Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!!

TFF Group 6M numbers

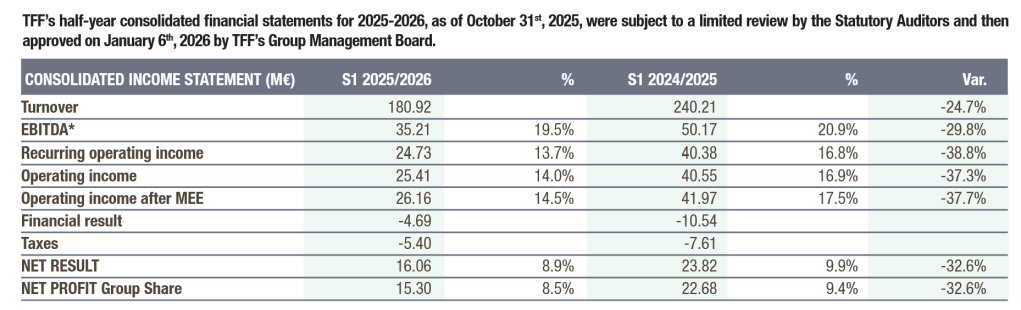

Irrespective of how you place it, TFF Teams 6M launch on January seventh was fairly unhealthy.

Gross sales down ~-25%, internet revenue down -33%. The one constructive side is that the working leverage (i.e. how rather more revenue declines than gross sales) is surprisingly modest.

Final 12 months as an example, a -9% decline in gross sales led to a -40% decline in earnings as we will see within the respective report kind final 12 months:

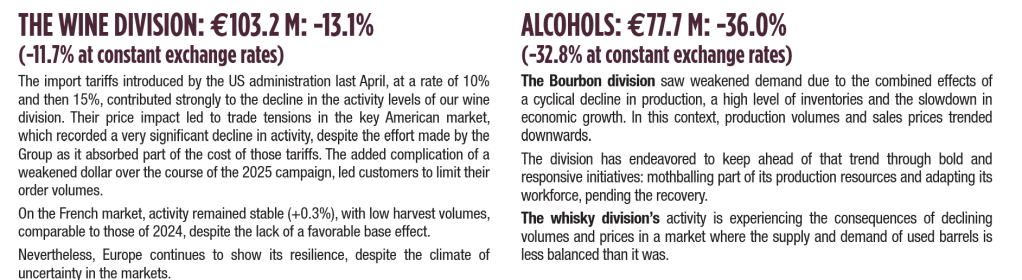

One degree deeper, Wine is doing comparatively higher than BourbonWhisky which noticed an very sharp drop:

It’s fairly apparent that it’s simpler for a Whisky distiller to lower annual manufacturing than for a Winemaker who would want to throw away precious grapes.

Just some days earlier, information that Jim Beam will shut its essential distillery for a full 12 months made the rounds, indicating that the ache for TFF is much from over.

The large query is that if we’re already on the low level or not .I actually have no idea.

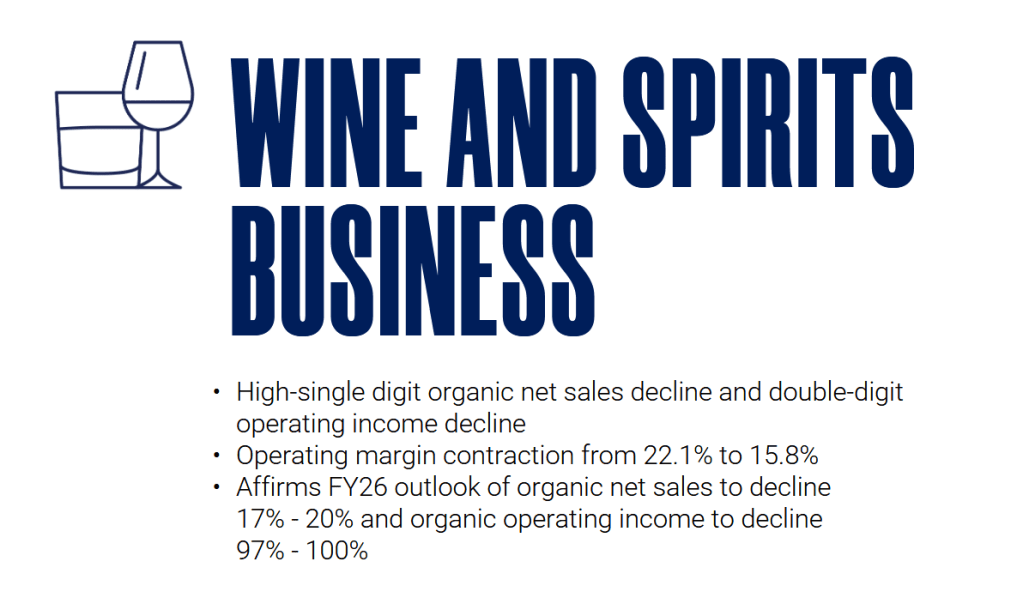

If we have a look at Constellation manufacturers as an example, who offered outcomes on the identical day, the outlook for Wine & Spirits doesn’t look fairly both:

