Do you need to create a wise technique on your firm’s IPO, however you have got choices and shares and RSUs, you don’t know the way they match collectively, and all of it simply appears irreducibly advanced?

Perhaps a case research will probably be useful, as an example how one lady got here up with a great resolution for her particular life and fairness particulars. My consumer, let’s name her Mia, has labored for an organization, let’s name it FinTech, Inc., for 5 years. Earlier this 12 months, it went public. Collectively we created a technique that she has partly executed to date.

We abided by these priorities when creating the technique for Mia. That is doubtless a wholesome start line for you, too.

- Outline what this cash is for in her life (i.e., outline her important targets; what does she have to really feel protected, to really feel fulfilled).

- Promote sufficient firm inventory to totally fund these targets.

- Reduce taxes whereas doing this.

- Take into account holding firm inventory solely to the extent she doesn’t want the cash for a vital objective.

To ensure you are actually understanding the which means of “priorities” right here: minimizing taxes is much less necessary than promoting firm inventory to fund her targets. Sure, she would possibly some tax-inefficient selections alongside the way in which!

Begin with the Most Essential Factor: What Is This Cash for?

Some folks have already got a listing of issues and experiences they need to spend cash on: shopping for a home, funding a child’s faculty financial savings account, doing a transform, taking a sabbatical, and so forth. These folks ought to deal with getting sufficient cash out of firm inventory and into money or a diversified portfolio ASAP, invested in a manner and in an quantity that’s acceptable for these targets.

Clearly outlined targets make this a part of the sport fairly straightforward. In my expertise, it’s very easy to persuade somebody to promote their firm inventory in the event that they get a home out of it, or a sabbatical, or one thing that’s personally significant to them. Convincing them to promote their inventory after they don’t have any well-defined want for it…nicely, it’s much less convincing.

That is the scenario Mia was in. She has no such clearly outlined targets. She has extra of a “I need to have robust funds in order that I’ve extra alternative and suppleness sooner or later” perspective about cash.

In my world, that meant promoting a bunch of the corporate inventory (not essentially all of it, however a bunch) to place it in a sturdy money emergency fund and a diversified portfolio that will probably be much less risky sooner or later than a single inventory could be. Fortunately, Mia was amenable to that. She didn’t maintain any robust emotions concerning the inventory.

So, she had an overarching technique for her work with firm inventory: Get sufficient cash out of the corporate inventory to construct:

- A strong money cushion. (This gives near-term flexibility and safety.)

- A retirement portfolio large enough to present her a sturdy stage of economic independence. Not totally financially unbiased, however financially unbiased sufficient. She focused attaining “Coast FIRE” (having a large enough retirement portfolio that she wouldn’t want to avoid wasting any extra to it), assuming she’d retire16 years from now. (This gives long-term flexibility and safety.)

She might assign a greenback worth to every. In Mia’s case, she determined to make it:

- 1 12 months’s value of bills, in money ($100k)

- Taking a look at her current retirement portfolio, she wanted an extra $700k to be Coast FIRE.

She wanted $800k, after tax, out of this IPO. (Sure, these are each considerably arbitrary targets. But additionally affordable, a mix that characterizes many necessary monetary selections.)

Between the 2, Mia will now have far more freedom to make life and profession decisions that aren’t motivated primarily by “how do I make some huge cash?”

In case you’re doing this your self, write these targets down and put a greenback quantity subsequent to them. It’s remarkably useful, in my expertise, to have a visually clear record of the greenback goal and the “why.”

Guidelines of the IPO

FinTech, Inc. had a reasonably customary (for the trendy period) IPO setup:

- Double-trigger RSUs totally vested on IPO day.

- Staff couldn’t promote any shares till six months after IPO day (i.e., there was a six-month lockup). They might train choices however must maintain the shares after train).

- If the inventory value hit sure fascinating targets, there could be a mid-lockup, one-week-long buying and selling window.

