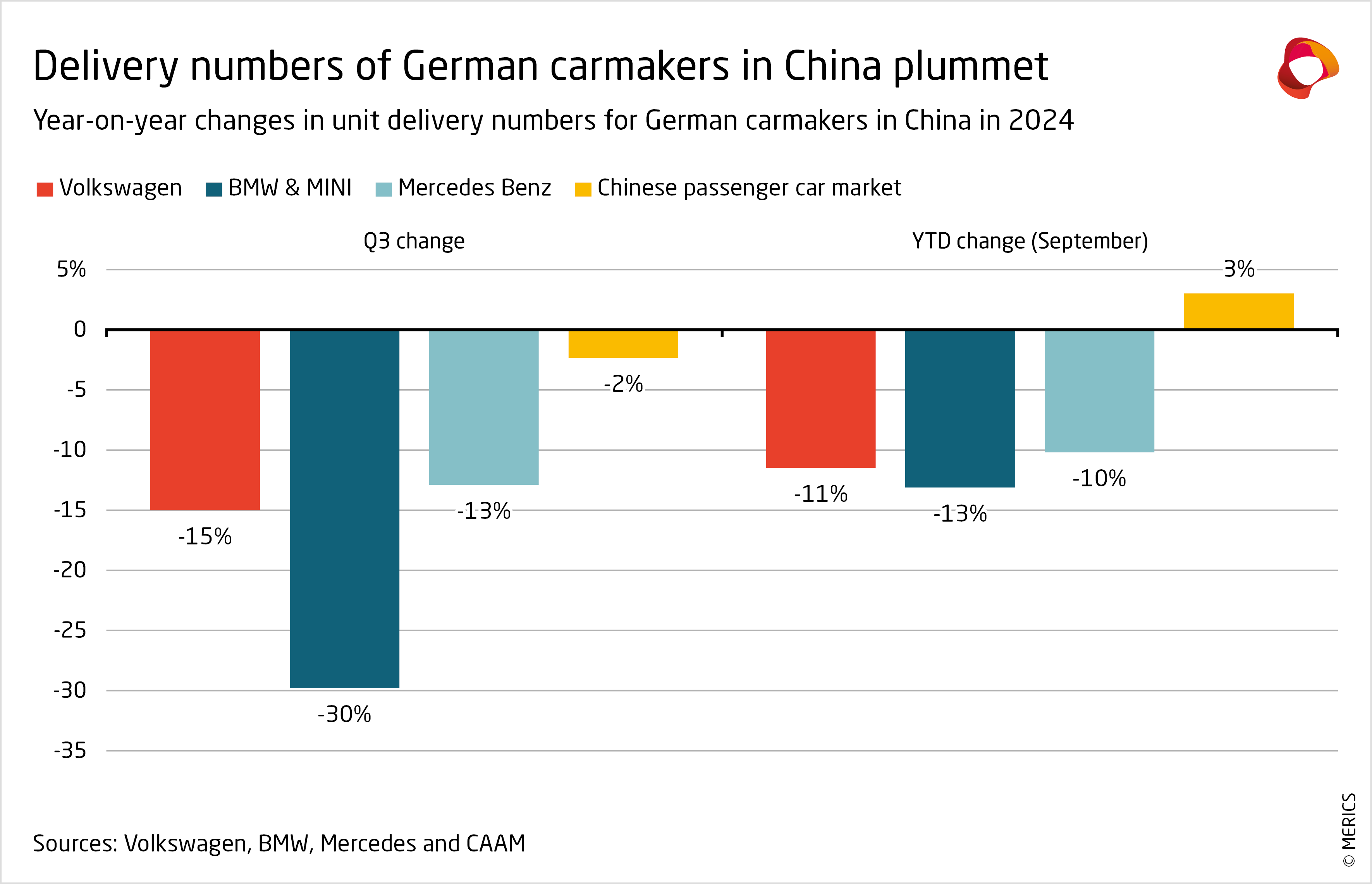

The tide seems to have turned in opposition to German carmakers in China. Volkswagen offered 1,000,000 fewer automobiles there in 2023 than it did in 2018, representing a 25 % decline in simply 5 years. The luxurious automobile manufacturers Mercedes-Benz and BMW fared higher for just a little longer, seeing all-time highs in 2022. However then gross sales declined in 2023 and dropped sharply in 2024, displaying that such sturdy outcomes weren’t sustainable. Within the first 9 months of the yr, deliveries by all three firms fell by 12 % on common, whereas China’s automobile market grew by round 3 %.

