Small enterprise tax deductions present an effective way for enterprise house owners to offset bills and decrease tax payments. And in enterprise, bills—particularly your workers on payroll—add up rapidly. Are worker wages tax deductible?

If you happen to’re a sole proprietor or single-member LLC who recordsdata Schedule C, learn on. You might be pleased with what we have now to say.

Are worker wages tax deductible?

Sure, worker wages are sometimes tax deductible. You may declare a tax deduction for qualifying wages and salaries, bonuses, commissions, and paid time without work you give workers.

The IRS has guidelines on tax-deductible worker pay necessities. To say a tax deduction, the worker pay should be:

- Bizarre and essential*

- Paid or incurred within the tax 12 months,

- Affordable, AND

- For providers carried out

*Bizarre bills are frequent and accepted in your area of enterprise. Mandatory bills are useful and applicable for your corporation.

What sorts of pay are tax deductible?

There are lots of methods you’ll be able to pay workers. You may pay them in money, property, or providers.

You may deduct the worth of all qualifying funds to workers, together with:

- Common wages and salaries

- Extra time pay

- Awards

- Bonuses

- Commissions

- Sick pay

- Trip pay

- Schooling bills

- Fringe advantages (e.g., well being plans)

- Loans or advances you don’t anticipate the worker to repay

- Property transferred to an worker as fee for providers

- Worker enterprise expense reimbursements

Are fringe advantages tax deductible?

Sure, the price of fringe advantages is usually tax deductible. Examples of fringe advantages embrace:

- Certified worker profit applications advantages

- Accident and well being plans

- Adoption help

- Cafeteria plans

- Dependent care help

- Academic help

- Group-term life insurance coverage protection

- Welfare profit funds

- Meals and lodging

- Automobile use

- Flights on airplanes

- Property or service reductions

Can I deduct my wage?

No, you can’t deduct your wage or any private withdrawals you make from your corporation. Sole proprietors should not workers of the corporate.

How one can declare an worker wage deduction on Schedule C

You may declare an worker wage deduction on Schedule C (Type 1040), Revenue or Loss from Enterprise. Sole proprietors and single-member LLCs use Schedule C to report earnings, bills, price of products offered, and different enterprise data.

To say an worker wage deduction, you will need to:

- Preserve detailed payroll information, together with wages paid to workers, gross wages, payroll taxes, and different payroll-related bills.

- Full all payroll tax types, together with Kinds 941, 940, and W-2s.

- Declare the worker wages within the “Bills” part on Schedule C.

And right here’s one of the best half—you’ll be able to declare extra than simply the wages you give to workers. Once more, it’s also possible to declare fringe advantages. And, you’ll be able to deduct the price of employer-paid payroll taxes.

Right here’s how.

1. How one can declare worker wages as a tax deduction

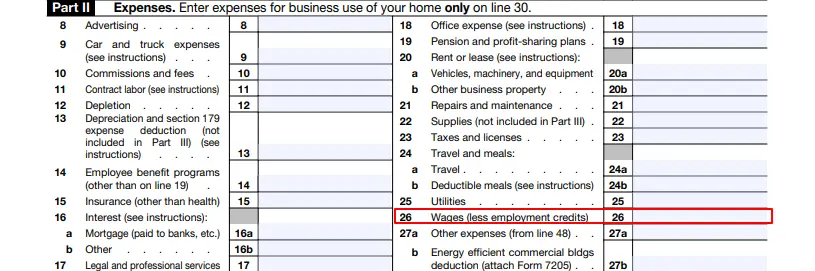

To say worker wages, fill out line 26 on Schedule C, “Wages (much less employment credit).” Exclude what you paid to your self and any credit acquired.

2. How one can declare employer-paid payroll taxes as a tax deduction

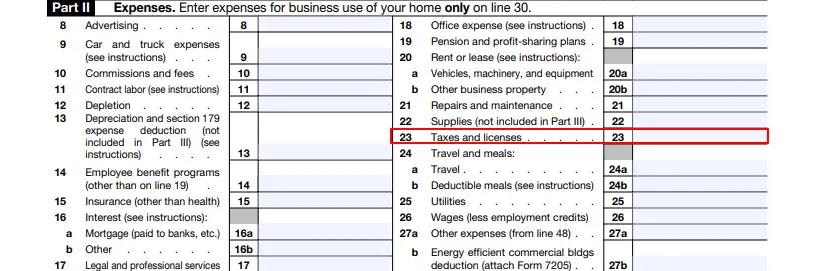

Don’t embrace employer-paid payroll taxes as wages. As a substitute, report these on line 23 of Schedule C.

Employer-paid payroll taxes embrace:

- Social Safety tax

- Medicare tax

- Federal unemployment tax

- State unemployment tax

3. How one can declare different payroll-related prices as a tax deduction

Embrace different payroll-related prices on the suitable strains in Half II of Schedule C.

For instance, you’d file worker profit applications (akin to qualifying medical insurance premiums) on line 14, “Worker profit applications.” You’d file retirement plan contributions on line 19, “Pension and profit-sharing plans.”

Let’s say you let workers use a automobile or different property that you just lease to them. You’d deduct the price on line 20a or 20b, beneath “Lease or lease.”

What different tax deductions are you able to declare?

There are a number of obtainable tax deductions for small enterprise house owners. You might be eligible to assert the next deductions to decrease your tax invoice:

- Enterprise startup prices

- Enterprise use of automobile

- Lease expense

- Residence workplace

- Charitable donations

- Workplace provides

- Insurance coverage

- Depreciation

- Authorized charges

- Promoting and advertising and marketing

- Enterprise taxes

- Stock

- Dangerous money owed

- Enterprise telephone invoice

- Journey bills

Make claiming tax deductions a stress aid, not a stress giver.

Preserve detailed information all year long to again up your claims. You should utilize accounting software program to streamline expense monitoring. Search for accounting software program that integrates seamlessly with on-line payroll your payroll information are pulled into your books.

Take into account consulting a tax skilled, like an accountant or enterprise tax legal professional, that can assist you maximize your tax deductions.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.