A lot ado has been made about Malaysia’s relationship with China, and nowhere is that this extra obvious than in commerce. By now, it must be self-evident that Malaysia and China have robust financial ties: in 2023, bilateral commerce reached $99 billion whereas Malaysia’s inventory of Chinese language overseas direct funding (FDI) was nearly $8 billion. Each governments goal to deepen this relationship additional, not too long ago emphasizing digital and inexperienced improvement.

In response, some observers, each in Malaysia and overseas, have raised alarm, framing Malaysia’s relationship with China as one in all “overreliance” or as reflecting a “tilt” towards Beijing. Others go additional, concluding that Malaysia is now unabashedly “pro-China.” Nevertheless, an analysis of bilateral and multilateral financial patterns, grounded in knowledge relatively than rhetoric, paints a extra nuanced image.

Gravity Issues

China has been Malaysia’s largest buying and selling associate since 2009, a truth that’s usually cited in assist of claims of financial overdependence. Throughout his March 2023 go to to Beijing, Prime Minister Anwar Ibrahim addressed this dynamic, remarking, “Given the precedence, we come to China first. However as a buying and selling nation, we should keep glorious relationship[s] with all, together with the USA.”

In its essence, Anwar’s remark, regardless of inadvertently creating room for sensationalist misinterpretation, alludes to the gravity mannequin of commerce, an empirically backed statement that commerce flows lower with geographical distance, all else being equal. In different phrases, it shouldn’t be stunning that China is such an necessary buying and selling associate for Malaysia, given its dimension and proximity to the nation, earlier than even contemplating the financial constructions and comparative benefits of each nations.

The Malaysian case just isn’t distinctive; certainly, it mirrors international tendencies. In keeping with knowledge extracted from the U.N. Comtrade database, mainland China is the biggest buying and selling associate of 55 nations worldwide, greater than another particular person nation. This contains a lot of the Asia-Pacific in addition to Brazil, Egypt, Germany, and enormous swathes of sub-Saharan Africa. Throughout Asia, the principle exceptions are small nations nearer to a bigger neighboring associate’s financial sphere of affect, together with Nepal with India, Timor-Leste with Indonesia, and Laos with Thailand.

Subsequently, the notion of “coming to China first” merely displays international commerce realities. For Malaysia, the close by Chinese language market, with its financial and inhabitants dimension, is an important supply of client demand and intermediate items. What issues just isn’t avoiding shut ties with China however constructing resilience by various commerce linkages throughout sectors, a purpose Malaysia has demonstrably achieved, as outlined beneath.

