One would fairly suppose that if somebody had been uncovered up to now for pumping out a discredited educational paper after being on the forefront of the harmful austerity push throughout the World Monetary Disaster, then some circumspection could be so as. Apparently not. In 2010, Carmen Reinhart and Kenneth Rogoff revealed a paper in one of many main mainstream educational journals – Development in a Time of Debt – which grew to become one of the crucial cited educational papers on the time. On the time, they even registered a WWW area for themselves (now defunct) to advertise the paper and inform us all what number of journalists, media applications and so on have been citing their work. Whereas one can perceive the self-promotion by Rogoff and Reinhart, plainly none of those media retailers or journalists did a lot checking. It turned out that they’d based mostly their outcomes on analysis that had grossly mishandled the info – intentionally or inadvertently – and {that a} appropriate use of the obtainable knowledge discovered that that nations who’ve public debt to GDP ratios that cross the alleged 90 per cent threshold skilled common actual GDP progress of two.2 per cent fairly than -0.1 per cent as was revealed by Rogoff and Reinhart of their unique paper. So all their boasting about discovering strong “debt intolerance limits” arising from “sharply rising rates of interest” – after which “painful fiscal changes” and “outright default” weren’t sustainable. Humility might need been the order of the day. However not for Rogoff. He often retains popping up making predictions of doom based mostly on defective mainstream logic.

I analysed the spreadsheet scandal intimately on this weblog publish – Elementary misuse of spreadsheet knowledge leaves tens of millions unemployed (April 17, 2013).

His newest intervention (November 28, 2024) –

Europe’s Financial system Is Stalling Out – was revealed by Challenge Syndicate, which often provides area to those nonsensical mainstream articles.

The straightforward proposition that Rogoff presents is:

As Germany and France head into one other yr of near-zero progress, it’s clear that Keynesian stimulus alone can not pull them out of their present malaise. To regain the dynamism and adaptability wanted to climate US President-elect Donald Trump’s tariffs, Europe’s largest economies should pursue far-reaching structural reforms.

And people structural reforms should deal with the:

… bloated and sclerotic welfare states responsible?

Apparently, people who maintain to essentially the most primary macroeconomic rule that spending equals output and revenue and drives employment progress are “indifferent from actuality”.

Welcome to my unreal world.

Rogoff claims that the “France’s aggressive stimulus insurance policies” are unsustainable and are usually not supporting progress.

However the info he presents is extremely selective.

He tells the readers that the fiscal deficit has risen to “6% of GDP” however the newest knowledge that’s adjusted for seasonality and calendar occasions (public holidays and so on) reveals the fiscal deficit is 5.5 per cent within the June-quarter 2024, down from 5.7 per cent within the September-quarter 2023.

So, the truth is, the federal government sector is lowering its web spending footprint within the economic system – which is anti-stimulus.

However the story will get extra difficult after we have a look at an extended knowledge span.

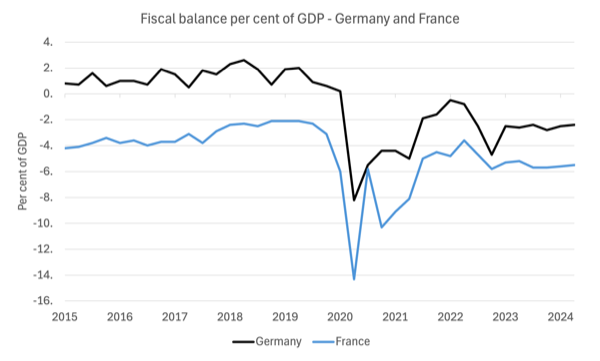

The next graph reveals the fiscal positions for Germany and France because the March-quarter 2015 as a % of GDP,

The final remark from Eurostat was for the June-quarter 2024.

The apparent level is that France usually runs bigger fiscal deficits (as a per cent of GDP), that means that the federal government sector is bigger there relative to Germany.

The second level is that the pandemic and the fiscal help required to handle that catastrophe drove fiscal deficits up in each nations – roughly by the identical proportion level variation.

But, France then reacted in a stronger contractionary shift solely to have to maneuver again in direction of stimulus towards comparatively shortly.

Lastly because the pandemic fiscal deficits have remained larger in each nations than the pre-pandemic ranges but the fiscal adjustment in direction of decrease deficits has really been bigger for France.

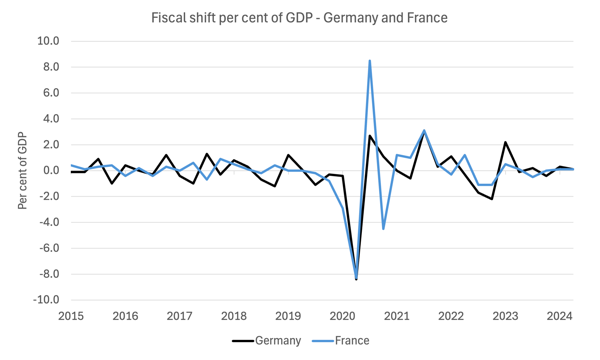

The subsequent graph helps us see that final level.

