In the event you’re trying to economize in direction of a future objective – comparable to paying for a marriage or a brand new dwelling – wouldn’t it be a greater thought to place your cash in a financial institution, a set deposit, or a brief to mid-term endowment coverage?

On this article, I’m going to convey you thru 2 important strategies you possibly can discover utilizing to get to your objective:

- The primary methodology assumes that you simply prioritize disciplined financial savings and like to not tackle any funding danger to get there.

- The second methodology requires you to tackle extra danger, in change for probably larger returns.

Methodology 1: Use capital-guaranteed choices

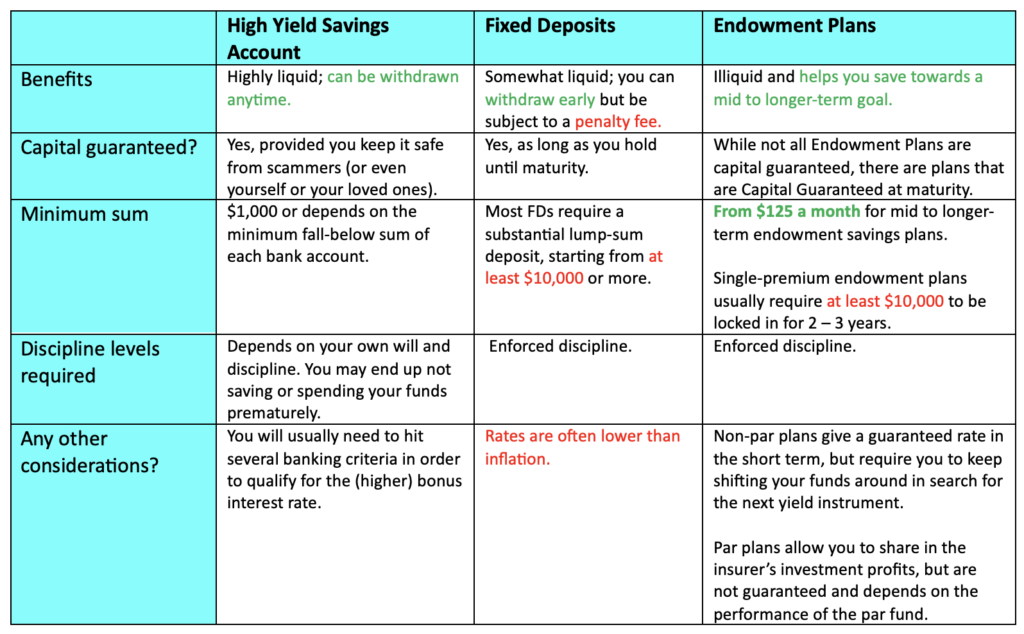

In case your high precedence is to save lots of and protect your capital, then you definately’d be higher off with both a excessive yield financial savings account (HYSA), a set deposit or an endowment plan that ensures 100% capital return.

Excessive Yield Financial savings Accounts (HYSAs)

The simplest and most accessible means can be to open a HYSA with any native financial institution, after which save a portion of your revenue recurrently and park it contained in the account.

Most of those accounts require you to fulfil sure banking actions – comparable to depositing your wage and spending a minimal on eligible bank cards – earlier than you qualify to unlock larger bonus curiosity. These charges at present vary between 2 – 6% p.a.

| Professionals | Cons |

| Extremely liquid: you possibly can withdraw anytime. | Its liquidity can also be your greatest weak point as you might find yourself not saving, and even spending it prematurely.

To earn a better bonus curiosity, you will want to carry out a number of banking actions each month. If you don’t hit the eligibility circumstances, you usually tend to earn a price nearer to 1 – 2% p.a. as an alternative. |

Fastened Deposits

If you do not need the trouble of getting to hit a number of banking standards every month earlier than you possibly can unlock larger curiosity, then an easier choice can be to go for mounted deposits as an alternative.

Fastened deposits mean you can earn a set rate of interest in your lump sum financial savings, which you lock up with the financial institution for a set period. These typically have minimal deposit sums, comparable to $10k to $20k in the event you’re hoping to get pleasure from extra enticing charges.

