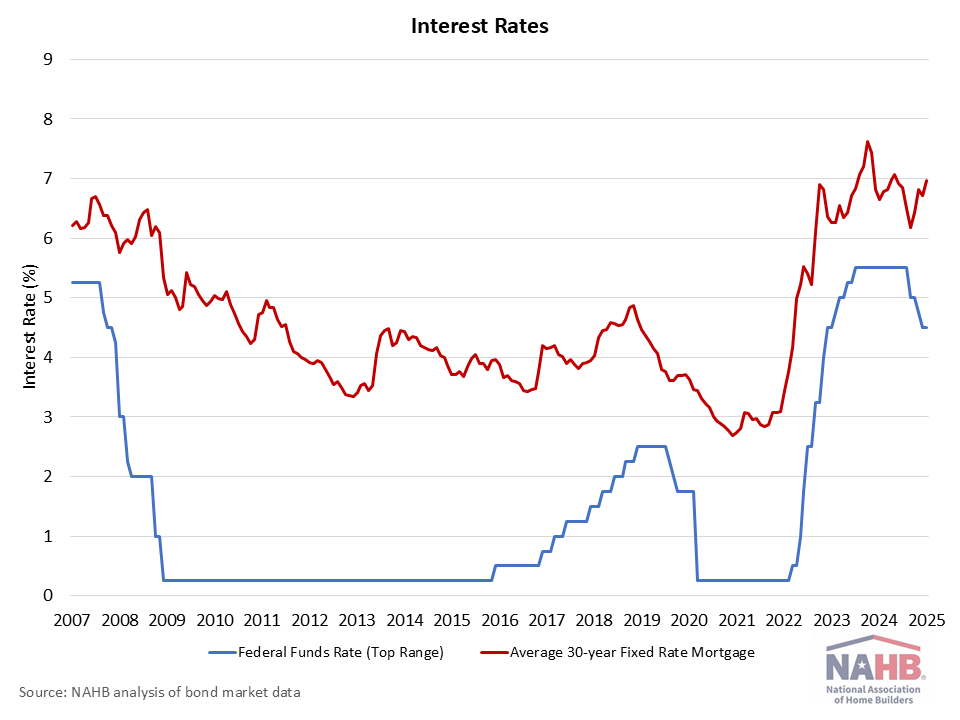

In a broadly anticipated announcement, the Federal Reserve paused on charge cuts on the conclusion of its January assembly, holding the federal funds charge within the 4.25% to 4.5% vary. The Fed will proceed to cut back its stability sheet, together with holdings of mortgage-backed securities. The Fed famous the financial system stays stable, whereas specifying an information dependent pause. Chair Powell did qualify present coverage as “meaningfully restrictive,” however the central financial institution seems to be in no hurry to enact further charge cuts.

Whereas the Fed didn’t cite the election and accompanying coverage adjustments in the present day, the central financial institution did notice that its future assessments of financial coverage “will take note of a variety of data, together with readings on labor market situations, inflation pressures, and inflation expectations, and monetary and worldwide developments.” Given the continued, outsized influence that shelter inflation is having on shoppers and inflation, an express point out to housing market situations would have been helpful on this in any other case exhaustive listing.

Chair Powell did state in his press convention that housing market exercise seems to have “stabilized.” An inexpensive assumption is that this can be a reference to an enhancing development for lease development (for renters and owners-equivalent lease), however the that means of this assertion just isn’t totally clear given latest housing market information and challenges. Whereas enhancing, shelter inflation is working at an elevated 4.6% annual development charge, properly above the CPI. These housing prices are pushed by persevering with value challenges for builders resembling financing prices and regulatory burdens, and different elements on the demand-side of the market like rising insurance coverage prices. And extra essentially, the structural housing deficit persists.

From the large image perspective, the Fed faces competing dangers for future coverage given adjustments in Washington, D.C. Tariffs and a tighter labor market from immigration points symbolize upside inflation dangers, however fairness markets have cheered prospects for an improved regulatory coverage setting, productiveness positive factors and financial development because of the November election. These crosswinds might sign a prolonged pause for financial coverage because the Fed frequently seeks extra short-term information.

Whereas the Fed targets short-term rates of interest, long-term rates of interest have risen considerably since September, as a second Trump win got here into focus. A future threat for long-term rates of interest and inflation expectations will likely be fiscal coverage and authorities debt ranges. Extension of the 2017 tax cuts will likely be good for the financial system, however ideally these tax reductions must be financed with authorities spending cuts. In any other case, a bigger federal authorities debt will place upward strain on long-term rates of interest, together with these for mortgages.

The January Fed assertion acknowledged the central financial institution’s twin mandate by noting that it could proceed to evaluate the “stability of dangers.” There was no language in in the present day’s assertion pointing to a future reduce, though markets nonetheless count on one or two reductions in 2025 if inflation stays on a moderating development.

Importantly, the Fed reemphasized that it’s “strongly dedicated to assist most employment and returning inflation to its 2 p.c goal.” That appeared like a shot throughout the bow for these speculating that the Fed is perhaps happy with attaining an inflation charge nearer to however not fairly 2%. Whereas there’s advantage to debating the two% coverage, the emphasis in the present day on the two% goal is a reminder of how essential the housing market and housing affordability is for financial coverage and future macroeconomic traits.

Uncover extra from Eye On Housing

Subscribe to get the most recent posts despatched to your electronic mail.