It reveals the fiscal shift every quarter in % of GDP – so a constructive quantity is a shift to decrease deficit to GDP ratio, a contractionary transfer, whereas a damaging quantity is a stimulus fiscal shift.

Notice that these shifts can’t be understood as being the unique results of discretionary coverage shifts.

That’s as a result of the fiscal stability incorporates each discretionary and non-discretionary (automated stabiliser) elements.

So an growing deficit could be as a result of the federal government has chosen to have interaction a stimulus technique and/or as a result of the non-government economic system has decrease financial exercise (much less spending) and the falling employment has diminished tax income and/or elevated welfare spending.

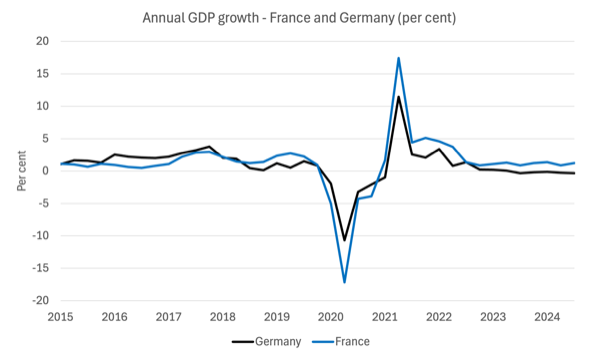

The subsequent graph reveals the respective annual GDP progress charges because the March-quarter 2015 (up till the September-quarter 2024).

It’s clear that because the chaos from the early years of the pandemic resolved considerably, France has persistently recorded the next (albeit modest) annual progress than Germany, the latter has been mired in recession because the September-quarter 2023.

France has up to now prevented a shift into recession.

Can we conclude that the upper fiscal deficits in France have helped it keep away from recession whereas the decrease deficits in Germany (about half the extent of France’s fiscal deficit) have biased it in direction of recession?

Virtually actually that’s the case, which refutes Rogoff’s precept conjecture that larger deficits do nothing to help financial progress.

Additional, what would we anticipate to occur if France abruptly began lowering web fiscal spending (by expenditure cuts and/or tax hikes)?

Properly, financial progress in France would shortly head in direction of recession – little question about that.

We even have to grasp the ‘bigger’ and ‘smaller’ deficit end result extra clearly.

A ‘bigger’ fiscal deficit (as a % of GDP) with a secure GDP progress fee is offering help to incomes and employment and its ‘dimension’ displays the present spending of the non-government sector.

The federal government sector might have taken the discretionary determination to have a bigger footprint – for instance, by imposing larger tax charges on the non-government sector.

Nonetheless, the bigger deficit would possibly simply imply that non-government sector spending is weaker and tax income is falling and so on.

Each conditions, nonetheless enable us to conclude that from that given place, any discretionary try to scale back the deficit will cut back progress, incomes and employment.

I used to be speaking to a podcast yesterday and so they requested me what would possibly occur if Elon Musk and his gang shut down loads of authorities departments.

Whereas the Musk zealots would possibly declare they’re releasing the US of wasteful and pointless paperwork, the spending that runs these departments is important to maintain the present GDP progress and employment ranges, given non-government spending decisions.

So in the event that they scrap these departments and don’t improve spending elsewhere to offset the chosen spending cuts then the US will possible fall into recession.

Whereas we would take the view {that a} particular space of presidency spending is wasteful in line with our preferences and values, on the present time, that spending is supporting employment and revenue technology.

The purpose of the graphs is to point out that whereas France did present elevated discretionary stimulus throughout the early years of the pandemic, it has not too long ago been lowering its web public spending relative to GDP.

Partially that’s the reason the GDP progress fee has declined because the bounce-back quarters by 2022, despite the fact that it stays constructive and never that across the post-Euro common fee.

Rogoff claims that “debt markets have not too long ago woken as much as the dangers posed by France’s ballooning debt” (yields have risen) and that implies that its long-term progress prospects are restricted.

He then cited the Reinhart/Rogoff work from the GFC as if it remained an authority.

Additional he conflates the European expertise with that of Japan as if there’s a legitimate comparability.

On this 2010 weblog publish – Be careful for spam! (January 25, 2010) – I famous that R&R are content material to conflate nations that function inside completely totally different financial techniques (gold requirements, convertible non-convertible, fastened and versatile change charges, international forex and home forex debt and so on).

They appear oblivious to the truth that there can by no means be a solvency problem on home debt issued by a fiat-currency issuing authorities, resembling Japan, regardless of whether or not the debt is held by foreigners or home buyers.

