The US Treasury first applied Inflation-Protected Bonds (TIPS) in 1997, and so they now make up about 7% of the Treasury market. Since then, inflation has hardly ever gone above 3% till 2021. Tariffs (customs duties) started surging in 2018, and President Trump is now implementing widespread tariffs. With retailers having low revenue margins, these tariffs will largely be handed on a tax on customers. This text represents my analysis on the best way to make investments the bond portion of a portfolio to scale back volatility and put together for larger inflation.

Inflation Forecasts

Inflation by varied measures has fallen under 2.3%. Tariff will increase had been introduced on April 2nd, and it takes time for merchandise with the extra tariffs to succeed in the cabinets. The Fed – Financial Coverage: Beige Guide describes costs growing at a reasonable tempo. The report says, “All District studies indicated that larger tariff charges had been placing upward strain on prices and costs.”

The Philadelphia Federal Reserve Second Quarter 2025 Survey of Skilled Forecasters exhibits that economists estimate that inflation will peak at 3.4% subsequent quarter and decline to 2.5% in 2026 and a couple of.1% in 2027. The Organisation for Financial Co-operation and Growth launched its OECD Financial Outlook, Quantity 2025 Difficulty 1, with estimates that inflation within the US will common 3.2% in 2025 and a couple of.8% in 2026. In “2025 Financial system Watch”, The Convention Board estimated that inflation would common 2.9% in 2025 and three.0% in 2026. The Worldwide Financial Fund database estimates that shopper costs within the US might be 3.0% in 2025, 2.5% in 2026, and a couple of.1% in 2027.

Regardless of these noble efforts to estimate inflation, there’s an excessive amount of uncertainty in coverage and too many unknowns concerning geopolitical threat and provide chain disruptions to have a dependable forecast. Following the escalation of the Israeli-Iran battle in June, oil costs rose 22% from a low of $60 to $73 on June 15th. Geopolitical dangers and provide chain disruptions have the potential to exacerbate tariff-induced inflation. I count on reasonable rises in inflation in a slowing economic system with the Federal Reserve reducing charges towards the top of the 12 months.

