Throughout 2018-19, the U.S. levied import tariffs of 10 to 50 p.c on greater than $300 billion of imports from China, and in response China retaliated with excessive tariffs of its personal on U.S. exports. Estimating the mixture affect of the commerce conflict on the U.S. financial system is difficult as a result of tariffs can have an effect on the financial system via many alternative channels. Along with altering relative costs, tariffs can affect productiveness and financial uncertainty. Furthermore, these results can take years to turn out to be obvious within the information, and it’s tough to know what the longer term implications of a tariff are more likely to be. In a current paper, we argue that monetary market information may be very helpful on this context as a result of market contributors have sturdy incentives to fastidiously analyze the implications of a tariff announcement on agency profitability via numerous channels. We present that researchers can use actions in asset costs on days through which tariffs are introduced to acquire estimates of market expectations of the current discounted worth of agency money flows, which then can be utilized to evaluate the welfare affect of tariffs. These estimates recommend that the commerce conflict between the U.S. and China between 2018 and 2019 had a unfavorable impact on the U.S. financial system that’s considerably bigger than previous estimates.

Tariff Bulletins Brought about Massive Declines in U.S. Inventory Returns

Our analysis reveals that the tariff bulletins vastly impacted agency stock-market valuations. We doc this impact by analyzing the market motion on the earliest announcement dates within the media of every spherical of tariffs carried out by the U.S. and China.

The desk beneath presents the record of announcement dates, an outline of the bulletins, and the corresponding (value-weighted) U.S. stock-market return on the buying and selling day following the announcement. We discover that stock-market returns are constantly large and unfavorable, with significantly massive drops following the March 2018 and Could 2019 tariff bulletins. The final line of the desk reveals the cumulative impact of those bulletins throughout all occasion dates. General, the U.S. inventory market fell 11.5 p.c on days when tariffs have been introduced, which quantities to a $4.1 trillion loss in agency fairness worth.

Inventory Market Returns on Days with Tariff Bulletins

| Occasion Date | ln RM,t (x100) | Nation | Description |

|---|---|---|---|

| 23 Jan 2018 | 0.3 | U.S. | U.S. imposes tariffs on photo voltaic panels and washing machines |

| 01 Mar 2018 | -1.1 | U.S. | U.S. imposes metal and aluminum tariffs |

| 22 Mar 2018 | -2.4 | U.S. | U.S. imposes $60 billion in annual tariffs on China |

| 23 Mar 2018 | -1.9 | China | China retaliates and proclaims tariffs on 128 U.S. exports |

| 15 Jun 2018 | -0.2 | China | China proclaims retaliation towards U.S. tariffs on $50 billion of imports |

| 19 Jun 2018 | -0.4 | U.S. | U.S. proclaims imposition of tariffs on $200 billion of Chinese language items |

| 02 Aug 2018 | 0.5 | China | China unveils retaliatory tariffs on $60 billion of U.S. items |

| 06 Could 2019 | -0.4 | U.S. | U.S. to boost tariffs on $200 billion of Chinese language items as much as 25 p.c |

| 13 Could 2019 | -2.5 | China | China to boost tariffs on $60 billion of U.S. items beginning June 1 |

| 01 Aug 2019 | -0.9 | U.S. | U.S. imposes a ten p.c tariff on one other $300 billion of Chinese language items |

| 23 Aug 2019 | -2.5 | China | China retaliates with larger tariffs on soy and autos |

| Cumulative | -11.5 |

Notes: The primary and final columns report the date and outline of every occasion day. The second column reviews the log stock-market return on every announcement day. ln RM,t is the log of 1 plus the proportional change of the stock-market return, outlined because the value-weighted market portfolio return from CRSP.

