Uncertainty is within the air. Do you are feeling it? The worth-to-earnings ratio of the S&P 500 is approaching 30 and is inside bubble territory which means under common long-term returns. Thirty-five p.c is concentrated within the high ten holdings and 46% is concentrated within the Expertise and Monetary Sectors. The economic system is stronger than anticipated and inflation pressures nonetheless exist so volatility is excessive. The yield on the 10-year treasury fell from 4.7% final April to three.6% in September again as much as 4.8% final month and has fallen to 4.6%. Bond traders predict charges to stay larger for longer and wish to be compensated for period danger.

President Trump campaigned on the platform of tax cuts that are a stimulus however traditionally didn’t pay for the misplaced income, deregulation which might be considered favorably by the markets, on implementing tariffs which most economists imagine are inflationary, on deporting unlawful immigrants which may shrink the labor pool and improve inflation, and on reducing Federal spending which might are likely to sluggish development. Decreasing the Federal Funds price sooner could be one other stimulus which may improve inflationary pressures. The Treasury began “extraordinary measures” on January 21st to keep away from hitting the debt restrict. There are quite a lot of shifting elements, so I acquired my monetary home so as over the previous few months.

The S&P 500 has had complete returns over the previous two years of fifty% and because of this, my allocation to inventory climbed to 65%. I made no modifications to my funding technique due to the election; nevertheless, I’ve made modifications based mostly on excessive valuations and excessive rates of interest.

Larger For Longer Charges

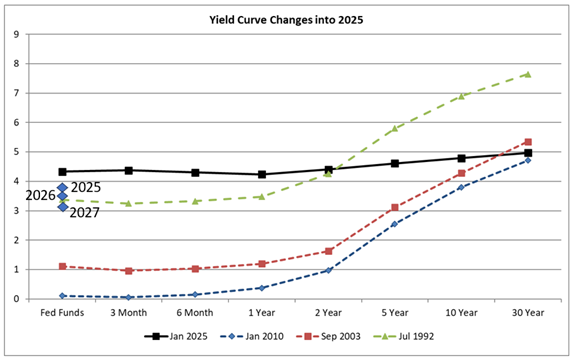

The Federal Reserve is projecting a cautious method to reducing short-term charges and nonetheless has practically $6 trillion of longer-duration bonds to search out patrons for as Quantitate Tightening continues. The yield curve has steepened as proven by the black line in Determine #1 however remains to be flat in comparison with 1992, 2003, and 2010. The blue diamonds signify the FOMC Abstract of Financial Projections for the Federal Funds Median Price at year-end for the subsequent three years. If realized, the brief finish of the curve will fall very slowly over the subsequent three years benefitting short-term bond costs, however the lengthy finish may steepen one other one or two proportion factors as bond traders demand the next return for holding bonds with longer durations.

Determine #1: Yield Curves for 2025, 2010, 2003, and 1992

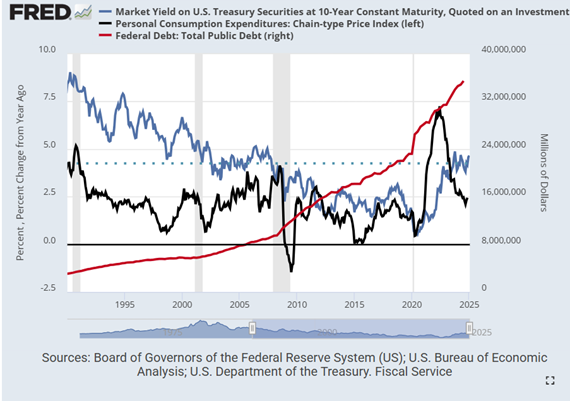

Determine #2 exhibits the yield on the ten-year Treasury (blue line, left scale), common ten-year Treasury Yield since 1990 (dotted blue line, left scale), and inflation (black line, left scale). With out Quantitative Easing which lowered long-term charges starting in 2008, charges will are likely to normalize larger. The Federal Debt (purple line, proper scale) has risen from $3T in 1990 to $35T in 2024 and can add strain to longer-term yields.