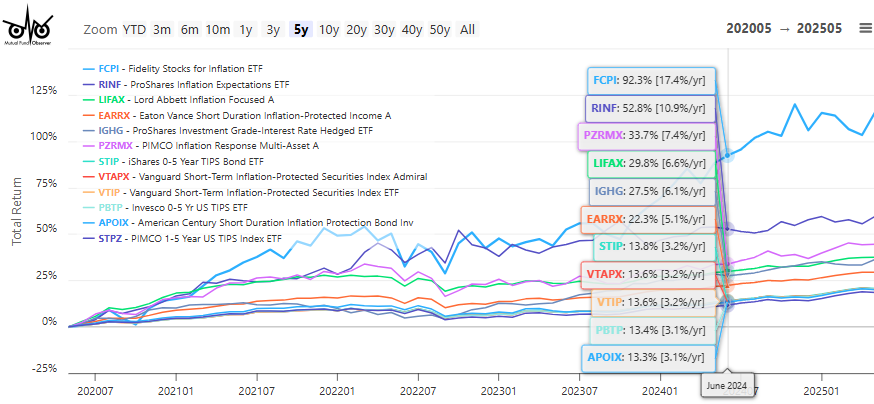

Submit-Pandemic 5-Yr Return

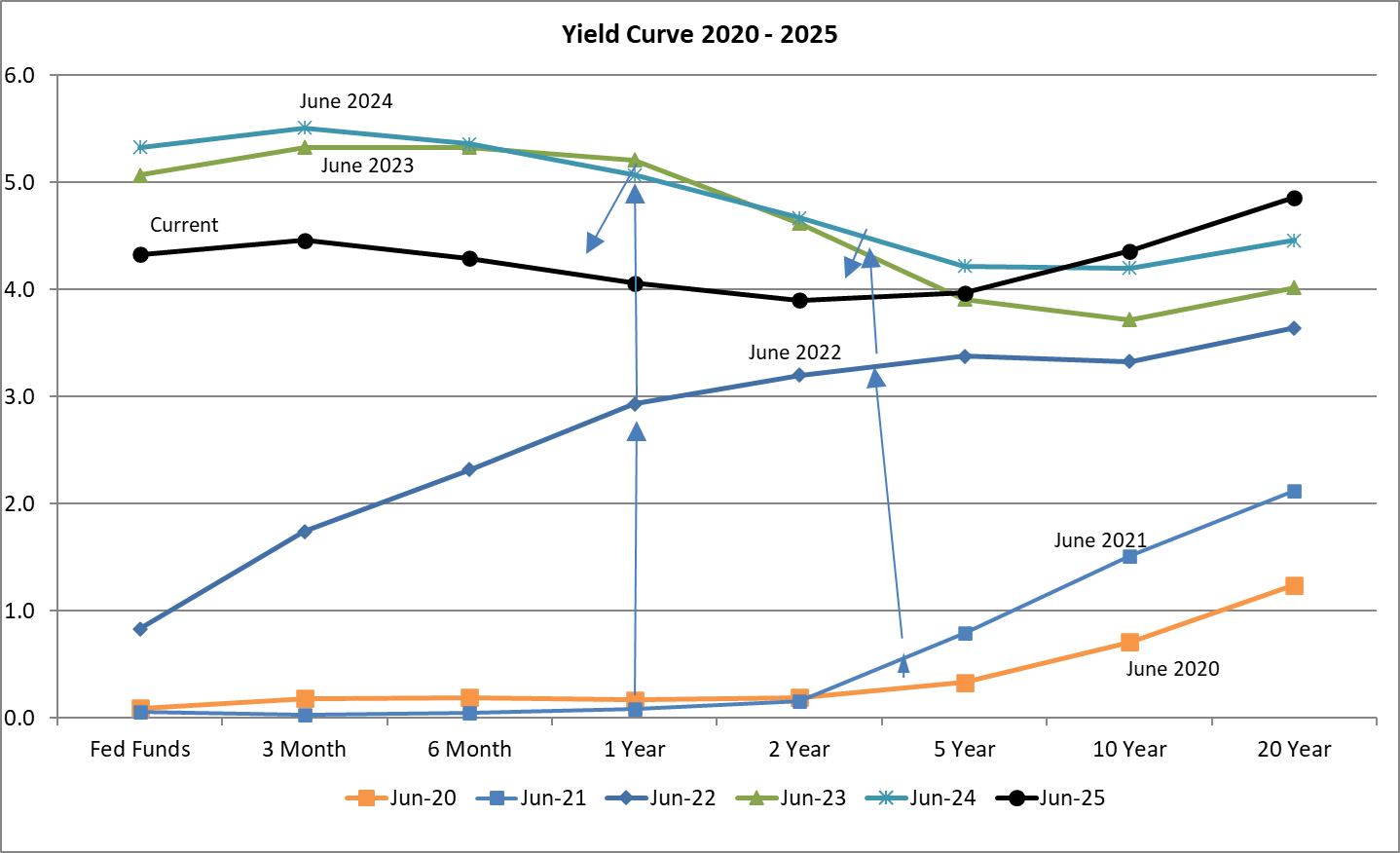

In the course of the previous 5 years, the US has skilled the COVID pandemic, huge stimulus, ensuing inflation, and speedy financial tightening. As proven in Determine #1, the yield curve has responded with your complete curve normalizing by June 2022. In 2023 and 2024, the brief finish of the curve rose and parts of the curve inverted because the Federal Reserve raised charges to struggle inflation. As we speak, the brief finish of the curve is falling because the economic system slows and traders anticipate decrease charges, and the lengthy finish stays excessive, probably impacted by the prospects of upper deficits.

Determine #1: Yield Curve June 2020 to June 2025

Now, as tariffs take impact amidst rising geopolitical threat, we will anticipate a resurgence of inflation to some extent. Let’s take a 30,000-foot-high stage have a look at bond efficiency over the previous 5 years. It ought to be no shock that bonds with shorter durations have carried out the perfect as a result of these with longer durations have been battered by rising long-term charges.

