Laptop Age Administration Companies Ltd – Main Registrar and Switch Agent for MFs

Integrated in 1988 and headquartered in Chennai, Laptop Age Administration Companies Ltd (CAMS) is India’s main and fastest-growing Certified Registrar and Switch Agent (QRTA) for Mutual Funds (MFs). With a market share of 68% based mostly on common asset beneath administration (AAUM), the corporate serves 10 out of 15 largest MF, together with the highest 4. The corporate additionally supplies tech enabled monetary infrastructure and companies to numerous monetary establishments similar to asset administration corporations (AMC), various funding funds (AIFs), and insurance coverage corporations, fee & account aggregator and central document maintaining company for NPS. As of 31 December 2024, the corporate has a large bodily community comprising 286 service centres unfold throughout 25 states and 5 union territories.

Merchandise and Companies

CAMS presents numerous companies similar to MF RTA, digital onboarding companies; transaction processing, document administration, fund accounting and many others for AIF and PMS; insurance coverage repository companies; account aggregator for banks, NBFCs, funding advisors and many others; streamlining the NPS journey of shoppers by way of eNPS registration, UPI-based checking account verification and many others; KYC registration company, RBI authorised fee aggregator, digital transformation, software program options and many others.

Subsidiaries: As of FY24, the corporate has 10 subsidiaries.

Funding Rationale

- Increasing market penetration – The corporate secured three MF-RTA mandates—Jio BlackRock MF, Pantomath MF, and Alternative MF. Moreover, it marked a major milestone by successful its first worldwide MF-RTA mandate from CeyBank AMC. CAMSREP, the corporate’s wholly owned subsidiary, has entered into an settlement with Life Insurance coverage Company of India (LIC) to offer insurance coverage repository companies. Moreover, CAMS has fashioned a three way partnership with KFin Applied sciences Ltd. to collectively personal, develop, preserve, and function the funding administration platform and ecosystem often called ‘MF Central’ (“Transaction”). Within the Alternate Funding Fund (AIF) phase, the corporate onboarded 21 new shoppers in Q3FY25. In its insurance coverage repository enterprise, the corporate secured a cope with Star Union Dai-ichi, making it the second life insurer to go for 100% policyholder protection with CAMS. On the insurance coverage aspect, it’s concentrating on a rise in insurance policies beneath administration from the present Rs.10 lakh to Rs.15 lakh per quarter.

- Sturdy operational efficiency – The corporate achieved its highest ever transaction quantity of Rs.24 crore (56% YoY development) throughout Q3FY25. AUM grew 38% to Rs.46 trillion on the again of sturdy fairness property development at 51%. Distinctive buyers grew by 31% to three.90 crore and Rs.0.98 crore new SIP registrations had been enrolled (a surge by 49% YoY), thereby rising the SIP e book to ~Rs.6 crore. Stay investor folio elevated by 35% in the course of the quarter to Rs.9 crore accounts. These signify the corporate’s elevated income technology potential, strengthened market management and wider investor base.

- Q3FY25 – Throughout Q3FY25, the corporate reported income of Rs.370 crore, a development of 28% as in comparison with the Rs.290 crore of Q3FY24. That is backed by a 28% development in MF income and 22% development in non-MF income. EBITDA elevated by 34% from Rs.130 crore of Q3FY24 to Rs.174 crore of the present quarter. Web revenue elevated from Rs.89 crore of Q3FY24 to Rs.125 crore of Q3FY25, a development of 40% YoY. EBITDA margin improved from 45% to 47% and internet revenue margin elevated from 31% to 34% YoY.

