Picture supply: Getty Pictures

In comparison with abroad equities, the returns on UK shares have broadly underwhelmed over the previous decade. A mix of low financial development and excessive political turbulence have restricted share value positive aspects as buyers have prioritised shopping for international shares.

But there have been some spectacular performances from specific British shares over this time. Take these two FTSE 100 blue-chips, as an illustration:

| Inventory | Common annual return since 2014 |

|---|---|

| JD Sports activities (LSE:JD.) | 17.5% |

| Scottish Mortgage Funding Belief (LSE:SMT) | 14.9% |

To place their sturdy performances into context, the annual returns of FTSE 100 and S&P 500 over the identical timeframe sit approach again, at 6.1% and 12.7%, respectively.

I’m optimistic that they might proceed to outperform these heavyweight indexes for the following decade too. Right here’s why.

Tech belief

Surging demand for tech shares has underpinned the S&P‘s sturdy positive aspects of the previous decade. So it’s not robust to see why Scottish Mortgage Funding Belief — which offers focused publicity to on-line retailers, software program builders and the like — has delivered superior returns.

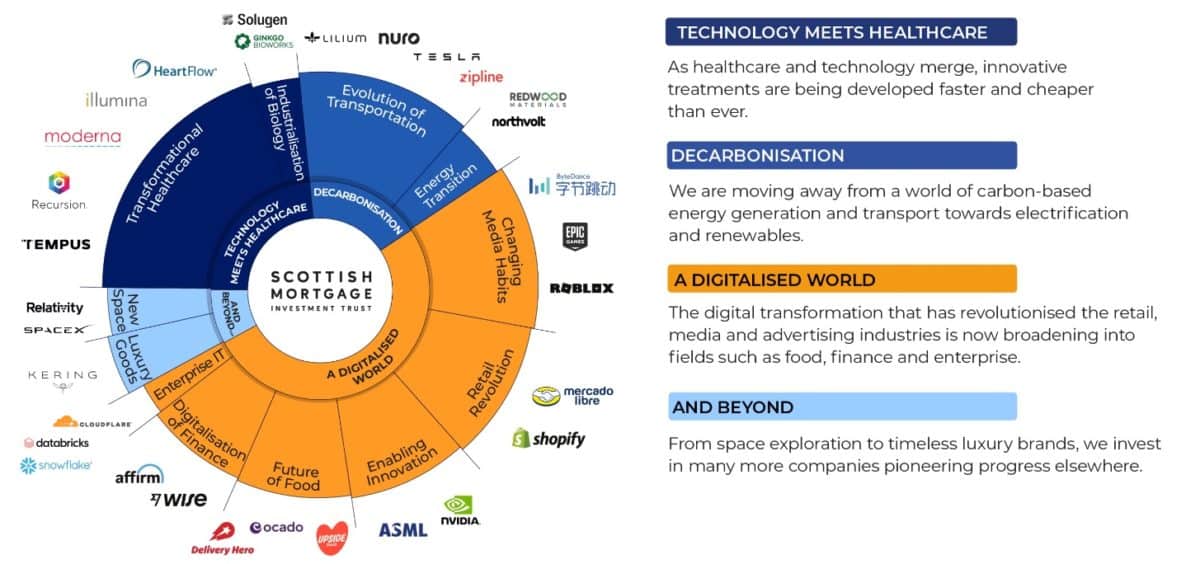

Holdings like Amazon, Tesla and Apple imply the belief has capitalised on sizzling developments like e-commerce development, electrical automobile (EV) adoption and hovering smartphone gross sales. At the moment it has stakes in 95 totally different corporations, giving it publicity to a mess of white-hot development sectors for the following decade.

All this being mentioned, the dangers of proudly owning Scottish Mortgage are rising. I’m frightened that an escalating tech commerce struggle between the US and China may dampen annual returns over the following 10 years.