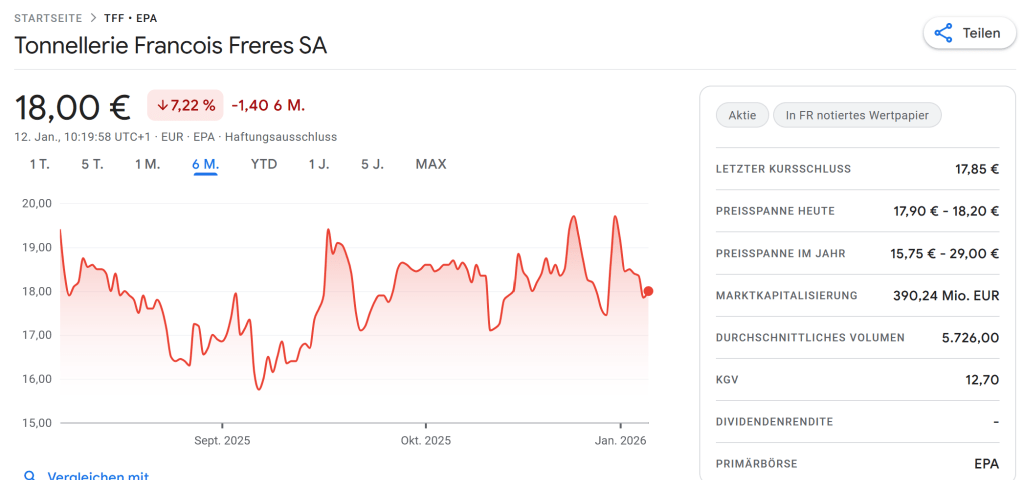

After a year-end bump, TFF’s share worth consolidated a bit of bit however thus far didn’t drop to new lows.

Evidently the market appears to have anticipated unhealthy information.

TFFs outlook for the remainder of the monetary 12 months was someway a bit of bit optimistic as after a -25% income decline within the first 6 months, they now information for -20-25% for the complete 12 months:

One other constructive signal is that they might decrease internet debt primarily by means of managing down stock which was an enormous concern final 12 months:

So total, issues are clearly not nice, however TFF surprisingly nonetheless manages to earn a double digit working revenue margin and appears to have gotten prices underneath management.

TIKR tells me that analysts count on 1,25 EUR EPS for FY 2026/2027 and 1,62 EUR for 2027/2028. This has been lowered a bit of since final time I checked this however ought to assist the present share worth in my view..

Would I purchase TFF shares proper now ? I don’t assume so, however I gained’t promote any proper now both as my present publicity with round 3% of the portfolio (after the large decline) is sort of low anyway. And, as talked about within the Efficiency evaluate, it forces me to evaluate and comply with the Alcohol/Spirits Sector in additional element.

EU-Mercosur Commerce Settlement Settlement

Just some days in the past, the EU lastly agreed on signing the Commerce settlement with the Mercosur area, which contains international locations like Brazil and Argentina.

Amongst others,to my understanding tariffs on Spirits and Wines shall be eliminated. For EU exports, tariffs have been 17% on wine and 20-35% on spirits.

This clearly goes each methods. For European wine producers, I’m not positive what the web impact will seem like. Argentina and Chile each have glorious and internationally appreciated wines and they are going to be extra aggressive now.

Nonetheless, for spirits, issues may get fascinating. Whereas Cachaça may clearly develop into cheaper in Europe, it might be fascinating for particular European spirits like Cognac or Campari’s Aperol if tariffs fall away. Champagne may be a beneficiary resulting from its world standing, though Brazil appears to develop nice glowing wines, too.

As this solely covers the EU, UK Whisky producers as an example is not going to profit from this settlement resulting from Brexit (Diageo and so forth).

So total, for the EU spirits trade, this appears to be a internet constructive, for wine I’m not so positive.

Further Soundtrack: Mano Chao – Me gustas tu