However, German automobile firms have doubled down on the world’s largest automobile market, nearly the dimensions of the US and Europe mixed, by saying hefty new investments in 2024. Volkswagen and BMW are every pouring a further 2.5 billion euros into their Hefei innovation hub and Shenyang manufacturing base respectively, whereas Mercedes-Benz is investing 1.8 billion euros with its Chinese language three way partnership (JV) accomplice BAIC. These commitments come on prime of a file 11 billion euros in new investments in China that the trio introduced in 2022. The partnerships constructed with Chinese language suppliers and native analysis and improvement (R&D) operations are thought-about key drivers of innovation.

Undoubtedly, China will stay a part of the long-term success of German automakers. However the challenges they face within the nation is not going to go away. Their sluggish begin within the electrical car (EV) race and Beijing’s assist for home automobile makers implies that the premium positioned on “German engineering” is not a given. The trio underestimated China’s fast shift to EVs and digitalization in addition to Chinese language rivals’ fast enhancements in high quality and innovation. These errors are actually proving expensive.

In opposition to this backdrop, German carmakers ought to recalibrate their targets for the Chinese language market. Counting on future development in China – particularly whereas contemplating manufacturing unit closures in Europe, as VW is doing – could lead on them down a slippery slope, given the dismal China gross sales all three firms have introduced to this point for 2024. Germany’s automobile giants ought to give attention to stabilizing reasonably than increasing their operations in China, releasing up funding to strengthen their aggressive place in different markets with higher development prospects.

Overseas Market Share Is Shrinking as China’s Automotive Market Modifications Quickly

