Yves right here. Beneath, Wolf Richter demonstrates how fabulously overvalued Tesla inventory is. Yours actually shouldn’t be a inventory jockey, however even permitting for that, I’ve issue pondering of any earlier case the place the valuation of a large-cap firm was held aloft primarily based mostly on the cult of character of its founder. Admittedly, a cohort of Tesla fairness patrons have lengthy been true believers; recall how Tesla inventory was very richly valued when there have been real questions as as to if it could ever turn out to be worthwhile.

A second attention-grabbing query is how a lot Musk’s political clout will fade when Tesla inventory value falls to extra practical ranges, which is sort of a great distance. Admittedly Musk’s possession of Twitter is now an enormous supply of his energy. However the widespread press likes to over-hype celebrities till their fortunes flip, after which pile on them. And Musk has a really skinny pores and skin. So a Musk reversal of fortune, regardless that he’s just about assured to stay comfortably a billionaire, could possibly be an attention-grabbing spectacle.

There’s additionally the associated of if and when recriminations will begin within the US as to why our carmakers are being so comprehensively shellacked within the EV market by Chinese language producers. Again within the late Seventies and Nineteen Eighties, the US enterprise press repeatedly and pointedly criticized the lack of US manufacturing prowess, then to Germany and Japan, with fingers pointed at sclerotic US executives. I see comparatively little of this kind of factor now. Apparently we now have the most effective of all attainable elites.

Admittedly, US automobile patrons will probably be shielded from that actuality of the prevalence of China’s EVs so long as attainable by tariffs and different import restrictions. However there’s a surprising failure to acknowledge that higher-than-necessary transportation prices translate into uncompetitive labor prices. This impact is admittedly not anyplace as pronounced as for housing. Word that Germany acknowledged that challenge explicitly, selling (till lately) reasonably priced rental prices and robust tenant rights in order that renters might and infrequently did keep in the identical flat for many years. The US appears to have misplaced the plot, that our rentier capitalism, with excessive housing, healthcare prices, increased training, and now automobile prices, can’t turn out to be aggressive until these are introduced beneath management. With the acute bloat in these classes, and the business incumbents wielding nice political energy, I’m not holding my breath.

By Wolf Richter, editor at Wolf Avenue. Initially printed at Wolf Avenue

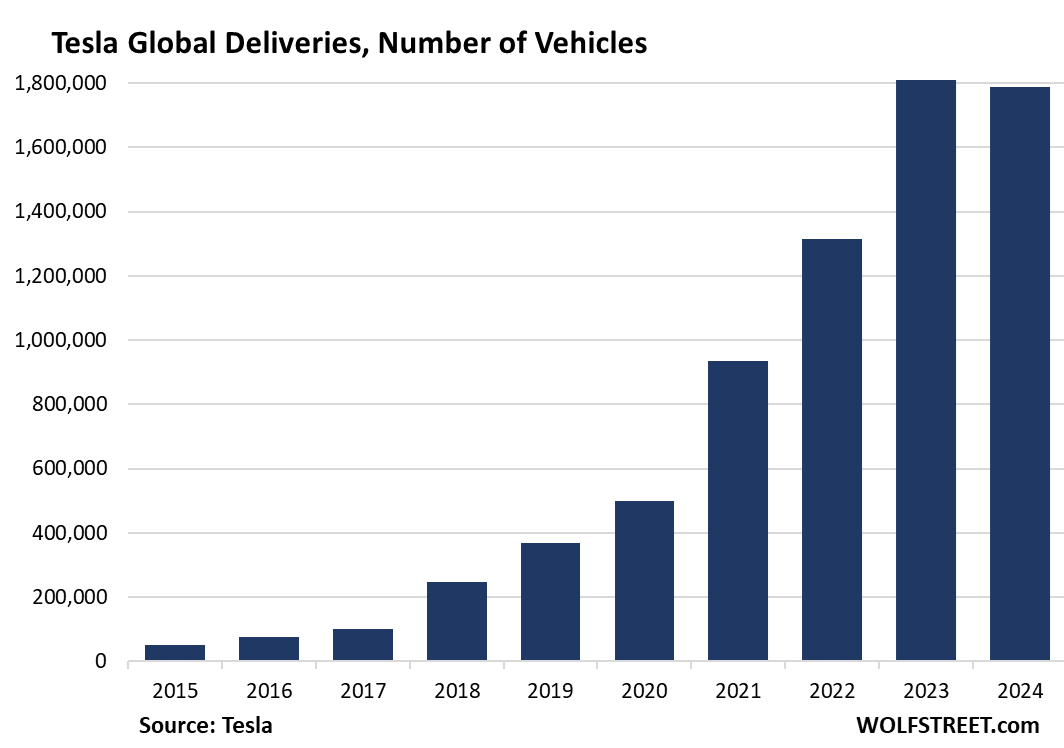

Tesla reported right this moment that international deliveries for the entire yr 2024 fell by 1.1% to 1.789 million autos, as is This autumn deliveries ticked up solely 2.3% year-over-year to 495,570, a brand new file by a hair. And the expansion story is over.