Present prevailing charges for mounted deposits are hovering at about 3% p.a. in right now’s local weather.

| Professionals | Cons |

| Pretty liquid: you possibly can withdraw early if it is advisable to and be subjected to a penalty payment. | Most mounted deposits require a considerable lump-sum deposit, ranging from at the least $10,000 or extra. |

Thus, mounted deposits can be a extra appropriate choice solely AFTER you’ve gotten saved up a sizeable quantity, and want to get some returns on them whereas holding on to it for an upcoming objective.

In the event you’re attempting to save lots of a sum of cash every month to build up in direction of a future objective, then mounted deposits aren’t going that can assist you get there.

Endowment Plans

What about endowment plans or insurance policies, comparable to these sometimes supplied by an insurer?

With endowment plans, you possibly can select from the (i) time period and (ii) premium cost frequency. Listed below are a number of examples:

- Brief time period – a single-premium endowment plan, often with a brief lock-in interval of 1 – 3 years with assured returns upon maturity

- Medium or long run – often a taking part endowment plan with annual premiums paid over 2 – 10 years and saved for six – 20 years. Returns upon maturity are a mixture of assured and non-guaranteed, topic to the efficiency of the par fund.

| Professionals | Cons |

| There are endowment plans that may rise up to five% p.a. assured and non-guaranteed returns | Illiquid: in the event you give up your plan earlier than maturity, you’ll solely get again the give up worth indicated (often lower than what you paid) |

| There are capital assured choices obtainable the place you’ll not get again much less than what you place in – so long as you don’t terminate prematurely | Brief time period endowments could have a shorter lock-in interval, however the issue comes when it is advisable to discover the following place to shift your funds into, and you’ll not know what the charges are thereafter.

Most short-term, single-premium endowment plans additionally sometimes require a minimal of $10,000 lump sum. |

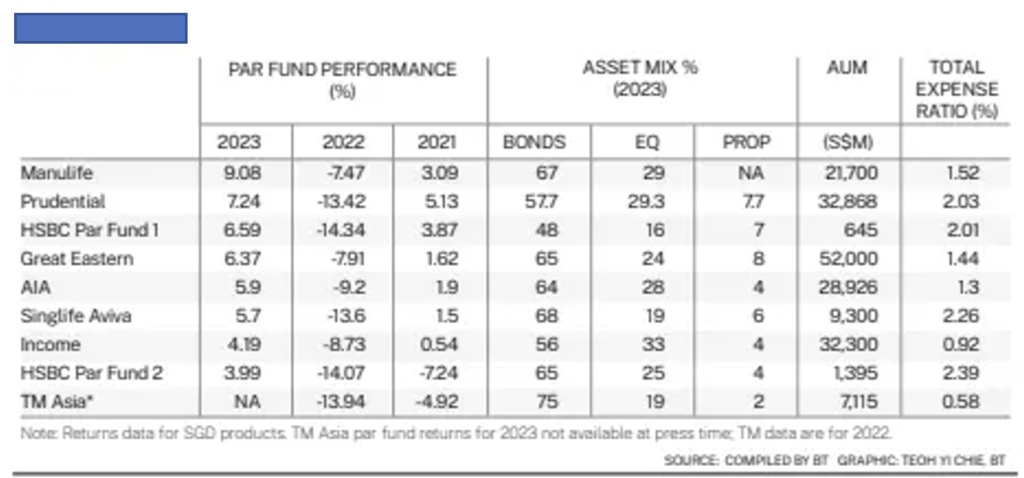

Endowment insurance policies are sometimes categorized into both taking part or non-participating plans, or par and non-par for brief. Par plans imply that policyholders get a share of the income from the insurance coverage firm’s taking part funds, that are paid out within the type of bonuses or dividends and might presumably improve the maturity pay-out in good years.

Necessary Notice: There are key variations between par and non-par endowment plans.

- Non-par plans: these should not entitled to any income that the insurance coverage firm makes. You possibly can spot them as they provide a assured return that you'll get again collectively along with your capital on the finish of the holding time period.- Par plans: insurance coverage insurance policies that take part or share within the income of the insurance coverage firm's par fund. Apart from the assured advantages, additionally they present non-guaranteed advantages could embody bonuses and money dividends – these depend upon how the par fund's investments are performing, what number of claims are made on the fund and the bills incurred by the par fund. You possibly can spot these by in search of the illustrated charges of return (often 3% and 4.35%, or 3.25% and 4.75%) proven in your coverage doc (the non-guaranteed bonuses).

