Picture supply: Getty Pictures

After a troublesome yr for oil costs, Shell and BP appear like attention-grabbing passive revenue alternatives. However I’m wanting outdoors the FTSE 100 relating to power shares.

Chord Vitality’s (NASDAQ:CHRD) the biggest impartial oil producer within the Williston Basin. And it has a distinct strategy to the massive oil majors.

Investor returns

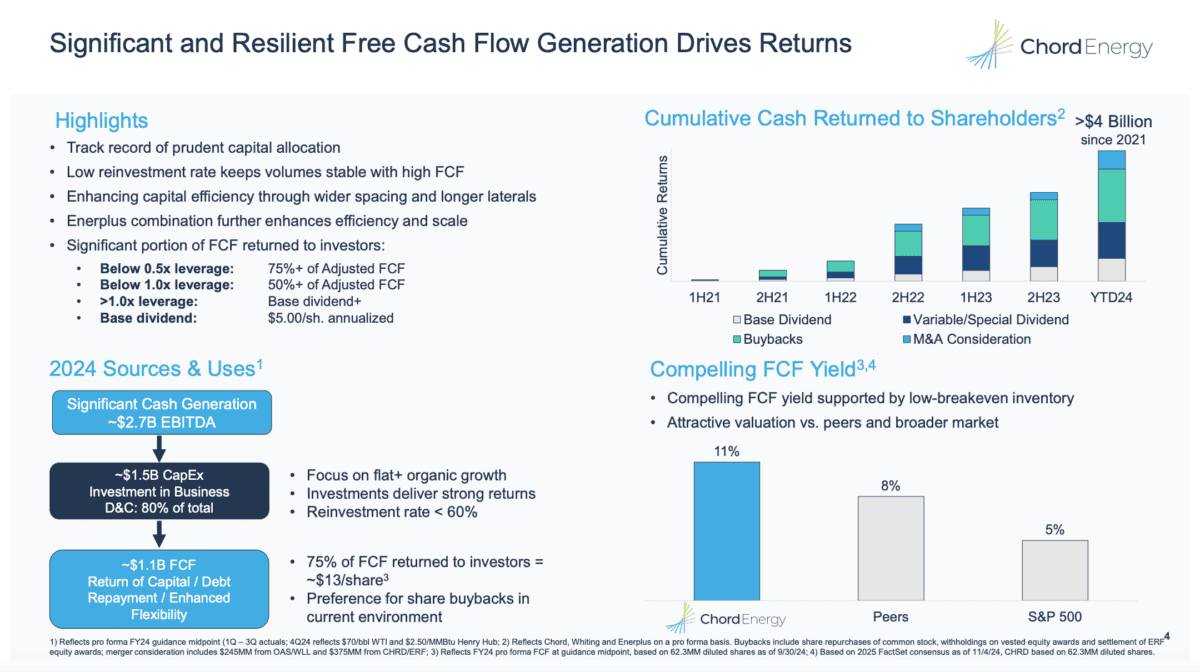

Primarily based on $70 oil costs, the corporate anticipates returning $13 per share to buyers in 2024 through dividends and share buybacks. With the share value presently at $119, that’s a return of virtually 11%.

Supply: Chord Vitality Q3 Investor Presentation

Traders ought to observe a few dangers although. An analogous final result in 2025 is completely not assured – decrease taxes within the US would possibly effectively enhance oil provide and this might ship costs decrease.

On prime of this, Chord doesn’t specify the break-even value of its belongings in its investor supplies. This makes it troublesome for buyers to evaluate what the impact of decrease oil costs is likely to be.

This makes it a riskier funding than I normally go in for. However I believe the chance is likely to be distinctive and it’s a danger I’m keen to take as a part of a diversified portfolio.

What makes Chord totally different?

What makes Chord – probably – distinctive is it doesn’t make investments closely in exploration initiatives. Not like the likes of ExxonMobil and Chevron, it focuses on returning earnings to shareholders.

The apparent limitation to this technique is that oil wells don’t final endlessly. And after they run out, the corporate wants to search out methods to switch them, in any other case its earnings will dry up.

Moderately than funding speculative initiatives, Chord prefers to do that by buying different companies with established belongings. The latest instance is its $4bn buy of Enerplus in Could.

Rising like this could put the agency’s steadiness sheet in danger. However the firm’s truly in a really sturdy place, with a leverage ratio round a 3rd of the extent of its friends and a fifth of the S&P 500 common.

UK oil

Each Shell (4.5%) and BP (6.1%) have engaging dividend yields in the intervening time. And as a UK investor, I’m set to pay a 15% withholding tax on distributions I obtain from Chord.

On prime of this, I strongly suspect each the UK oil firms have decrease manufacturing prices. And this offers them a transparent benefit over the agency I’ve been shopping for shares in.

Regardless of this, I believe the upper windfall taxes BP and Shell are going to must take care of subsequent yr – and past – is more likely to offset this. These obtained more durable within the Price range and look fairly sturdy to me.

In contrast, Chord’s (together with different US firms) more likely to face decrease taxes in 2025. And this could imply its manufacturing prices – no matter they’re – come down.

I’m shopping for

I see Chord as one of many riskiest investments in my Shares and Shares ISA, however I’m nonetheless shopping for progressively. What occurs if oil costs fall is unclear.

From a passive revenue perspective although, I believe the potential reward means the danger’s price it. If oil costs simply keep above $70, that is an funding that might prove extraordinarily effectively for me.