THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE SEE MY DISCLOSURES. FOR MORE INFORMATION.

After I first began to take initiative and enhance my funds, step one was to construct a strong financial savings base.

I knew that by having a big pile of financial savings, I’d cowl myself if emergencies occurred.

And having this financial savings would additionally enable me to give attention to investing my cash and rising it quicker.

Because of my finance background, I understood the ability of compound curiosity and needed to discover a financial savings account that supplied me a excessive yield.

It’s because the upper the rate of interest, the extra curiosity I’d earn.

In the present day, many on-line banks attempt to be the one cease store for all of your banking wants.

Consequently, they don’t provide aggressive rates of interest, thus taking longer to develop your financial savings.

Fortunately, CIT Financial institution is right here.

They provide one of many highest yields within the nation so your financial savings will develop as quick as potential.

On this put up, I’m going to indicate you why I preserve my financial savings with CIT Financial institution and why you must too.

CIT Financial institution Evaluation | The Finest Place To Develop Your Financial savings

What Is CIT Financial institution?

Based greater than 100 years in the past, CIT Financial institution started as a brick and mortar financial institution specializing in serving to companies and people with their cash.

In the present day, CIT Financial institution is primarily an web financial institution, nevertheless it does have a number of bodily branches in California underneath the OneWest Financial institution division.

As a banking establishment within the US, it’s regulated by the Workplace of the Comptroller of the Foreign money.

CIT Financial institution Merchandise

CIT Financial institution affords quite a lot of services that helps you in assembly your monetary objectives and bettering your funds.

These merchandise embrace:

- eChecking

- Cash markets

- Financial savings builder

- Jumbo CD

- Time period CD

- No-penalty CD

Here’s a detailed take a look at every one.

eChecking

Lately, CIT Financial institution launched a checking account to prospects. This makes CIT a one cease banking resolution.

The checking account follows the identical premise as different accounts, which means no charges and a aggressive rate of interest.

In addition they provide as much as $15 in ATM reimbursement charges a month and work with many digital cost options together with Zell, Invoice Pay, Apple Pay, and Samsung Pay.

Cash Market Accounts

A CIT Financial institution cash market account is especially advantageous for purchasers who can preserve a $25,000 steadiness.

At that stage, you’ll unlock their highest incomes potential, typically surpassing what many conventional banks provide on related accounts.

Financial savings Builder

CIT Financial institution’s Financial savings Builder account is designed for constant savers. It affords most of the identical benefits as the cash market account—with out requiring a big minimal steadiness.

Try the quick video beneath to be taught extra about the way it works.

Begin with a $100 opening deposit, then proceed including $100 or extra every month to maintain incomes their high fee.

In the event you miss a month-to-month deposit, your fee will dip quickly, nevertheless it’ll bounce again as quickly as you resume your common financial savings behavior.

Finest Financial institution Account

CIT Financial institution

With a few of the highest paying rates of interest within the U.S. CIT Financial institution stands out as providing the very best financial savings accounts, particularly the Financial savings Join Account. Add in ease of use and nice customer support, and you’ve got a transparent winner.

CIT Financial institution Private Account Disclosures

For full record of account particulars and charges, see CIT Financial institution Private Account disclosures.

Jumbo CD

CIT Financial institution has a few of the greatest CD choices accessible.

The jumbo CD will maximize your return on funding with none stress in your half.

Phrases vary from 2 to five years and have numerous charges.

There are not any account opening charges, curiosity is compounded day by day, and your CD is FDIC insured.

Time period CD

With a gap deposit of $1,000 you possibly can open a high-yield CD for phrases starting from 6 months to five years, and charges with numerous charges as properly.

There isn’t a payment to open an account, your curiosity compounds day by day, and your CD is FDIC insured.

No-penalty CD

Open a no-penalty, 11-month CD with solely $1,000 and have entry to your funds with out worry of penalties if you must make an early withdrawal.

Curiosity is compounded day by day and funds are insured by the FDIC.

Opening An Account With CIT Financial institution

Opening an account with CIT Financial institution is straightforward and could be accomplished in lower than 10 minutes.

The truth is, there are simply 3 easy steps to opening an account, whatever the financial institution product you need.

That’s all there’s to it.

In fact, in case you are opening a Financial savings Builder account, I like to recommend you arrange a month-to-month switch of $100 so that you assure your self the best yield potential.

Finest Financial institution Account

CIT Financial institution

With a few of the highest paying rates of interest within the U.S. CIT Financial institution stands out as providing the very best financial savings accounts, particularly the Financial savings Join Account. Add in ease of use and nice customer support, and you’ve got a transparent winner.

CIT Financial institution Private Account Disclosures

For full record of account particulars and charges, see CIT Financial institution Private Account disclosures.

CIT Financial institution Charges

That is one other space the place CIT Financial institution shines.

They don’t cost any of the everyday charges most banks cost.