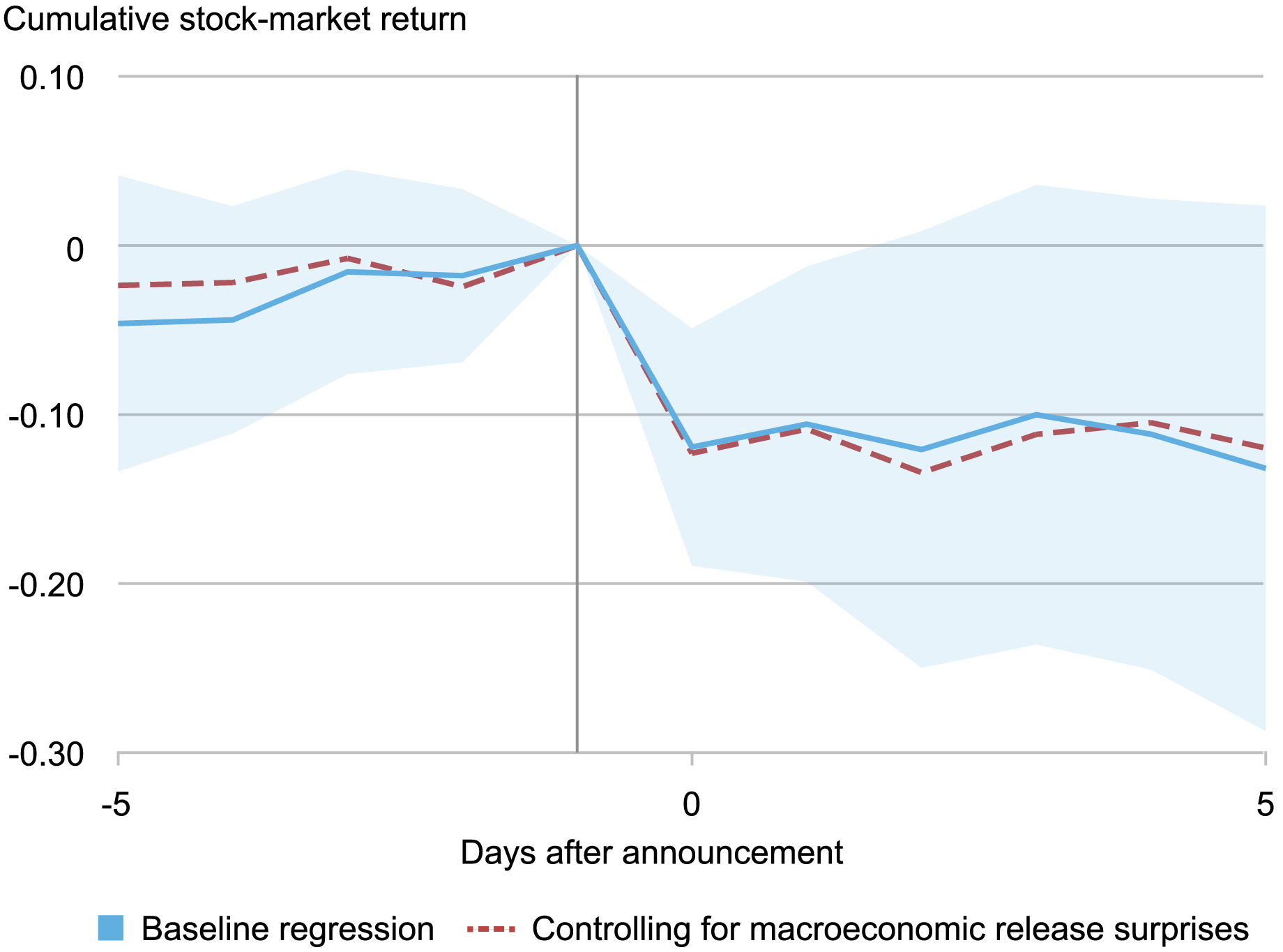

Whereas one may be tempted to dismiss these declines as market overreactions, the info militates towards this interpretation as a result of the declines have been persistent. The chart beneath reveals the cumulative stock-market return over a ten-day window across the tariff bulletins. We discover that the impact completely happens on the buying and selling days equivalent to the bulletins, indicating that the market didn’t anticipate these bulletins and didn’t bounce again within the week following the bulletins. We additionally examine that our findings can’t be defined by simultaneous bulletins of different financial information (for instance, bulletins on employment) by controlling for the affect of those different bulletins within the dashed line.