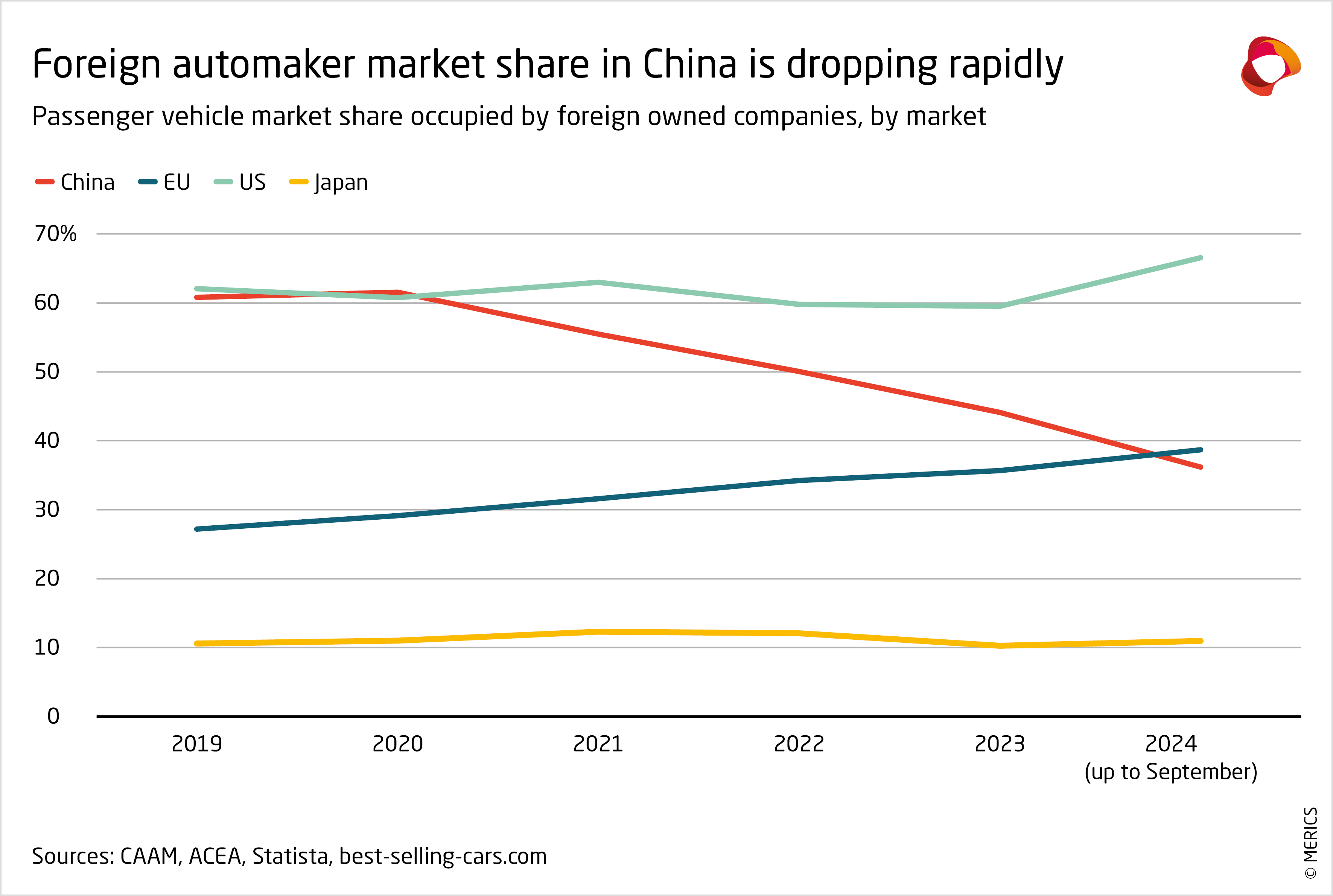

China’s passenger automobile market is altering quickly to the drawback of international gamers. It’s shifting away from the U.S. mannequin – the place international firms make barely greater than 60 % of all automobiles offered – to one thing extra just like the Japanese mannequin, the place home producers dominate with a market share of round 90 %. Given the present trajectory of their gross sales in China, the market share of international automobile makers seems set to drop to beneath 20 % within the subsequent three or 4 years – a decline of two-thirds in underneath a decade.

The primary motive for that is the fast transition of Chinese language customers to electrical and hybrid automobiles, recognized in China as new power autos (NEVs). Their share of China’s automobile market shot up from simply 5.4 % in 2020 to 32 % in 2023 and hit 39 % of automobiles offered from January to September 2024 – and home carmakers are assembly most of this demand. SAIC Volkswagen is the one (partly) German firm among the many prime electrical car producers in China, rating tenth with a mere 2.3 % of the market from January to September 2024.. Apart from Tesla, all the largest firms are both wholly or partly Chinese language owned.

China’s fast shift to NEVs and the dominance of Chinese language producers clarify why German carmakers now face an uphill battle on this market. The market share of international firms in China has fallen from 62 % in 2020 to 36 % within the interval of January to September in 2024. German carmakers have seen their market share decline from 24 % to fifteen %. It’s arduous to see how even a number of billion euros in further funding by German carmakers could make a significant dent on this pattern. Staying on prime as probably the most profitable international carmakers in China seems like an ambition with doubtful advantages.

Chasing the Mirage of the Chinese language Market May Destroy German Carmakers

Within the face of rising competitors from Chinese language gamers, German automobile executives are performing as if nothing has modified. They’re ramping up analysis and improvement and manufacturing capability within the nation, as if the reply to their woes in China is just “extra China.” Hoping to learn from China’s world management in NEVs and associated applied sciences akin to software program, all three main German carmakers are working with Chinese language companions – Volkswagen with Xpeng, BMW with Baidu, and Mercedes-Benz with Geely.

Behind these strikes is the hope that German carmakers will ultimately discover a strategy to revive their previous success and the hefty income they made in China. For a few years, heavy funding and collaboration with Chinese language companions labored to determine a premium place for German automobiles within the Chinese language market. However this method is extremely unlikely to proceed delivering. The German trio will discover it troublesome to make up misplaced floor as Chinese language firms are one step forward in NEVs and luxuriate in a house market benefit. There’s a danger that German carmakers stay overly optimistic about their possibilities in China.

German carmakers mustn’t pull out of China, however they need to recalibrate their expectations to make sure long-term success. Overly bold targets in China may result in a dismal return on funding and undermine their world efficiency. As an alternative, firms that fail to fulfill their ambitions would possibly use China as an export base – though rising commerce limitations in Europe, the US, and elsewhere will elevate the price of this technique.

Alternatively, they may use their sources extra effectively to strengthen their place in third markets as Chinese language rivals are going world. Both means, German carmakers want to seek out alternate options to the Chinese language market. From 2022 to 2023, Volkswagen’s unit deliveries rose by 20 % in Europe and by greater than 15 % in each North America and South America, whereas these in China crept up lower than 3 %. The most important international automobile maker in China is already demonstrating that sturdy development in different markets is feasible.