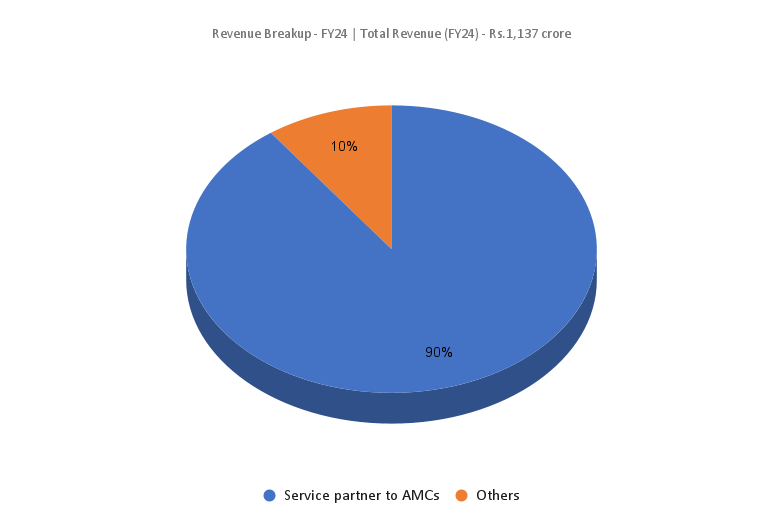

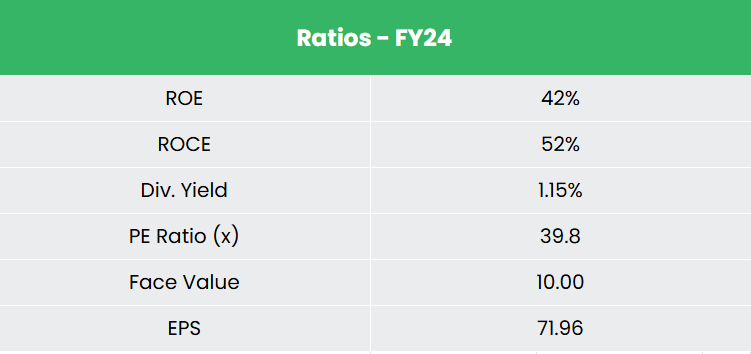

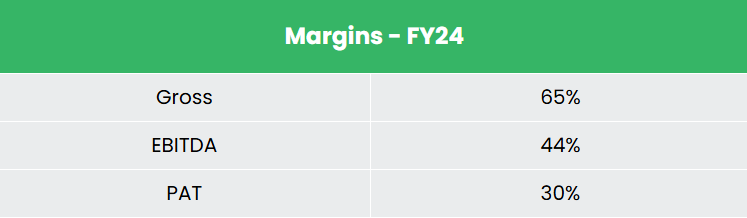

- FY24 – Fast development in transaction volumes and SIPs and buoyant investor confidence in capital markets has aided the corporate to generate a income of Rs.1,137 crore, a rise of 17% in comparison with the FY23 income. Working revenue is at Rs.505 crore, up by 20% YoY. The corporate reported internet revenue of Rs.354 crore, a rise of 24% YoY.

- Monetary Efficiency – The corporate has generated income and internet revenue CAGR of 17% and 25% over the interval of three years (FY21-24). Common 3-year ROE & ROCE is round 41% and 50% for FY21-24 interval. The corporate has a debt-to-equity ratio of 0.09.

Trade

India’s monetary sector – which incorporates industrial banks, insurance coverage suppliers, non-banking monetary corporations (NBFCs), cooperatives, pension funds, mutual funds, and different smaller monetary establishments – is witnessing speedy development. This enlargement is pushed by each the sturdy efficiency of present companies and the entry of latest gamers into the market. With sturdy help from each the federal government and personal sector, together with the fast-paced adoption of cellular and web applied sciences, India is rising as one of many world’s largest digital markets. As of FY25 (as much as January 2025), the mutual fund business’s Belongings Underneath Administration (AUM) reached Rs.68.05 lakh crore (US$ 789.44 billion). Throughout the identical interval, investments by way of Systematic Funding Plans (SIPs) totalled Rs.2,37,427 crore (US$ 27.54 billion).

Progress Drivers

- Decrease mutual fund penetration of 5-6% displays latent development alternatives given the rise of salaried middle-class inhabitants.

