This submit presents an replace of the financial forecasts generated by the Federal Reserve Financial institution of New York’s dynamic stochastic normal equilibrium (DSGE) mannequin. We describe very briefly our forecast and its change since September 2024. As ordinary, we want to remind our readers that the DSGE mannequin forecast will not be an official New York Fed forecast, however solely an enter to the Analysis employees’s total forecasting course of. For extra details about the mannequin and variables mentioned right here, see our DSGE mannequin Q & A.

The New York Fed mannequin forecasts use knowledge launched by means of 2024:Q3, augmented for 2024:This fall with the median forecasts for actual GDP development and core PCE inflation from the November launch of the Philadelphia Fed Survey of Skilled Forecasters (SPF), in addition to the yields on 10-year Treasury securities and Baa-rated company bonds based mostly on 2024:This fall averages as much as November 22. Beginning in 2021:This fall, the anticipated federal funds price (FFR) between one and 6 quarters into the long run is restricted to equal the corresponding median level forecast from the newest out there Survey of Main Sellers (SPD) within the corresponding quarter. For the present projection, that is the November SPD.

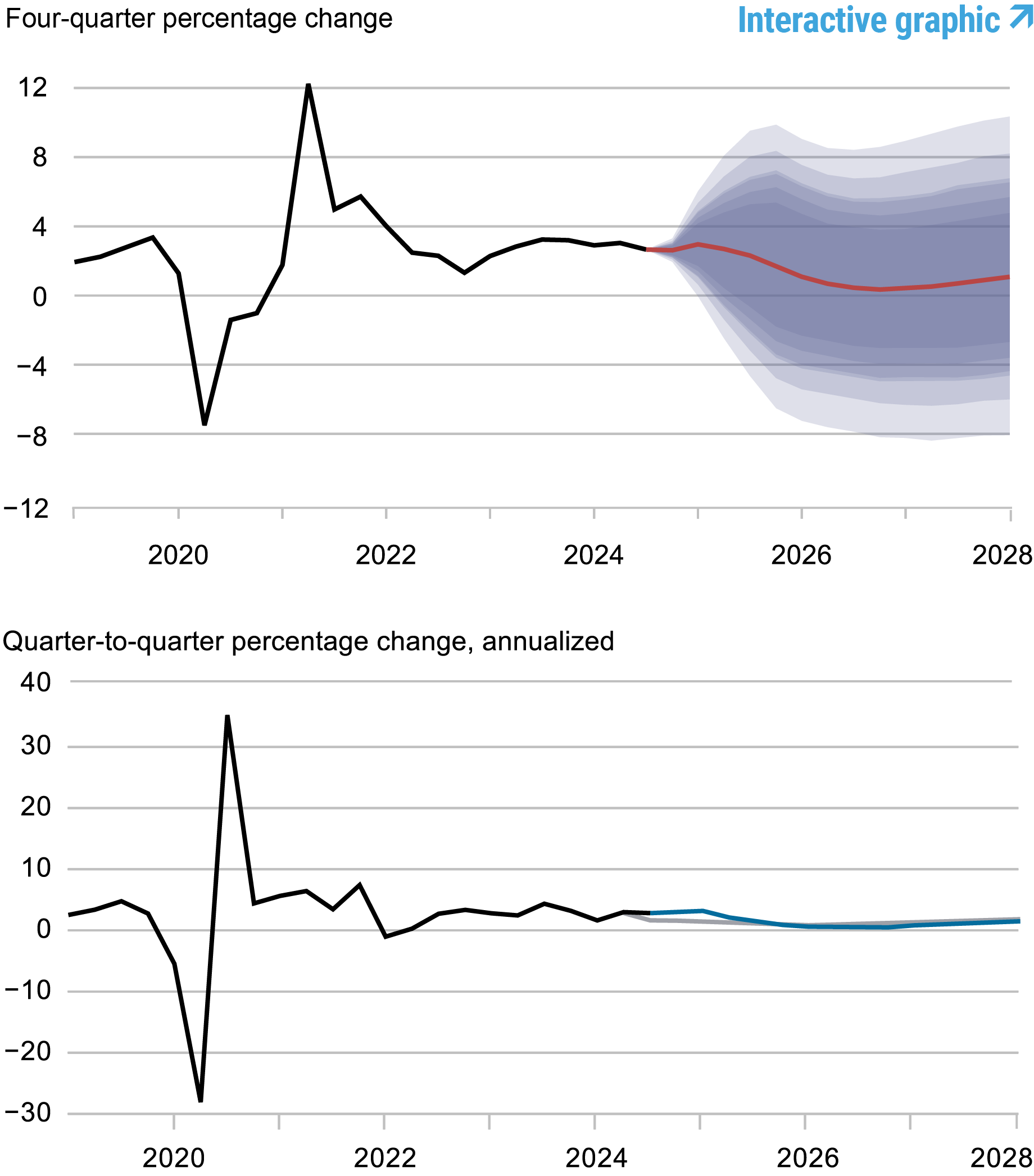

As soon as once more, each skilled forecasters and the DSGE mannequin had been stunned by the power of the financial system. Output development in 2024:Q3 was greater than 1 share level increased than the SPF had predicted in August—and due to this fact increased than the DSGE forecast, for the reason that mannequin used the SPF projection as a nowcast. As well as, the present SPF nowcast for annualized GDP development in 2024:This fall can also be virtually 2 share factors increased than the DSGE prediction in September. Each forecast errors translate into increased output development for 2024 and 2025 relative to September (2.6 versus 1.8 p.c, and 1.7 versus 1.0 p.c, respectively), however have much less influence on the output projections thereafter (the present forecasts are 0.4 and 0.9 p.c in 2026 and 2027 versus 0.8 and 1.3 p.c in September). The chance of a recession, outlined as four-quarter output development falling beneath -1 p.c over the subsequent 4 quarters, has decreased from 31 p.c in September to 24 p.c now.