It’s All Relative

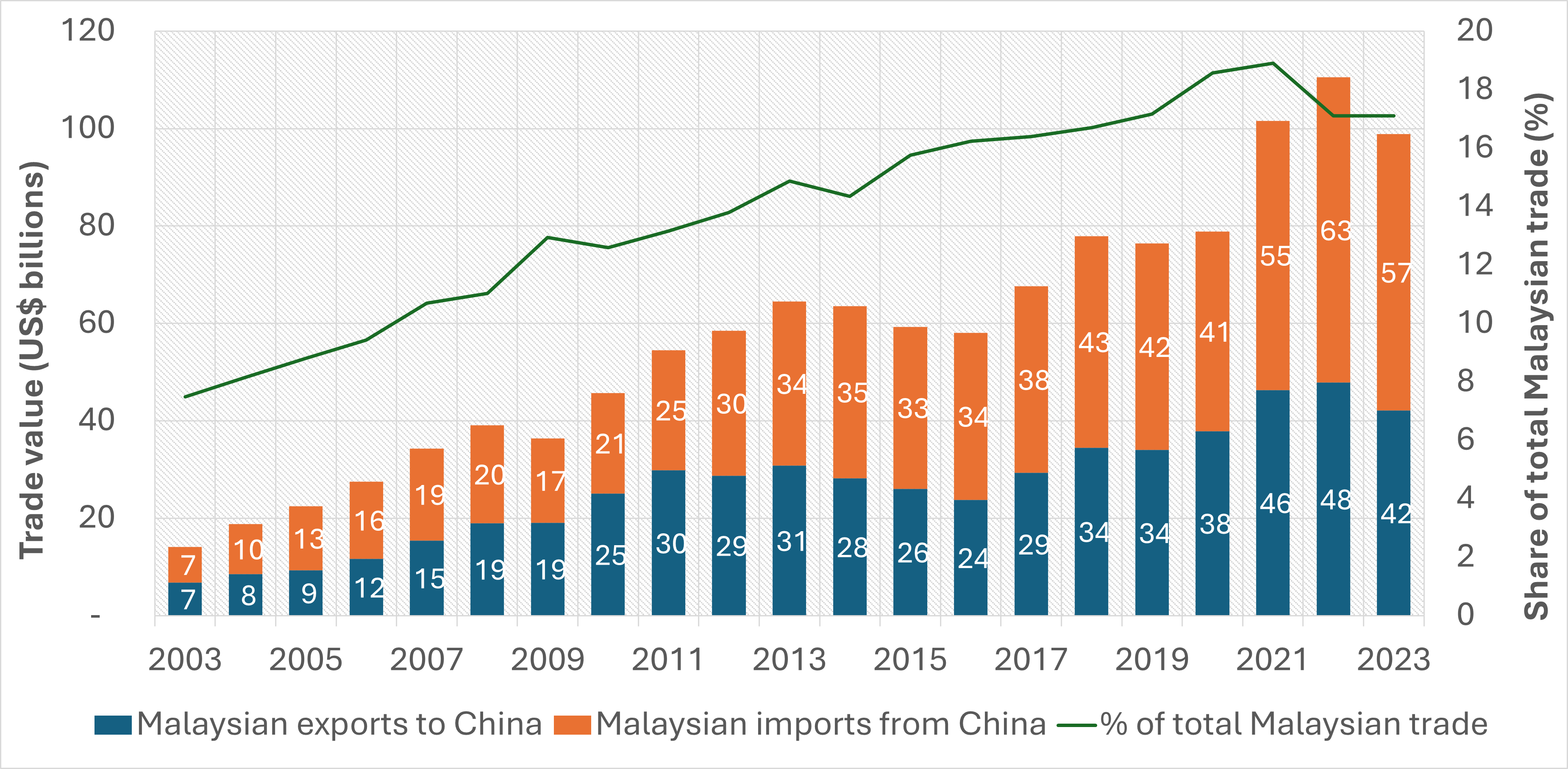

One other statement is that China’s relative significance to Malaysian commerce has in truth declined lately. The share of Malaysia-China exports and imports to complete Malaysian commerce has decreased from its peak of 19 p.c in 2021 to 17 p.c in 2023, roughly on par with pre-pandemic tendencies (Fig. 1).

Determine 1: Malaysia-China bilateral commerce ($ billions, left) and share of complete Malaysian commerce (%, proper). Supply: Creator’s calculations primarily based on U.N. Comtrade (2024)

This commerce share started to say no in 2022, the identical yr that bilateral commerce peaked at almost $111 billion. Since 2021, Malaysia’s general commerce progress has outpaced its commerce with China, marked by an increase in ASEAN’s share of Malaysian commerce from 26 p.c to 27 p.c. Collectively, these tendencies spotlight Malaysia’s resilience amid reviews of a Chinese language financial slowdown, as slower commerce with China has not had a direct, proportional impression on Malaysian commerce outcomes.

