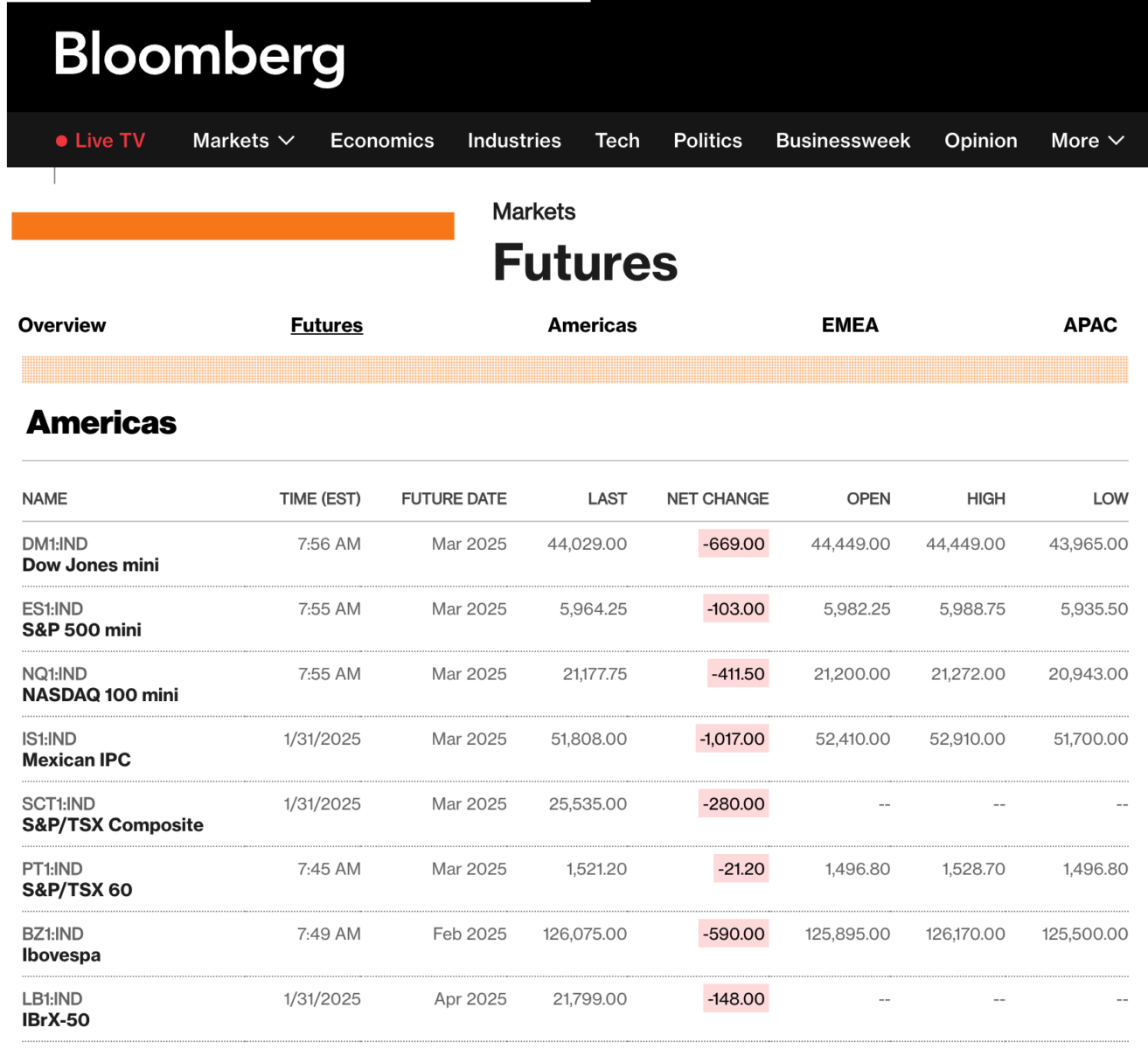

My weekend routine wraps up with checking in on the Futures markets (free through Bloomberg right here) after 6 p.m. to see how equities are doing. Futures buying and selling reveals how markets are reacting to no matter information broke over the weekend. It might present a snapshot of what Monday morning would possibly appear to be, and even how the remainder of the week might form up.

~~~

We’re however two weeks into the administration of Trump 2.0. As a brand new set of insurance policies ramps up, I needed to share some information factors about the place we’re and what we would anticipate from an administration that presents dangers and alternatives. I need to focus on Coverage, however earlier than I do, a fast phrase about Politics, and particularly about mixing politics with Investing.

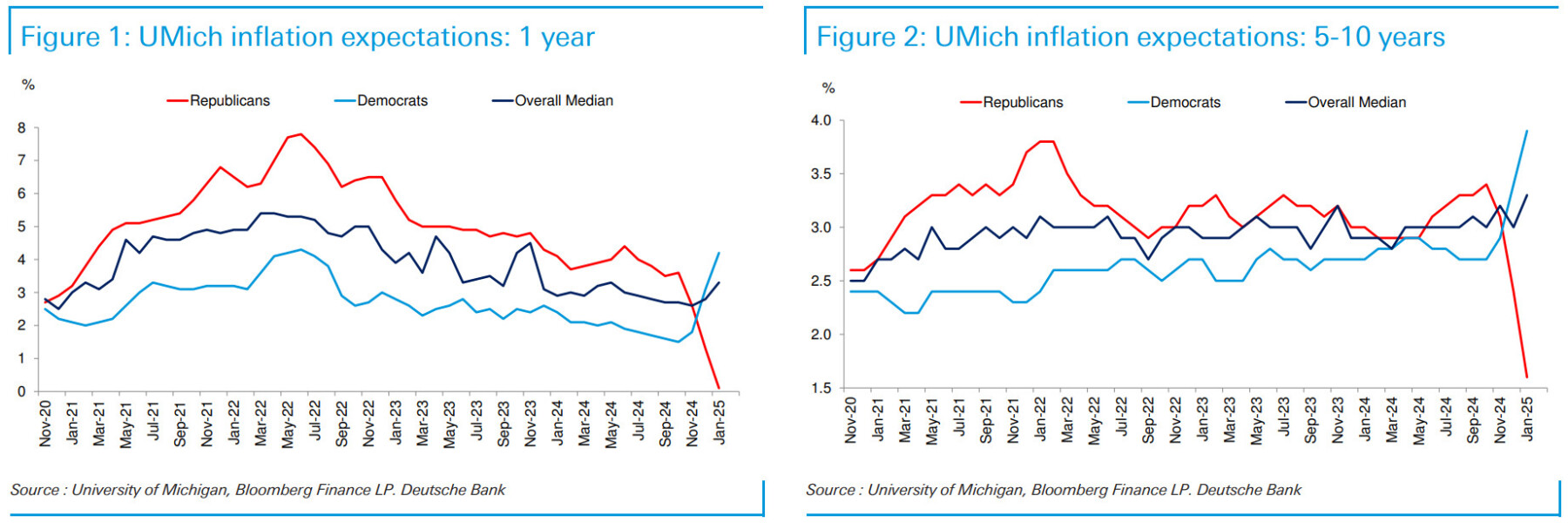

Even one thing as fundamental as SENTIMENT is impacted by your priors, tribal affiliation, and flawed cognition. You see what your mind desires/expects you to see, not what’s there. This chart has turn out to be the traditional instance:

Your purpose, difficult although it could be, is to keep away from letting no matter partisan preferences you could have intervene together with your portfolio preferences. Because the chart above reveals, partisanship results in costly errors, as an investor is an costly passion…

~~~

Let’s bounce into the non-partisan fray to see what we will deduce. Word: These bullet factors and charts come from my Q1 convention name for shoppers (week of January sixth) and pre-date the newest information by a number of weeks.

Economic system: For the second time, President Trump inherited a strong financial system from his predecessor. Regardless of economists predicting a recession for the previous two years (Incorrect!), we’ve loved a resilient, surprisingly sturdy financial system characterised by full employment, sturdy wages, and strong spending.

-Full-year GDP is shut to three%;

-Unemployment Charge: 4.1% (full employment);

-Inflation is at a close to regular. 2.7% (headline CPI);

-Wages are greater;

-Markets are (had been) at report highs.

The U.S. has a ~$28 trillion financial system, 4% of the world’s inhabitants, >20% of the globe’s GDP, and >55% of the worldwide market cap. Economically talking, America is already nice.