For example, you received’t see any of those charges:

- No account opening charges

- No month-to-month upkeep charges

- No inactivity charges

- No account closure charges

And with a minimal deposit of $25,000, there no wire switch charges both.

But when your steadiness drops beneath this, there could also be a payment for outgoing wire transfers.

Be aware the payment is barely on outgoing wire transfers. There are not any charges for incoming wire transfers.

For Financial savings Builder accounts, as an alternative of charging a payment, you earn a decrease rate of interest in case your steadiness falls beneath the minimal quantity otherwise you don’t make the required month-to-month deposit.

Nevertheless, as soon as your steadiness is greater than the minimal otherwise you full the required month-to-month deposit, you earn the best rate of interest once more.

Benefits And Drawbacks

Benefits

Here’s a fast abstract of the issues that makes CIT Financial institution stand out from different banks.

- Aggressive curiosity potential

- No month-to-month upkeep or service charges

- Low opening deposit requirement

Drawbacks

There are a number of wish-list objects I want to see improved upon or applied with CIT Financial institution.

- No bodily branches / online-only mannequin

- Tiered / conditional qualification for greatest charges

- Slower transfers / fund entry wait occasions

Steadily Requested Questions

Listed below are the most typical questions I get requested about CIT Financial institution.

This can be a good spot to give attention to in case you are quick on time.

Is CIT Financial institution legit?

Sure, CIT Financial institution is a reputable financial institution.

CIT Financial institution has been in enterprise for over 100 years and is regulated by america Treasury.

Along with providing on-line banking to prospects, they’ve roughly 60 bodily branches in California underneath the identify OneWest Financial institution.

Lastly, FinTech Breakthrough rated CIT Financial institution the very best private monetary firm for 2019.

Is CIT Financial institution safe?

CIT Financial institution does every part it will possibly to maintain itself and prospects information safe.

For starters, they use cutting-edge 188-bit SSL encryption to have a safe browser.

As well as, they routinely signal you out of your account after a interval of inactivity in addition to layered safety so solely you possibly can entry your account data.

For an entire run down of the safety measures CIT Financial institution takes to maintain safe, see beneath.

Who’s CIT Financial institution owned by?

CIT Financial institution is owned by CIT Group.

CIT Group affords banking companies via CIT Financial institution and in addition affords financing, leasing, and different companies to small enterprise in america.

Is CIT Financial institution and Citibank the identical?

No.

They’re two utterly totally different firms.

Many individuals falsely imagine they’re the identical because the mum or dad firms sound the identical.

CIT Financial institution is owned by CIT Group and Citibank is owned by Citigroup.

Does CIT Financial institution provide a excessive rate of interest?

CIT Financial institution persistently affords a few of the highest rates of interest on all the merchandise they provide.

And so they don’t make you leap via hoops to earn this premier rate of interest.

Simply deposit a certain quantity or arrange a month-to-month deposit of $100 and you’re set.

How lengthy does it take to switch cash to CIT Financial institution?

Transfers to and from CIT Financial institution tackle common 3-5 enterprise days to finish.

That is typical for the banking business, although some now provide quicker switch occasions.

What merchandise does CIT Financial institution provide?

CIT Financial institution affords a handful of excessive curiosity financial institution merchandise for shoppers.

These embrace:

- Financial savings Builder

- Cash Market Accounts

- Certificates of Deposit

- Premier Excessive Yield Financial savings

The rates of interest on these merchandise varies. To get essentially the most present charges, click on right here.

Is my cash with CIT Financial institution protected?

The cash you deposit with CIT Financial institution is roofed by FDIC Insurance coverage.

This insurance coverage protects as much as $250,000 value of deposits.

Which means if CIT Financial institution goes bankrupt or out of enterprise, you’ll get your a refund.

What charges does CIT Financial institution cost?

CIT Financial institution expenses little or no charges.

The truth is, the charges are solely associated to sure actions and never on the accounts themselves.

With CIT Financial institution, you aren’t charged any account opening charges or month-to-month service charges.

The few charges they do cost are on outgoing wire charges and overdraft charges on their cash market account.

Is CIT Financial institution Good?

Sure, CIT Financial institution is a strong selection for savers who need aggressive rates of interest and low charges.

It’s an online-only financial institution, so it’s greatest fitted to folks snug managing their cash digitally.

Whereas transfers can take a bit longer than at some banks, CIT affords sturdy worth general for these targeted on rising their financial savings.

