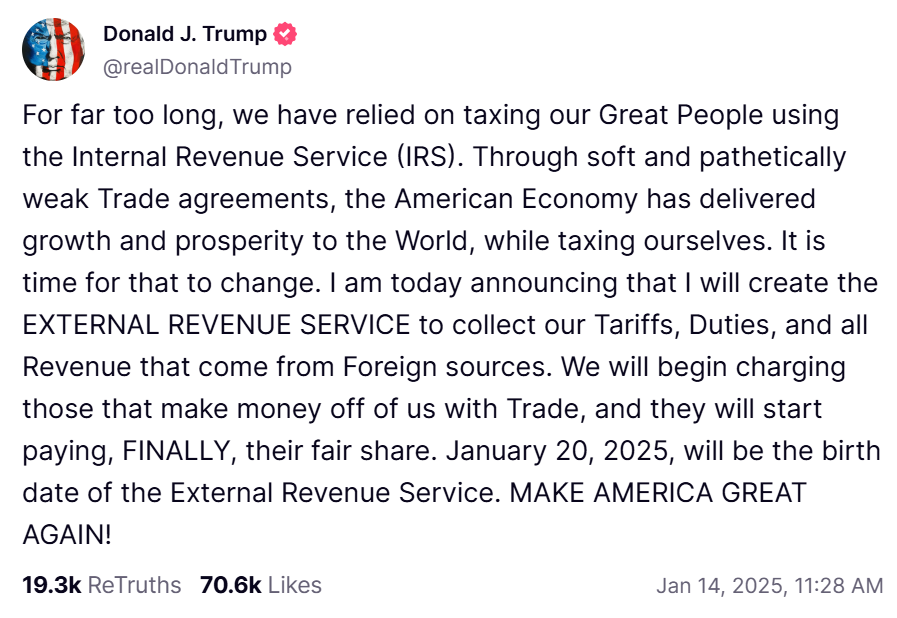

President-elect Donald Trump has floated the thought of making an Exterior Income Service, which he claims will likely be used to “acquire our Tariffs, Duties, and all Income that come from Overseas sources” (sic). Whereas we’d applaud his rhetorical aptitude, his alternative of phrases belies a elementary misunderstanding of how tariffs really work.

Earlier than we start, we must always deal with the elephant within the room: we have already got an company that does this: US Customs and Border Safety. Created because the US Customs Service in 1789 and breathed into existence by none apart from George Washington himself, the company was transferred and rebranded to its present type in 2003 with the creation of the Division of Homeland Safety. Altering the branding of an already-existing entity — and even worse, duplicating the work of one other company — does nothing to facilitate authorities effectivity.

However extra to the purpose, the verbiage utilized in his submit on Reality Social reveals that Mr. Trump is confused on the idea of the incidence of taxes. Merely put, when economists consult with the incidence of a tax, we’re referring to the share of a tax that’s paid by shoppers and the share paid by producers.

An Instance

Suppose now we have a easy sweet bar, bought for $2 at a gasoline station. Thankfully, this gasoline station is in Montana, the place there isn’t any state gross sales tax. You go to the attendant with a sweet bar that has a sticker value of $2, hand them two crisp one-dollar payments, and you’ll be in your manner. However now, let’s faux that Montana enacts a state gross sales tax of $1 per unit. How a lot will the $2 sweet bar value now?

One is perhaps inclined to imagine that the worth will likely be $3 as a result of, in spite of everything, the sweet bar initially value $2, we’re including a $1 tax, and, as my five-year-old son jogs my memory, 2+1=3. However as we be taught in Econ 101, whereas my son is right in math, he’s (as of but) untrained in economics (I’m engaged on it).

Since demand curves slope down and provide curves slope up, each the patron and the producer will find yourself paying some portion of this $1 tax. It may very well be the case that the worth the patron finally ends up paying after this tax solely rises to $2.50. The vendor, nevertheless, would solely get to maintain $1.50 for the sale of the sweet bar. And since $2.50 – $1.50 = $1.00, we’ve discovered our $1 per unit tax. On this instance, the patron pays half of the tax within the type of increased value paid and the vendor pays the opposite half of the tax within the type of decrease income stored. The incidence of the tax felt by shopper and vendor is 50 cents every. It may be the case that the incidence of the tax is simply 25 cents for shoppers and 75 cents for vendor, during which case the patron would pay $2.25 and the vendor would preserve $1.25 per sweet bar bought. Once more, the distinction between the worth paid by shoppers and the worth obtained by sellers is at all times going to be the quantity of the tax: one greenback.