- The Union Price range 2025 has introduced a rise of FDI sectoral cap for the insurance coverage sector from 74% to 100%. This enhanced restrict will probably be accessible for these corporations, which make investments all the premium in India.

- The discount within the tax burden within the 2025-26 Union Price range is predicted to spice up the investable quantity accessible among the many increasing center class inhabitants.

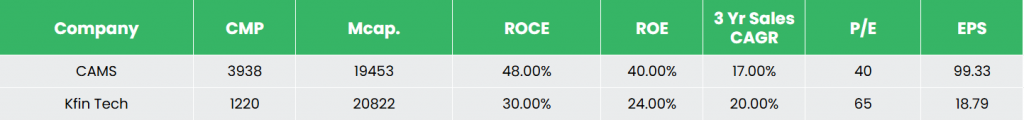

Peer Evaluation

Competitor – KFin Applied sciences Ltd.

In comparison with its competitor, the corporate is producing higher returns from invested capital aided by a secure development in income, indicating its prudent capital allocation and income producing capabilities.

Outlook

With a market share of ~68% based mostly on AAUM, 62% share in new SIP registration and 70% share of NFO assortment, CAMS has marked its place as a key monetary middleman within the Indian capital market. Its cutting-edge IT platforms and cellular functions have enabled the corporate in offering superior know-how options to its prospects. Notably the corporate is securing an rising variety of inbound contracts from each home and worldwide shoppers.