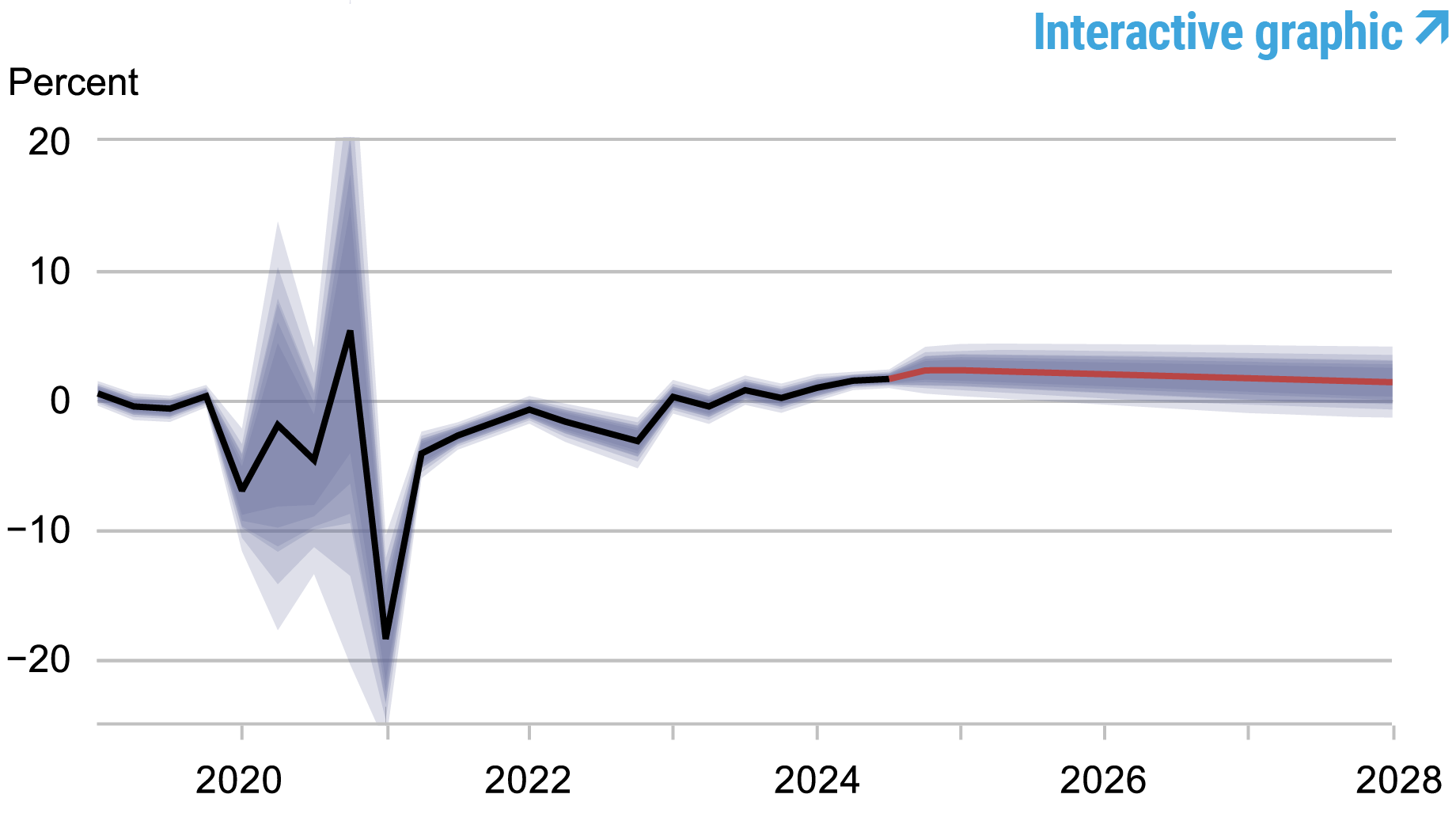

The mannequin attributes a lot of the current power within the financial system to financial coverage, which has change into considerably much less restrictive than predicted in September (recall that in September, the mannequin used the July SPD to kind coverage expectations). Importantly, when it comes to assessing the coverage stance, the mannequin’s prediction for the short-run actual pure price of curiosity, r*, has not modified for 2024 (2.4 p.c) however its predictions are decrease than they had been in September for the rest of the forecast horizon. The present forecast for r* is 2.1, 1.8, and 1.5 p.c in 2025, 2026, and 2027, in comparison with 2.3, 1.9, and 1.6 p.c in September.

As a result of the higher-than-predicted output is basically attributed to coverage, versus shocks that will elevate potential output, the output hole can also be estimated to be increased than it was in September.