- Throughout that restricted buying and selling window, staff might promote 25% of their whole possession as measured on IPO Day. We calculated that Mia “owned” 100,000 shares (between outright shares, vested choices, and RSUs vesting on IPO day). She was due to this fact allowed to promote 25,000 shares.

Technique within the Years Earlier than the IPO

In every year main as much as the hoped-for-but-we-don’t-really-know IPO, Mia exercised some ISOs. In case you have actually low cost choices, the higher boundary of this train ought to doubtless be the variety of ISOs you may train with out triggering Various Minimal Tax.

In Mia’s case, the train value was kinda dear ($10). So, Mia selected an sum of money that she felt good dropping completely (as a result of that’s what she risked by exercising choices in a non-public firm, particularly one with no particular plans for a liquidity occasion), and she or he exercised as many choices as that may purchase. Seems, that was all the time beneath the AMT threshold. She ended up exercising solely a small fraction of her ISOs by the point the IPO rolled round.

(By the way in which, regardless of the potential tax awesomeness of exercising ISOs early, it was affordable for Mia to train so few ISOs. Any cash you set into exercising private-company choices is cash you threat dropping all of. It’s, in truth, completely rational to delay exercising all choices till you can even promote the ensuing shares. Though it limits your upside (as a result of your tax fee will probably be increased), it eliminates your draw back.

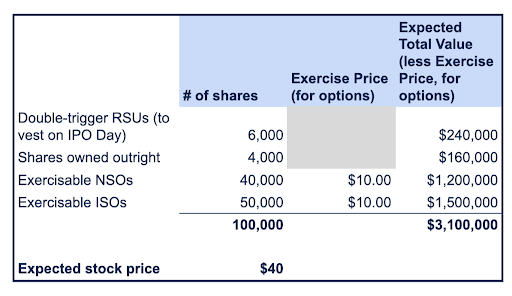

Going into the IPO, she had:

Principally, she had each sort of fairness comp you may think about. How ought to she make the perfect selections throughout your complete suite of fairness comp, not only for one sort at a time?

Technique Proper Earlier than the IPO: Select RSU Withholding

Main as much as the IPO, Mia had one huge determination to make: When her RSUs vested on IPO day, she might default into the statutory 22% withholding fee for federal earnings taxes on the RSU worth, or she might select to withhold 37%.

Regardless that Mia didn’t have a lot in the way in which of RSU shares—which meant that this alternative didn’t contain plenty of {dollars}—she selected to have 37% withheld. Why?

- This diminished her “focus threat” sooner. We had no concept what was going to occur to the inventory value earlier than she’d be capable of promote any shares. If the inventory listed at $50 and dropped to $20, she would have successfully “bought” at that increased $50. Yay! Even when the inventory value ended up rising, she not less than didn’t have to fret about it within the meantime.

- Regardless that her RSU earnings wasn’t going to be huge this 12 months (meriting the very best tax-bracket withholding), she had plans for exercising NSOs, and that would make her earnings excessive (and due to this fact tax fee excessive) this 12 months.

Technique In the course of the Lockup and Proper After: Flip Firm Inventory into Money ASAP

After IPO Day, when the foundations have been in place and we had some sense of the inventory value after the corporate went public, that’s when many of the strategery might usefully occur.

RSUs that Vested on IPO Day

When the particular, restricted buying and selling window opened up in the course of lockup, she needed to diversify (begin promoting).

As a result of Mia’s RSUs have been “double set off,” (which is the norm for private-company RSUs), all of Mia’s 6000 time-vested RSUs had totally vested on IPO Day. Virtually 50% of the RSUs have been withheld (between state earnings tax and 37% federal tax), so Mia then owned 3000 shares from that vesting.