The above represents the financial incidence of a tax. However there’s additionally what we name the authorized incidence of a tax. The authorized incidence of a tax refers to whom should really ship the tax cash to the federal government. With sweet bars, we sometimes assign the authorized incidence to the gasoline station, i.e. the vendor. That is primarily performed for accounting causes: shops preserve detailed information of each sale they make. Auditing them to see what number of {dollars}’ price of gross sales that they had every year is a comparatively easy train, as a result of they have already got these information. In contrast, auditing each shopper for each buy they’ve made could be onerous to say the least. So though the gasoline station, legally, “pays” the tax within the sense that they’re those who really ship the federal government the total greenback of tax cash, the fact is that each shoppers and sellers pay a portion of the tax. Whether or not the authorized incidence is positioned on the shoppers or the producers makes no distinction for the financial incidence in any way.

Making use of This to Tariffs

As a result of tariffs are taxes, they function in the very same method. The one distinction between a tariff and a standard gross sales tax is the placement of the vendor. A gross sales tax is imposed on a vendor throughout the US, and a tariff imposed on a vendor positioned outdoors the US.

Apart from the placement of the vendor, the 2 taxes work precisely the identical. If an organization in China is at present promoting, for instance, tires to shoppers within the US, what is going to occur if the US decides to impose a tariff on these Chinese language-made? The worth of tires will proceed to rise so long as the tariff stays in place. Importantly, the patron value of the tires will possible not rise by the total quantity of the tariff reflecting the concept the Chinese language tire producers will “pay” a few of the tariff within the type of decrease retained income from every sale.

Extra possible, the Chinese language tire producers will announce the variety of {dollars} that they may get to maintain because the “value” of the tires after which will add the tariff “on the register.” That is precisely the identical conduct that we see at shops all through the US in localities with a gross sales tax: the sticker value says one quantity however all of us perceive that, on the register, the shop will add the tax to that quantity.

A Humorous Factor Known as Proof

The above might sound too simplistic. There’s no manner that this really occurred, proper? Funnily sufficient, that is precisely what occurred. In 2009, the Obama Administration imposed a tariff on “new pneumatic tires, of rubber, from China, of a sort used on motor automobiles (besides racing automobiles) and on-the-highway gentle vans, vans, and sport utility automobiles.” This tariff could be “imposed for a interval of three years” and would begin at 35 % within the first yr, drop to 30 % within the second, and drop once more to 25 % within the third earlier than being phased out or “sundown.”

What occurred to the worth of tires within the US, you ask?

They rose from 2009 — 2012 earlier than beginning to fall again down in 2013, after the tariff ended. Extra to the purpose, the worth of tires by no means rose the total 35 %, 30 %, and even 25 %. In truth, from 2009 to 2012, the worth of tires “solely” rose 21.7 %. The place did the remaining tariff income come from? From the Chinese language manufacturing firms accepting decrease costs per unit than they beforehand had.

Importantly, although, all the cash used to pay these tariffs got here from the American shoppers, not China. Sure, Chinese language tire producers obtained fewer {dollars} per tire than they did beforehand and, in that sense, “paid” a few of the tariff within the type of lower cost per tire. However the American shopper paid the next value for tires, whether or not they had been Chinese language- or American-made, and in that sense paid a few of the tariff within the type of increased costs.

The Powerless ‘Exterior Income Service’

With this new company being floated, President-Elect Trump would have us imagine that he’s going to drive overseas firms to “[pay], FINALLY, their justifiable share” (sic). The problem right here will likely be certainly one of jurisdiction. The US doesn’t have jurisdiction in different nations (although US leaders generally neglect this). We can not legally drive firms in different nations to do something.

Even when the US might, nevertheless, the one distinction could be the worth introduced by, on this case, Chinese language tire producers. If the US might drive Chinese language tire producers to pay the tariff themselves, they might merely elevate the worth of their tires on their web sites. The brand new checklist value could be equivalent to the worth American shoppers paid underneath the present system, the place Chinese language producers introduced a lower cost after which left the calculating and taxing to the US Customs and Border Safety company. In the long run, there could be no distinction in any way to the American shopper.

The thought of Exterior Income Service deserves credit score for rhetorical aptitude. It’s certainly a really intelligent flip of phrase. Nonetheless, it stays an answer looking for an issue.