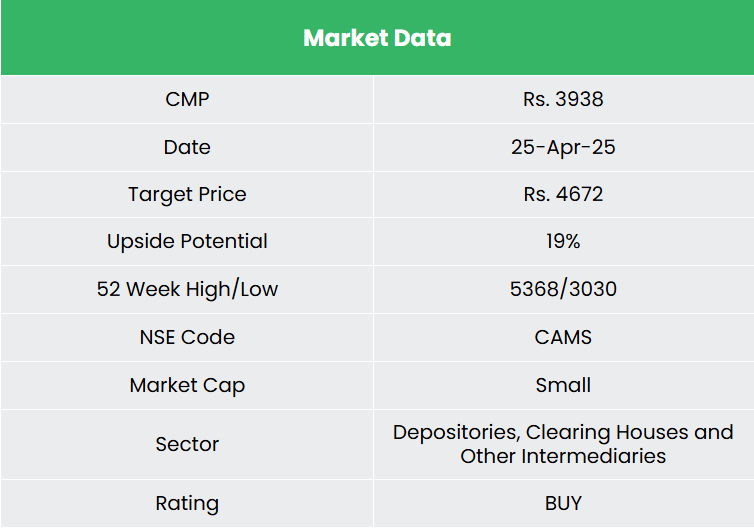

Valuation

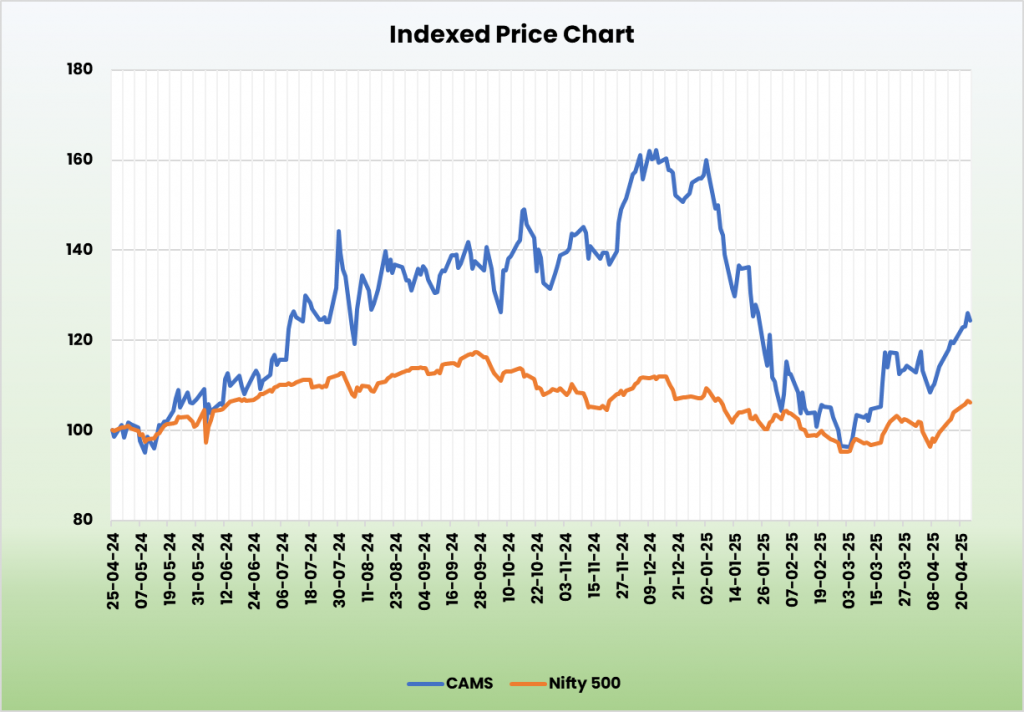

Being the market chief QRTA in India’s quick rising mutual fund business, strongly backed by the federal government’s impetus on digital transformation of monetary companies, we imagine CAMS is properly positioned to speed up its development momentum. We advocate a BUY score within the inventory with the goal worth (TP) of Rs.4,672, 48x FY26E EPS.

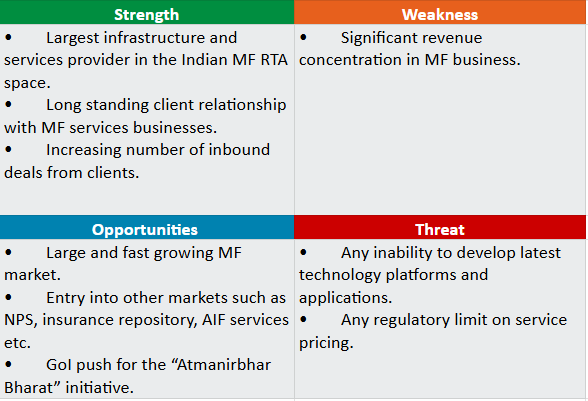

SWOT Evaluation

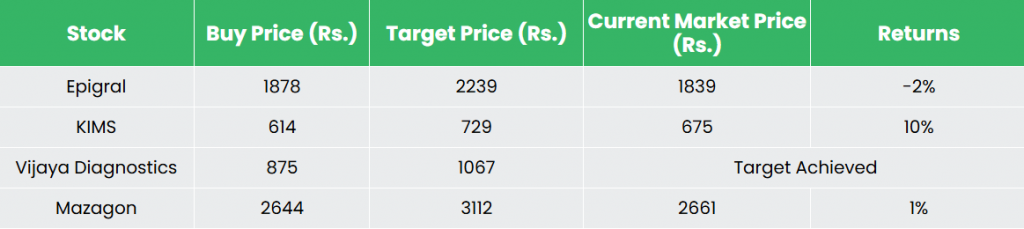

Recap of our earlier suggestions (As on 25 April 2025)

Krishna Institute of Medical Sciences Ltd

Disclaimer: Investments within the securities market are topic to market dangers, learn all associated paperwork fastidiously earlier than investing. Securities quoted listed here are exemplary, not recommendatory. Please seek the advice of your monetary advisor earlier than investing. Please notice that we don’t assure any assured returns for the securities quoted right here.

Analysis disclaimer: Funding within the securities market is topic to market dangers. Learn all of the associated paperwork fastidiously earlier than investing. Registration granted by SEBI, and certification from NISM under no circumstances assure the efficiency of the middleman or present any assurance of returns to buyers.

For extra particulars, please learn the disclaimer.

Different articles you might like

Submit Views:

17