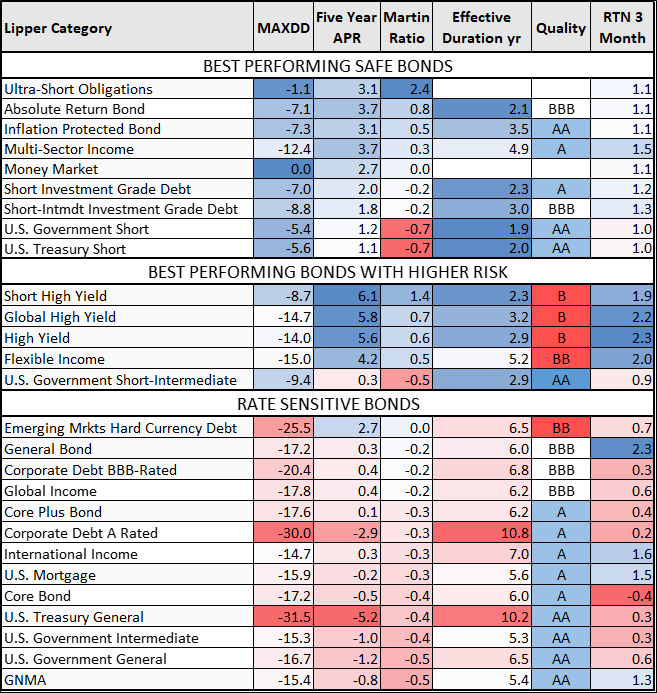

Desk #1 comprises many of the Lipper Bond Classes divided into “safer”, “reasonable threat”, and “price delicate” Lipper Classes. Over the previous 5 years, excessive yield funds with shorter durations and Versatile Earnings funds had been the perfect performing, adopted by Extremely-Brief Bond, Absolute Return Bond, and Inflation Protected Bond, and Multi-Sector Funds. These are the identical bond classes which have carried out the perfect over the previous three months. The Lipper Class of Inflation Protected Bonds will not be segregated by length which is the main target of the following part.

Desk #1: Lipper Bond Class Efficiency – 5 Years

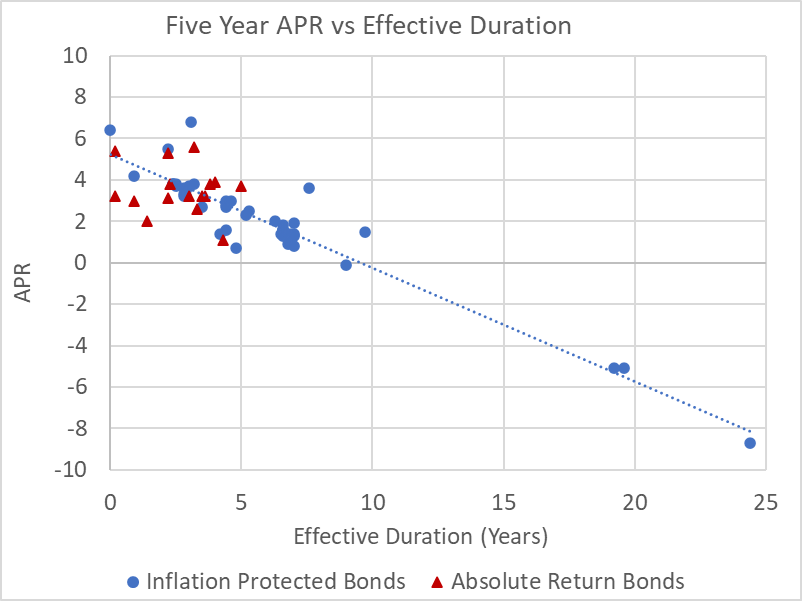

Determine #2 exhibits the connection between annualized p.c return for the previous 5 years and length for inflation-protected bonds and absolute return bond funds.