R&R pull out examples of sovereign defaults method again in historical past with none recognition that what occurs in a contemporary financial system with versatile change charges isn’t commensurate to earlier financial preparations (gold requirements, fastened change charges and so on). For instance, Argentina in 2001 can also be not a very good instance as a result of they surrendered their forex sovereignty courtesy of the US change fee peg (forex board).

Their scandalous 2010 American Financial Evaluate paper additionally fell into the error of conflating financial techniques.

Japan’s low GDP progress fee has little to do with the general public debt ratio and all to do with damaging inhabitants progress and a selected non-government bias in direction of family saving.

The bond markets don’t drive up yields on Japanese authorities bonds.

Reasonably they queue up for each scrap of debt they will get and at numerous occasions have been prepared to simply accept damaging yields on 10-year debt points.

Europe is a special case altogether as a result of 20 of the 27 EU Member States surrendered their forex sovereignty and should depend on bond market borrowing to run fiscal deficits.

And, the debt these Member States problem is topic to credit score (default) danger, which implies that the bond markets will demand larger yields to be able to mortgage funds in the event that they imagine a Member State is transferring in direction of larger default danger and the ECB doesn’t sign it can purchase that Member States debt in secondary bond markets.

The issue isn’t fiscal coverage positions per se however fairly the truth that the Eurozone Member States have chosen to retain their fiscal coverage duties (below the so-called subsidiarity precept, which was simply part of the deliberate purpose of the European Fee to straitjacket the Member States within the austerity bias favoured by the neoliberal designers of the system), whereas utilizing a international forex (the euro), which they don’t problem.

Rogoff is useless improper when he lumps the currency-issuing states in with the Eurozone states, as in the event that they face the identical fiscal constraints.

They clearly don’t.

However his observations about fiscal area within the Eurozone being restricted are appropriate, despite the fact that he doesn’t actually perceive the reasoning.

In relation to Germany, he thinks that the federal government “has ample room to revitalize its crumbling infrastructure and enhance its underperforming schooling system”, though he doesn’t focus on the explanation for the parlous scenario – the Stability and Development Pact fiscal guidelines which the German authorities has weaponised.

Inasmuch because the bund is wanted and Germany maintains its excessive austerity bias, then he’s appropriate, the Authorities might broaden web public spending with out spurring speedy bond market concern about solvency.

However his answer to Germany’s austerity-damaged society is, in impact, to broaden the microeconomic adjustments that Germany undertook within the early days of the frequent forex (the so-called Hartz reforms), which was a part of a deliberate technique to ‘sport’ the nation’s commerce companions inside the frequent forex by growing its commerce competitiveness as soon as it misplaced the power to control the Deutschmark change fee.

That technique deregulated the labour market and created a secondary tier of low-paid, insecure employees and starved the home economic system of spending.

The massive export surpluses that eventuated created an enormous funding pool that had nowhere to go (earn a return) within the home economic system and located returns within the debt buildup and actual property bubbles in different Eurozone nations, resembling Spain, and so on.

Quickly after the entire unsustainable bubble burst (the GFC) and we all know what occurred then.

Rogoff acknowledges that the Hartz insurance policies “made the German labor market considerably extra versatile than France’s”, however fails to say the unsustainable imbalances they created all through the frequent forex, which manifest within the GFC disaster.

Some nations haven’t recovered from the disaster.

Rogoff’s declare is that nations like France and Germany should undertake a scorched earth method (deregulation, pension cuts, wage cuts, abandon job safety, and the like) to be able to develop sooner as a result of extra spending won’t assist.

But in direction of the tip of his article he says:

The financial outlook would have been a lot bleaker if not for Europe’s enduring enchantment as a vacationer vacation spot, significantly amongst American vacationers, whose sturdy {dollars} are propping up the trade. Even so, the outlook for 2025 stays lackluster. Though European economies might nonetheless get well, Keynesian stimulus won’t be sufficient to maintain strong progress.

Take into consideration the contradiction in that closing assertion.

GDP progress in Europe, significantly France, has been propped up by vacationer spending.

In different phrases, elevated spending does stimulate progress.

And when the industrial sector is taking orders for brand new items and repair provision they don’t to start with ask whether or not the customer is an American vacationer spending Euros on some vacationer attraction or whether or not it’s the French authorities ordering provides for its public sector establishments.

A Euro spent is a Euro of additional output if there’s idle capability.

And there’s loads of that throughout Europe at current.

Conclusion

I suppose the edict from Max Plank that ‘paradigms change one funeral at a time’ implies that Rogoff will proceed to be given an viewers for so long as he’s round.

And that reduces the standard of our public discourse.

That’s sufficient for in the present day!

(c) Copyright 2024 William Mitchell. All Rights Reserved.