For example, in good years (like 2023 and 2024), many insurers had been capable of put up a revenue and therefore larger bonuses had been paid out, which was useful to policyholders. However in tough years like 2022, that was not the case as world markets had been typically down and funding performances had been largely muted throughout the board.

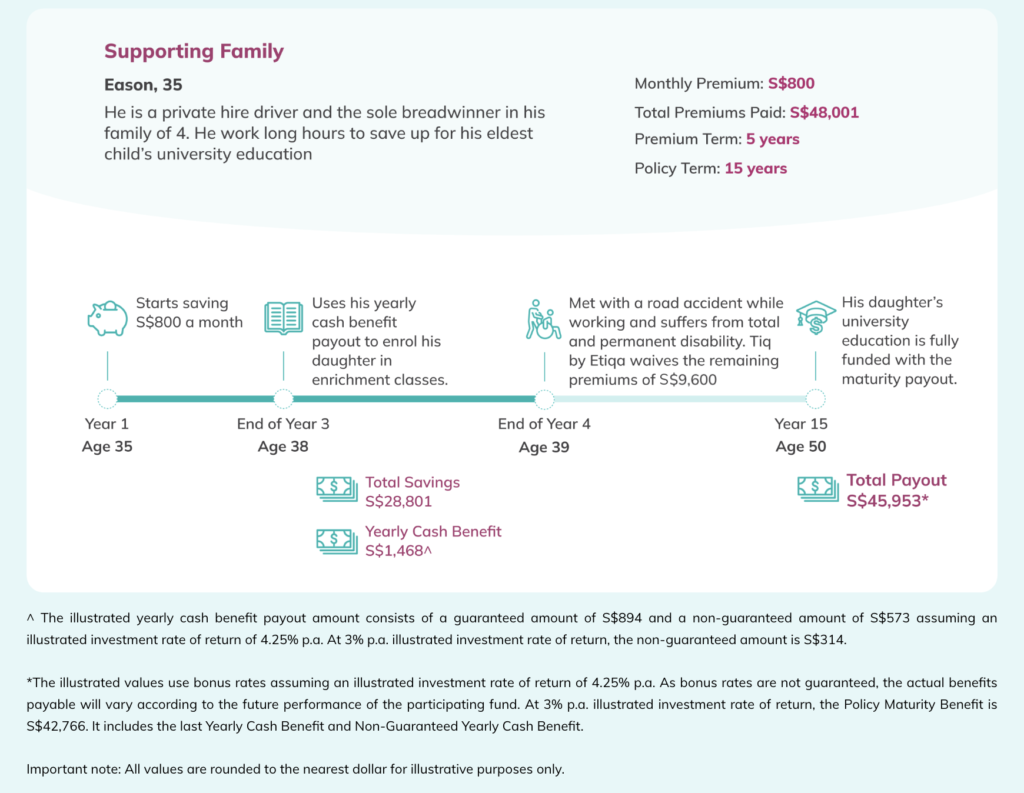

For example, endowment plans are sometimes widespread amongst dad and mom who use it as a way to save lots of in direction of their youngsters’s college charges. Some even use the yearly money advantages to pay for enrichment or non-public tuition lessons, whereas others select to reinvest it additional. Right here’s an illustrated instance:

Key Concerns

As with each monetary instrument, whether or not it’s appropriate for you’ll in the end rely in your private circumstances, danger urge for food and expectations of returns.

In case your precedence is to implement self-discipline and have a plan that forces you to save lots of so that you simply WILL hit your objective it doesn’t matter what occurs, then the best choice will in all probability be that of an endowment coverage.

By serving to you to construct a financial savings behavior (every time you pay in your premiums), endowment plans function a instrument utilized by many individuals whose high precedence is to verify they hit their future monetary objectives. As your capital is often assured (so long as you maintain to maturity), this naturally comes at a trade-off i.e. decrease returns than in the event you had invested it by different means.

Therefore, you need to determine whether or not you care extra in regards to the degree of returns, or absolutely the assure supplied by an endowment plan.

