Expectations can play a big position in driving financial outcomes, with central banks factoring market sentiment into coverage selections and market individuals forming their very own assumptions about financial coverage. However how effectively do central banks perceive the expectations of market individuals—and vice versa? Our mannequin, developed in a current paper, incorporates a dynamic sport between (i) a financial authority that can’t decide to an inflation goal and (ii) a set of market individuals that perceive the incentives created by that credibility drawback. On this publish, we describe the sport, a kind of Keynesian magnificence contest: its primary novelty is that every aspect makes an attempt, with various levels of accuracy, to forecast the opposite’s beliefs, leading to new findings relating to the degrees and trajectories of inflation.

Guidelines versus Discretion

The long-running “guidelines versus discretion” debate in economics (see Kydland and Prescott (1977) and Barro and Gordon (1983)) highlights an essential tradeoff that happens when central banks are granted discretion over financial coverage.

Whereas discretion will be priceless in sure situations—resembling when financial authorities have superior details about the state of the economic system—issues can backfire if these authorities lack credible mechanisms that commit them to inflation targets, as this provides rise to excessive inflationary expectations that turn into self-fulfilling. In consequence, central banks can find yourself “trapped” into creating wasteful inflation—inflation that doesn’t have an effect on output—regardless of everybody understanding that this can occur.

Most analysis on this matter assumes that central banks know market expectations with certainty—however what if financial authorities have no idea market beliefs, and market individuals have no idea authorities’ beliefs about their beliefs, and so forth? Does it matter that these actors have to forecast others’ forecasts?

Magnificence Contests and Increased-Order Uncertainty

The significance of higher-order beliefs—beliefs about others’ beliefs and so forth—for macroeconomics and finance has been acknowledged since John Maynard Keynes analogized monetary markets to magnificence contests: choosing a sizzling inventory just isn’t actually about deciding on an organization that you like, however quite figuring out one that you just suppose everybody likes—an train that each different investor can also be conducting concurrently.

Sadly, it may be very difficult to investigate this type of uncertainty in financial fashions, particularly in a dynamic setting. The reason being twofold. First, financial actors will use time sequence knowledge to find out about payoff-relevant variables which might be unobserved, leading to expectations that (i) common previous knowledge and (ii) evolve over time as extra knowledge are noticed. Which means higher-order beliefs are successfully fluctuating averages of averages of previous knowledge, and therefore their dynamics are more and more difficult. Second, this iterative technique of forming forecasts of others’ forecasts would possibly by no means finish: if financial actors possess knowledge not out there to others, all their beliefs can stay non-public info, doubtlessly forcing counterparties to repeatedly kind non-trivial forecasts of what others consider, advert infinitum.

In a current paper, we make clear this uncertainty drawback by inspecting a basic class of “signaling video games,” that’s, settings the place people maintain non-public info and transmit it—strategically, to their very own benefit—via their actions.

Think about the next state of affairs. A financial authority has non-public details about the optimum degree of stimulus—therefore, of inflation—for an economic system. Because the authority begins setting coverage, the non-public sector gathers imperfect alerts concerning the final influence of the authority’s actions on the economic system, and therefore concerning the optimum degree of inflation within the authority’s thoughts. Forecasts of inflation matter for the non-public sector as a result of they’re used to set nominal wages; in flip, forecasting this non-public sector forecast issues for the financial authority, which tries to spice up the economic system by creating unanticipated inflation (inflation that exceeds market forecasts).

The problem is that every one the info collected by the non-public sector needn’t be available to the authority. On this case, not understanding what info the market has seen, the authority must replicate by itself previous actions to do the forecasting; it is because greater previous inflationary stimuli make greater inflation expectations by the market extra possible than if decrease previous inflationary stimuli had been chosen. However for the reason that authority’s previous selections had been additionally primarily based on its non-public info, the non-public sector could now have to forecast the authority’s perception concerning the market forecast of financial circumstances, etcetera. This extra market forecast can be primarily based on non-public alerts once more, and the forecasting drawback will get restarted.