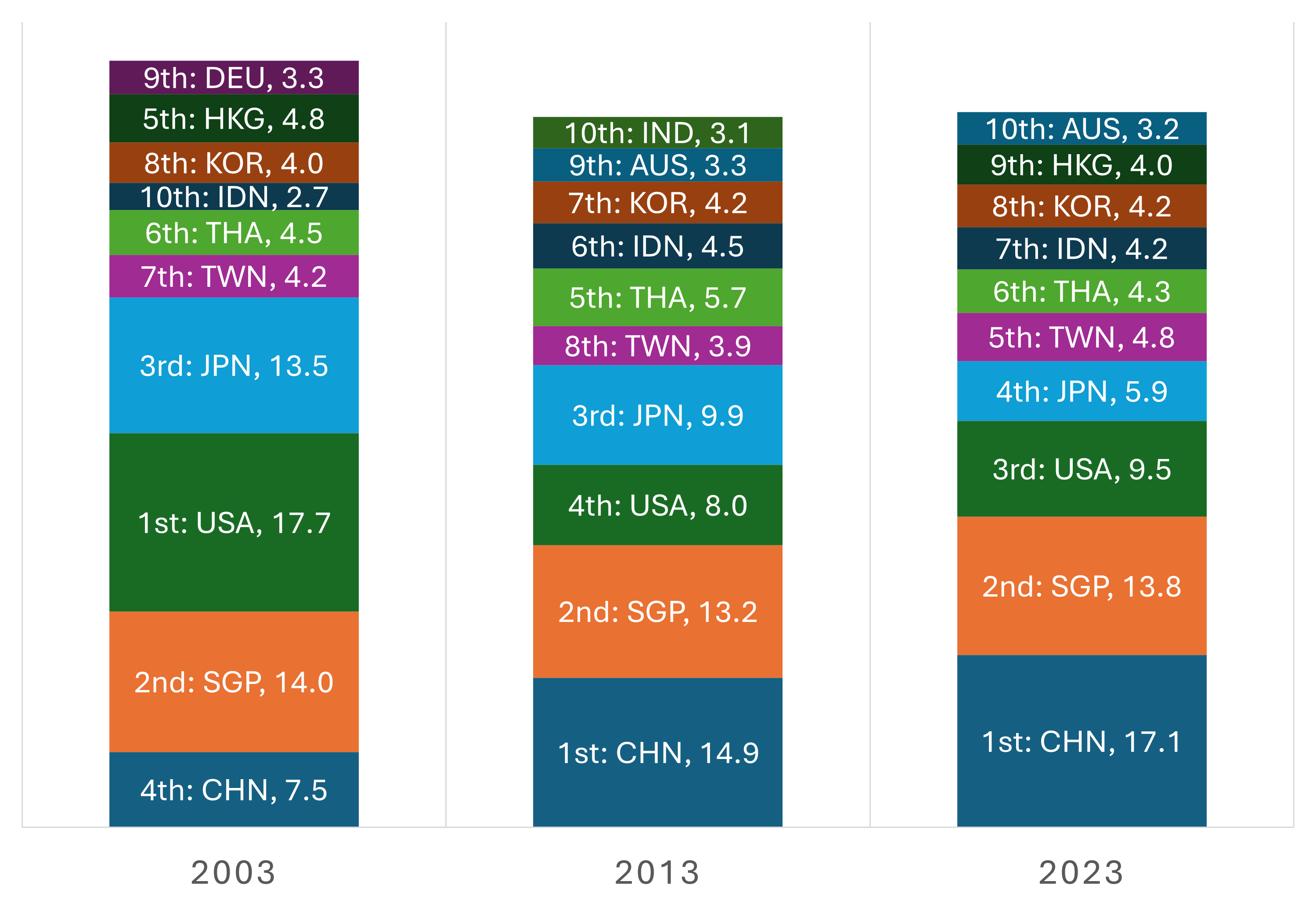

Trying additional again, Malaysia’s commerce has diversified. China’s function in Malaysia’s commerce has grown since 2003, however as we speak’s general commerce focus is decrease than 20 years in the past (Fig. 2). For one, China’s present commerce share is beneath that of the USA again in 2003, when the latter was Malaysia’s prime buying and selling associate. Moreover, Malaysia’s 5 largest buying and selling companions now account for 51 p.c of complete commerce, down from 58 p.c in 2003.

Determine 2: Malaysia’s prime 10 buying and selling companions and their relative share of complete Malaysian commerce (%), 2003-2023. Supply: Creator’s calculations primarily based on U.N. Comtrade (2024). Three-digit nation codes mirror ISO 3166 requirements.

