EIH Ltd – Leaders in luxurious hospitality

Established in 1949, EIH Ltd. is likely one of the largest luxurious resort chains in India. A flagship firm of The Oberoi Group, the corporate owns and operates 30 lodges, resorts, and luxurious cruisers throughout 7 nations and 22 cities beneath the model names Oberoi, Trident and Maiden. Along with personal properties, the corporate can also be following an asset mild mannequin by signing operations and administration contracts with third events. As of FY24, the corporate owns a portfolio of 4,269 keys (owned and managed) throughout all classes. The corporate’s companies additionally embody flight catering, airport lounge, journey planning, company air charters and many others.

Merchandise and Providers

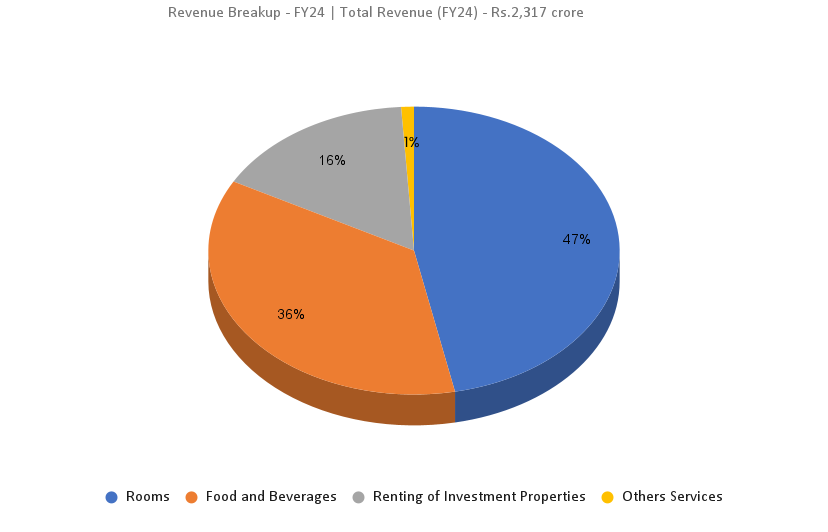

The corporate’s enterprise actions comprise of:

- Lodge companies – Lodging, meals & beverage and different companies offered by resort, inns, resorts, vacation houses, eating places, caterers, and many others.

- Actual Property Actions – Renting of funding properties.

Subsidiaries: As of FY24, the corporate has 9 subsidiaries, 3 affiliate firms and three joint ventures.

Funding Rationale

- Enlargement plans – EIH plans to open 20 new properties, totalling 1,350 keys, by 2029. The portfolio will embody a mixture of lodges, boats, and cruises throughout each home and worldwide markets, both owned outright or developed via joint ventures and partnerships. The enlargement additionally entails the creation of mixed-use developments with business, retail, and F&B areas. Within the home market, three lodges are set to open in 2025 and 2026. Internationally, the corporate goals to launch two lodges, two luxurious boats, and a cruiser throughout the identical timeframe. Notably, EIH is coming into the London market with a luxurious resort in Mayfair, exploring partnership alternatives to cut back its publicity. This 21-key resort is slated to open in 2028. These enlargement efforts are anticipated to drive profitability, strengthen the model, and assist a various and sustainable enterprise mannequin for the corporate.

- Sturdy operational efficiency – The corporate noticed notable progress in RevPAR (Income per Accessible Room) throughout all its enterprise segments. In Q2FY25, in comparison with the identical interval final yr, Oberoi Metro noticed a ten% improve, Oberoi Leisure improved by 7%, and each Trident Metro and Trident Leisure rose by 22% every. Occupancy charges grew from 69% to 72%, whereas the Common Room Charge (ARR) rose to Rs.14,973 within the final quarter, in comparison with the Rs.13,732 throughout the identical interval within the earlier yr. General, these efficiency positive factors mirror the corporate’s operational success, market energy, and monetary stability, setting the stage for continued progress and profitability.

- Q2FY25 – EIH reported its highest ever quarterly income and revenue throughout the interval. The corporate generated income of Rs.589 crore marking a rise of 11% in comparison with the Rs.531 crore income of Q2FY24. EBITDA stood at Rs.208 crore towards the Rs.165 crore of Q2FY24, a progress of 26% YoY. Web revenue stood at Rs.133 crore which is a progress of 41% as in comparison with the Rs.94 crore of the identical interval within the earlier yr. The corporate is money constructive with ~Rs.711 crore.