Determine #2: Bond Efficiency Versus Efficient Length

I retired in 2022 and started utilizing Monetary Advisors at Constancy and Vanguard about that point. They have a tendency to depend on core and common bond funds, which over the long run have a low correlation to shares. I handle the extra conservative sub-portfolios of Conventional IRAs. To organize for tariff-induced inflation, over the previous 9 months, I’ve elevated allocations to ultra-short and short-term bond funds, absolute return bond funds, inflation-protected bond funds, and multi-sector funds.

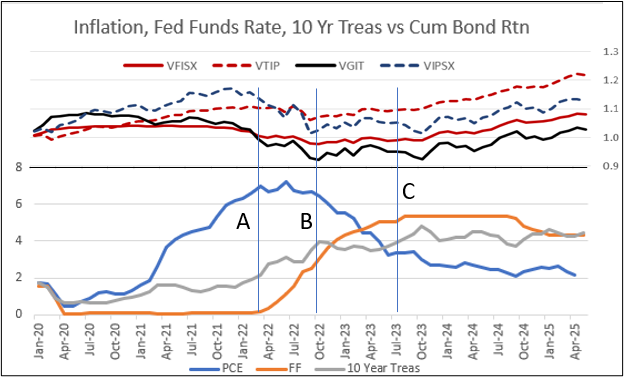

The Nice 2020 to 2025 Inflation Laboratory

The post-COVID pandemic time interval gives a wonderful alternative to know how inflation-protected bonds carry out. The underside half of the chart exhibits inflation as measured by the private consumption expenditure index (12 months over 12 months), the Federal funds price, which is the Federal Reserve’s main instrument for slowing the economic system to scale back inflation, and the 10-Yr Treasury. The highest half of the chart exhibits the cumulative returns of short-term authorities bonds (stable purple line) and short-term Treasury inflation-protected bonds (dashed purple line) in comparison with intermediate authorities bonds (stable black line) and intermediate-term Treasury inflation-protected bonds (dashed black line) carried out.

Determine #3: Cumulative Bond Return vs Inflation and Yields

Supply: Creator Utilizing St. Louis Federal Reserve FRED database and MFO Premium fund screener and Lipper world dataset.

Level A within the determine above is when the Federal Reserve started elevating short-term charges (orange line). Level B is when inflation (blue line) started to fall and the rise within the 10-year Treasury price (grey line) started to flatten. Level C is when the Federal Reserve stopped elevating short-term charges.

The storyline is that intermediate inflation-protected bonds carried out finest previous to Level A, when inflation was rising, whereas intermediate authorities bonds started to carry out poorly as intermediate charges started to climb. As much as level B, intermediate inflation-protected bonds started to carry out poorly as inflation plateaued and intermediate charges continued to rise. Previous to Level C, each short- and intermediate-term inflation-protected bonds outperformed their nominal counterparts as inflation fell however remained above 2%, and charges stabilized. After Level C, short-term bonds, particularly inflation-protected, outperformed as short-term charges fell and intermediate charges stay elevated. Brief-term inflation-protected bonds proceed to carry out nicely in 2025.