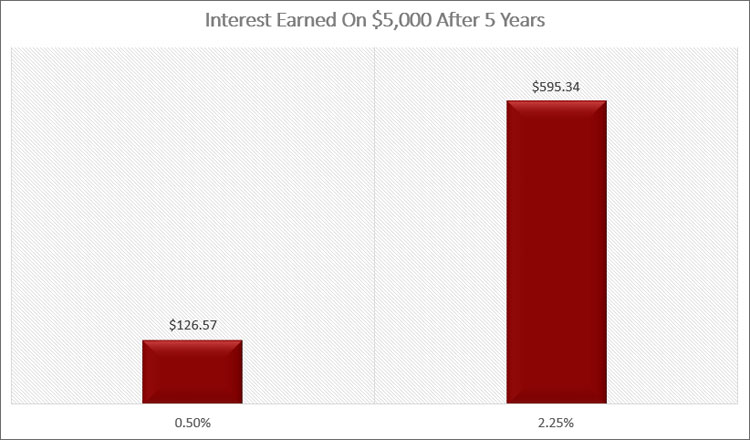

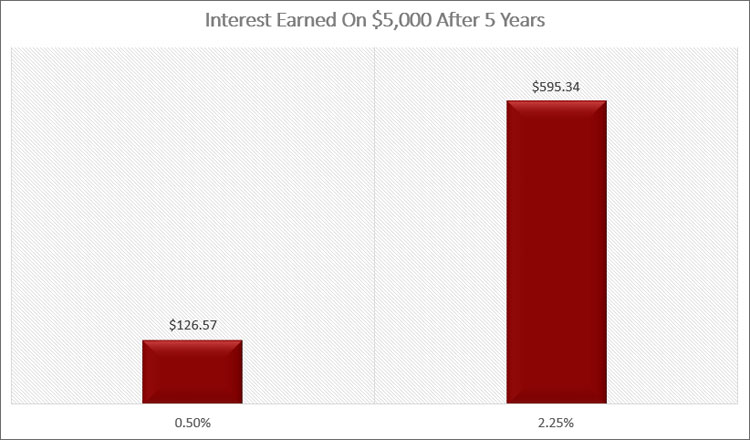

Why does a excessive rate of interest matter?

The upper the rate of interest in your financial savings, the quicker your cash compounds and grows.

Right here is a straightforward instance for you.

Let’s say you may have $5,000 and may put it right into a financial savings account that earns 0.50% curiosity or one which earns 2.25% curiosity.

Right here is how a lot curiosity you earn in 5 years in every account.

As you possibly can see, the upper curiosity paying account grows your cash quicker.

Because of this you wish to ensure that whenever you open your financial savings account with CIT Financial institution, you arrange a month-to-month switch of $100 so that you earn the best rate of interest they provide.

Finest Financial institution Account

CIT Financial institution

With a few of the highest paying rates of interest within the U.S. CIT Financial institution stands out as providing the very best financial savings accounts, particularly the Financial savings Join Account. Add in ease of use and nice customer support, and you’ve got a transparent winner.

CIT Financial institution Private Account Disclosures

For full record of account particulars and charges, see CIT Financial institution Private Account disclosures.

CIT Financial institution Alternate options

There are loads of on-line banks on the market, however not all are created equal.

Listed below are two alternates to CIT Financial institution that compete properly.

CIT Financial institution vs. Ally

What makes Ally stand out vs. CIT Financial institution is they provide checking accounts. Due to this, they may very well be you solely financial institution you utilize.

Along with this, they pay aggressive rates of interest on their financial savings merchandise. Nevertheless, their fee will not be as excessive as CIT Financial institution.

You may click on right here to be taught extra about Ally Financial institution.

CIT Financial institution vs. Capital One 360

Capital One 360 additionally affords a whole banking expertise like Ally Financial institution does.

The distinction with Capital One 360 is the curiosity they pay on their financial savings accounts is significantly decrease than CIT Financial institution and Ally Financial institution.

Nonetheless, they’re simple to make use of and many purchasers are proud of them.

CIT Financial institution vs. Betterment On a regular basis

Betterment affords a checking and financial savings product as properly, known as Betterment On a regular basis.

The primary distinction between these accounts and CIT Financial institution is Betterment will not be a financial institution. It companions with banks to give you a banking product.

Betterment doesn’t cost any charges on their checking or financial savings accounts and each earn curiosity.

And like CIT Financial institution, Betterment On a regular basis affords FDIC insurance coverage in your cash.

Remaining Ideas

On the finish of the day, CIT Financial institution affords financial savings merchandise that can assist you get monetary savings. And it does an incredible job at this.

It doesn’t have any frills or bells and whistles, which permits them to supply one of many highest rates of interest within the nation.

Whereas some folks would possibly see the dearth of extras as a disadvantage, I see it as a power.

Your financial savings is there to develop and for use for particular objectives. By not having the extras, your cash grows quicker and stays in your account to develop.

And once I was first beginning to work on constructing wealth, that is what I needed.

So I opened up a web-based checking account and I shredded the ATM card. I didn’t need quick access to the cash.

I needed it to develop and compound.

And that’s what it did.

If you wish to begin bettering your funds you must construct a financial savings cushion and CIT Financial institution helps you do that effectively and successfully.