Determine #2: Ten 12 months Treasury Yield, Inflation, and Nationwide Debt.

The nonpartisan Congressional Funds Workplace launched The Funds and Financial Outlook: 2025 to 2035 which incorporates the nationwide debt rising by $23.9 trillion over the subsequent decade, excluding extra tax cuts, to $52.0 trillion in 2035 which is 118% of GDP.

Joachin Klement wrote a publish on Substack referred to as A Watershed Second For Bond Yields. He describes a examine by Martin Ademmer and Jamie Rush from Bloomberg evaluating actual 10-year bond yields during the last 50 years. Mr. Klement wrote:

“However most significantly, observe that the pattern actual bond yield has began to extend once more since 2015. And there are two essential components that drive this improve in actual bond yield. The rising deficits of governments and the shift within the world stability between provide and demand for protected property have each pushed up actual bond yields.

It is a watershed second, we’re witnessing right here. For the primary time within the final 50 years we see proof that bond markets are demanding a ‘danger premium’ for US Treasuries as a result of provide outstrips demand.”

I’ll add that Quantitative Tightening is an element, and two scores businesses have lowered scores on US debt. One essential factor to bear in mind is that the yield on a 10-year Treasury rising from 0.6% in 2020 to 4.8% presently represents an increase of 700 p.c. An increase from 4.8% to six.0% is just an increase of 25%. Bond costs could also be much less delicate to smaller will increase. I favor intermediate period bonds, and can wait and see earlier than investing in lengthy bonds. This places me in with the bond vigilantes who wish to be compensated for period danger.

Portfolio Changes For 2025

Getting ready for 2025, I decreased my general stock-to-bond ratio to round 60% promoting fairness funds that I handle and withdrawing from balanced portfolios that Constancy and Vanguard handle to replenish my Security Bucket for dwelling bills and emergencies. The ultimate change to my portfolio was to alter the technique of intermediate Bucket #2 conservative sub-portfolios from complete return to investing for earnings. In 2026, if shares are performing poorly, I’ll depend on my yield of over 5% and bond ladders will present regular money move. If shares proceed to carry out effectively, I’ll withdraw from Bucket #2 aggressive sub-portfolios to take extra danger off the desk.

My general bond publicity is roughly 60% p.c invested in Core Bond, Basic Bond, Worldwide Earnings, and Cash Markets, 20% invested in high-quality bond ladders, 15% in Municipal Bonds, and 10% invested in excessive yielding bond funds largely positioned in Conventional IRAs. All however two of the bond funds that I personal have an MFO Danger Ranking of Conservative or Very Conservative. My bond portfolio is diversified and has barely decrease high quality than the Bloomberg Barclays U.S. Combination Bond Index.