Desk #2: Bond Fund Efficiency By Yr

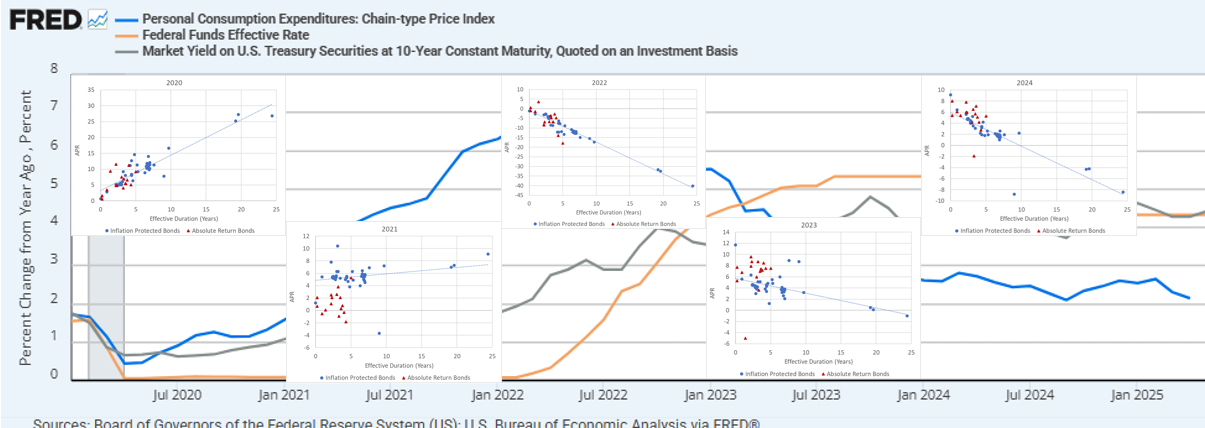

Determine #4 exhibits all inflation-protected bonds (blue circle) and actual return bonds (purple triangle) by 12 months overlain onto a chart of inflation (PCE YOY), Fed Funds price, and 10-year Treasury price. I favor the bonds with shorter durations right now.

Determine #4: Bond Efficiency vs Efficient Length By Yr

Supply: Creator Utilizing St. Louis Federal Reserve FRED database and MFO Premium fund screener, and Lipper world dataset.

Conceivable Dangers

What we noticed within the earlier part are inflation and rate of interest dangers. A recession was averted. There are different dangers that may affect efficiency. Slowing development can result in a recession or, worse but, a recession with larger inflation is named stagflation which presents issues for the Federal Reserve. Isolationism and commerce wars can result in provide chain disruptions, retaliatory tariffs, and even larger inflation. Economists that I comply with agree that the price range proposal will result in larger deficits and additional will increase within the nationwide debt, which may result in larger charges and slower development. Fairness valuations are excessive, that are tailwinds for home shares.

For these causes, I’ve taken precautions to scale back my stock-to-bond allocation from 65% to 50%, keep bond ladders for round seven years, enhance allocations to short-term bonds, and spend money on funds to guard towards inflation. I keep a diversified world allocation to shares and bonds.

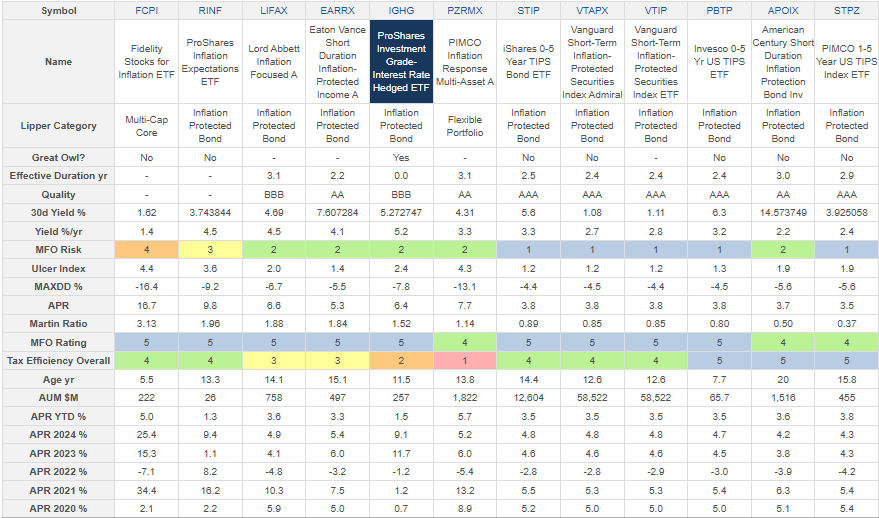

Desk #3 comprises a number of the high-performing funds that shield towards inflation. They’re sorted from the very best risk-adjusted return (Martin Ratio) on the left to the bottom on the best.