Inflationary Bias

Our sport displays a basic inflation-output tradeoff: the authority has discretion over methods to optimally set inflation consistent with its non-public details about the economic system, however this could battle with the authority’s need to stabilize output round a goal. Moreover, we assume that the authority has entry to publicly out there knowledge concerning the market’s inflation expectations (as obtained from surveys, for instance).

The authority makes use of that knowledge to refine the estimates constructed utilizing its previous habits (as described above). The accuracy of this knowledge determines the diploma of higher-order uncertainty. However as long as this knowledge is imperfect, neither participant is aware of precisely what the opposite is pondering at any cut-off date. Regardless of this complexity, we present that the issue of higher-order uncertainty will be dealt with efficiently: a finite subset of beliefs can be utilized to summarize your complete hierarchy of beliefs about beliefs.

Outfitted with this subset of perception states, we are able to compute the inflationary bias: inflation that’s anticipated by everybody and is due to this fact expensive for the economic system as a result of it departs from the optimum degree of inflation with out having the ability to have an effect on output. This type of wasteful inflation can come up when the authority has a need to lift output above its pure degree: as an example, if the market expects no inflation, the central financial institution can have an incentive to create it to spice up output. In equilibrium, then, the market should accurately anticipate these incentives, and inflation expectations are shaped in such a method that the central financial institution finds it optimum to satisfy them. The credibility drawback results in an inferior end result.