Main as much as the restricted buying and selling window, she didn’t know precisely what she was going to do with these shares. We made this plan:

- If the corporate inventory rose in value for the reason that IPO, she’d preserve it, so she wouldn’t pay the upper short-term capital beneficial properties tax on that achieve, as she’d solely held the shares for a couple of months. We’d must promote extra of different sorts of shares to fill that 25,000.

- If the corporate inventory fell in value for the reason that IPO, we’d promote it. She wouldn’t incur any tax invoice (though wash gross sales would doubtless imply she couldn’t profit from that tax loss till future years). This might imply we’d promote fewer of the opposite sorts of shares to fill that 25,000.

Because it seems, the inventory value fell from IPO to restricted buying and selling window. It had IPOed at $40 and was right down to $30, so she bought these 3000 shares she had from IPO Day RSU vesting. These ended up being the tax-wise least expensive shares to promote…as a result of she bought them at a loss.

She had now bought 3000 of the permitted 25,000 shares.

Shares She Already Owned

Mia owned 4000 shares of firm inventory. She bought all of them throughout the restricted buying and selling window.

As a result of Mia had already owned these shares for not less than one 12 months, she would get the decrease, long-term capital beneficial properties tax fee when she bought them. These have been the second least expensive shares tax-wise to promote.

Had Mia had vital charitable intentions, she might need stored these shares to donate (as a substitute of money), as a result of that’s tax awesomeness.

One factor that didn’t apply to Mia however would possibly to you: In case you acquired the inventory early sufficient within the firm’s timeline, it may be Certified Small Enterprise Inventory (QSBS), which might eradicate most and even all federal capital beneficial properties tax on the achieve whenever you promote. So, earlier than you promote, ensure you know the inventory’s QSBS standing!

She had now bought 7000 of the permitted 25,000 shares.

Exercisable NSOs

To promote the remaining 18,000 of the permitted 25,000 shares, she appeared to her NSOs. Since you owe earnings tax (on the “unfold” between train value and honest market worth) the second you train, it prices some huge cash to train 18,000 NSOs ($10 x 18,000; plus taxes on the unfold). However as a result of she bought on the similar time (and she or he might put aside among the money proceeds to pay the taxes), Mia didn’t put any of her current wealth in danger.

You must know that there isn’t any good motive to train and maintain NSOs (in a public firm). So, when Mia exercised, it was assumed that she would additionally promote. Learn my favourite weblog put up on this matter.

We additionally took into consideration the thought of the “leverage” her choices offered (leverage = train value / honest market worth). NSO leverage isn’t a very intuitive idea (not less than, to not me!) but it surely boils right down to this: It could be foolish to train the choices at $10 if the honest market worth have been solely $11. You solely get, in a way, $1 of worth. That leverage is excessive ($10/$11 = 91%). It’s higher to attend till you get extra bang on your train buck.

In the course of the buying and selling window, nevertheless, the inventory value was $30, so leverage was 33% ($10/$30). Leverage beneath 40% makes it worthwhile, as a rule of thumb.

RSUs as They Vest, Now in a Public Firm

One of many difficult transitions when your organization goes from non-public to public is how your RSUs work. When your organization is non-public, often you haven’t any management over RSUs and do nothing. It’s simply Future Fantasy Cash. As soon as your organization is public, when these RSUs attain their vesting date…

- They instantly flip into inventory.

- They’re handled as taxable earnings.

- You’ll be able to promote them for precise {dollars}.

- You in all probability don’t have sufficient taxes withheld on the vest and can due to this fact find yourself with shock tax payments.

The greatest follow for RSUs, in public corporations, after they vest is: Promote ASAP. And that is what Mia is doing. Bear in mind, there isn’t any tax profit to holding RSU shares after they vest. No actually.

Bear in mind, so long as Mia stays an worker, she is going to proceed to get new inventory through RSUs vesting. So, regardless of the destiny of the corporate inventory, she is going to share in it through the worth of these RSUs upon vest, even when she have been to promote all the remainder of her inventory.