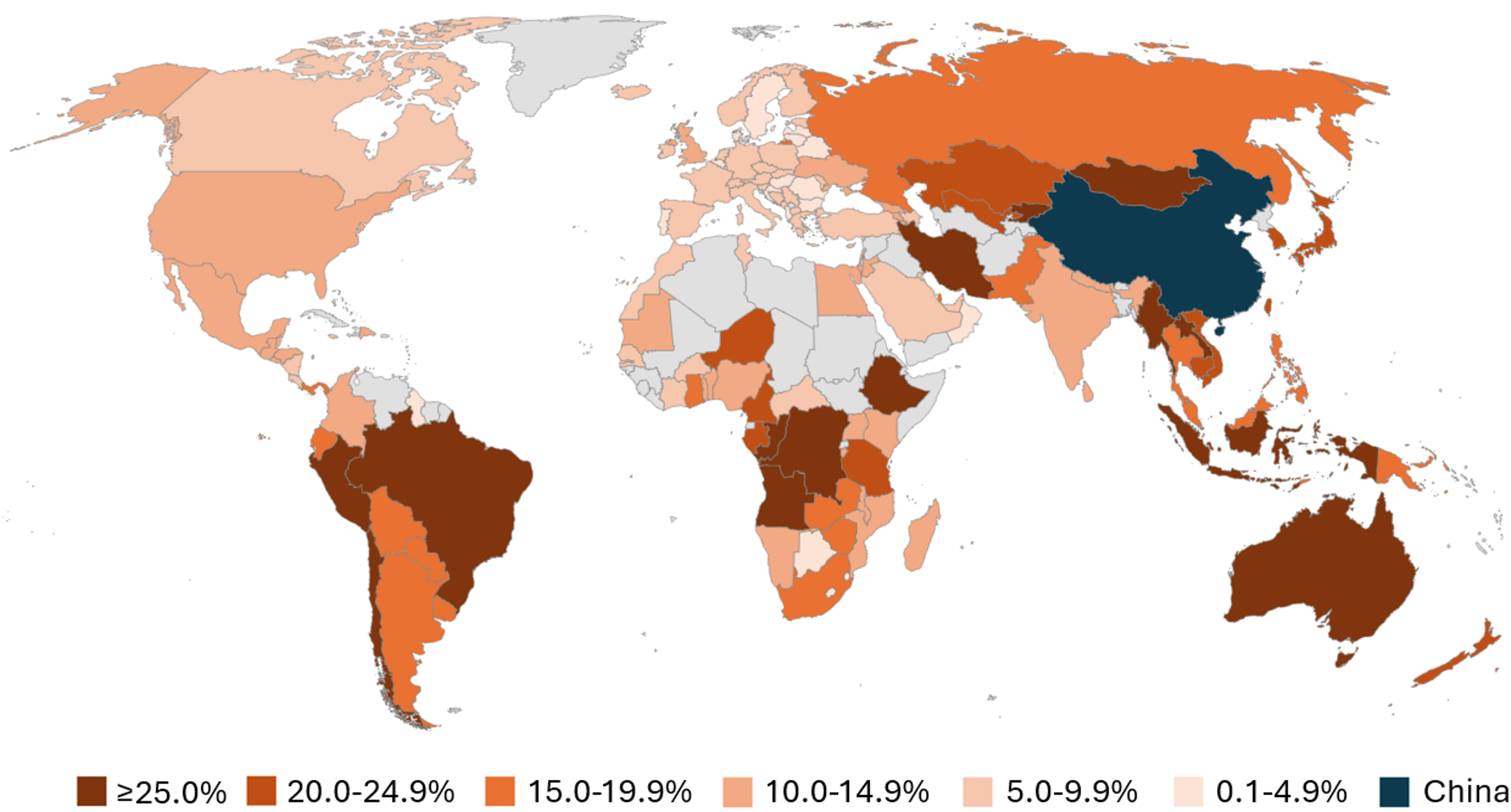

Malaysia’s commerce depth with China is near ASEAN’s common of 16 p.c, and nicely inside one normal deviation of the worldwide common of 13 p.c. Primarily based on knowledge sourced from the U.N. Comtrade database, 40 different economies, together with Australia (29 p.c), Indonesia (25 p.c), Japan (20 p.c) and South Korea (22 p.c), have a considerably larger commerce reliance on China (Fig. 3), however issues over perceived financial alignment with Beijing not often lengthen to those instances.

Determine 3: Nations by relative share of commerce with China (%), 2023. Supply: Creator’s calculations primarily based on U.N. Comtrade (2024)

Sectors and Sensibilities

The argument that Malaysia is overdependent on commerce with China is even much less compelling on the sectoral degree, as some industries work together extra with Chinese language corporations than others.

In keeping with U.N. Comtrade knowledge, Malaysia’s six largest business/commodity sectors by commerce worth in 2023 are electrical equipment and gear (33 p.c of complete Malaysian commerce), mineral fuels (18 p.c), equipment and mechanical home equipment (9 p.c), scientific devices (4 p.c), fat and oils (3 p.c), and plastics (3 p.c).

China is Malaysia’s largest buying and selling associate in solely three of those six sectors, with various commerce intensities. For plastics, China is the first import supply, accounting for 1 / 4 of sectoral commerce, over twice that of the following associate, Singapore at 11 p.c. In equipment and mechanical home equipment, 22 p.c of commerce includes China, with Singapore second at 15 p.c. For electrical equipment and gear, China leads at 19 p.c, however Singapore (16 p.c) and the U.S. (14 p.c) comply with carefully, exhibiting no important overreliance on China on this strategic sector.

