In 2022, it was a foul yr for the markets.

On the time I wrote about the way it was possibly one of many worst years ever when you think about bonds had a bear market similtaneously shares.

Final yr I wrote about how 2023 was a good yr which was good as a result of generally dangerous years are adopted by dangerous years.

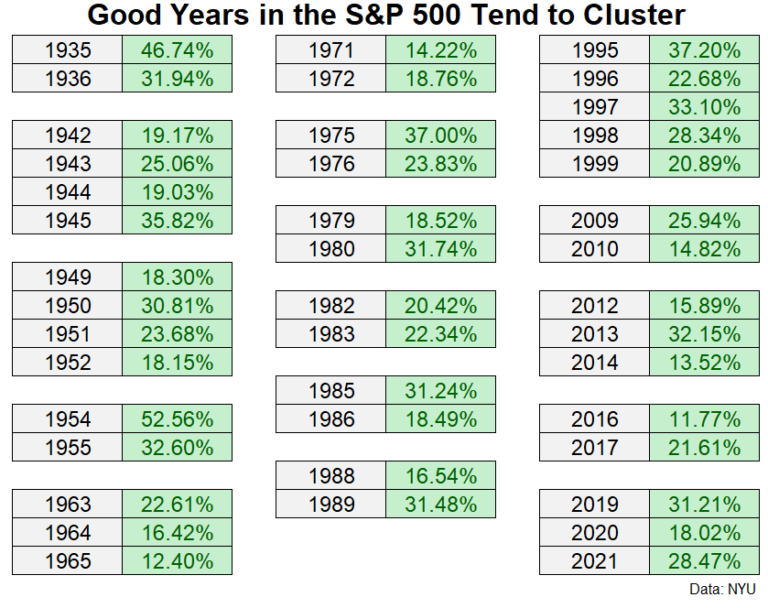

I adopted that up writing about how good years within the markets are inclined to cluster:

Properly, the S&P 500 was up 25% in 2024. It occurred once more.

I’m not taking a victory lap right here. I wasn’t making a prediction that 2024 can be one other nice yr. I used to be merely utilizing historical past as a information to point out how momentum tends to work within the inventory market.

So now we’re taking a look at back-to-back years of 25%+ features for the S&P 500 (+26% in 2023 and +25% in 2024).

A number of weeks in the past I famous how uncommon that is:

Since 1928 there have solely been three different situations of 25%+ returns in back-to-back years:

-

- 1935 (+47%) and 1936 (+32%)

- 1954 (+53%) and 1955 (+33%)

- 1997 (+33%) and 1998 (+28%)

So what occurred subsequent?

One thing for everybody:

-

- 1937: -35%

- 1956: +7%

- 1999: +21%

Horrible, respectable and nice. Not useful.

I suppose we could possibly be establishing for an additional late-Nineteen Nineties increase time the place 20% features yearly have been the norm however we’ve already been on a improbable run within the U.S. inventory market.

Not so for the mounted revenue aspect of the ledger. The Bloomberg Mixture Bond Index was up slightly greater than 1% in 2024.1 That will imply a U.S.-centric 60/40 portfolio was up slightly greater than 15% final yr.

Some would say this reveals diversification is useless or doesn’t work anymore. I might say this proves diversification works as meant. Bonds have carried out poorly in recent times however the inventory market has picked up the slack. That’s how diversification is meant to work.

There’ll come a time within the years forward when the inventory market struggles and bonds do the heavy lifting.