Exercisable ISOs

I contemplate ISOs essentially the most sophisticated of fairness comp sorts, so I depart it for final, each on this weblog put up, and in Mia’s technique basically.

ISOs have this superior tax remedy of not incurring tax at train so long as you keep beneath the Various Minimal Tax threshold. (Do not forget that that is in distinction to exercising NSOs; tax is all the time due whenever you train NSOs.) Additionally, so long as you maintain the inventory for not less than a 12 months after train, you’ll get the decrease long-term capital beneficial properties tax fee on the achieve whenever you ultimately promote.

Add on prime: That AMT threshold, basically, goes up the upper your abnormal earnings is. So, with the RSUs that vested at IPO and proceed to vest each quarter now that the corporate is public, and particularly with the train of NSOs, she now has a really excessive abnormal earnings this 12 months.

What does that imply for Mia’s ISO technique? It permits her to train (and maintain…to get the tax advantages) a bunch of ISOs with no tax invoice.

What number of? Welp, that is the place she introduced in her CPA and requested them to mannequin what number of ISOs Mia can train with out triggering AMT. Thanks, CPAs with equity-comp experience and a service mannequin that features an annual tax projection!

I nonetheless suggested Mia to solely train as many ISOs this 12 months as she might with out triggering AMT. Why?

- She doesn’t plan to depart the corporate within the close to future, so she ought to have future years wherein to proceed to train the ISOs. (After you allow an organization, your ISOs would possibly outright expire. But when they don’t, they will convert, by legislation, to NSOs after 90 days.)

- This retains her threat of dropping cash with the corporate inventory decrease. Certain, she’s placing that exercise-price cash in danger, however she’s not additionally placing tax cash in danger.

Sure, this can add to her assortment of firm inventory (in battle with our normal objective of lowering the focus). She is knowingly rising focus threat as a result of the potential tax advantages are so good. By itself, that doubtless wouldn’t be sufficient, however this is just one half of a bigger technique of promote, promote, promote.

I discover this little bit of psychological accounting useful: Mia isn’t placing any of her current wealth in danger. The cash she’s risking by exercising and holding ISOs is cash she received from promoting different FinTech, Inc. inventory.

[Side note: AMT is not to be avoided at all costs under all circumstances. There are situations in which exercising a bunch of ISOs and triggering AMT is a reasonable choice. If you pay AMT this year, you get an AMT credit and it’s possible to get that credit back in future years. That said, it still puts you at higher risk of loss. You’re spending more money to buy stock…whose price might then drop.]

Technique in 2026 and Past: She Can Be a Bit Extra Nuanced

Bear in mind our high-level technique:

Precedence #1 = Promote sufficient inventory to fund targets.

Precedence #2 = Reduce taxes.

What does this prioritization appear like in follow? In 12 months 1, promote promote promote. In Years 2+, as soon as she has funded her targets from these 12 months 1 gross sales, she will select to decelerate the gross sales and let tax concerns (or risk-taking) drive the bus extra usually.

What is going to she do together with her RSUs? Mia will proceed to promote them as they vest in 2026 and past, so long as she stays at FinTech, Inc. As a result of, to repeat the message, there isn’t any tax benefit in holding on to RSUs after they vest.

What is going to she do with the shares from exercised ISOs? These are solely shares she is going to maintain. She’s going to hold on to them for a full 12 months (to get the decrease tax fee on the beneficial properties) after which promote. If Mia develops a charitable plan within the meantime, these ISO shares (assuming the honest market worth is increased than their $10 price foundation) will doubtless be the issues she ought to donate to charity, not money.

What is going to she do together with her exercisable choices? Annually she begins the NSO/ISO dance once more:

- She workout routines (and sells) some NSOs (so long as leverage < 40%).

- If she desires to prioritize taxes over diversification, she might cut back the variety of NSOs she workout routines with the intention to preserve her earnings beneath a sure tax fee. (Her CPA will help her calculate simply what number of NSOs that’s.)