The Dynamics of Inventory Market Returns Round Tariff Bulletins

Tariff Bulletins Led to Elevated Uncertainty within the U.S. Economic system

These stock-market value declines are more likely to replicate two forces. First, markets might have turn out to be extra pessimistic about future agency income, and second, market contributors might have turn out to be much less keen to carry dangerous belongings even when the anticipated path of future income remained unchanged. To tell apart between these two forces, we analyze the impact of tariff bulletins on market-based low cost fee measures, which seize traders’ willingness to carry dangerous belongings.

We start by analyzing the cumulative response of Treasury yields, that are seen as risk-free belongings, on tariff announcement days. As proven within the chart beneath, tariff bulletins result in a pointy drop in nominal Treasury yields by 50 foundation factors throughout all maturities, with the biggest impact noticed at a five-year horizon. The chart additionally reviews the response of actual Treasury yields, which drop by 40 foundation factors. The drop in Treasury yields possible displays market contributors’ elevated want to carry secure belongings.

Subsequent, we study the impact of tariff bulletins on the fairness premium, outlined because the anticipated fee of return on fairness relative to risk-free belongings. Whereas the fairness premium isn’t instantly observable, we deal with a decrease certain constructed from the worth of S&P 500 choices (SVIX). As proven within the chart beneath, we estimate that the implied annualized fairness premium will increase by a number of share factors (cumulatively) on announcement days.

To summarize, our proof signifies that tariff bulletins decreased actual yields and elevated fairness premia, which is suggestive of a “flight to security” amongst traders. After adjusting the decline in fairness costs for these modifications in low cost charges, we estimate that roughly 40 p.c (4.7 share factors) of the decline in fairness costs on tariff-announcement days may be attributed to modifications in anticipated agency dividends (versus modifications in fairness premia). Be aware that this estimate is silent on the timing of those dividend declines, which is in line with the truth that no decline was noticed instantly after the tariffs have been introduced.

Cumulative Impact of Tariff Bulletins on Low cost Charges

Be aware: The items on the vertical axes are the decimal illustration of share modifications, so 0.01 corresponds to a 1 share level change.

Reassessing the Mixture Impression on the U.S. Economic system

We use these outcomes to estimate the general welfare impact of tariffs. Conceptually, the welfare impact of tariffs is a weighted common of their results on dividend earnings, curiosity earnings, labor earnings, and tax revenues. Combining the unfavorable results on corporations and staff within the U.S. with elevated authorities income from the tariffs, we estimate that the general affect of tariff bulletins on anticipated welfare is -3 p.c. Though this welfare impact is significantly smaller than the -11.5 p.c drop in stock-market valuations, it’s considerably bigger than the welfare predictions from commonplace commerce fashions. This discovering means that these fashions might overlook essential channels by which tariffs may have an effect on the financial system, such because the dampening impact of tariffs on innovation, the unfavorable penalties of elevated commerce uncertainty on funding, or the destabilizing affect of tariff bulletins on world commerce insurance policies.

Mary Amiti is the pinnacle of Labor and Product Market Research within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Matthieu Gomez is an affiliate professor of economics at Columbia College.

Sang Hoon Kong is an economics PhD scholar at Columbia College.

David E. Weinstein is the Carl S. Shoup Professor of the Japanese Economic system at Columbia College.

The way to cite this submit:

Mary Amiti, Matthieu Gomez, Sang Hoon Kong, and David E. Weinstein, “Utilizing Inventory Returns to Assess the Mixture Impact of the U.S.‑China Commerce Warfare,” Federal Reserve Financial institution of New York Liberty Road Economics, December 4, 2024, https://libertystreeteconomics.newyorkfed.org/2024/12/using-stock-returns-to-assess-the-aggregate-effect-of-the-u-s-china-trade-war/.

Disclaimer

The views expressed on this submit are these of the writer(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the writer(s).