Apart from the US, the developed world is doing solely OK; Europe has structural issues, and China is doing worse(!). Within the U.S., sentiment has been weak for years. However to paraphrase Ralph Waldo Emerson:

“I can’t hear what you’re saying as a result of what you’re doing speaks so loudly.”

From Thanksgiving Day to Cyber Monday, on-line spending was $41B—that may be a monstrous quantity! House costs are up, demand for cars is strong, and client spending on journey, leisure, and discretionary objects is substantial. Individuals might complain in regards to the costs of Eggs, however their actions are pure expansionary growth conduct.

The underside 50% is undoubtedly struggling: There will not be sufficient starter houses (and they’re dear), bank card charges are very excessive, and automotive financing ain’t low cost. Whereas wages are up for everyone, they’re much greater for the highest half, quartile, and decile.

The underside line economically is that we rolled into 2025 with a robust, constructive financial footprint, with households in good condition, sturdy wage development, affordable saving charges, and company income at report highs.

Footnote: For an incumbent get together to lose the White Home with this kind of financial information is political malpractice.

~~~

Dangers & Alternatives from the brand new 2025 administration

Dangers:

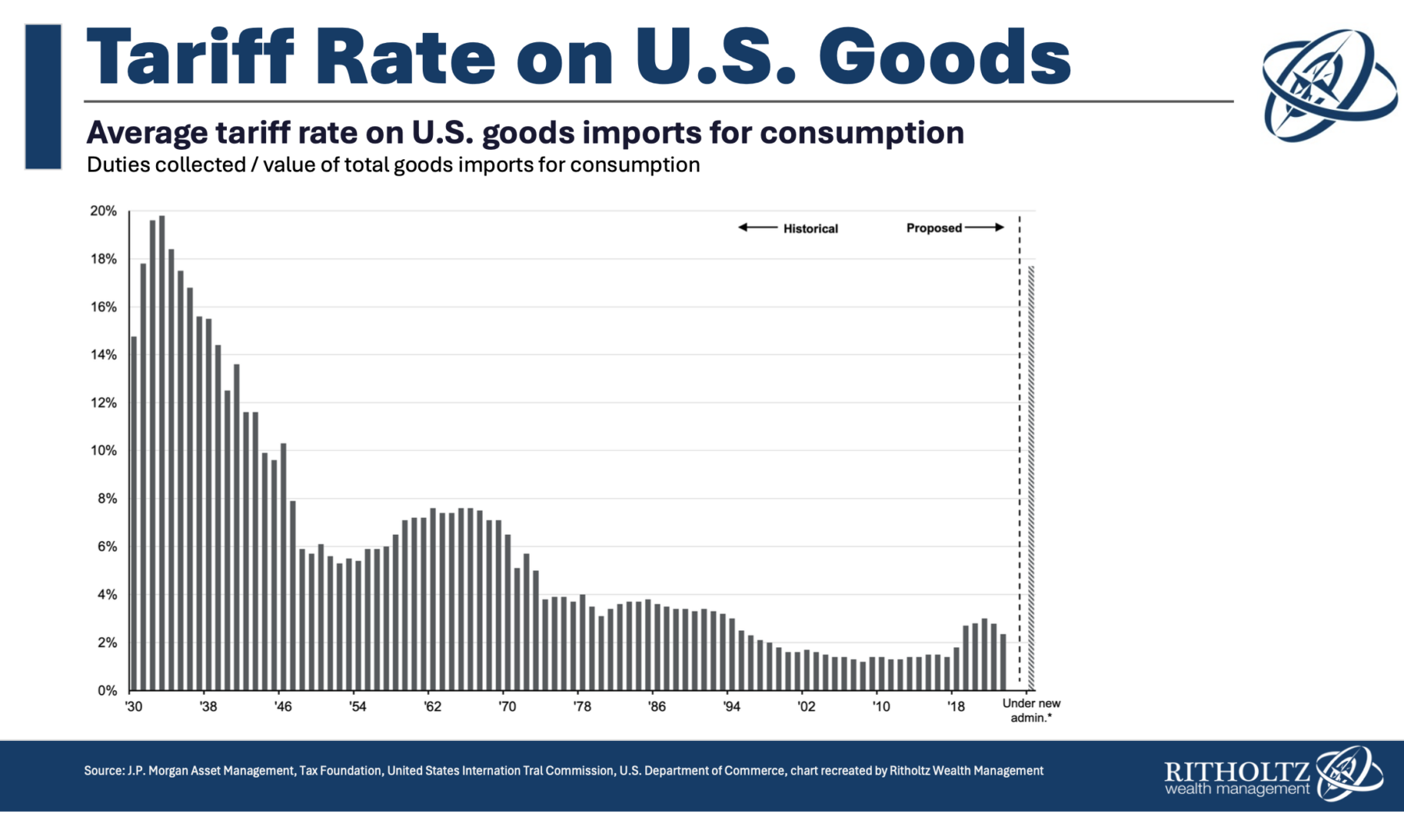

1. Tariffs: Smoot-Hartley tariffs had been partly blamed for the Nice Despair (or at the very least for worsening it). 25% tariff ranges could have a really important affect on the worldwide financial system and the U. S. financial system. I don’t know what to make of 20% tariffs on particular nations and 10% tariffs on the remainder of the world. My wishful considering is that is hopefully a negotiating tactic (however who is aware of?). Sure, there must be some parity/equity for Tariffs. That is very true for US Agricultural merchandise (farmers) and oil and pure fuel (vitality producers).

Tariffs are an inflationary tax in the end paid by shoppers. If we’re placing tariffs on Toyotas from Japan or oil from Canada, it’s the client that principally pays them. (Some tariff prices could also be absorbed by the products producers and resellers).

2. Fiscal spending: Regardless of what 50 years of BS, extra spending has by no means been an issue throughout my lifetime. Web curiosity funds – what we’re paying in curiosity on our borrowed cash – is now bigger than our complete protection spending. That does catch my consideration.

3. Geopolitics: The Trump admnistration is a wild card right here. China? Russia? Center-East? Danger of battle and disruption, are all dangers to markets.