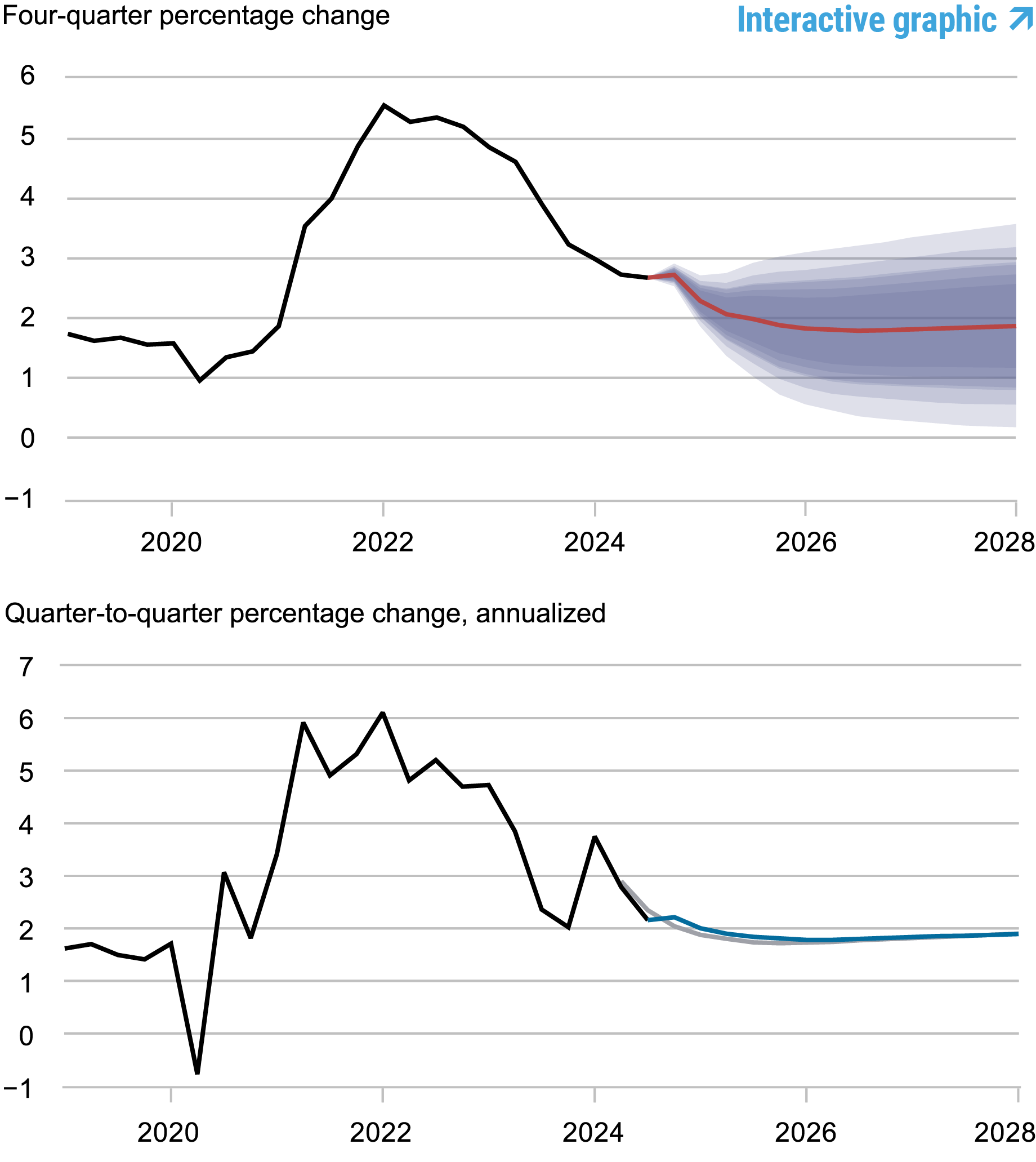

Core PCE inflation forecasts are basically the identical as in September. Particularly, the present inflation projections are 2.7, 1.9, 1.8, and 1.9 p.c in 2024, 2025, 2026, and 2027, versus 2.8, 1.8, 1.8, and 1.8 p.c in September, respectively. Whereas the much less restrictive financial coverage pushes up inflation projections, in line with the mannequin, that is offset by increased productiveness development.

Forecast Comparability

| Forecast Interval | 2024 | 2025 | 2026 | 2027 | ||||

|---|---|---|---|---|---|---|---|---|

| Date of Forecast | Dec 24 | Sep 24 | Dec 24 | Sep 24 | Dec 24 | Sep 24 | Dec 24 | Sep 24 |

| GDP development (This fall/This fall) |

2.6 (2.2, 3.0) |

1.8 (0.1, 3.6) |

1.7 (-3.4, 6.9) |

1.0 (-4.2, 6.3) |

0.4 (-4.7, 5.4) |

0.8 (-4.4, 6.2) |

0.9 (-4.6, 6.2) |

1.3 (-4.2, 6.7) |

| Core PCE inflation (This fall/This fall) |

2.7 (2.6, 2.8) |

2.8 (2.5, 3.0) |

1.9 (1.0, 2.6) |

1.8 (1.0, 2.5) |

1.8 (0.9, 2.7) |

1.8 (0.8, 2.7) |

1.9 (0.8, 2.9) |

1.8 (0.8, 2.9) |

| Actual pure price of curiosity (This fall) |

2.4 (1.3, 3.5) |

2.4 (1.2, 3.6) |

2.1 (0.7, 3.5) |

2.3 (0.9, 3.7) |

1.8 (0.2, 3.3) |

1.9 (0.3, 3.4) |

1.5 (-0.1, 3.1) |

1.6 (-0.1, 3.2) |

Notes: This desk lists the forecasts of output development, core PCE inflation, and the true pure price of curiosity from the December 2024 and September 2024 forecasts. The numbers exterior parentheses are the imply forecasts, and the numbers in parentheses are the 68 p.c bands.

Forecasts of Output Development

Supply: Authors’ calculations.

Notes: These two panels depict output development. Within the high panel, the black line signifies precise knowledge and the purple line reveals the mannequin forecasts. The shaded areas mark the uncertainty related to our forecasts at 50, 60, 70, 80, and 90 p.c chance intervals. Within the backside panel, the blue line reveals the present forecast (quarter-to-quarter, annualized), and the grey line reveals the September 2024 forecast.