Taxable Bonds

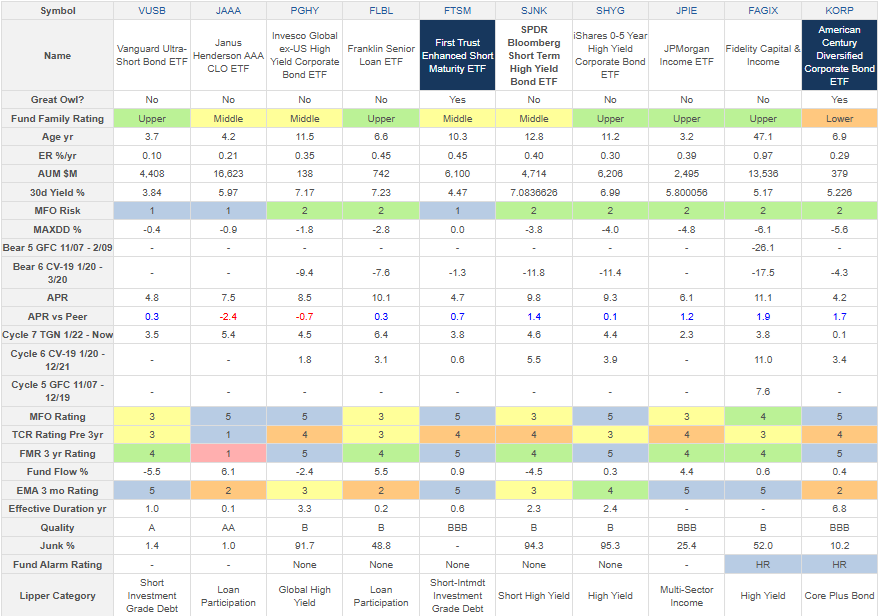

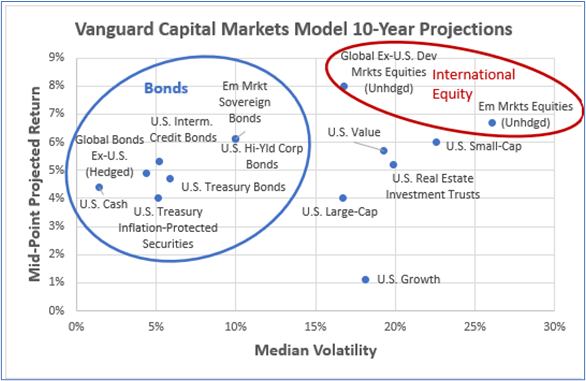

I wrote Investing in 2025 And the Coming Decade which included Determine #3 exhibiting Vanguard’s ten-year outlook. Word that Vanguard initiatives U.S. Treasury Bond returns to be within the vary of 4.1%–5.1% however says that extra excessive returns are attainable. Bond yields have secular tendencies which I imagine will probably be larger for longer. For the a number of previous months, I’ve been learning how riskier bond funds carry out in numerous market situations. “Looking out For Yield in All of The Secure Locations” covers eight Lipper Classes with excessive yields and low to reasonable danger as impressed by the next chart. I chosen high-performing classes and funds based mostly on Danger, Yield, Return, High quality, Development, and Tax-Effectivity.

Determine #3: Vanguard VCMM 10-12 months Return vs Volatility Projections

Supply: Creator Utilizing Vanguard Perspective (October 22, 2024)

Vanguard initiatives that Rising Market Sovereign bond funds will do effectively over the subsequent ten years, however they’re absent within the classes that I cowl as a result of they are often very risky. As a substitute of investing immediately in rising market bonds, I put money into actively managed funds in different classes the place managers diversify into rising markets.

Of the Intermediate Buckets that I’ve arrange for earnings, roughly half is in bond ladders, 25% in core bond holdings yielding 4.7%, and 25% is within the high-yielding funds described on this article yielding 5.4% for a mixed yield of 5.1%. I can add to the bond ladder with high quality particular person non-callable bonds for 4 to 5 years with a yield to maturity of 4.5% to five.0%. The benefit of the bond ladders is that they don’t fluctuate in worth if held to maturity.