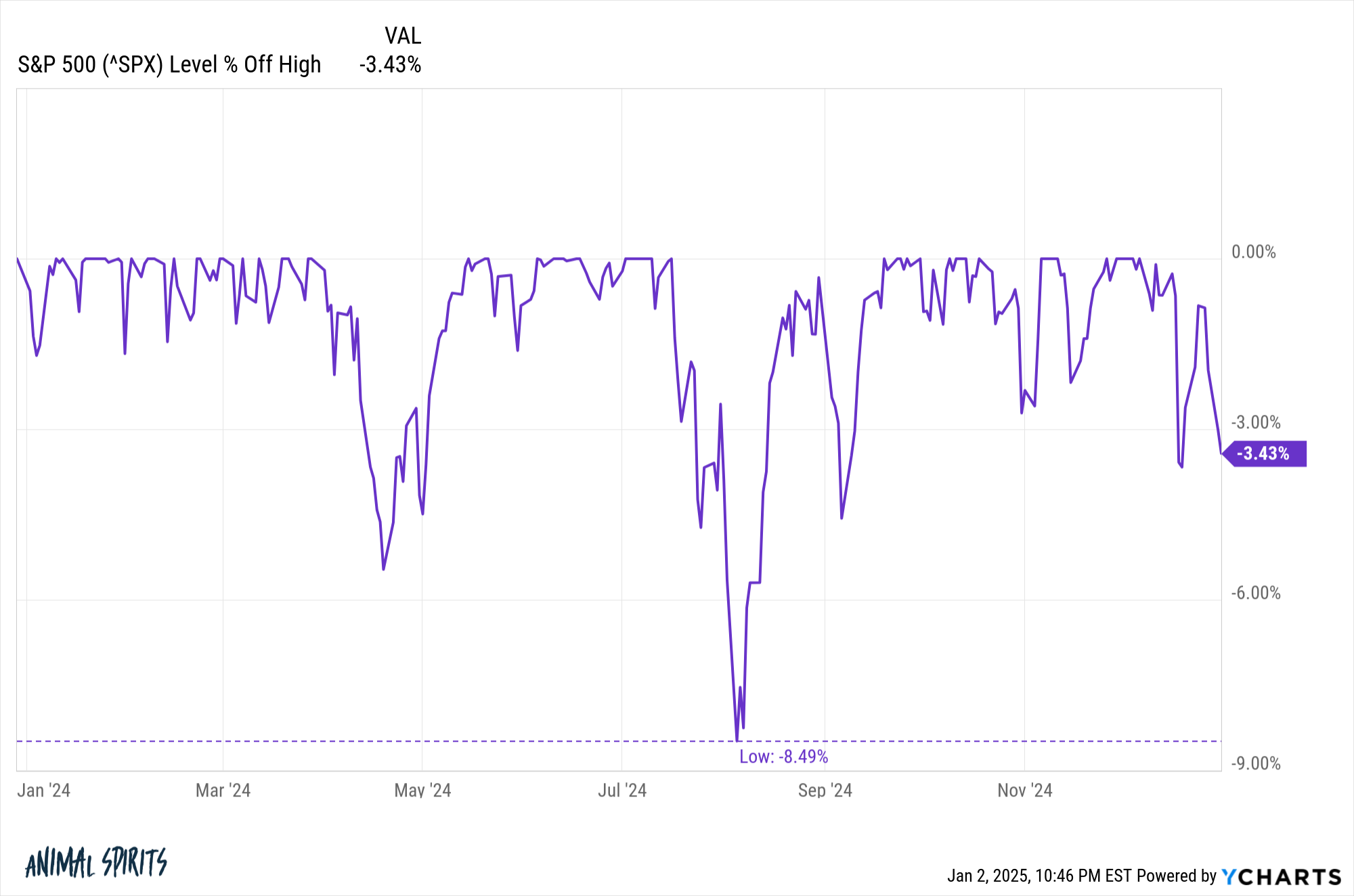

The inventory market additionally made it by the yr with out triggering a double-digit correction, one thing that has occurred in two-thirds of all years going again to the late-Twenties:

One of many causes it was a great yr for the inventory market is as a result of it was a great yr for the financial system.

The U.S. inflation fee averaged 3% for the yr. The unemployment fee got here in at a mean of 4% in 2024. Actual GDP development was roughly 3% annualized within the 2nd and third quarters.

2024 was an exquisite yr for shares and the financial system.

It gained’t at all times be like this however it’s good to understand the nice instances whereas they’re right here.

One of many causes we get to take pleasure in good instances available in the market is as a result of they’re invariably adopted by dangerous instances.

The excellent news is the nice instances greater than make up for the dangerous instances.

Micheal and I talked in regards to the yr that was within the inventory market and extra on the newest Animal Spirits this week (sorry no video due to the vacations):

Additional Studying:

30% Up Years within the Inventory Market

Now right here’s what I’ve been studying recently:

Books:

1The saving grace this yr was larger yields. The worth returns have been truly unfavorable.

This content material, which comprises security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here shall be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.