Forecasts of Inflation

Supply: Authors’ calculations.

Notes: These two panels depict core private consumption expenditures (PCE) inflation. Within the high panel, the black line signifies precise knowledge and the purple line reveals the mannequin forecasts. The shaded areas mark the uncertainty related to our forecasts at 50, 60, 70, 80, and 90 p.c chance intervals. Within the backside panel, the blue line reveals the present forecast (quarter-to-quarter, annualized), and the grey line reveals the September 2024 forecast.

Actual Pure Fee of Curiosity

Supply: Authors’ calculations.

Notes: The black line reveals the mannequin’s imply estimate of the true pure price of curiosity; the purple line reveals the mannequin forecast of the true pure price. The shaded space marks the uncertainty related to the forecasts at 50, 60, 70, 80, and 90 p.c chance intervals.

Sophia Cho is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Marco Del Negro is an financial analysis advisor in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Ibrahima Diagne is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics. Group.

Pranay Gundam is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Donggyu Lee is a analysis economist in Macroeconomic and Financial Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Brian Pacula is a analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Easy methods to cite this submit:

Sophia Cho, Marco Del Negro, Ibrahima Diagne, Pranay Gundam, Donggyu Lee, and Brian Pacula, “The New York Fed DSGE Mannequin Forecast—December 2024,” Federal Reserve Financial institution of New York Liberty Road Economics, December 20, 2024, https://libertystreeteconomics.newyorkfed.org/2024/12/the-new-york-fed-dsge-model-forecast-december-2024/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).