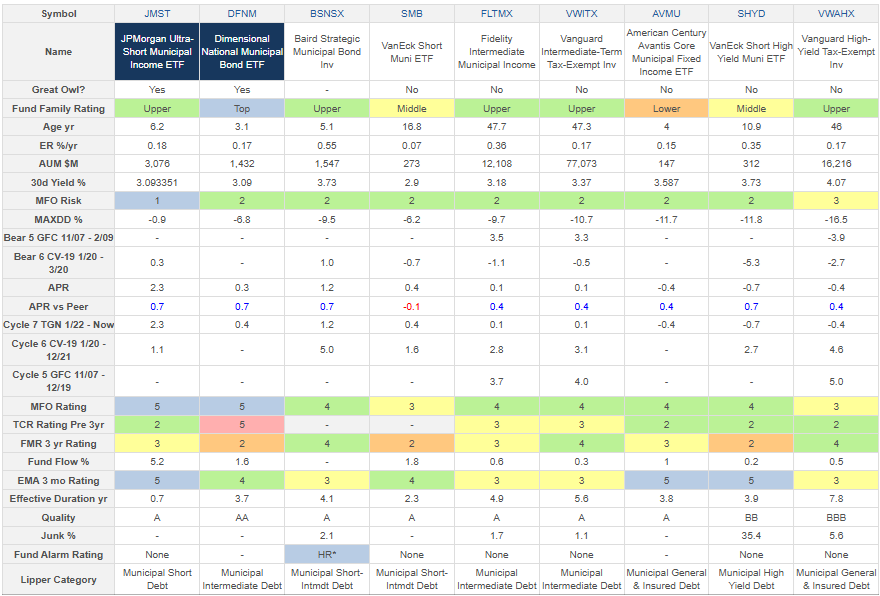

Desk #1 incorporates one or two of my favourite high-yielding funds from every of the eight Lipper Classes. It’s full of helpful details about danger (MFO Danger, MaxDD %, Bear Markets), risk-adjusted return (MFO Ranking), returns (APR, Full Cycle), tendencies (Fund Stream, Exponential Transferring Common), high quality (High quality, Junk), and bills (ER, Ferguson Mega Ration), and yield.

Desk #1: Creator’s Choose Excessive Performing Funds Per Lipper Class (2.5 12 months Metrics)

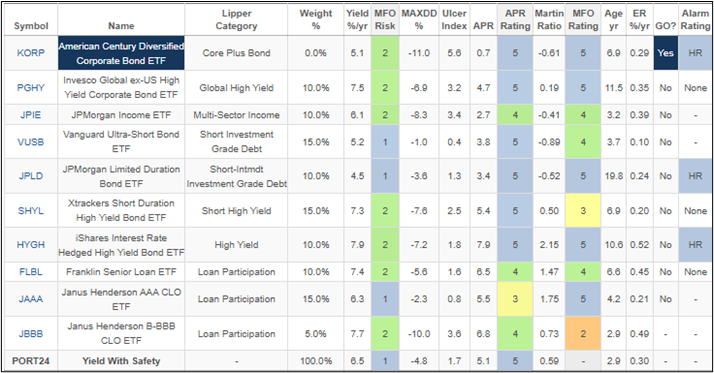

Desk #2 is an instance portfolio the place I balanced yield and danger to my liking. The MFO Danger of the portfolio is “Very Conservative”. It will have returned 5.1% APR over the previous 2.9 years with a present yield of 6.5% and a most drawdown of 4.8%. Word that it has 30% allotted to mortgage participation funds with 15% in essentially the most conservative Janus Henderson AAA CLO ETF (JAAA). I’ve room in my very own portfolio to extend yield with low danger.

Desk #2: Instance Yield with Security Portfolio

Tax Exempt Bonds

One in all my goals is to take a position tax effectively. I personal Roth IRAs, and Conventional IRAs, and have accounts for tax effectivity and tax loss harvesting. There’s a tradeoff between larger taxable yields and decrease tax-exempt yields.

“Looking out For Excessive Tax-Exempt Yield” is a companion article this month that describes some high-performing tax-exempt bond funds. Desk #3 incorporates a few of my favourite Municipal bond funds in six completely different Lipper Classes. Tax-exempt yields vary from 3% on the low-risk left facet of the desk to 4% on the higher-risk proper facet. The article offers some ideas for why some traders might select to put money into Municipal bonds.

Desk #3: Creator’s Choose Excessive Performing Funds Per Lipper Class (3-12 months Metrics)

Closing

I don’t anticipate making any main modifications to my portfolio in 2025. I anticipate shares to carry out effectively however with volatility throughout the first half of this 12 months and can do a mid-year reassessment then. I’ve some bonds in my bond ladder maturing that I must reinvest. I’ll make investments some for liquidity, and roll the remainder again into the bond ladder at larger yields and to make sure regular earnings for the subsequent 5 to 10 years.

I consulted with Monetary Advisors at Constancy and Vanguard on withdrawal methods and automatic an account for investing and withdrawals. If the inventory market is excessive, I plan to withdraw from accounts with excessive fairness ratios, and if the inventory market is low, I wish to depend on mounted earnings and bond ladders.