In December, the US slapped contemporary restrictions on superior microchip shipments to China. Inside days, Beijing mentioned it was investigating Nvidia on the grounds of breaking native anti-monopoly legal guidelines.

These tit-for-tat actions may intensify additional as soon as tariff fan and China critic Donald Trump returns to the White Home this month. However regardless of this, there’s a very good likelihood for my part that Scottish Mortgage will ship one other decade of market-beating returns.

International digitalisation is poised to proceed at speedy tempo, offering the belief with terrific revenue potential. Fields like synthetic intelligence (AI) and robotics particularly have vital scope for development.

Sports activities star

JD Sports activities had a poor 2024 as inflationary pressures and better rates of interest squeezed client spending. These stay risks throughout the sportswear retailer’s US, UK and European markets within the New 12 months and probably past.

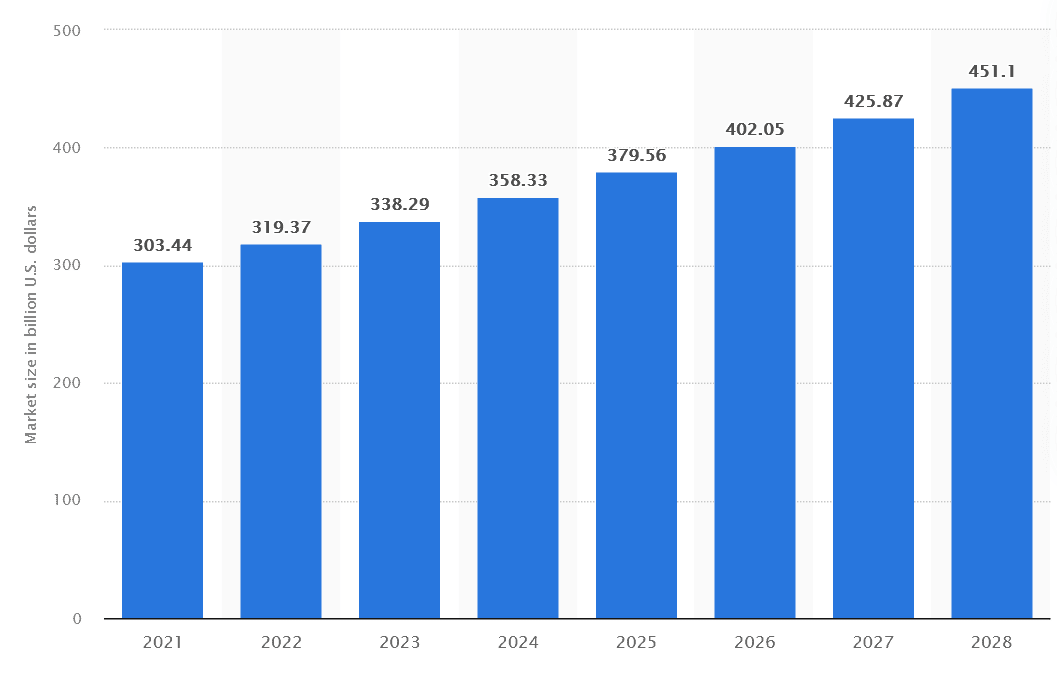

However as with Scottish Mortgage, I believe the potential long-term rewards right here make it worthy of consideration. The worldwide activewear (or athleisure) market is tipped to proceed taking off, because the chart from Statista beneath reveals.

As we noticed over the last decade, JD ought to be in good condition to capitalise on this chance. Underneath its long-running enlargement scheme, it plans to open between 250 and 350 shops annually by to round 2028.

A robust stability sheet additionally provides the Footsie agency scope to make extra earnings-boosting acquisitions. Its most up-to-date acquisition was France’s Courir, whose completion in December boosts JD’s presence in Europe’s largest sneaker market.

I additionally like JD’s main place within the premium athleisure market the place development is very sturdy. Given its low price-to-earnings (P/E) ratio of seven.5 occasions, I believe it has vital room for a share value restoration.