- FY24 – The corporate generated income of Rs.2,317 crore, a rise of 26% in comparison with FY23 income. Working revenue is at Rs.911 crore, up by 46% YoY. The corporate posted a internet revenue of Rs.521 crore, a rise of 63% YoY. FY24 working revenue margin is at 39% and internet revenue margin is at 22%.

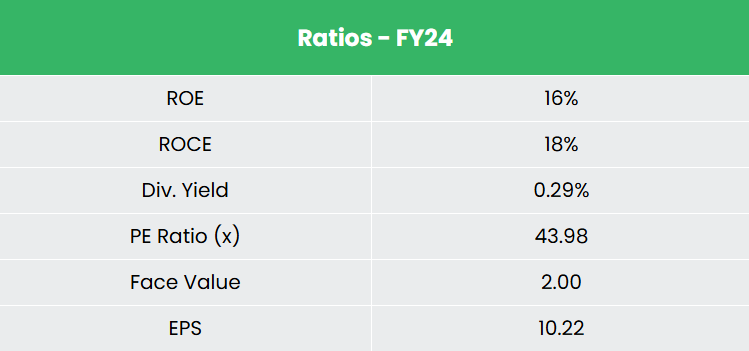

- Monetary Efficiency – EIH has generated income and internet revenue CAGR of 72% and 56% over the interval of three years (FY21-24). The common 3-year ROE & ROCE is round 9% and 12% for the FY21-24 interval. The corporate has a powerful stability sheet with a sturdy debt-to-equity ratio of 0.05.

Business

Tourism and Hospitality is one the biggest service industries in India, enjoying a vital function in driving the nation’s progress and prosperity. With its numerous geography and wealthy cultural heritage, India affords a variety of distinctive experiences, positioning it as one of many prime locations for worldwide tourism spending. By 2028, the sector is projected to generate over US$ 59 billion in income, with International Vacationer Arrivals (FTAs) anticipated to achieve 30.5 million. In accordance with the World Journey and Tourism Council (WTTC), India’s Journey & Tourism GDP is anticipated to develop at a median fee of seven.1% yearly over the subsequent decade. The nation is eyeing for additional enlargement within the sector via initiatives resembling wellness tourism, culinary tourism, and eco-tourism.

Progress Drivers

- Authorities initiatives like Swadesh Darshan 2.0, e-visa amenities, RCS-UDAN Scheme that had been launched to energy the sustainable imperatives within the tourism sector.

- 100% International Direct Funding (FDI) allowed within the tourism business beneath computerized route.

- Within the Interim Finances 2024, Rs.2,449.62 crore (US$ 294.8 million) was allotted to the tourism sector.

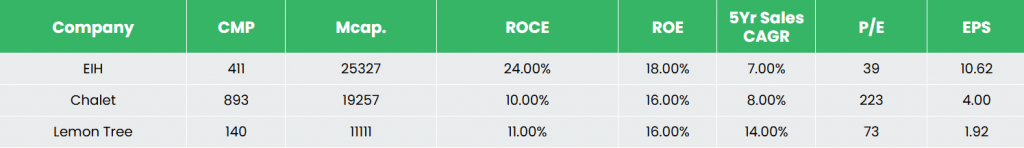

Peer Evaluation

Rivals: Chalet Motels Ltd, Lemon Tree Motels Ltd, and many others.

In comparison with the above rivals, EIH is probably the most undervalued inventory with strong returns on the capital invested and wholesome progress in gross sales.

Outlook

The corporate’s enlargement technique, which incorporates 20 properties throughout key world and home markets, reveals robust potential. These efforts are anticipated to drive income progress, broaden geographic attain, and diversify the corporate’s market presence. The corporate plans to develop its portfolio of mixed-use improvement initiatives, incorporating each residential and business areas, which is predicted to spice up returns and profitability. It anticipates improved income and profitability within the second half of FY25. Moreover, the corporate goals so as to add roughly 216 keys in 2025 and 2026.