- Then she sees what number of ISOs she will train (and maintain) with out triggering AMT.

She now has far more flexibility in how she treats firm inventory:

- Hold extra: If she has an emotional connection to the inventory, or doesn’t need to promote the whole lot as a result of “what if?!”, then cool, let’s depart extra NSOs unexercised or let’s preserve some exercised ISO shares previous the one-year date.

- Hold much less/none: Statistically talking, any focus in a single inventory will increase your threat with no concomitant enhance in your reward. 100% diversification (i.e., getting out of all of her inventory) is her greatest probability of getting profitable long-term investing. This, by the way in which, is the place I stand. However I don’t impose this attitude on purchasers when their life targets don’t require it.

There’s extra element to the “2026 and past” technique, however I’m holding issues quick and easy right here for the sake of digestibility.

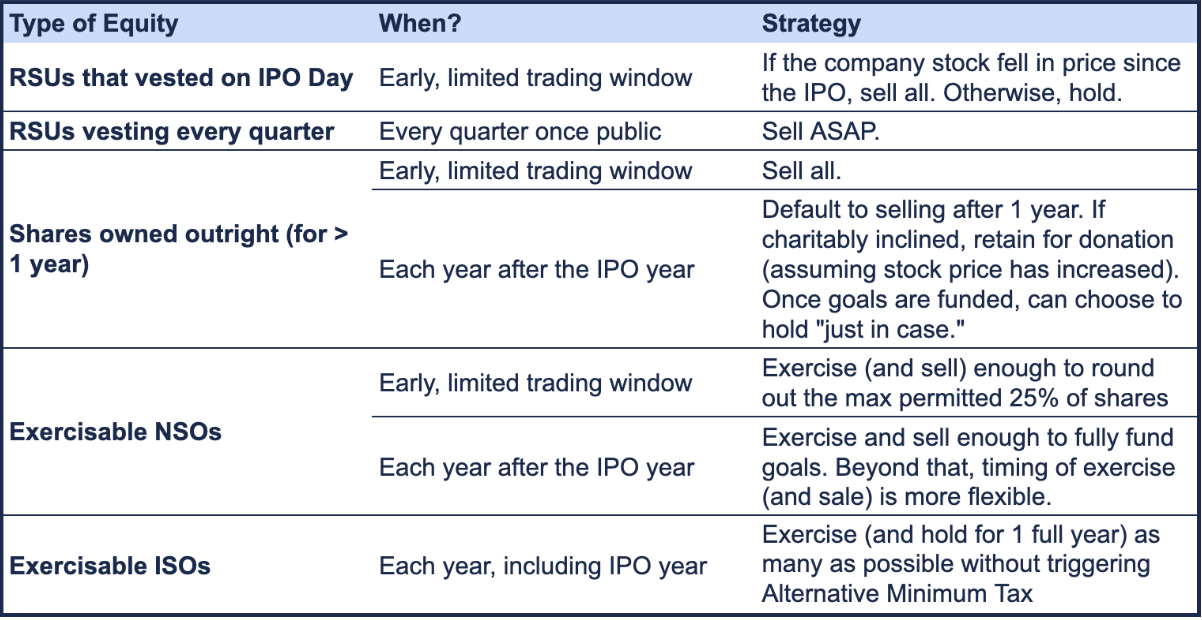

Right here’s a abstract of Mia’s technique by sort of fairness:

Feeling overwhelmed? I’m not shocked.

Have a greater sense that each one these items can and will match collectively? I hope so.

Satisfied of the first significance of clarifying what this cash is for in your life, and of orienting all of your selections round supporting that? Good.

If you wish to work with a monetary planner who will help information you thru your IPO in a manner that feels proper and true, attain out. Even when I can’t provide help to myself, I Know Folks.

The put up A Case Examine in Navigating an IPO appeared first on Stream Monetary Planning, LLC.