Nationwide Pension System (NPS) is a outlined contribution retirement financial savings scheme. The NPS has been designed to allow systematic financial savings through the subscriber’s working life. It’s an try in the direction of discovering a sustainable answer to supply enough retirement revenue to each citizen of India. NPS is just like the 401k plan provided for workers within the US. This text covers all details about NPS, provides overview of NPS, returns of NPS, The right way to open eNPS account, Tax Advantages on NPS.

Particulars of NPS

Hyperlink to Following articles covers the subject intimately.

Overview of NPS

The NPS was launched on the first of January 2004 and was geared toward people newly employed with the central authorities, however not together with ones within the armed forces. From the yr 2009 nonetheless, the NPS was made open to each Indian citizen between the age of 18 and 60 . Even NRIs can put money into NPS.

- You contribute a sure sum each month throughout your working years, which is then invested in accordance with your desire.

- You may then withdraw the cash while you retire, which is at present set at 60 years outdated.

- Funding is in accordance with investor desire, It imply one can choose from totally different choices

- Underneath the NPS, a person’s financial savings is pooled in a pension fund.

- These funds are invested by Pension Fund Regulatory and Improvement Authority (PFRDA) regulated skilled fund managers as per the accepted funding tips within the diversified portfolios comprising of presidency bonds, payments, company debentures, and shares.

- Distinctive Everlasting Retirement Account Numbers (PRAN) is allotted to every subscriber below the NPS on the time of their becoming a member of.

- Subscribers are additionally allotted two accounts, which they will entry at any time

- Tier I Account – Underneath this account, withdrawals usually are not allowed. It’s solely meant for financial savings after the subscriber’s retirement.

- Tier II Account – Underneath this account, a subscriber is free to make as many withdrawals as she or he likes at any time, just like an everyday financial savings account.

- These contributions would develop and accumulate through the years, relying on the returns earned on the funding made.

- On the time of a standard exit from NPS, the subscribers can withdraw solely 60%. 40% must be used to buy a life annuity from a PFRDA empanelled life insurance coverage firm.

- NPS gives seamless portability throughout jobs and throughout areas, in contrast to all present pension plans.

- NInvestment in NPS is impartial of your contribution to any Provident Fund or another pension fund.

- NPS is distributed via licensed entities referred to as Factors of Presence (POP’s) . One may transact in NPS on-line solely.

- The contribution for NPS and curiosity earned are eligible for deduction whereas withdrawals are taxable.

The Nationwide Pension System (NPS) has managed to generate respectable returns in 2016. Though its fairness plans remained lacklustre, it was compensated by an excellent efficiency by the federal government bond plan and the company debt plan. If one assumes an asset allocation of fifty% fairness, 25% authorities bond and 25% company debt, the common NPS returns for 2016 work out to be 9.47%, higher than another competing merchandise.

The NPS was capable of outperform its benchmarks and in addition related mutual fund schemes. For instance, the common one-year returns for the fairness plan is 3.75%, increased than 2.16% generated by the benchmark index, Nifty , and 1.88% by the large-cap fairness funds. The same sample is seen with the federal government bond plan and the company debt plan.

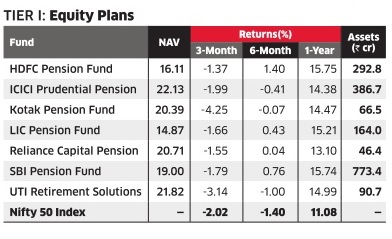

There are solely seven NPS fund managers at current and the desk under compares their efficiency for Fairness Plans. For extra on NPS returns please examine our article Returns of NPS

Negatives of funding in NPS

- Liquidity is likely one of the necessary sides of any funding. Within the NPS you won’t be able to withdraw till the age of 60 besides for those who contract a essential sickness or are shopping for or developing a home.

- Your complete revenue stream from the NPS, the lump sum, and the pension is totally taxable, besides the portion really used to buy the annuity. Moreover, annuity payouts i.e pension are additionally totally taxable. Evaluating this with investments in fairness and fairness mutual funds which a minimum of at current are exempt from the long-term capital features tax. The PPF additionally doesn’t undergo any tax on withdrawals.

- The worst clause is while you withdraw after the age of 60, 40% of that corpus must be compulsorily used to buy an annuity from a life insurance coverage firm. However, if withdrawal is completed earlier than that, then a staggering 80% of the accrued capital should compulsorily be used to purchase a life annuity and the steadiness of 20% could be utilised by the account holder for any objective. Annuities are high-cost, low-return merchandise of life insurance coverage corporations, glorious for the brokers and corporations that promote them.

- Even for a really very long time horizon, a most of solely 50% allocation to fairness is permitted, even when the investor needs a better fairness allocation.

- Whereas a lot is made from the very low fund administration cost, there are multi-level fees at varied places of work and ranges of the NPS system, the cumulative impact of which make the NPS is a much more costly system than seems at first look.

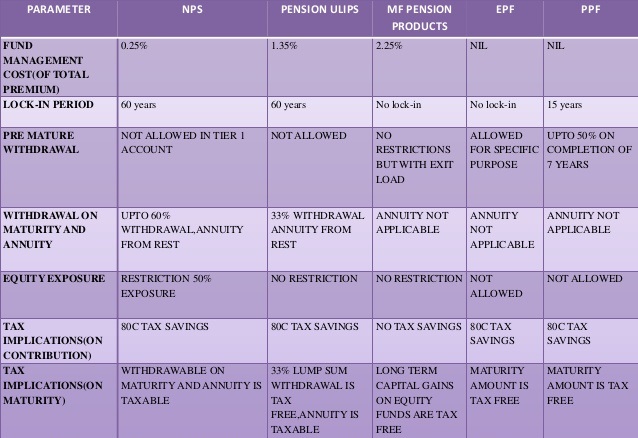

Evaluating NPS with EPF, PPF, Pension Plans

New Pension scheme being a retirement plan one find yourself evaluating with varied different authorities pension schemes(like EPF,PPF) and linked pension schemes(personal pension linked merchandise) accessible out there. Outlined profit scheme means a certain quantity of profit is outlined at first whereas in outlined contribution schemes, a sure contribution is outlined by each employer and staff The given desk reveals the varied parameters on which the totally different pension schemes accessible within the market are differentiated.

NPS Tier 2 Account

NPS comes with two accounts: Tier I and Tier II. Tier I is the retirement account which will get a bunch of tax breaks, whereas NPS Tier II is a voluntary account is sort of a mutual fund, which means there isn’t a lock-in until retirement and cash could be withdrawn any time thus providing higher flexibility.

The fund administration fees of NPS Tier II plans are barely 1% of the price of the common direct plan. For managing an funding of Rs 1 lakh

- An everyday mutual fund fees Rs 1,500-2,500 per yr

- A direct mutual fund cost 0.75-1.5%—or Rs 750-1,500 per yr

- However NPS Tier II cost solely 0.01%—or Rs 10 per yr for managing an funding of Rs 1 lakh.

The ultra-low prices imply increased returns for buyers. NPS Tier II plans have outperformed mutual funds of the identical classic by .7-2% throughout totally different time frames.

Regardless of the apparent benefit of upper returns, only a few buyers have put cash in NPS Tier II plans

Our article NPS Tier 2 or Tier II Account: Efficiency,The right way to open,Withdraw discusses Tier II account of NPS scheme, its distinctive options, execs and cons of investing in NPS Tier II,taxation and withdrawal on Tier II account, together with returns from funding in NPS Tier 2 account.

Associated Articles :