Valuation

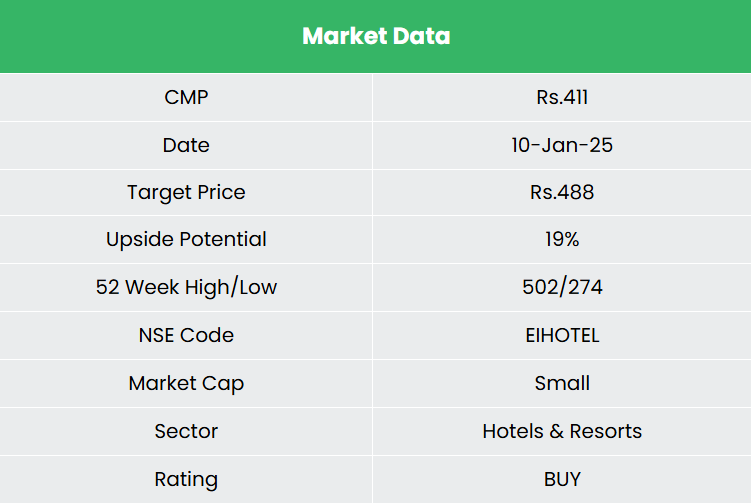

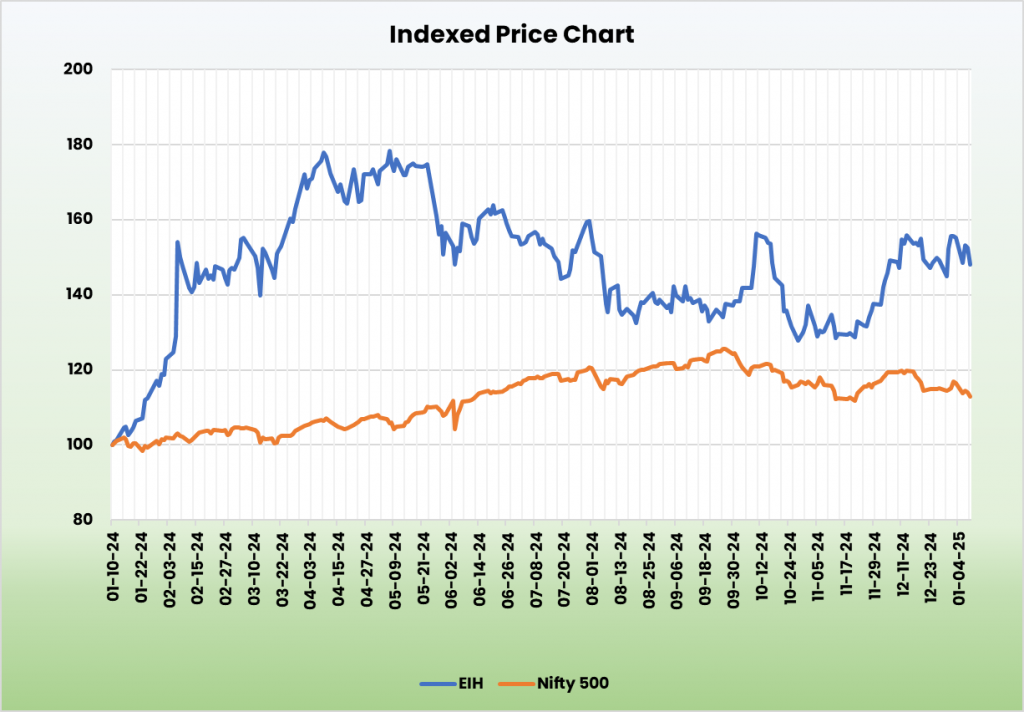

The corporate’s steady operational efficiency and upcoming enlargement plans are anticipated to maintain its progress momentum. We advocate a BUY score within the inventory with the goal value (TP) of Rs.488, 39x FY26E EPS.

Threat

- Macroeconomic elements – Any financial slowdown within the nation might affect the demand for the journey business thereby impacting the corporate turnover.

- Launch of latest lodges – Any delay within the launch of latest lodges/cruises will affect profitability.

Observe: Please word that this isn’t a advice and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

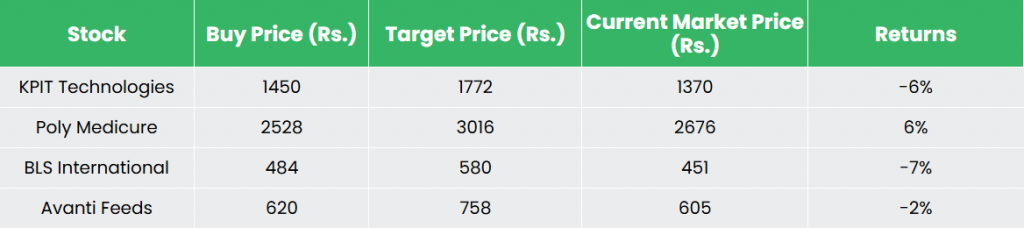

Recap of our earlier suggestions (As on 10 January 2024)

Different articles you could like

Put up Views:

88