However Tesla’s EV opponents are making hay within the quickly rising EV market. Tesla’s largest EV competitor, China’s BYD, introduced that deliveries of its battery-electric autos in 2024 jumped by 12%, to 1.764 million EVs. In This autumn, it delivered 595,413 EVs, up by 13.1% year-over-year, outpacing Tesla’s This autumn deliveries by 100,000 autos or by 20%!

Different Chinese language EV makers, whose names are acquainted within the US as a result of their shares/ADRs are traded within the US markets, introduced huge positive factors in EV gross sales in 2024, together with:

Li Auto Inc. [LI], annual gross sales: +33% to 500,508 EVs; Nio [NIO], annual gross sales: +39% to 221,970 EVs; and Xpeng [XPEV], annual gross sales: +34% to 190,068 EVs.

Even US legacy automakers GM and Ford have been reporting huge will increase of their battery-electric EV gross sales within the US in 2024 via Q3 (This autumn deliveries will probably be introduced over the following days):

- Ford EV gross sales in 2024 via Q3, within the US: +45% to 67,689 EVs

- GM EV gross sales in 2024 via Q3, within the US: +24% to 70,450 EVs

GM killed its widespread Bolt and Bolt EUV in 2023 however got here out with a bunch of recent fashions that only recently have hit vendor tons. So in Q3, GM’s EV gross sales jumped by 60% year-over-year.

So this decline at Tesla in 2024 is an indication of bother at Tesla – is Musk the largest downside there now? – whereas total EV gross sales proceed to develop at a fast tempo, at the same time as ICE automobile gross sales have stalled at low ranges.

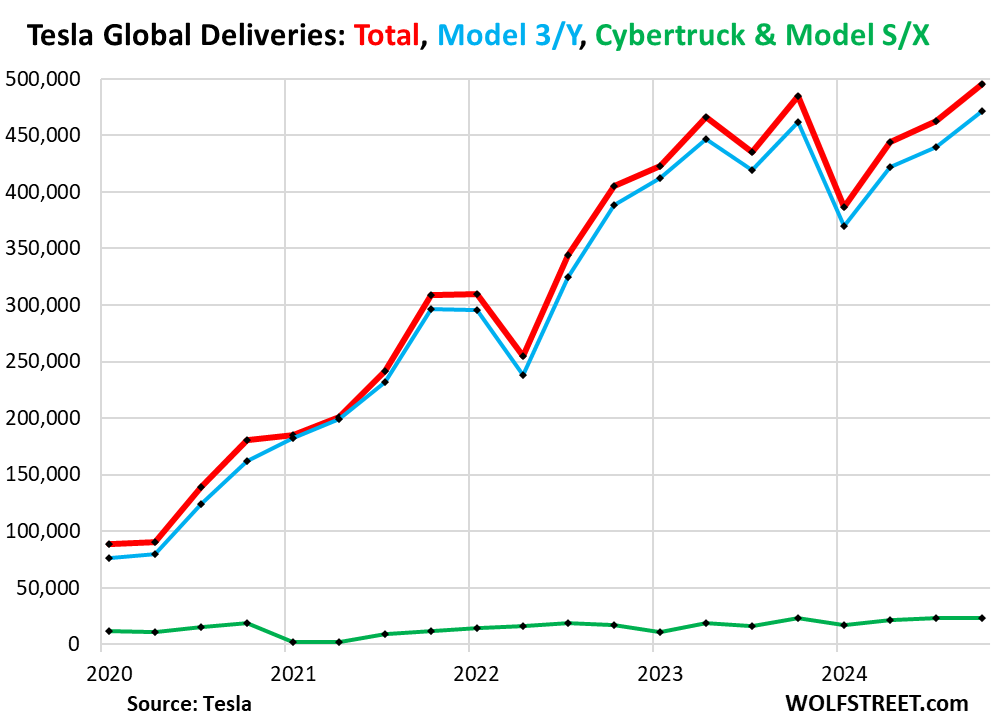

For This autumn, Tesla’s deliveries eked out a file at 495,570 autos, simply 2.3% above This autumn 2023 (pink within the chart under), together with:

- Mannequin Y and Mannequin 3: 471,930 (+2.3% year-over-year, blue)

- Cybertruck, Mannequin S, and Mannequin X: simply 23,640 (+2.9% year-over-year, inexperienced).