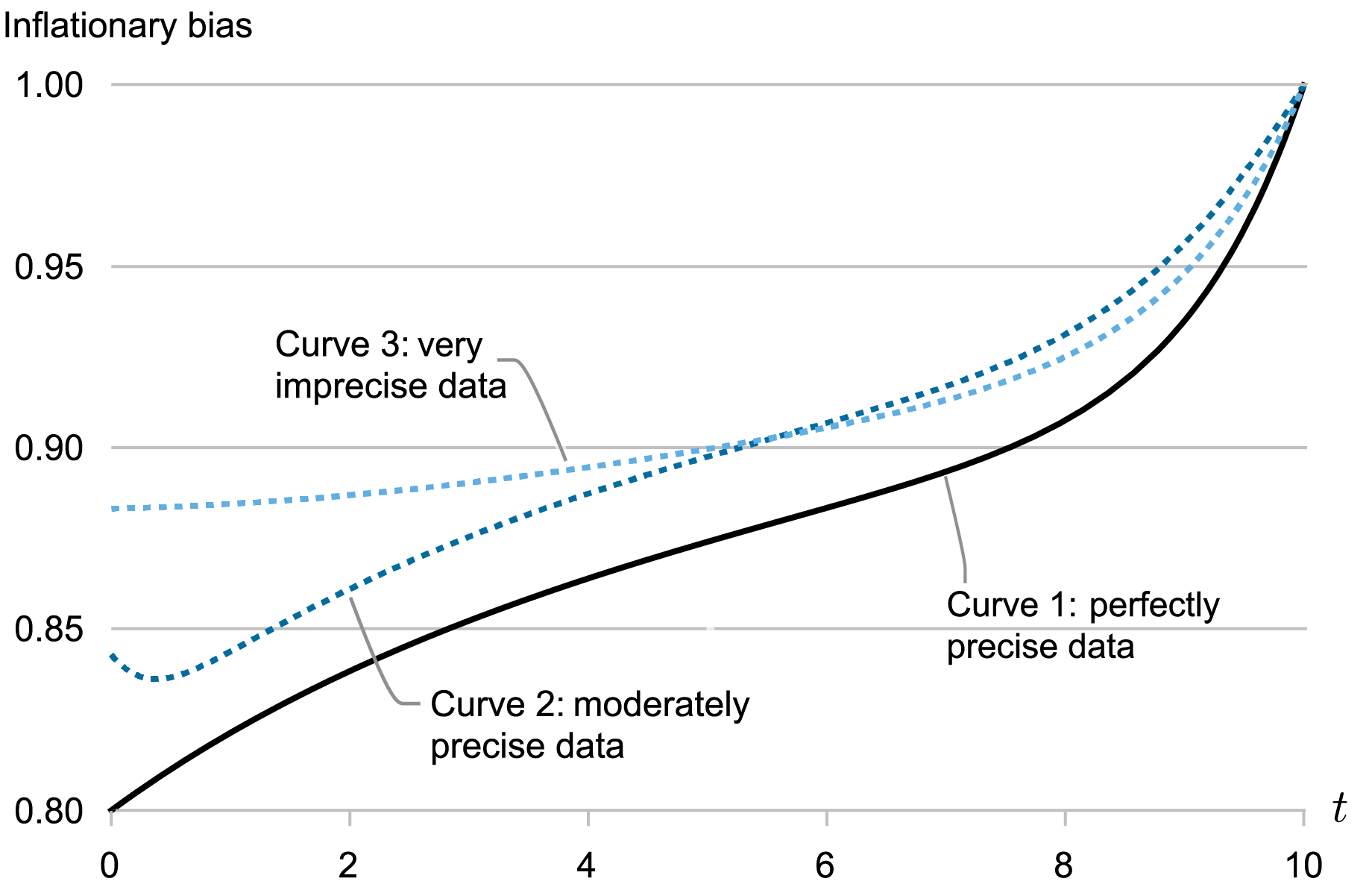

The next chart exhibits the time paths of such inflationary biases in three situations of our mannequin. Curve 1: The central financial institution gathers completely exact knowledge about market expectations, so the authority is aware of what the market is aware of. Curve 2: The info are reasonably imprecise. Curve 3: The info are very imprecise and there’s substantial higher-order uncertainty.

Inflationary Bias Varies In line with the Accuracy of Inflation Expectations Knowledge

The upward slope of all three curves displays the dynamic prices from creating inflation: attempting to shock the economic system at present can anchor market expectations at greater ranges, making it extra expensive to shock the economic system sooner or later—the authority due to this fact creates little inflation early on, however the credibility drawback grows as the top of the related horizon approaches. Nonetheless, the chart additionally reveals that, when there’s higher-order uncertainty, extra inflation is created (curves 2 and three are greater than curve 1). The reason being the “common about averages” notion defined earlier: as beliefs about beliefs are aggregates of previous aggregates of previous knowledge, these beliefs are extra sluggish in responding to new knowledge. Which means market beliefs will reply much less to inflation surprises. In flip, the dynamic prices that self-discipline the central financial institution are diminished, and extra inflation is created.

As the standard of expectations knowledge worsens—shifting from curve 2 to curve 3—beliefs turn into extra sluggish and inflation is greater early on when the authority begins setting coverage, per the earlier logic. However notice that issues can reverse as time progresses: the inflationary bias can fall, mirrored in curve 3 finally being decrease than curve 2. This is because of a strategic impact. Certainly, with much less correct knowledge about market expectations, the authority depends extra closely on its previous habits to forecast what the market is aware of. Because the authority makes use of its forecast to set coverage, its actions turn into extra informative, and therefore market beliefs acquire extra responsiveness (take into account the alternative excessive: if the authority doesn’t transmit info, the market doesn’t need to replace). In different phrases, the intrinsic sluggishness of market expectations is offset as a result of extra info will get transmitted.

In abstract, in economies the place central banks lack dedication mechanisms for coverage aims, magnificence contests between financial authorities and markets exacerbate the credibility issues at play. Bettering the accuracy of knowledge about market expectations possible mitigates this drawback, however financial authorities can nonetheless seem like much less dedicated to low inflation at some closing dates.

Gonzalo Cisternas is a monetary analysis advisor in Non-Financial institution Monetary Establishment Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Aaron Kolb is an affiliate professor of enterprise economics and public coverage at Indiana College Kelley College of Enterprise.

cite this publish:

Gonzalo Cisternas and Aaron Kolb, “The Central Banking Magnificence Contest,” Federal Reserve Financial institution of New York Liberty Road Economics, September 30, 2024, https://libertystreeteconomics.newyorkfed.org/2024/09/the-central-banking-beauty-contest/.

Disclaimer

The views expressed on this publish are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).