Effectively, 2025 is off to a tough begin with one pretty giant mortgage lender calling it quits already.

Ally Monetary is reportedly executed with mortgage lending totally, per a assertion from their spokesman Peter Gilchrist.

He advised the Charlotte Observer that the corporate plans to exit the mortgage origination enterprise within the first quarter of the yr.

Because of this, the corporate will see “lower than 5% of its workforce” impacted by layoffs.

Apparently they are going to “right-size” the corporate, lowering workers in some areas (like mortgage lending) however hiring in others.

Ally Monetary Exits the Mortgage Enterprise

Regardless of solely being within the mortgage enterprise beneath the Ally Monetary identify for simply over a decade, they’re apparently executed.

And the wrongdoer this time is probably going higher-for-longer mortgage charges, not subprime lending or skyrocketing mortgage defaults prefer it was again within the early 2000s.

Talking of, Ally Monetary was beforehand often known as GMAC till 2010, a unit of Common Motors.

Additionally they owned Residential Capital (ResCap), their subprime lending division that was caught up within the huge mortgage disaster again then.

They finally shuttered ResCap as their multi-billion-dollar subprime mortgage portfolio went kaput, resulting in a chapter and bailout from the Treasury.

However as issues settled down, they remodeled the model into Ally Financial institution and a yr later renamed it Ally Monetary.

Then Ally Dwelling was born, centered on consumer-direct mortgage lending and providing all the things from conforming mortgage to jumbo loans.

Their technique was to offer a “high-touch expertise” not like lots of their digital opponents corresponding to Higher Mortgage, which eschewed the mortgage officer altogether.

Whereas it appeared to work for some time, their mortgage origination quantity dwindled as soon as mortgage charges have been now not a screaming discount.

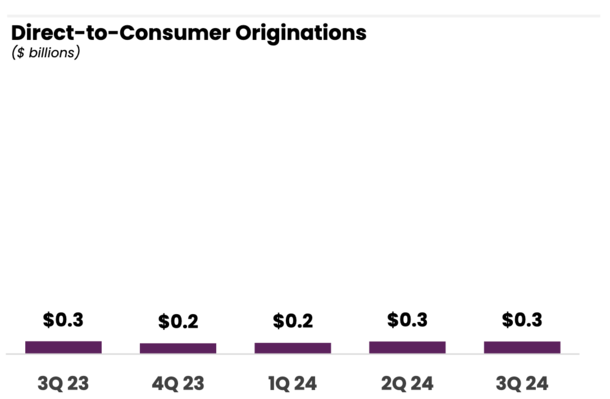

Ally Monetary Solely Funded About $1 Billion Over the Previous 12 months

Upon wanting into their financials, I found that Ally Monetary solely mustered about $1 billion in whole house mortgage origination quantity over the previous yr.

Whereas that sounds first rate, it’s not sufficient for a big depository financial institution corresponding to theirs.

The corporate funded simply $0.2B within the first quarter, and $0.3B within the second and third quarters of 2024.

Apparently, they famous that they continued to concentrate on a “digital expertise and operational effectivity” within the channel.

So apparently the high-touch strategy proved to be too costly, or was now not the popular technique of origination.

Within the newest quarter, the corporate mentioned the $256 million in whole mortgage origination quantity was “reflective of [the] present atmosphere,” aka the excessive mortgage fee atmosphere.

In fact, 70%+ of their direct-to-consumer mortgage originations have been sourced from current depositors on the financial institution.

Which means they didn’t appear to be actively pursuing clients exterior the financial institution. However with quantity so low, the enterprise may simply not make sense shifting ahead.

Nonbanks Proceed to Acquire Market Share in Mortgage House

The transfer makes you marvel if different banks will comply with go well with, with mortgage lending more and more dominated by nonbanks.

In 2023, United Wholesale Mortgage was the largest mortgage lender within the nation. Not solely are they a nonbank, however they solely work with mortgage brokers. So there are not any retail operations.

They have been adopted by Rocket Mortgage, which collectively accounted for about 10% of whole origination quantity.

Chase and Wells Fargo took the third and fourth spots, however we all know Wells Fargo is actively lowering its mortgage footprint.

And after that CrossCountry Mortgage took fifth, and Fairway Impartial Mortgage took seventh, with DHI Mortgage (D.R. Horton’s lender) and loanDepot rounding out the highest 10.

It makes you marvel what sort of urge for food the depository banks have for mortgages, exterior the biggest ones.

Oh, and regardless of being a depository financial institution, Ally Monetary mentioned lower than 1% of the house loans it originated within the newest quarter have been retained on its stability sheet.

Learn on: Try the most recent mortgage layoffs, closures, and mergers