The Cybertruck had been the good hoopla-hope-promise, and it has been in manufacturing for a full yr, however deliveries are apparently rising at a modest tempo:

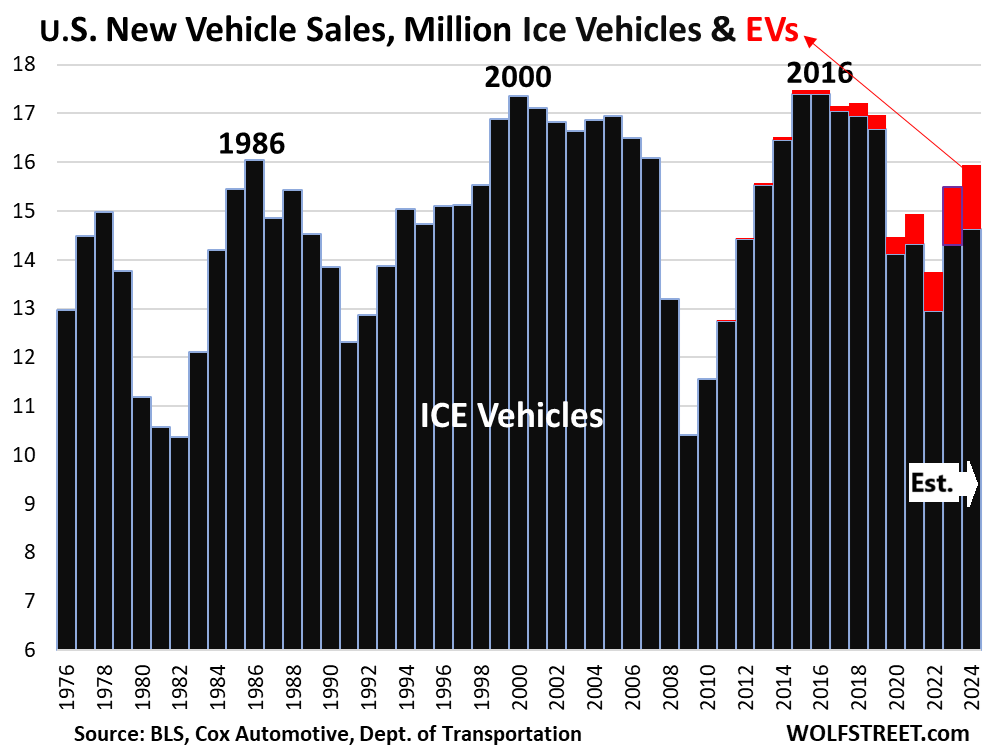

The opposite automakers will report their US supply figures over the following few days. So whereas we wait, let’s assume that EV gross sales grew by solely 10% within the US in 2024, dragged down by Tesla, after having grown by 46% in 2023. Then whole EV gross sales would exceed 1.3 million (EV = pink segments), whereas ICE automobile gross sales, together with hybrids, would are available in at about 14.6 million (ICE = black columns). And Tesla’s function within the EV section, whereas nonetheless massive, is diminishing quickly, as different EV fashions surge:

So How A lot Ought to Tesla Be Value?

With stagnating automobile gross sales, shedding market share, getting handed by a Chinese language competitor (BYD), as different opponents catch up, Tesla is now in the identical place as Ford and GM, that commerce at P/E ratios between the one digits and possibly 15.

P/E ratios at present:

- Ford: 11.1

- GM: 5.5

- Stellantis: 2.7

- Honda: 7.3

- Toyota: 9.6

- Tesla: 103.2

These legacy automakers with their low P/E ratios should not good offers. They’re not undervalued. That’s the place automaker shares are – and for a great purpose.

The auto business within the US, as you’ll be able to see from the chart above, has been a no-growth business for many years, interrupted by huge plunges, bankruptcies, and bailouts. Related dynamics performed out in Europe, Japan, and different developed markets.

Solely rampant value will increase and going ceaselessly upscale have allowed automakers to extend their dollar-revenues, at the same time as unit gross sales stagnated and fell. In reality, as a result of they saved pushing up costs of their fashions to extend their revenue margins and {dollars} gross sales, their unit gross sales have fallen as a result of their fashions have gotten too costly.

Tesla remains to be hyping a whole lot of stuff that it’s going to blow your socks off with, prefer it used to hype the Cybertruck, the Semi, and all the opposite issues. The largest two hype-and-hoopla components at present are AI and a robotaxi that doesn’t exist but.

So OK, let’s give Tesla’s hype and hoopla the advantage of the doubt, and say that as Ford trades at a P/E ratio of 11.1, Toyota at 9.6, Honda at 7.3, and GM at 5.5, then Tesla ought to fairly commerce at a P/E ratio of as much as 15 possibly, to be valued for actuality. So divide Tesla’s present share value of $378 by about 7, to get a share value of $54, at which level it could commerce with at a P/E ratio of about 15, nonetheless far increased than the key automakers within the US. It nonetheless could be comparatively excessive for an automaker.

I’m clearly simply kidding. Wall Avenue doesn’t care about actuality or P/E ratios. Wall Avenue sells hype and hoopla, and Musk has lengthy identified this, and has completely performed this recreation, which allowed him to fund and construct the corporate, and its success up to now. That was an enormous accomplishment.

As Tesla grew to become a worthwhile international automaker that now sits on $33 billion in money, it shook up the legacy automakers, compelled the complete business to take a position large quantities in creating and manufacturing EVs and batteries for EVs, a lot of them within the US, which has entailed a growth in manufacturing facility building within the US, and so on. and so on. So this was all good and really onerous to do, and Tesla managed to do it.

However now Tesla is simply one other mid-sized automaker with stagnating automobile gross sales amid EV opponents which might be consuming its lunch. So it ought to commerce like an automaker.