Sponsored Message

If it is advisable to save for an upcoming life milestone or in your youngster’s training, let Tiq CashSaver provide help to domesticate the behavior of normal financial savings and get you to your objective.

You can begin saving from as little as S$125# a month, and obtain a regular movement of supplementary revenue from the top of your second coverage yr. In any other case, you can even choose to build up your yearly money profit to additional develop your financial savings on the prevailing rates of interest!

You possibly can tailor your plan to suit your financial savings horizon, from selecting to pay your premiums over 2 years or 5 years. Underwritten by Etiqa, Tiq CashSaver is a 100% capital assured endowment plan upon maturity and offers you with a lump sum payout as you arrive at your goalpost.

#Based mostly on a premium time period of 5 years and ~$1,500 yearly cost.

What’s extra, one other profit that almost all endowment plans include is the choice so as to add a premium waiver rider i.e. in order that in case one thing unlucky had been to occur to the coverage proprietor, the remaining premiums shall be waived and the plan continues to remain in-force.

For Tiq CashSaver, this profit just isn’t a rider however built-in with the primary plan.

Endowment (par) plans like Tiq CashSaver provide excessive flexibility for people who need to domesticate the behavior of saving (even whether it is only a modest quantity), whereas making investing easy and accessible by its taking part funds. What’s extra, dad and mom who want to place the endowment plan below their youngster’s identify whereas they continue to be insured (towards surprising TPD) can select to take action; within the occasion that something untoward occurs through the time period that renders the father or mother completely disabled, the remaining premiums shall be waived however the financial savings and compounded funding returns proceed.

It’s important to know your self finest with a view to decide what’s most acceptable for you.

In the event you don’t have self-discipline, then endowment insurance policies shall be higher for you than in the event you merely left your cash within the financial institution, or relied by yourself (lack of) will to switch a portion of your wage and save up.

Methodology 2: Make investments immediately for larger potential returns

In fact, in the event you’re savvy and know methods to make investments, then a greater method to get to your objective quicker can be to speculate immediately within the markets.

You could possibly do that by investing into unit trusts, change traded funds (ETFs) that observe the broader market, and even by a diversified portfolio of shares and bonds. Even in the event you had been to easily put money into low-cost change traded funds monitoring the S&P 500 or the STI Index, the chances that you simply’ll make returns larger than 3 – 5% p.a. will be fairly respectable, so long as you don’t make any main errors or use leverage – word that this assertion is predicated on the historic returns of the S&P 500 over the past 40 years. That is the strategy that I personally use, and you’ll see a few of my returns captured right here (2023 monetary evaluation) and right here (for final month, August 2024). Nevertheless, it has not been with out its personal challenges, as you possibly can see documented on this reflection article.

Having stated that, I typically don’t advocate investing any cash that you simply want inside the subsequent 1 – 3 years into the inventory market, particularly in the event you want the cash for a non-negotiable occasion by then! Given the unpredictability of the market, there isn’t any certainty that if you want the cash, the markets shall be doing effectively – you might thus be exiting at a major capital loss in the event you’re unfortunate.

Want an instance? Think about John, who learn “recommendation” on Reddit and determined to speculate into an ETF monitoring the S&P 500 in 2021 for a monetary objective that he wants to fulfill inside 1 yr. Properly, guess what occurred to unfortunate John? That timing additionally occurred to be when the broader markets crashed, and he misplaced 18% of his capital as an alternative.

When you received’t lose cash on an endowment plan (or any of the above capital-guaranteed choices we explored earlier), you possibly can lose cash if you make investments by your self – particularly in the event you’re not cautious. Everyone knows a good friend or two who invested in shares like Tesla or Peloton through the pandemic, solely to go on and lose 20% – 90% of their invested capital.

The S&P 500 index clocked 26.3% in 2023 and has gained over 20% up to now this yr. Most of us who’ve been invested within the markets for lengthy sufficient know that this isn’t the norm; the final time this occurred was in 1995 – 1999, when the S&P notched double-digit beneficial properties for five consecutive years earlier than occurring to fall by double-digits yearly for the following 3 years.

In the event you’re investing for the long run, investing in ETFs that observe the S&P 500 isn’t such a nasty thought, for the reason that index has traditionally returned 8 – 10% over the previous few many years.