Within the three different sectors – mineral fuels (primarily petroleum), fat and oils (principally palm oil), and scientific devices – China’s commerce footprint is smaller. For fuels, China ranks fourth (9 p.c), at half the worth of Malaysia-Singapore commerce. In fat and oils, Malaysia exports extra to India than to China. For scientific devices, the U.S. ranks first (22 p.c), with China second (14 p.c).

This sectoral breakdown exhibits minimal proof of an unhealthy commerce dependence on China. Whereas claims of overreliance are sometimes imprecise, the information largely means that Malaysia has averted placing all its eggs within the Chinese language basket because of a various mixture of companions and merchandise. China’s primacy is noticed solely in plastics, a sector affected by international issues over Chinese language overcapacity, a problem Malaysia is trying to handle by commerce treatments, as mentioned beneath.

Past Commerce

Claims of “overdependence” additionally lengthen into areas past commerce like FDI. Issues revolve round China’s stake in Malaysian infrastructure initiatives by the Belt and Street Initiative (BRI). This line of argument is two-fold: first, that China is Malaysia’s largest investor; and second, that BRI-linked FDI perpetuates “debt-trap diplomacy” amongst associate nations like Malaysia.

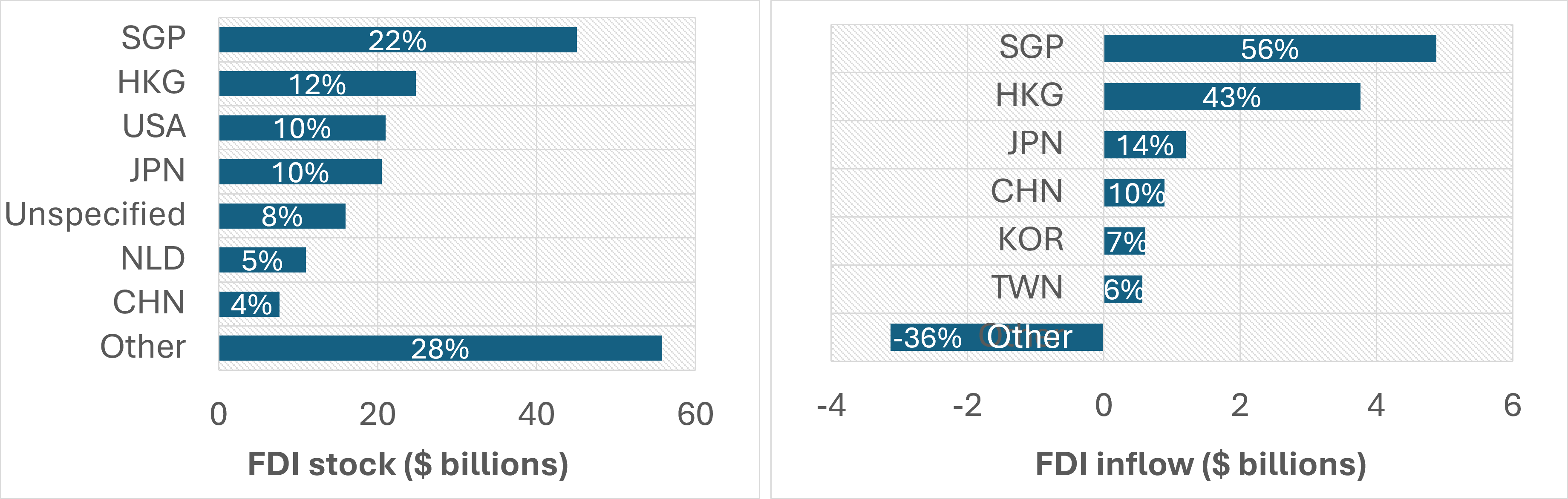

These claims don’t align with the information. China just isn’t Malaysia’s principal supply of FDI. As of 2023, China’s FDI inventory in Malaysia was $7.6 billion, lower than 4 p.c of the whole, nicely behind Singapore, the U.S., and Japan (Fig. 4a). China’s annual FDI inflows to Malaysia in the meantime quantity to simply $900 million for a similar yr, in comparison with the nationwide complete of $8.8 billion (Fig. 4b). Briefly, Chinese language funding constitutes a modest a part of Malaysia’s FDI portfolio.