Desk #3: Chosen Excessive-Performing Inflation-Protected Funds – 5 Years

Determine #5: Chosen Excessive-Performing Inflation-Protected Funds – 5 Years

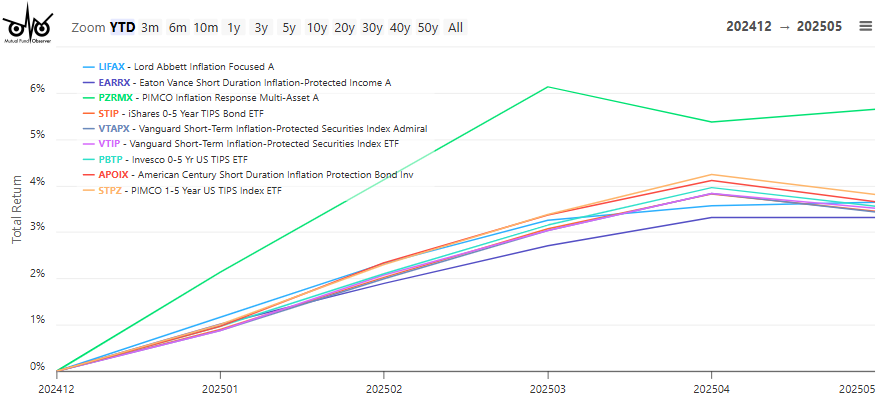

Determine #6: Chosen Excessive Performing Inflation Protected Funds – YTD

My Technique

Over the previous a number of months, I’ve rotated from my worst-performing bond funds into inflation-protected bond funds and bought the PIMCO Inflation Response Multi-Asset Fund (PZRMX) talked about by David Snowball final month. I’ve purchased largely Vanguard Brief-Time period Inflation-Protected Securities Index (VTAPX, VTIP). I additionally purchased Constancy Inflation-Protected Bond Index Fund (FIPDX), which has a considerably longer length, and can monitor it for a attainable sale if efficiency falls.

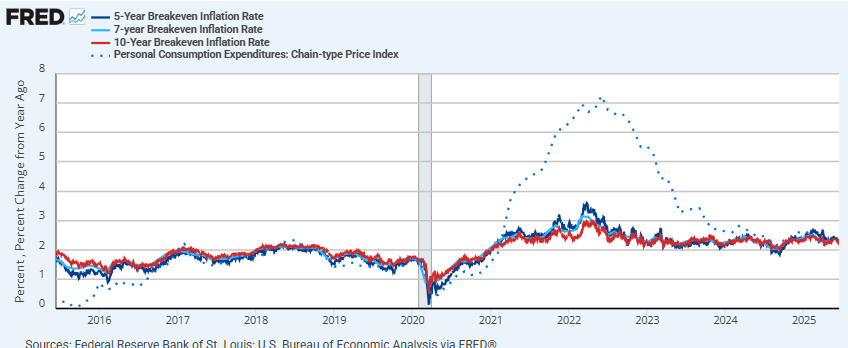

I turned concerned with including Treasury Inflation-Protected Bonds to my bond ladders after studying, Retirement Planning Guidebook by Wade Pfau, amongst different books. He explains that TIPS outperform treasuries when inflation exceeds the implied break-even inflation price. I created Determine #7 to point out varied breakeven inflation charges and inflation (PCE). I count on inflation to rise to shut to three.5% over the following 12 months or two, whereas the breakeven price is at the moment 2.3%.

Determine #7: Inflation Breakeven Charges and PCE Worth Index (YOY)

As I wrote, within the Mutual Fund Observer March e-newsletter, ETF Bond Ladders, I’m concerned with utilizing ETFs designed for bond ladders. Kim Clark describes Blackrock’s inflation-protected bond ETF with goal maturities in These New TIPS ETFs Make It Simpler To Construct A Bond Ladder at Kiplinger. I purchased iShares iBonds Oct 2030 Time period Suggestions ETF (IBIG) so as to add to the 2030 rung on my bond ladder. The efficient length is 4.7 years, which will get shorter over time.

Closing

I now have roughly 7% of my bonds invested in inflation-protected bonds, together with PIMCO Inflation Response Multi-Asset Fund (PZRMX). One other 40% is invested in bond funds with shorter durations. Subsequent month, I’ll reevaluate inflation and geopolitical threat and make small changes if acceptable. I even have the 2025 rung in my bond ladder maturing in a couple of months, and want to find out the place to reinvest the funds.