Every thing on the Dangers facet comes all the way down to rates of interest. All the insurance policies above are possible if carried out totally, to stress rates of interest greater. (Partila implementation much less so). Even immigration insurance policies make labor shortages worse (agriculture, development, eating places). Deport 3 million folks, a lot much less 13 million folks, and it’ll be tougher to seek out and rent folks to work on farms, and in development. Every thing will value extra.

Alternatives:

The alternatives are much less nuanced: What is going to drive markets greater?

1. Tax cuts That is Easy and easy: Decrease tax charges for Company America and particularly manufacturing are supportive of upper inventory costs.

2. Deregulation might be useful to particular sectors (Power, tech, Healthcare). Elevated funding in home vitality manufacturing might present development alternatives in associated sectors. Word: Power & Supplies had been among the many weaker sectors in 2024

3. Mergers: A defanged FTC will enable extra M&A exercise, supportive of upper market costs.

4. IPOS and Secondaries are likely to do higher in that setting, and that’s additionally supportive of upper costs.

5. Inventory buybacks will improve (Ditto)

The constant theme within the alternatives part are merely very market pleasant insurance policies…

~~~

What made the Trump 1.0 so difficult is that the majority observers suffered a failure of creativeness as to a full implementation of MAGA insurance policies. There have been a number of social coverage adjustments — SCOTUS, Abortion insurance policies, little one separation, and so forth. — however aside from the TCHA of 2017 tax cuts, there have been fewer radical financial insurance policies carried out.

Trump 2.0 presents very completely different set of potential outcomes. It is vitally difficult to guess which could have a much bigger affect, as we do not know as to what’s going to get totally, partially or by no means implemnented.

Strap your self in, Volatility might start to maneuver greater…

Beforehand:

Why Politics and Investing Don’t Combine (February 13, 2011)

Is Partisanship Driving Client Sentiment? (August 9, 2022)

Archive: Politics & Investing

See additionally:

The Trump commerce battle begins Superb, let’s discuss tariffs (Callie Cox, February 03, 2025)

Tariff Nation: Explaining to your fifth grader why tariffs damage everybody (Roger Lowenstein, Feb 03, 2025)

Trump Will Take the Inventory Market on a Bumpy, if Affluent, Trip. What to Do Now. Barron’s January 26, 2025

It Was a Very Good 12 months, Liz Ann Sonders, Kevin Gordon (Schwab, January 6, 2025)