Figures 4(a) and (b): Malaysia’s FDI inventory (left) and inflows (proper) by supply nation and share ($ billions), 2023. Supply: ASEANstats (2024)

Moreover, Malaysia’s exterior debt owed to China is minimal, estimated at 0.2 p.c of GDP in 2017. Evaluation of AidData’s 2023 World Chinese language Growth Finance dataset additionally signifies that almost all of Chinese language initiatives in Malaysia contain personal gamers or government-linked companies (GLCs) motivated by business issues.

Corroborating this, a Chatham Home report finds no proof of Chinese language geoeconomic maneuvering by the BRI. Certainly, Malaysia initiated most BRI initiatives and has renegotiated some to go well with altering home priorities, as with the $16 billion East Coast Rail Hyperlink. Essentially, this signifies Malaysian company in attempting to maximise the BRI’s advantages per home pursuits relatively than any undue affect from Beijing.

Lastly, the “debt-trap” narrative presupposes that Chinese language funding is inherently problematic. Removed from it, final yr’s accredited Chinese language FDI alone is predicted to create over 10,000 new jobs for Malaysians within the years to return, in keeping with the Malaysian Funding Growth Authority. As well as, the Worldwide Financial Fund judged the nation’s exterior debt to be “manageable” in its March 2024 macroeconomic evaluation, countering the debt-trap issues.

Company in Motion

The overdependence camp additionally claims repeatedly that Malaysia is “too deferential” to China, which overlooks Malaysia’s use of commerce treatments and safeguards in keeping with the multilateral rules-based order. As of the top of 2023, Malaysia had extra antidumping measures in place towards China than towards another nation, primarily duties on sure metal merchandise, per recurring issues about Chinese language overcapacity. In August 2024, Malaysia’s Ministry of Funding, Commerce, and Trade opened a probe into plastic imports from China and Indonesia over alleged dumping. Any accusation that Malaysia kowtows to Chinese language financial pursuits subsequently ignores Malaysia’s company in prioritizing nationwide pursuits when these are at odds with Chinese language actions.

Company extends to Malaysia’s pragmatic pursuit of broad international financial partnerships. Relations with China don’t preclude engagements with different nations, as seen in Malaysia’s participation in financial frameworks such because the Complete and Progressive Settlement for Trans-Pacific Partnership (CPTPP) and the U.S.-led Indo-Pacific Financial Framework, which don’t contain China. Equally, Malaysia’s acceptance of BRI doesn’t impede its assist for different initiatives, just like the European Union’s World Gateway. The $16 billion Lumut Maritime Industrial Metropolis venture, as an illustration, is predicted to profit from EU funding. With the U.S., Malaysia has a memorandum of cooperation on semiconductor provide chain resilience, bolstered by its standing because the largest supply of American semiconductor imports.

Company can be mirrored in intensified efforts to diversify commerce by larger South-South cooperation, past Malaysia’s headline-grabbing BRICS membership utility. For instance, Malaysia has formalized a bilateral Joint Commerce Committee with Brazil, agreeing to strengthen semiconductor and vitality collaboration. With India, relations had been upgraded in August to a complete strategic partnership, encompassing larger authorities and enterprise engagement. Furthermore, because the upcoming ASEAN chair, Malaysia has additionally highlighted its curiosity in championing progress in intra-ASEAN commerce.

Malaysia’s implicit geoeconomic technique subsequently demonstrates a balanced strategy, avoiding alignment with any single energy, whether or not China or the U.S.

The Overdependence Delusion

On the finish of the day, reviews of Malaysia’s overdependence on China have been tremendously exaggerated. Obscure and poorly outlined, these claims unravel upon shut examination of bilateral and multilateral commerce and funding knowledge. Relatedly, there’s a flawed tendency to misconstrue Malaysia’s robust ties with China as an unbridled embrace of Beijing, which is perceived to return on the expense of Washington or Brussels. This reasoning overlooks the financial cooperation that Putrajaya has established with myriad international companions. It additionally fails to acknowledge Malaysia’s company in safeguarding its financial pursuits.

In the end, Malaysia’s strategic positioning transcends simplistic zero-sum narratives, showcasing its capacity to interact China with out pivoting away from both the West or the remaining. As a substitute, it displays the geoeconomic realities of a extremely open economic system navigating a fancy, interconnected world.