Nevertheless, in the event you want the cash in a sure yr or by a set timing, then the issue with blindly following recommendation on the Web is that whereas the favored monetary mandate of “simply put money into the S&P 500” is spreading like wildfire, nobody can predict the market cycle on the time limit if you want the cash.

You’ll need to personally determine and select between certainty and returns. In the event you want the understanding, then it is advisable to be ready to pay the value within the type of decrease returns. However in the event you can and keen to take the danger of potential loss, then your upside returns will also be a lot larger.

Conclusion

I’m not a fan of long-term endowment plans (particularly those who you need to maintain for 20 years or extra), as I really feel that their charges vs. returns haven’t stored up with the opposite market options which have sprung up lately.

Nevertheless, I’ve talked about short-term endowment plans on this weblog pretty typically earlier than – particularly when a horny price comes up, every now and then.

As for medium time period endowment plans, I really feel they could be a respectable instrument for individuals who have to implement a saving behavior for themselves, in addition to those that search out a capital-guaranteed choice for the following few years with out eager to tackle the dangers of investing within the monetary markets.

In actual fact, relatively than having to decide on between both choice, I’d additionally encourage you to consider dividing up your money into 2 pots – constructing your basis with a capital-guaranteed instrument comparable to endowment plans, whereas additionally studying methods to put money into the markets for better potential returns.

Sponsored Message

If you need to speculate for probably larger returns however you’re uncertain about doing it your self, you can even take a look at Tiq Make investments right here, which provides you entry to funds by Dimensional Fund Advisors, PIMCO International Advisors (Eire), BlackRock International Funds and/or Lion International Traders.

There is no such thing as a lock-in interval, and you’ll put money into a wide range of fund portfolios that fit your danger targets. You can begin investing from as little as S$1,000 is all you want, and experience by market volatility by organising common top-ups with mounted frequency from $100 monthly.

With the bottom administration cost of solely 0.75% p.a., this removes the largest downside with conventional ILPs – their excessive charges. This ensures that extra of your funds get allotted in direction of investing for returns as an alternative.

In the event you select to speculate with Tiq Make investments between now to 31 December 2024, you can even get cashback of as much as S$200. Phrases apply.

Disclosure: This text is delivered to you in collaboration with Etiqa Insurance coverage.

All merchandise talked about on this article are underwritten by Etiqa Insurance coverage Pte. Ltd (Firm Reg. No. 201331905K).This content material is for reference solely and isn't a contract of insurance coverage. Full particulars of the coverage phrases and circumstances will be discovered within the coverage contract.As shopping for a life insurance coverage coverage is a long-term dedication, an early termination of the coverage often includes excessive prices and the give up worth, if any, that's payable to chances are you'll be zero or lower than the full premiums paid. You must search recommendation from a monetary adviser earlier than deciding to buy the coverage. In the event you select to not search recommendation, you need to think about if the coverage is appropriate for you.

Tiq Make investments is an Funding-linked Plan (ILP) which invests in ILP sub-fund(s). Investments on this plan are topic to funding dangers together with the potential lack of the principal quantity invested. The efficiency and returns of the ILP sub-fund(s) just isn't assured and the worth of the models within the ILP sub-fund(s) and the revenue accruing to the models, if any, could fall or rise. Previous efficiency just isn't essentially indicative of the longer term efficiency of the ILP sub-fund(s). A product abstract and product highlights sheet(s) referring to the ILP sub-fund(s) can be found and could also be obtained from Etiqa or by way of https://www.etiqa.com.sg/portfolio-funds-and-ilp-sub-funds. A possible investor ought to learn the product abstract and product highlights sheet(s) earlier than deciding whether or not to subscribe for models within the ILP sub-fund(s).

These insurance policies are protected below the Coverage House owners’ Safety Scheme which is run by the Singapore Deposit Insurance coverage Company (SDIC). Protection in your coverage is automated and no additional motion is required from you. For extra data on the forms of advantages which might be coated below the scheme in addition to the bounds of protection, the place relevant, please contact Etiqa or go to the Life Insurance coverage Affiliation (LIA) or SDIC web sites (www.lia.org.sg or www.sdic.org.sg).

This commercial has not been reviewed by the Financial Authority of Singapore. Info is appropriate as of 30 October 2024.